2020 Precision Ag Dealership Survey: Moving the Needle on Decision Agriculture

Editor’s note: The CropLife/Purdue Precision Survey is the longest-running continuous survey of precision farming adoption. The 153 respondents mostly from the Midwest included cooperatives, independent retailers, and those part of a regional or national chain. A full report detailing all of the 2020 results will be posted online later this summer. The full report from the 2019 survey can be accessed here.

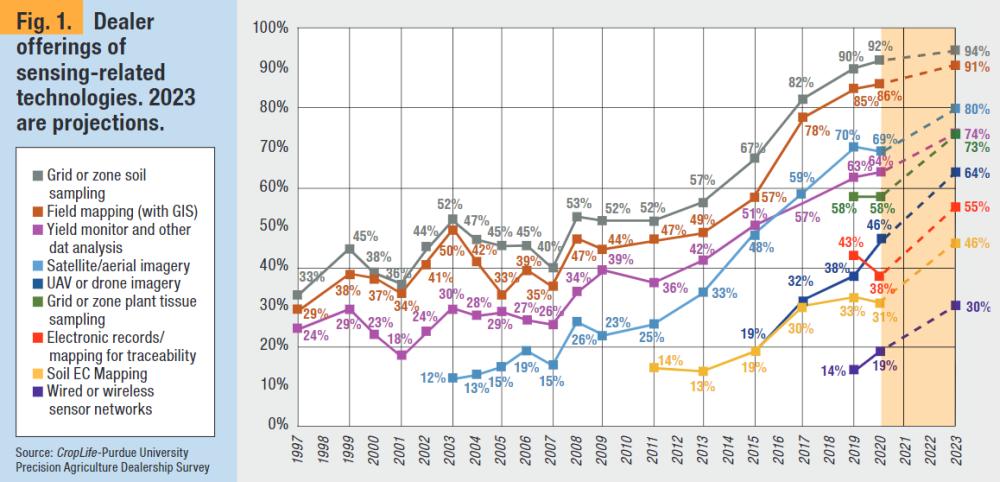

2020’s Precision Agriculture Dealership Survey, like 2019’s, showed further steps toward a future where crop management decisions will be guided more and more by data collected from fields. Information gathering and analysis services such as grid/zone soil sampling, UAV imaging, and yield map analysis all showed steps up compared to 2019’s results, and these were all substantially up compared to 2017 and 2015. Sensor networks showed an uptick — the start of IoT, or Internet of Things.

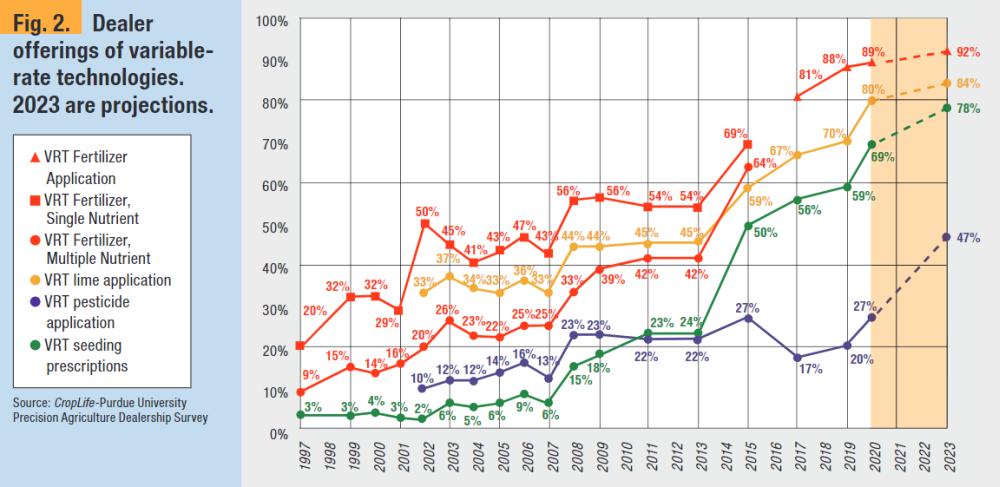

There also were accompanying and even greater increases in all variable-rate services — for fertilizers, lime, prescriptions for variable seeding. Even variable-rate pesticides are up, though that remains relatively small. Pooled data, especially for nutrient management and hybrid/variety placement, continues to guide decisions.

