Plenty to Dissect with the 2023 Biologicals Survey Results

Ask most anyone in agriculture today what one of the hottest topics of conversation is when it comes to product categories, and chances are good that they will respond “biologicals.” As many market watchers are quick to point out, the desire by many grower-customers to prove to end-users and the general public that they farming practices are sustainable, and biologicals usage almost becomes a natural outgrowth of this effort.

In its press release announcing the company’s acquisition of FBSciences, Valent Biosciences President and CEO Ted Melnik, pointed out this fact. “The wide range of biostimulant, biopesticide, and crop nutrition products and technologies in the FBSciences portfolio augments Valent BioSciences’ broad family of biorational products, thereby creating an unmatched range of value-added and sustainable solutions that no other company can provide,” said Melnik.

However, there seems to be something of a paradox in play when it comes to some of the overall numbers the biologicals category is seeing among ag retailers. While more companies and products are entering the industry space, usage rates seem to have flattened out some from prior years.

This was the overall finding of the 2023 Biologicals Survey, conducted by CropLife® magazine this past January. This built upon an earlier such surveys, released back during the 2017-18, 2020-21, and 2021-22 growing seasons, looking at the performance of the biologicals category in the ag retail marketplace.

This was the overall finding of the 2023 Biologicals Survey, conducted by CropLife® magazine this past January. This built upon an earlier such surveys, released back during the 2017-18, 2020-21, and 2021-22 growing seasons, looking at the performance of the biologicals category in the ag retail marketplace.

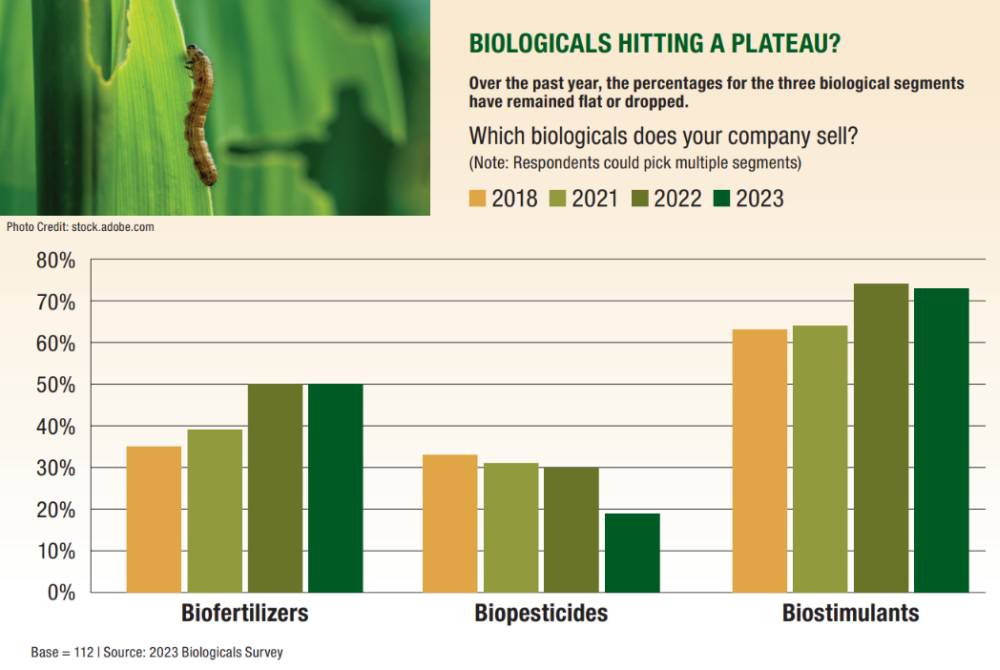

For starters, the 2023 survey asked about the mix of biological products companies currently sold to grower-customers. These were broken down into three distinct segments — biofertilizers, biopesticides, and biostimulants. Respondents were allowed to choose all three product types for this question. And 17% indicated their companies sold no biological products at the present time — a 1% decline from the 18% that said this was the case for their companies in the 2021-22 survey.

In terms of the three types of biological products, biostimulants remain the most common. According to the 2023 survey, 73% of respondents sell these products to their customers, down 1% from the 2021-22 survey. The percentage of respondents selling biofertilizers remained flat from last year’s growing season, coming in at 50% for both years. Meanwhile, the biopesticide segment saw its percentage drop significantly from 2021-22, off 11% to 19% in this year’s survey results.

