CropLife 100: A Surprisingly Strong Year in Fertilizer

Compared with the other crop inputs/services categories that make up the CropLife 100, fertilizer might be the ultimate example of a survivor winner. Indeed, during an incredibly tough 2019, the fertilizer category managed to significantly grow both its overall revenue number and total market share figure — a feat that no other category was able to do during this “most challenging” of growing seasons.

To appreciate this accomplishment, a look back is in order. After the fertilizer category first became the largest of the CropLife 100 crop inputs/services categories in 2006, it spent the next several years building upon that lead. In fact, during the early years of the 2010s decade many industry watchers speculated that the time would come when the fertilizer category by itself represented more than 60% of all sales for the nation’s top ag retailers.

However, market dynamics then began to change for fertilizer. During the 2013 CropLife 100 survey report, the category’s market share dropped 2%. It was down another 4% the following year. And another 1% the year after that. By the end of 2018, the fertilizer category represented only 40% of all crop inputs/services sales among the nation’s top ag retailers. And the crop protection products category — which had trailed fertilizer in sales by as much as 27% in 2012 — was only 1% market share behind. Going into the 2019 CropLife 100 survey, many market watchers probably wondered if fertilizer could survive as the lead market share holder among ag retailers.

The answer, in a word, is yes. And quite an emphatic yes at that!

According to data compiled in the 2019 CropLife 100 survey, the fertilizer category had an eye-popping year. Sales in this category moved forward more than 13%, growing from $12.2 billion in 2018 to $13.8 billion. Better still, since this rate of growth significantly outpaced every other CropLife 100 category, fertilizer was able to improve its overall market share of crop inputs/services by a full 3% in 2019, improving from 40% in 2018 to 43%.

Improvements Across the Board

Given how much news was made during 2019 of the number of prevent plant acres found across much of the U.S. (an estimated 19 million, according to USDA statistics), some conventional wisdom might have predicted demand for fertilizer from the country’s grower-customers could have waned significantly as a result. However, the numbers from this year’s CropLife 100 survey tell a slightly different story.

Going back to the 2018 CropLife 100 survey for a minute, 61% of respondents said that their demand for fertilizer had increased more than 1% vs. the 2017 growing season. Obviously, this kind of percentage strength usually isn’t recorded with large-volume categories such as fertilizer, so expecting the category to surpass this kind of number for the 2019 survey seemed far-fetched to say the least.

Going back to the 2018 CropLife 100 survey for a minute, 61% of respondents said that their demand for fertilizer had increased more than 1% vs. the 2017 growing season. Obviously, this kind of percentage strength usually isn’t recorded with large-volume categories such as fertilizer, so expecting the category to surpass this kind of number for the 2019 survey seemed far-fetched to say the least.

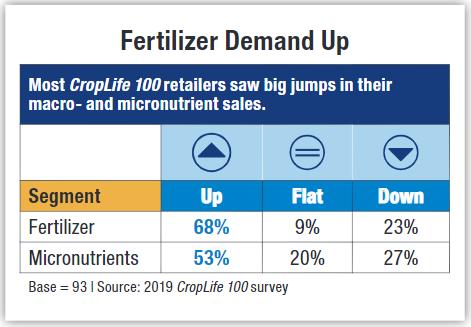

But the fertilizer category managed to pull it off! According to the 2019 CropLife 100 survey, the percentage of the nation’s ag retailers that saw their fertilizer demand increase more than 1% topped 68%. Of the remaining 32%, 9% said their fertilizer sales between 2018 and 2019 were flat while 23% recorded fertilizer sales declines of more than 1%.

To appreciate just how deeply this crop nutrient demand ran during 2019, consider the story told when looking at micronutrient sales. Normally, in difficult crop years, such as was seen during this year’s growing season, grower-customers will forgo or reduce their micronutrient usage in favor of macronutrients.

In 2019, however, this didn’t appear to be the case. According to the 2019 CropLife 100 survey, 53% of the nation’s top ag retailers saw their micronutrient revenues improve more than 1% for the year. This was down only slightly (2%) from the 55% of respondents who had witnessed this kind of sales gain during the 2018 growing season.

Of the remaining respondents, 20% indicated that their micronutrient sales between 2018 and 2019 remained at the same levels for both years. The other 27% saw micronutrient demand decline more than 1%.

Still Some Challenges

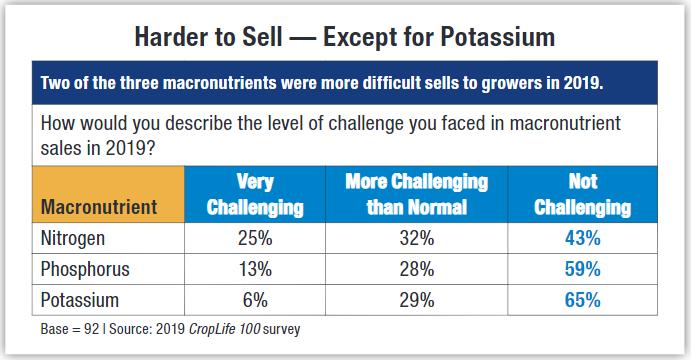

Despite these generally positive numbers, ag retailers still reported facing some challenges when trying to convince many of their grower-customers to apply macronutrients to their crop fields. For several years the annual CropLife 100 survey has asked ag retailers to describe how easy or difficult it was during the past year’s growing season to convince their customers to make fertilizer purchases. During the past two surveys, in 2017 and 2018, the percentage of respondents saying this process was “very challenging” has rarely strayed into the low double-digit territory. In fact, the highest percentage recorded in a survey to date came from a single segment on the 2018 survey, in which 12% of respondents said their efforts to get growers to use nitrogen fit this bill.

But these percentages took a big jump forward during the 2019 growing season, with two of them more than doubling their 2018 percentages. According to the 2019 CropLife 100 survey, nitrogen was again the hardest sell among macronutrients, with 25% of respondents saying this sales effort on their part was “very challenging.” Another 32% indicated selling nitrogen during 2019 was “more challenging than normal” for them. The remaining 43% said selling nitrogen this year was “not challenging.”

For phosphorus, the situation was even more difficult. According to survey respondents in 2018, only 3% described selling phosphorus to growers as “very challenging.” During 2019, however, this percent-age shot up to 13%. Another 28% said selling phosphorus during the year was “more challenging than normal.” The remaining 59% indicated they had no such problem with their phosphorus customers.

For phosphorus, the situation was even more difficult. According to survey respondents in 2018, only 3% described selling phosphorus to growers as “very challenging.” During 2019, however, this percent-age shot up to 13%. Another 28% said selling phosphorus during the year was “more challenging than normal.” The remaining 59% indicated they had no such problem with their phosphorus customers.

The bright spot among macronutrients was potassium. For this segment, 8% of 2018 respondents said selling the fertilizer was “very challenging.” But in 2019 this percentage dropped to 6%. Another 29% said selling potassium this year was “more challenging than normal.” However, the vast majority (65%) indicated growers were more than happy to apply potassium to their field during 2019.