The State of Ag Retail Distribution is Still Changing

Editor’s note: The first-ever CropLife® magazine State of Retail Distribution survey was sent to readers in August 2019. In total, 139 surveys were completed with valid answers. Forty percent of respondents identified themselves as cooperatives, 30% as independent retailers, and 30% as part of national chains/others. Fifty-three percent said their businesses are located in the Midwest, 24% in the West, 15% in the Mid-South, and 8% in the Northeast. In terms of revenues, 39% of respondents said their companies generate less than $50 million in annual sales, 24% have sales of $100 million to $900 million, 21% have sales of more than $1 billion, and 16% fall within the $50 million to $99 million sales range.

For those who business in the agricultural marketplace, change is an almost constant variable. Year in and year out, ag retailers and their grower-customers must deal with such changes as weather patterns bringing too much heat or moisture, soil conditions, insect/weed/disease pressures, and even unanticipated trade environments. And through it all, ag retailers and their grower-customers are expected to deliver crop inputs, custom application services, and crops to a waiting food producer/consumer driven end market.

Dave Coppess

With this in mind, for the past two years now, CropLife has looked at how all these converging factors have begun changing the way ag retailers conduct their business. In fact, in October 2017 – the first time that looked at this topic in-depth – Dave Coppess, Executive Vice President of Sales and Marketing for Heartland Co-op, West Des Moines, IA, made this observation about the ag retail space: “We are definitely in a period of change in the market. There are new business models beginning to pop up, and they are threatening to destroy or at least radically alter the old ones.”

Now compare this comment with one made this past August at a meeting with CropLife and Steve Rao, CEO of Farm Market iD, discussing the ag retail distribution market. “The retailer part of agriculture will probably change dramatically in the next few years,” said Rao. “For the most part, this part of the market has a business model that haven’t changed for many, many decades. But it will probably need to to survive going forward.”

To kick off this year’s coverage of this topic, we thought it might be nice to gauge how the overall marketplace feels about the changes currently taking place in the ag retail space. Therefore, this past August, we sent out an email survey to our readers, asking some of the questions readers have posed to us over the course of the past two years’ worth of stories we’ve featured online. As always, some of this feedback was surprising (see charts in slideshow above).

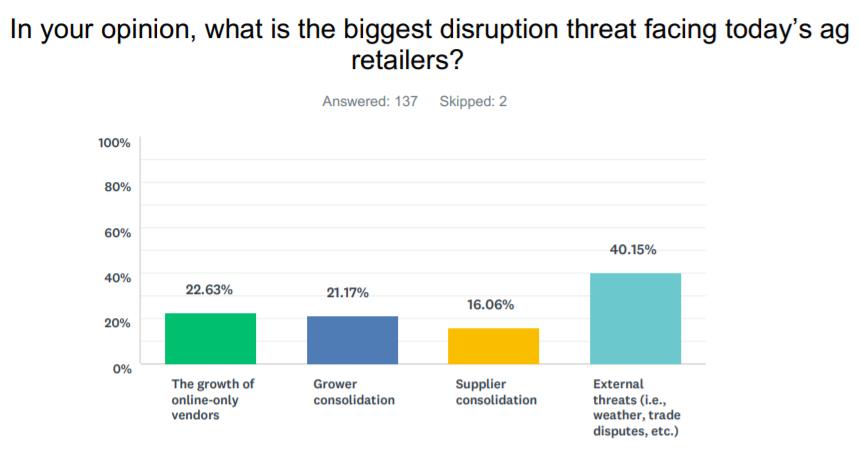

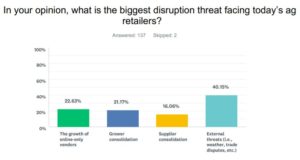

For example, take the answer to the question of the market disruptors. While many industry watchers have pointed to mergers and e-commerce as key drivers for market change, the majority of CropLife readers (40%) still say that external threats such as extreme weather events and trade disputes are bigger disruptors than the growth of online-only vendors (23%) or grower or supplier consolidation (21% and 16%, respectively).

