Ag Retailers ‘Cautiously Optimistic’ About Spring Fertilizer Demand

Ag retailers, geared up for the upcoming growing season, predict a moderately good year for crop nutrients.

What will the 2020 spring season look like for fertilizer? Many signs are pointing to a good year ahead while, in part, building off a strong fall application season.

“Our fall application season was good, so I would be positive,” says Tim McArdle, Vice President for BRANDT, Springfield, IL. “This could be driven by strong corn acres, a possible resolution of trade deals between the U.S. and other countries, and good fertilizer prices.”

Other numbers seem to support this view. Although most players in the agricultural market experienced tough sledding during the uneven 2019 growing season (with companies such as CHS reporting “decreased fertilizer volumes … due to a slow harvest” in its quarterly income report), ag retailers that make up the 2019 CropLife 100 rankings did just fine. In fact, according to the annual survey of these companies, overall fertilizer revenues increased more than 13% for the year, up from $12.2 billion in 2018 to $13.8 billion.

And the fertilizer trends remain strong for this year as well. According to the sixth-annual CropLife Buying Intentions Survey, presented in the January edition of the magazine, all crop nutrient segments should see significant increases in their 2020 spending levels compared with those recorded during the 2019 growing season. This ranges from 53% spending increases for additives/enhancers and nitrogen/phosphorus stabilizers to 69% spending increases for dry fertilizer.

However, McArdle still notes some caution when looking at the overall picture of the 2020 fertilizer market outlook. “Farm economics could be a major impediment,” he says. “We need better crop prices.”

Fred Morscheck, General Manager, Operations for The McGregor Co., Colfax, WA, agrees with this assessment. “I am neutral on the outlook for the 2020 fertilizer season,” Morscheck says. “Lower fertilizer prices will enable growers to apply the recommended rates of most yield-limiting nutrients. But in terms of cash flow, our customers will have to once again raise above average yields, and that means being highly efficient with inputs but not getting into a yield-limiting situation by curbing inputs.”

Stronger Fall = Weaker Spring

In addition, Morscheck thinks that stronger fall fertilizer demand could cut into spring fertilizer sales potential. “In our marketing territory, we had a very strong fall fertilizer season preplant for our winter wheat crop,” he says. “This may lead to lower spring topdress acres this spring.”

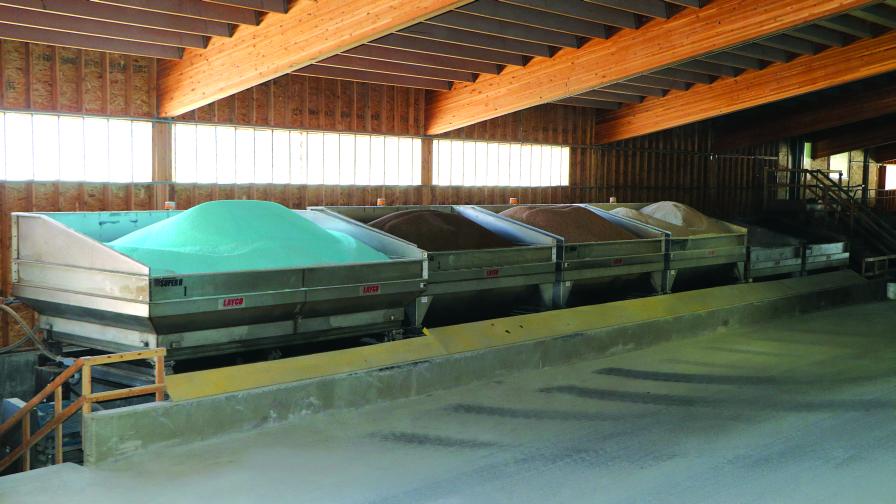

In terms of macronutrient demand, Morscheck predicts some good news for all segments. “Nitrogen will outperform all other nutrients,” he says. “Dry phosphorus pricing hasn’t been this good of a value for a long time. That, coupled with lower potash pricing, will be very good news to markets that sell dry fertilizer.”

For the most part, BRANDT’s McArdle agrees with Morscheck’s outlook. “If we have strong corn acres, we are looking for a good nitrogen season,” he says. “Phosphate prices are good, but I would look for lower demand, if anything.”

Potential ‘Black Swans’

Of course, any crop year has its share of uncertainty ahead, and 2020 is no different. According to McGregor’s Morscheck, there are three potential “black swans” circling the agricultural industry going into the 2020 spring season. “Weather is top of mind for me,” he says. “Winter here in my backyard is eerily like last winter. Will spring be the same?

“Tariffs and progress with our trading partners is No. 2 on my list,” he continues. “Is Phase One of the China trade deal real? We depend heavily on trade to China and the Pacific Rim. Will we see real progress in more China purchases of agricultural products? Also, what about the USMCA and Japan trade agreements? These agreements are very important to agriculture here in the Pacific Northwest and other regions of the U.S.

“And Iran becomes No. 3 on my list,” he says. “A crisis in the Persian Gulf could result in a lot of unintended consequences for agriculture, higher fuel costs, crop inputs, and economic slowdowns.”

In the end, Morscheck says, the industry in 2020 should continue to play to its strengths when it comes to the spring season.

“There won’t be any silver bullets for ag retailers in 2020,” he says. “With crop prices at levels that barely support the production of major crops, growers will be holding tight to every dollar they have. It will be critical that ag retailers have a value proposition that growers want and need this spring.

“As I mentioned before, yield will drive the success or failure of our customers so they will want the best information, consulting, and services they can get from the folks they trust. We see opportunity in today’s challenging farm environment and feel that our efforts to provide ‘exceptional customer service’ at every level will be rewarded in 2020.”