CropLife 100 Ag Retailers: Not Only Surviving in 2019, But Thriving

Going through the 2019 growing season, many of the people that make their livings from agriculture were doing their best to simply survive the year. A host of issues — trade wars, low commodity prices, weather, etc. — caused many individuals and companies to struggle to make any kind of money, let alone turn a profit.

Through the early part of the year, it seemed as if ag retailers would follow this “survivor script” as well, trying their best not to get voted off “profit margin island.” In the end, however, the majority of companies that make up the CropLife 100 not only found a way to survive the 2019 growing season but also managed to grow their overall revenues along the way.

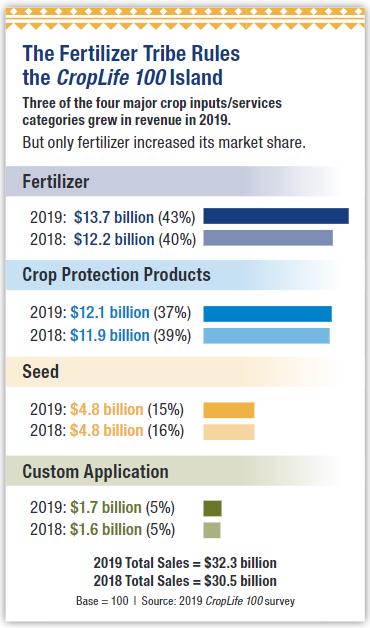

According to the 2019 CropLife 100 survey, the nation’s top ag retailers saw their overall sales volume grow by an impressive 6% during the year, increasing from $30.5 billion in 2018 to $32.3 billion. Considering the kind of year 2019 turned out to be for all of agriculture — and the fact that the revenues for CropLife 100 ag retailers have averaged around 2% annual growth the past few years — this was indeed a surprising result.

According to the 2019 CropLife 100 survey, the nation’s top ag retailers saw their overall sales volume grow by an impressive 6% during the year, increasing from $30.5 billion in 2018 to $32.3 billion. Considering the kind of year 2019 turned out to be for all of agriculture — and the fact that the revenues for CropLife 100 ag retailers have averaged around 2% annual growth the past few years — this was indeed a surprising result.

To understand how the CropLife 100 ag retailers managed to pull off this survivor strategy, there are two factors to look at. One is the performance of fertilizer, the leading category for CropLife 100 companies in 2019.

Although conventional wisdom might have pointed to a lot of prevent plant acres and predicted decreased fertilizer sales as a result, this apparently wasn’t the case during 2019. In fact, according to survey respondents, the fertilizer category revenues for the year grew more than 12%, up from $12.2 billion in 2018 to $13.7 billion. Buoyed by this growth, the market share for the fertilizer category — which had been falling the past seven years — shot back up during 2019, hitting 43%. This marked the only category within the CropLife 100 that managed to accomplish such a market share gain.

As for why fertilizer enjoyed such a strong sales year in 2019, market watchers attribute it to two possible factors. One is the fact that fertilizer prices might have remained higher than normal during the early portion of 2019, when spring application was taking place. The other could be the fact that grower-customers went ahead with their fertilizer purchases despite market difficulties and cut back on other crop inputs/services instead.

This latter explanation for the fertilizer category’s performance during 2019 could explain what happened to the rest of the market for CropLife 100 ag retailers. According to the survey, two of the other crop input/service categories — crop protection products and custom application — did manage to make modest sales gains during 2019. For crop protection products, sales were up less than 2%, from $11.9 billion in 2018 to $12.1 billion. In custom application, revenues improved 6%, from $1.6 billion in 2018 to $1.7 billion in 2019. However, neither category gained market share. The custom application category stayed flat at 5% while the crop protection products category dropped 2%, from 39% in 2018 to 37%.

Meanwhile, the other category — seed — saw its sales volume between 2018 and 2019 remain static at $4.8 billion. Nonetheless, the seed category’s market share of all CropLife 100 crop inputs/services dropped 1% to 15%.

Company Driven

The other factor that caused overall CropLife 100 sales to grow significantly in 2019 ties back to the companies that make up the list. For several years many of the ag retailers within the CropLife 100 have been actively buying up neighboring/competing companies every year. And this trend continued in 2019. In fact, just a few examples of CropLife 100 retailers joining forces would include No. 3 GROWMARK buying last year’s No. 70 retailer Northwest Ag Supply; Nos. 39 and 58 — The Tremont Group and The Lyman Group (which were already owned by the same parent company) — formally combined to form Grow West (and provide customers with a “single unified brand,” according to company President/CEO Ernie Roncoroni); and No. 1 Nutrien Ag Solutions purchasing 2018’s No. 42 retailer Van Horn.

