Precision AgTech Buying Intentions Survey: How Ag Retailers Will Invest in Technology in 2023

For the past nine years, CropLife® magazine has devoted a portion of its January issue to looking at what crop input categories the nation’s top ag retailers plan to spend their money on during the upcoming growing season. The results from this Buying Intentions Survey can be found here.

Of course, this got us to thinking — what about doing a Buying Intentions Survey looking at the precision agtech sector? So, we did, and here is what we found out.

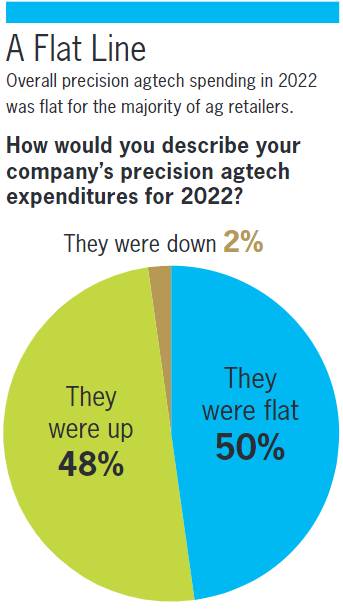

According to the results the inaugural Precision AgTech Buying Intentions Survey, 2022 was something of a slow year for the segments that make up this part of the ag business.

Based upon the feedback from slightly more than 100 respondents, overall precision agtech expenditures during 2022 were flat for half the marketplace (50%). Luckily, for the other half of ag retailers, the market for precision agtech products and services was more up than down. According to the survey, 48% of respondents saw their expenditures in this area increase during last year’s growing season. Only 2% reported expenditure declines.

Interestingly, this matched up pretty well with the results of another survey CropLife magazine annually conducts — the CropLife 100. According to data from this survey, overall precision agtech revenues for 2022 were down only slightly from 2021, from $809 million to $796.2 million — a decline of less than 2%.

Newer = More Excitement

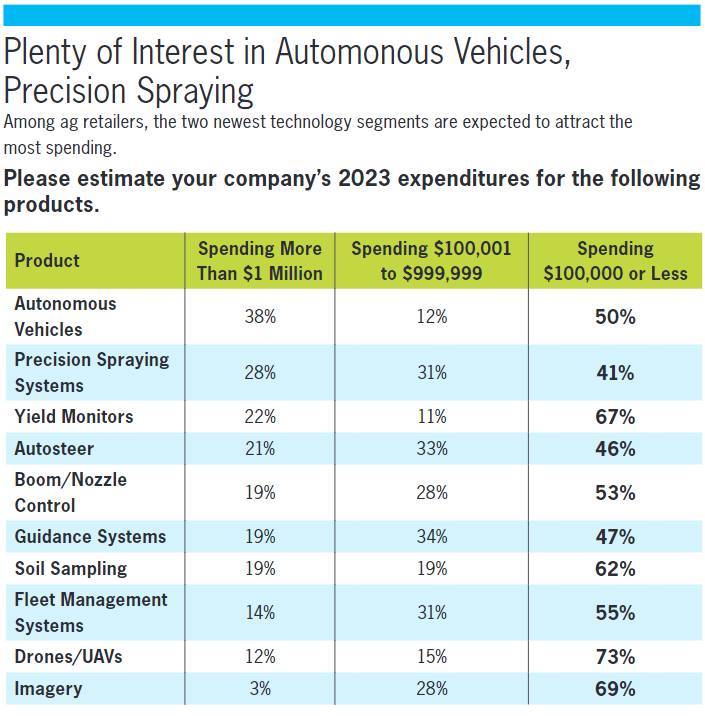

Of course, for the purposes of this first-ever Precision AgTech Buying Intentions Survey, we were most interested in finding out what product segments the nation’s largest ag retailers plan to spend their money on during the upcoming 2023 growing season. For the product mix, we listed both long established precision ag items such as yield monitors and newer/just coming into focus ones such as autonomous vehicles. Perhaps of no surprise, the newer segments can expect to see more ag retail dollars spent on them than the older ones during 2023 — with one notable exception.

Base = 101 | Source: CropLife 2023 Precision AgTech Buying Intentions Survey

For the survey, CropLife magazine asked respondents how much money they planned to spend on each of the product segments we were tracking. This included three options: Spending more than $1 million in 2023, spending between $100,001 and $999,999, and spending less than $100,000. For the most part, the highest percentages among these three spending ranges were in the less than $100,000 sector, with figures ranging from a high of 73% for drones to 41% for precision spraying systems.

In terms of precision agtech segments that the nation’s top ag retailers plan to spend more than $1 million on in 2023, the newest led the pack. According to the survey, 38% of respondents plan to spend at least this much to purchase autonomous vehicles for their operations. Recently, there has been a lot of activity in this sector, new product wise, with product introductions from the likes of Raven Industries and Case IH, so it appears that many ag retailers are intrigued by what market advantages these brands have to offer in their field work.

Another newer segment landed in second place among the spending more than $1 million group — precision spraying systems. These systems, exemplified by such brands as John Deere’s See & Spray Ultimate, garnered a 28% in the survey.

Base = 101 | Source: CropLife 2023 Precision AgTech Buying Intentions Survey

Rounding out the Top Five among precision agtech segments on the survey were a blend of older and newer technologies. In third place with spending of more than $1 million was the yield monitors segment at 22%. This was followed closely by automatic steering systems at 21%. In fifth place, there was a three-way tie between boom/nozzle controls, guidance systems, and soil sampling systems, each coming in 19%.

Yet, despite this high level of anticipated spending activity during 2023 among ag retailers for many of the newer precision agtech segments, one isn’t projected to perform quite so well — drones/unmanned aerial vehicles (UAVs). Although drones have had plenty of interest from ag retailers over the past decade or so, ag retailers aren’t planning to spend that much on the segment during the 2023 growing season. In fact, according to the survey, only 12% of respondents plan to spend more than $1 million on drones this year. Another 15% plan to spend between $100,001 and $999,999 on this category. The vast majority, however (73%), indicated that their spending in this segment would be $100,000 or less for the year.