Buying Intentions Survey: Gauging What Products Ag Retailers Plan to Buy for 2023

Editor’s note: The 9th annual CropLife® magazine Buying Intentions survey was sent to readers in November and early December 2022. In total, there were 241 surveys returned with valid answers. In terms of breakout, 66% of the respondents identified themselves as being ag retailers/cooperatives. Another 11% said that their companies were classified as pesticide manufacturers or formulators. Seven percent indicted they were fertilizer producers, with 9% identifying as manufacturers of equipment or components. The remaining 7% identified themselves as “others.” CropLife magazine would like to thank everyone that took part in this year’s survey. Your insights are appreciated!

As the agricultural industry moves into 2023, most folks are probably feeling pretty good. Over the past three years, there have numerous issues for ag retailers and their grower-customers to work through. This included worker shortages, product shortages, rising prices, and supply chain disruptions, to name a few. Through it all, however, the marketplace persevered (and even thrived), with overall income levels for the nation’s top ag retailers topping $46 billion (according to the annual CropLife 100 survey) and grower income almost hitting the $200 billion mark.

So, with 2022 now behind the industry, how do things look for the various crop inputs/equipment segments as the 2023 growing season rolls around? In a word, flat.

According to data compiled from the 9th annual CropLife Buying Intentions Survey, most of the nation’s ag retailers are anticipating a somewhat slower buying season ahead of them this year. Let us review the major segments of the business to see how each might end up for the 2023 growing season.

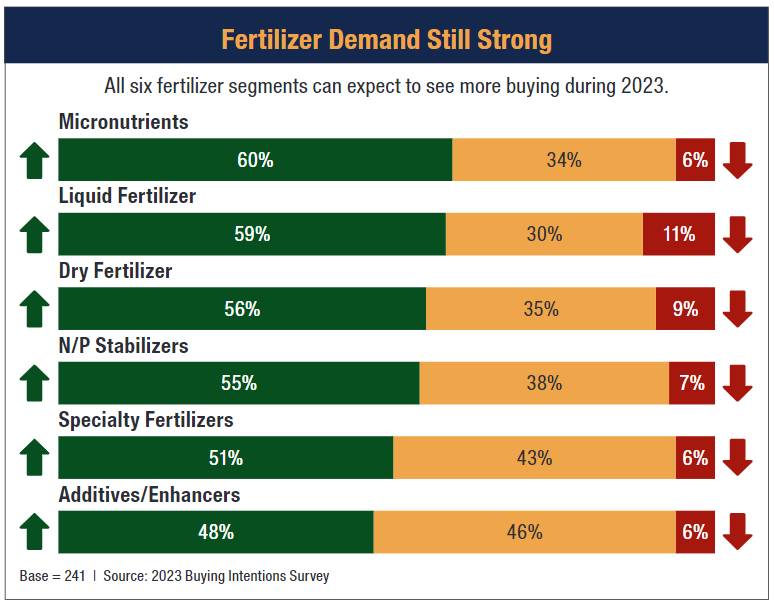

The Fertilizer Outlook

During 2022, the fertilizer category had one of its best years ever. Despite higher-than-normal prices for virtually every form of macronutrient, overall fertilizer sales for the nation’s top ag retailers grew to a record $23.4 billion during the year. This marked an unbelievable 53% increase from the 2021 category sales total of $15.3 billion.

Now, looking ahead to 2023, it looks as if fertilizer spending will remain strong. According to the Buying Intentions Survey, all six of the segments that make up the fertilizer category will see stronger sales figures during the upcoming growing season. In fact, the percentage of respondents planning to spend more on these segments during 2023 will be higher than the percentage of respondents planning flat to lower sales in every case.

Leading the pack in terms of expected sales numbers are micronutrients, where 60% of survey respondents expect to spend between 1% and more than 11% more during 2023, and liquid fertilizer, which sports a similar 59% spending mark. On the reverse side, the additives/enhancers segment is expected to be the lowest in terms of fertilizer spending, with 48% of respondents saying they plan to increase buying in this area vs. 46% that expect spending to be flat.

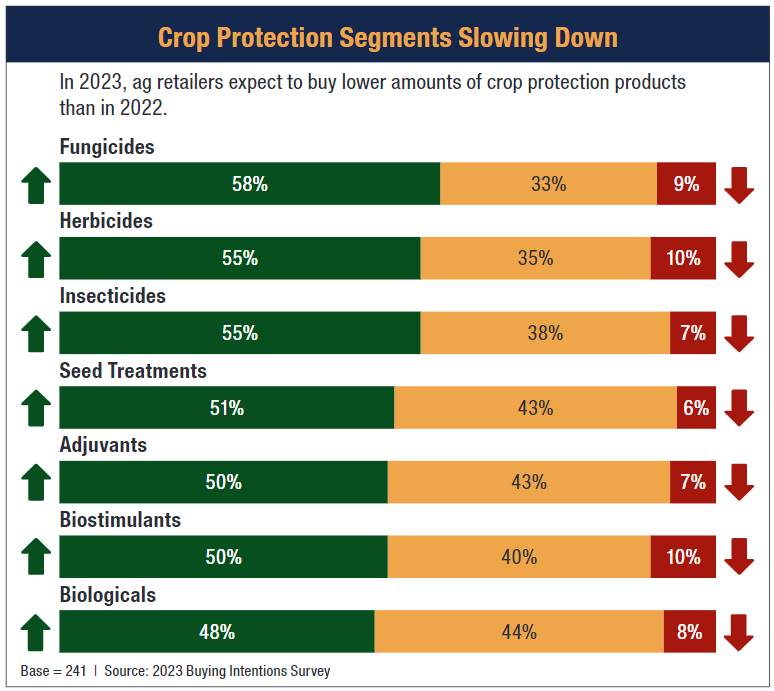

The Crop Protection Products Outlook

In 2022, the anticipation among ag retailers for plenty of sales activity in the crop protection products category was very high indeed. In fact, according to 2022 Buying Intentions Survey, respondents expected to spend significantly more on products here than in most other categories. This was led by a high 78% mark for herbicides to a low of 57% for seed treatments.