Indeed, much of the growth for the 2019 CropLife 100 could be traced back to merger moves made by Nutrien Ag Solutions. In total, the company reported that it now had 1,000 outlets in its family of locations — an increase of almost 150 storefronts from the 2018 survey report. Overall, the number of outlets that make up the 2019 CropLife 100 stands at 4,942, up from 4,703 the year before.

However, most of the companies that make up the CropLife 100 did have better sales years in 2019 vs. 2018. Looking at the entire list, slightly less than half (48%) saw their revenues this year increase from one year ago. Only slightly less than one-third (30%) recorded sales declines. The rest (22%) had flat sales year-over-year.

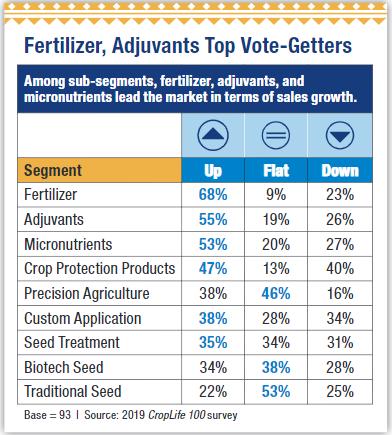

When looking at overall CropLife 100 sales, CropLife magazine not only looks at the four major crop input/service categories but also several sub-segments as well. Here again, the sub-segments that make up the fertilizer category — fertilizer and micronutrients — performed best in terms of sales gains during 2019. According to the survey, 68% of the nation’s top ag retailers saw their fertilizer segment sales improve more than 1% this year. As for micronutrients, 53% of respondents said their sales in 2019 vs. 2018 increased more than 1%. The only other sub-segment to mirror this revenue growth was adjuvants, which 53% of CropLife 100 retailers said were up in this same sales range.

When looking at overall CropLife 100 sales, CropLife magazine not only looks at the four major crop input/service categories but also several sub-segments as well. Here again, the sub-segments that make up the fertilizer category — fertilizer and micronutrients — performed best in terms of sales gains during 2019. According to the survey, 68% of the nation’s top ag retailers saw their fertilizer segment sales improve more than 1% this year. As for micronutrients, 53% of respondents said their sales in 2019 vs. 2018 increased more than 1%. The only other sub-segment to mirror this revenue growth was adjuvants, which 53% of CropLife 100 retailers said were up in this same sales range.

Most of the other sub-segments increased for less than half of the 2019 CropLife 100 retailers. Significant are the sub-segments involving seed, all three of which — seed treatment, biotech seed, and traditional seed — saw sales gains of less than 40% each. Virtually all of them had flat sales compared with 2018, perhaps indicative of all the prevent plant acres witnessed across the country this year (more than 19 million acres, according to government statistics).

Bevy of Concerns

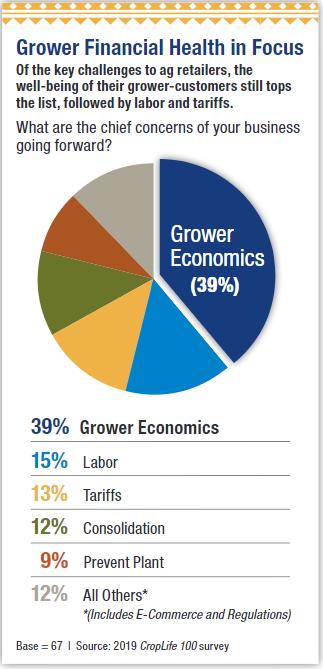

Speaking of prevent plant acres, this was the fifth-biggest concern among CropLife 100 ag retailers in 2019, mentioned by 9% of respondents.

“There were lots of prevent plant acres this year,” wrote Dennis Halbach, Vice President of Agronomy for Country Visions Coop, Reedsville, WI. “[This will mean] weed issues next year.”

Kaci Larsen, Office Manager, Spink Location for Valley Ag Supply, Gayville, SD, echoed this remark. “Preventive plant acres [will mean] weed pressures going forward on those acres,” wrote Larsen.

Furthermore, James Howe, President/CEO for Star of the West Milling, Frankenmuth, MI, thinks prevent plant acres in 2019 could impact the 2020 growing season as well. “We had many unplanted acres due to an extremely wet spring,” wrote Howe. “So, credit will be the concerning issue.”