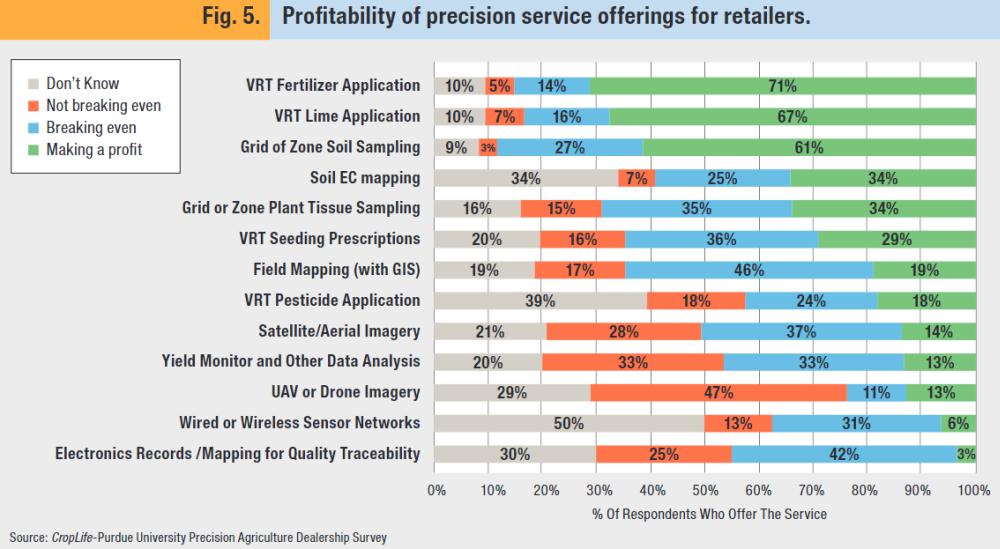

After a decade where approximately half of dealers were offering grid and zone soil sampling, this increased to 67% of dealers offering in 2015, to 82% in 2017, 90% in 2019, and now at 92% (Figure 1). Dealers offering satellite imagery, a possible foundation for creating management zones or guiding site-specific decisions, increased from 48% in 2015 to 59% in 2017, 70% last year, and leveling out at 69% in 2020.

It should be noted that the data represents the percent of dealers offering these services, not the percent of acres where these services were applied. The 2023 numbers are what dealers anticipate they will offer in three years, and all are very optimistic. Among dealers who do not currently offer, the largest increases expected are for adding UAV/drone imagery and electronic records/mapping for crop traceability. The survey was administered during the initial upswing of the pandemic in March and April, so while there may have been reason for dealers to express some pessimism, it didn’t overwhelm their view of the future.

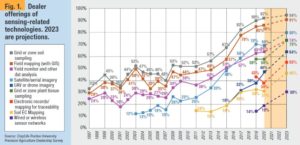

Variable-rate technology (VRT), where an informed approach is used to address inconsistency across fields, has correspondingly increased (Figure 2). From 2002-13 about half of dealers were offering VRT fertilizer applications, but this increased to 69% in 2015, to 81% in 2017, 88% in 2019 and now is at 89%. VRT seeding recommendations have made a huge jump in the last few years, from 24% in 2013 to 50% in 2015, 56% in 2017, 59% in 2019 and 69% of dealers now offering these services.

This dramatic increase in variable seeding recommendations likely follows changes in planter technology that enabled this, and also the explosion in data service providers, many of these part of agricultural retail companies. Only 27% of dealers indicate they now offer variable-rate pesticide applications, but similar to 2019 half of the dealers foresee they will be offering this in the near future — probably linked to new machine vision technology enabling weed recognition and targeting individual weeds.

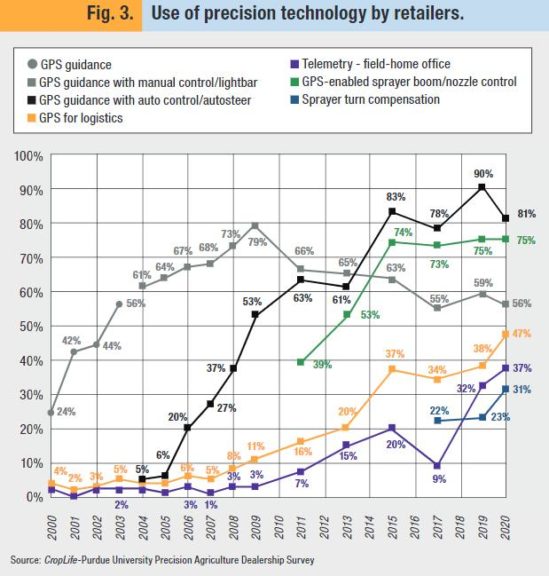

In contrast to the data-intense technologies that underlie decision agriculture are a set of automated practices that do not depend on a field’s agronomic characteristics, only a field’s size and shape and where the machine has been. The economic benefits of reducing overlaps and skips, allowing drivers to work longer hours with less fatigue, and to work through dust, fog, and through the night have proven substantial for dealers as well as farmers. The use of guidance technologies by dealers for their custom pesticide and fertilizer applications indicates a maturing market, with 81% of dealers using autoguidance, 56% still using a lightbar, and 94% of those who offer precision services using guidance of any type.