What a difference a year makes. According to the results from the 2023 Buying Intentions Survey, the highest expected buying percentage for this category is fungicides, with 58% of respondents planning to spend 1% to more than 11% on these items. Most of the other segments have buying percentages in the 50s — significantly lower than what was seen during the 2022 Buying Intentions Survey.

Of note is the expected performance of bio-based products. According to the survey, 50% of respondents plan to spend more on biostimulants during 2023 vs. 2022 (down 10% from the percentage in 2022). Likewise, biologicals are expected to see 48% of ag retailers spending between 1% and more than 11% on these products, with a near identical 46% planning to keep their buying flat in this segment.

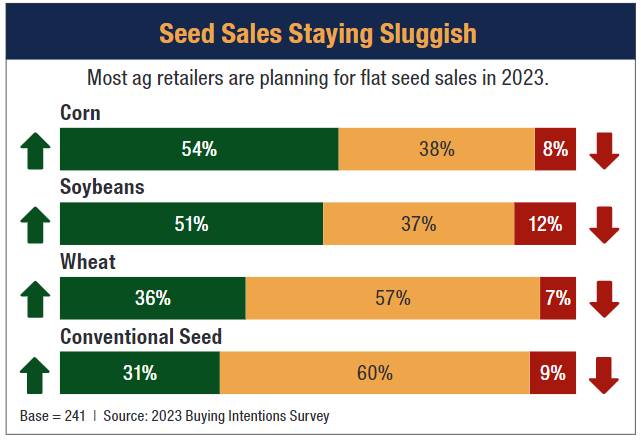

The Seed Outlook

Going into the 2022 growing season, the seed category was expected to be very busy indeed. In fact, according to results from the 2022 Buying Intentions Survey, 60% of ag retailers were anticipating spending between 1% and better than 11% more on corn seed. Soybean seeds had even stronger percentages, with 73% of respondents expecting to increase their buying in this segment.

Yet, when all was said and done, seed sales in 2022 were not that robust. According to results from the 2022 CropLife 100 survey of the nation’s top ag retailers, overall seed sales stayed flat during the year, coming in at just under $5 billion.

Perhaps with this in mind, the majority of ag retailers in 2023 are not expecting to increase their seed buying much at all. According to the 2023 Buying Intentions Survey, only 54% of respondents plan to up their corn seed spending between 1% and more than 11% during the upcoming year. Soybean seed sales will be similar, with 51% of ag retailers increasing their spending in this segment.

The Equipment Outlook

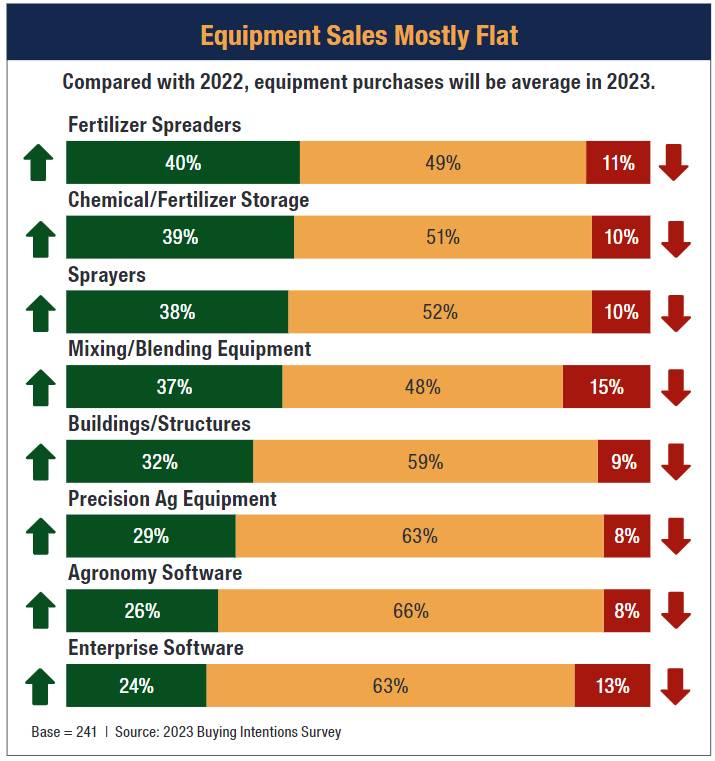

In the 2022 Buying Intentions Survey, one of the biggest takeaways was the performance of the equipment sector. Following relatively flat sales in virtually all segments during the 2020 and 2021 growing seasons, ag retailers indicated a willingness to up their spending for all segments during 2022 (except in agronomy software). Indeed, most segments had recorded percentage increases between 51% and 64% in last year’s survey.

Alas, this trend is not expected to hold up during 2023. According to this year’s survey results, not a single segment within the equipment sector can expect sales increases to outpace flat spending among the nation’s top ag retailers. In fact, the only segment where respondents plan to increase their spending between 1% and more than 11% is spreaders at 40%. All of the other categories have increased spending percentages ranging from 24% for enterprise software to 39% for chemical/fertilizer storage.