Of course, overall agricultural economics/grower financial health/commodity prices remained the top issue of concern among CropLife 100 retailers during 2019. In fact, according to the survey, 39% of respondents thought this related series of issues posed a challenge to their profitability today and in the future.

“The ag economy is our biggest threat for the growth of our business,” wrote Rory Olerud, CEO/Owner of Agri Partners, Clear Lake, SD.

Erik Guy, CEO for Delta Growers Association, Charleston, MO, agreed. “Lower commodity prices and lower farmer net income will stay a topic in 2020,” he predicted.

Art Schmidt, General Manager/CEO at Mountain View Co-op, Black Eagle, MT, believed this issue would dog agriculture even further out than next year. “We need to get really prepared for the next couple of years of grower financial hardship if commodity markets and global trade issues are not resolved,” he wrote.

Art Schmidt, General Manager/CEO at Mountain View Co-op, Black Eagle, MT, believed this issue would dog agriculture even further out than next year. “We need to get really prepared for the next couple of years of grower financial hardship if commodity markets and global trade issues are not resolved,” he wrote.

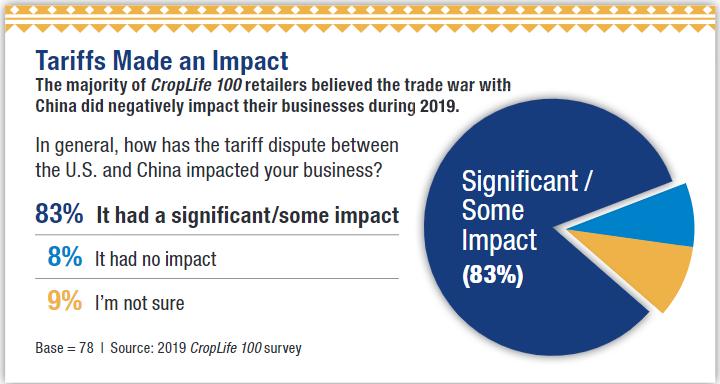

In particular, many CropLife 100 retailers feel that the ongoing trade/tariff dispute between the U.S. and China is making the financial health of agriculture worse than it has been over the past few years. Overall, 13% of respondents on the 2019 survey listed the trade fight as their biggest concern for the year. Digging even deeper, the survey asked CropLife 100 retailers how much impact the trade war was having on their business operations in 2019. A whopping 83% said it had “a significant” or “some” impact. The other 17% said the tariff dispute had “no” impact or “I’m not sure of the impact.”

“We are an export-oriented area, with 90% of our wheat going abroad, along with the bulk of our potatoes, legumes, etc.,” wrote Alex McGregor, Chairman of The McGregor Co., Colfax, WA. “[We are] working full blast to speak out to legislators on tariffs.”

After financial issues, the second biggest concern among CropLife 100 retailers in 2019 wasn’t new at all — labor. According to 15% of respondents, finding and keeping “qualified, good” employees remained their biggest challenge (although this was down from 26% of respondents that said labor was their chief concern during the 2018 CropLife 100 survey).

“The labor market continues to get tighter, and it is very difficult to find good people,” wrote Brian Lish, CEO for AgRx, Oxnard, CA.

“The lack of people interested in working with farmers,” wrote R. Hovey Tinsman III, President for Twin State, Davenport, IA. “Finding qualified people [is the] No. 1 issue.”

Outlook for 2020

Given how difficult the year was for the whole of agriculture, it is interesting to see how the nation’s top ag retailers believe the 2020 growing season will ultimately play out. First, however, a look back.

When ag retailers were asked how their grower-customers felt going into the 2019 season, respondents were relatively lukewarm toward the year. According to the 2018 CropLife 100 survey, only 23% of the nation’s top ag retailers believed 2019 would rate between a seven and a 10 in terms of profit potential. Another 18% thought the year would rank between a one and a three, sales-wise. The majority, 59%, were convinced 2019 would be an average year (ranking between a five and seven). For the most part, this “read” on 2019 was borne out by the year-end results from across agriculture.

So how do CropLife 100 retailers feel about 2020 based upon the feedback from their grower-customers? In a word — positive. When asked to rate the upcoming growing season on a scale of one to 10, 64% of respondents believe it will rate between a seven and a 10 in terms of growth. Another 29% think that 2020 will rate between a four and a six in overall revenues. Significantly, only 7% of CropLife 100 retailers expect 2020 to rate between a one and a three.

Ultimately, the proof for these projections will come next spring. “Commodity prices must improve in order to allow our customers/growers the opportunity to profit,” wrote Kent McPherson, Director of Operations for Greenpoint AG, Memphis, TN.