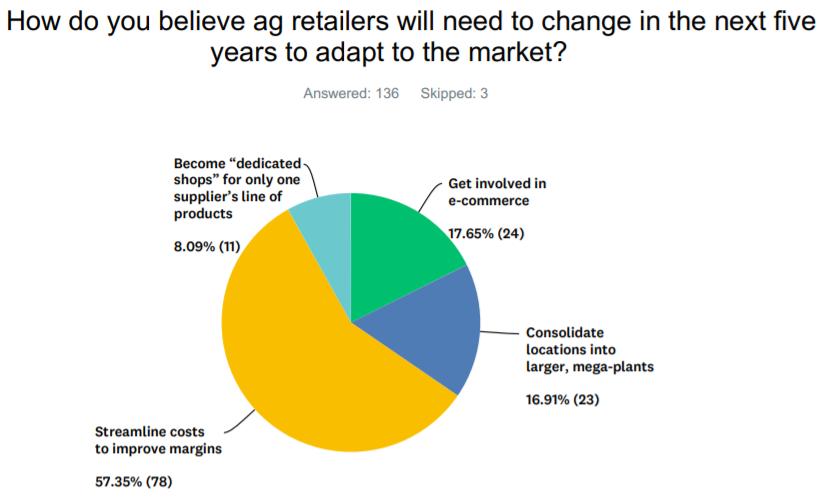

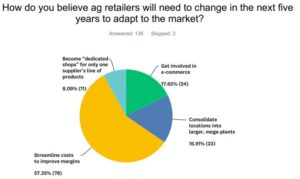

Also, somewhat surprising was what readers thought ag retailers would do to adapt to market changes between now and 2025. Regarding this question, only 18% of respondents believed that traditional ag retailers engaging in e-commerce would be the answer. The vast majority, 57%, thought that ag retailers would need to better “streamline costs to improve margins” to survive. The remaining 25% indicated that consolidating into larger, “mega-plants” was the best option (17%), with 8% thinking that ag retailers becoming “dedicated shops for only one supplier’s product line” was the answer.

Planning for the Next Generation

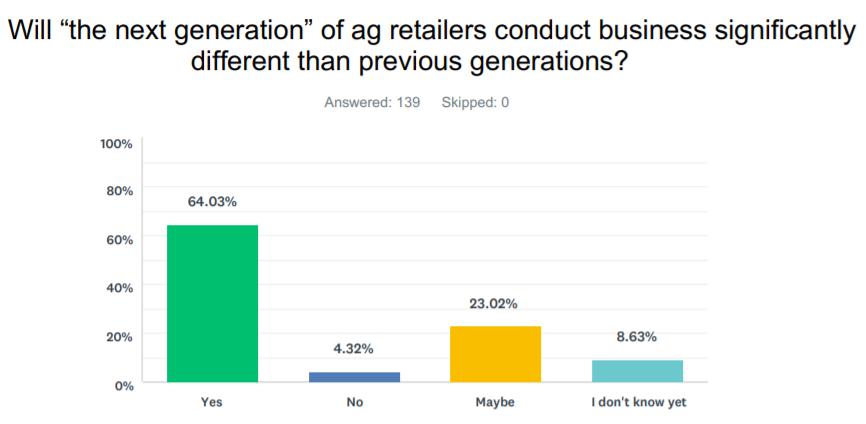

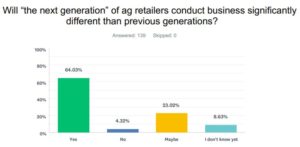

Of course, the choices for the first two survey questions was directed at the current slate of ag retailers. But what about the next generation? Will this likely younger group of decision-makers conduct ag retail business in the same way as their predecessors? In short, most of today’s ag retailer don’t think this will be the case.

When asked “will the next generation of ag retailers conduct business significantly different than previous generations?” a sizable 64% of respondents said “yes.” Only 4% believed younger decision-makers would follow the examples set forth by their forefathers. The remaining 32% weren’t sure how the next generation of ag retailers would run their businesses.

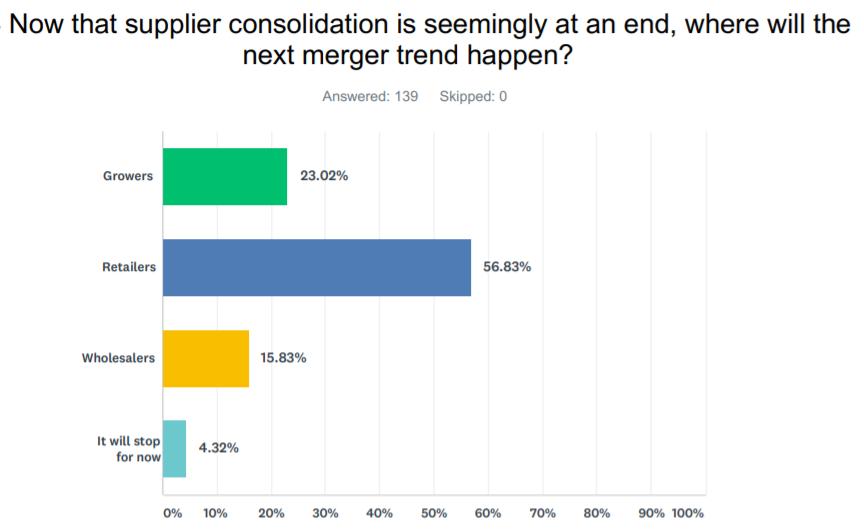

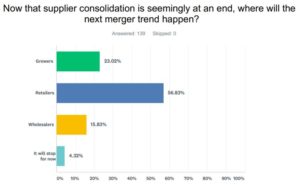

Along these lines, ag retailers believe that ag retail will be the next major “consolidation driver” moving the industry forward now that supplier consolidation seems to be slowing down significantly. According to the survey respondents, 57% think ag retailer consolidation will be the most prevalent area of mergers over the next five years. Another 23% thought that grower consolidation would dominate the agricultural landscape. Sixteen percent believed a wave of wholesaler consolidation was on the horizon. The remaining 4% said that consolidation in agriculture “will stop for now.”