GPS-guided boom section/nozzle controllers on sprayers are used at three-fourths of dealerships (Figure 3). Another guidance-related technology, sprayer turn compensation, is emerging with 31% adoption by dealers, but only up slightly compared to 2017 and 2019. Turn compensation adds value more subtly by helping to reduce over- and under-application rates vs. reducing doubling-up and skips. There are more dealers using telemetry to exchange information among applicators or to/from office locations, and more dealers using GPS fleet management for vehicle logistics and tracking the locations of vehicles.

Data-To-Decision Increase is Encouraging

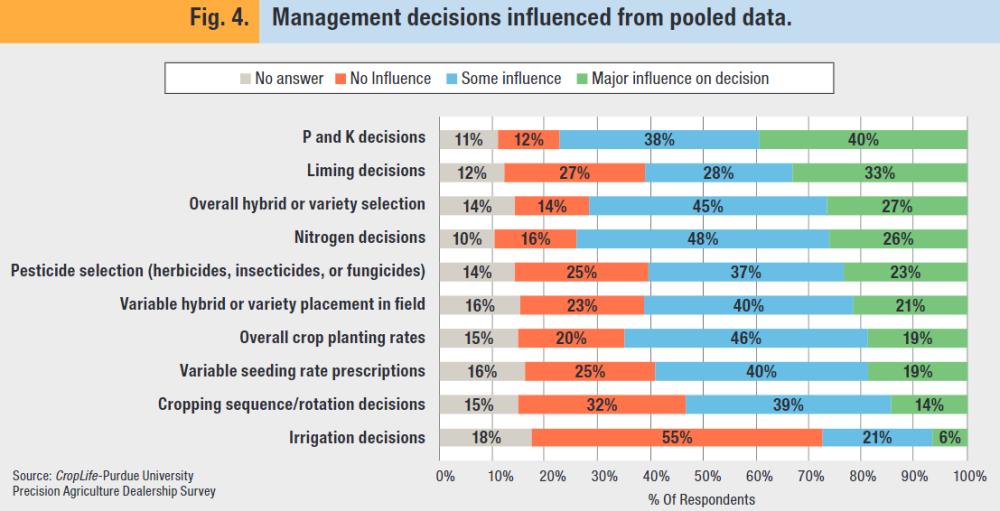

The biggest news last year was the remarkable uptick in crop management decisions from pooled data, and for the most part this uptick held in 2020. We asked dealers to gauge the influence of data shared among farmers on crop management decisions (Figure 4). Pooled data is aggregated from multiple farms, either managed within the dealership or as part of an outside offering.

For crop nutrient decisions, 78% of dealers said phosphorus and potassium decisions were at least somewhat influenced by pooled data, similar to last year but nearly doubling compared to three years ago, and 74% saying nitrogen decisions were being influenced, up from 39% in 2017. Seventy-two percent of dealers indicated pooled data had at least some influence for overall hybrid/variety placement, 61% said it was influencing variable hybrid or variety placement in fields, and 59% said pooled data informed variable planting rate prescriptions, all these nearly doubling compared to three years ago. As mentioned before, some of this is likely driven by an increasing presence of data service providers.

In 2019 less than half of dealers (47%) indicated their company had a customer data privacy statement and/or a data terms and conditions agreement, similar to 2017, but that has inched up to 58% for 2020.

Identifying ROI

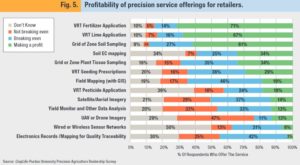

Finally, in the end all of this technology has to eventually pay its own way. This can be done in multiple ways — through returns for that specific activity, but also through reducing the costs to the dealership, as might be the case with guidance, section controllers, or fleet logistics management for custom application services. The value could be indirect, such as enhancing customer relationships or providing a product or service not available from a competitor.

When dealers were asked about profitability of the services they offer, precision soil sampling and VRT fertilizer applications stood out positively from the others (Figure 5), where 85% to 88% of dealers, respectively, indicated a profit or break-even. Notable on the unprofitable side were dealers who offer UAV services, where three-fourths of those with a UAV indicated they were not breaking even or didn’t know, even more negative than recent surveys, and for satellite/aerial imagery where half were not breaking even or didn’t know.