2017 Precision Dealership Survey: Making the Turn Toward Decision Agriculture

Editor’s note: The CropLife®/Purdue precision dealer services survey is the longest-running continuous survey of precision farming adoption. The 209 respondents included cooperatives (47%), independent retailers (37%), and retailers part of a regional or national chain (16%). Seventy-eight percent of the respondents were from the U.S. Midwest, 9% West, and 7% from the South. A full report detailing all of the results will be posted online later this summer. View the full report from the previous survey in 2015 here.

It has been a long road to fully implement the vision crafted two decades ago — where soil, nutrient, yield, EC, remote sensing, and other data would be transformed into knowledge to guide decisions of inputs and precise amounts of seeds, fertilizers, and pesticides applied across crop fields. All of which would substantially reduce input costs, increase productivity, reduce the environmental footprint, and transform crop production. Some of this has come to be, but much more has not.

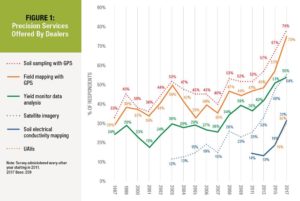

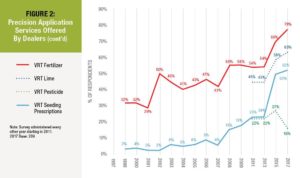

But the 2017 precision dealer survey results show large upticks in adoption in not only the technologies to measure spatial and temporal variations within fields, but in the technology of addressing these via variable-rate applications of fertilizers, lime, and seeds. For example, after a 10-year stretch where only around half of dealers were offering grid and zone soil sampling, this increased to 67% of dealers offering in 2015, to 75% now in 2017 (Figure 1). Dealers offering satellite imagery, a possible foundation for creating zones or guiding site-specific decisions, increased from 48% in 2015 to 55% now, and unmanned aerial vehicle (UAV) services from 19% to 30%. Variable-rate technology (VRT), where an informed approach is used to address variability across fields, has correspondingly increased (Figure 2). Throughout the 2000s decade about half of dealers were offering VRT fertilizer applications, but this increased to 69% in 2015 and to 78% in 2017. Lime VRT was up as well, and VRT seeding recommendations made a huge jump, from 24% in 2013 to 50% in 2015, and in 2017 with 52% of dealers offering these services.

Looking at Crop Management

This site-specific side of crop management has been poised for its coming-out moment since grid and zone soil sampling, yield monitors, and variable rate technology first became commonplace in the mid 1990s. But a decade ago the initial excitement became bogged down in the details — in that field environments were more complicated than we had thought. We could see correlations among factors, but not always cause and effect. With rectangular grids or multiple acre management zones we may not have been capturing a resolution fine enough to characterize fields. And dealing with all of the data proved to be cumbersome with yesterday’s computers and data portability, fumbling with data cards, CDs, and flash drives.

But the 2015 and now the 2017 results signal a change. Some is certainly related to technological capability: Cloud data storage and telematics are now common, which makes managing and moving around large data sets much less cumbersome. Computer processing speeds and data transfer rates are multiples of what were available just a few years ago. Another piece could be related to an explosion in data-related service providers and their site-specific decision tools, many of whom entered the market in the last five years.

Automation Leads the Way

In contrast to the data-intense technologies that underlie decision agriculture are a set of automated practices that don’t depend on a field’s agronomic characteristics, only a field’s size and shape and where the machine has been. Guidance systems were viewed by some as a luxury when they entered the market in the early 2000s — who can’t accurately steer a tractor with their own two hands? But the economic benefits of reducing overlaps and skips, allowing drivers to work longer hours with less fatigue, to come back to row cultivate or sidedress on previously marked rows, and to work through dust, fog, and through the night proved substantial.

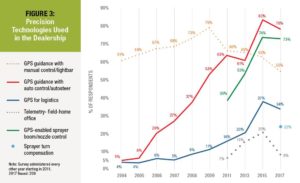

The guidance numbers indicate a maturing market, at 78% adoption, along with section controllers, used at three-fourths of dealerships (Figure 3). Piggy-backing with guidance, GPS-guided boom section/nozzle controllers on sprayers have overall proven very effective in saving inputs along point rows, waterways, and field borders. Another guidance-related technology, sprayer turn compensation, is emerging with 22% adoption by dealers. Turn compensation adds value more subtly by helping to reduce over- and under-application rates vs. reducing doubling-up and skips.

What Will Lead?

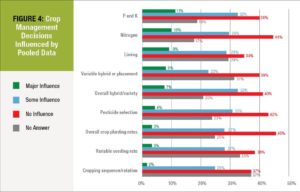

So as decision agriculture matures, what types of decisions are leading the way? A new question in 2017 asked dealers to gauge the influence of pooled data on of a variety of factors related to crop management decisions (Figure 4). This would be data aggregated from multiple farms, either managed within the dealership or as part of an outside offering.

Leading the way, as might be expected, were crop nutrient decisions where 43% of dealers said phosphorus and potassium decisions were at least somewhat influenced by pooled data, 39% saying nitrogen decisions were being influenced, and 37% saying liming decisions were influenced. Seeding decisions were second in line, where 39% indicated pooled data had at least some influence for overall hybrid/variety placement and 30% said were influencing variable hybrid or variety placement in fields.Responses indicate that pooled data had less influence on decisions related to pesticide selection, overall seeding rates, variable site-specific seeding rates, and decisions related to cropping sequence and rotation. On another new question, less than half of dealers (45%) indicated their company had a customer data privacy statement and/or a data terms and conditions agreement.

Looking for ROI

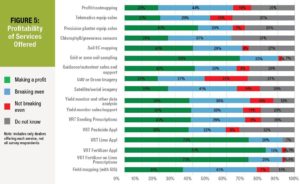

Finally, while many of us still enjoy the mental rush that comes from seeing things in a new way with imagery, a telling yield map, or interpolated soil sampling results, in the end it all has to pay the bills. Those bills can be paid in multiple ways — through increased returns for that specific activity, but also through reducing the costs to the dealership, as might be the case with guidance, section controllers, or fleet logistics management. Or the indirect benefits of enhancing customer relationships or providing a product or service not available from a competitor.

When dealers were asked about profitability of the services they offer, precision soil sampling and VRT fertilizer applications stood out positively from the others (Figure 5). Notable on the unprofitable side were dealers who offer UAV services, where 53% of those with a UAV indicated they were not breaking even or didn’t know. UAV technology is exciting, but it has been hard to tie to a product or service that offers value to a farmer.