For a more in-depth look at how each of these biological segments performed during the 2022 growing season — and are projected to perform for 2023 — please see the individual stories elsewhere in this special report.

For a more in-depth look at how each of these biological segments performed during the 2022 growing season — and are projected to perform for 2023 — please see the individual stories elsewhere in this special report.

A Great Combination

As for how biological products are used by grower-customers, the vast majority in prior years were utilized in conjunction or combination with conventional agricultural products.

And this hasn’t changed much during the past year. If anything, this trend has become even more prominent. According to the 2023 Biologicals Survey, 85% of respondents indicated this was the case with their biological product users. Somewhat surprisingly, absolutely zero respondents said the biological products they sell to grower-customers were being used as standalone options. (The remaining 15% of survey respondents said that this question was “not applicable” to their operations.)

Regarding how these biological products are being applied by grower-customers, 15% of the 2023 survey respondents indicated these were used as topicals, up from 1% in the 2022 survey. Another 9% said that biological products are applied as seed treatments (a decline of 4% from last year’s survey results). The majority of respondents, 61%, said that biological users were applying products as both topicals and seed treatments.

(Editor’s Note: The remaining 15% of respondents for both of these questions said biological product usage was “not applicable” for their customers.)

Trust Issues Remain

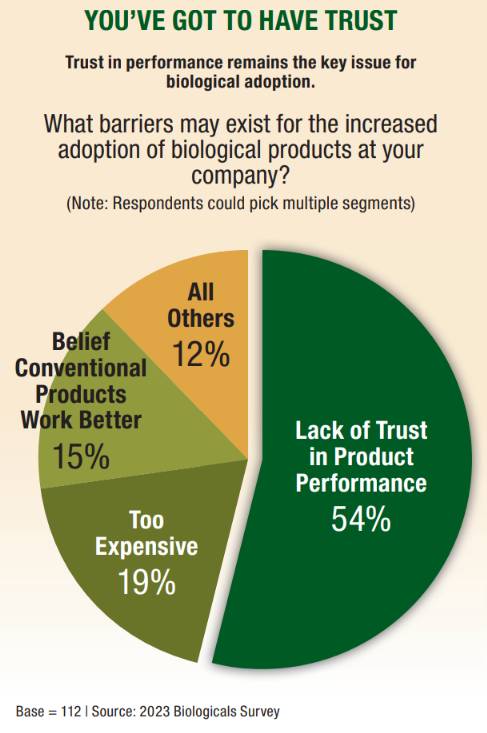

When survey respondents were asked about what barriers still exist within the agricultural marketplace to seeing the adoption of biological products become more widespread, they presented a range of reasons. By far the one mentioned most often by respondents was “a lack of trust in the product’s performance.” This was cited by 54% of survey respondents as the major reason biological products have had a hard time finding market acceptance. This was an increase from 41% in the 2022 survey, a significant jump.

In second place among barriers was cost. According to 19% of survey respondents, biological products are just “too expensive” compared with conventional agricultural products for grower-customers to use regularly (this represented a 1% increase from the 2022 survey). Close behind this was the belief that “conventional products are better than biologicals in the field,” which was mentioned by 15% of respondents — identical to the percentage this concerned held in the 2021-22 survey. The remaining 12% cited myriad reasons for low biological product adoption, including storage concerns, a loss of seller profits, and regulatory issues.

Myriad Companies to Pick From

In recent years and months, many new companies have entered into the biologicals space. This has significantly broadened the category’s market presence and sales performance, according to market watchers. However, for those observers looking at the names of the leading biological companies, many of them will sound incredibly familiar.

Regarding which suppliers respondents are getting their biologicals from (another question that allowed respondents to choose multiple options), major crop protection product companies lead the pack. According to the 2023 survey, Corteva Agriscience is the leader in the field among respondents, being the source of biologicals for 53%. Verdesian and WinField United were tied in second place, both being the source of biologicals for 35% of respondents. BASF was fourth at 34%, with Syngenta rounding out the Top 5 suppliers list at 31%.

Finishing out the Top 10 biologicals companies, Bayer CropScience ranked at No. 6, supplying products to 29% of respondents. No. 7 was FMC Corp. at 27%. Novozymes finished in eighth place, with 23% of respondents sourcing biologicals from the company. Finally, tied for ninth and tenth place at 20% apiece were Valent Biosciences and Valagro.

Still Looking for Future Growth

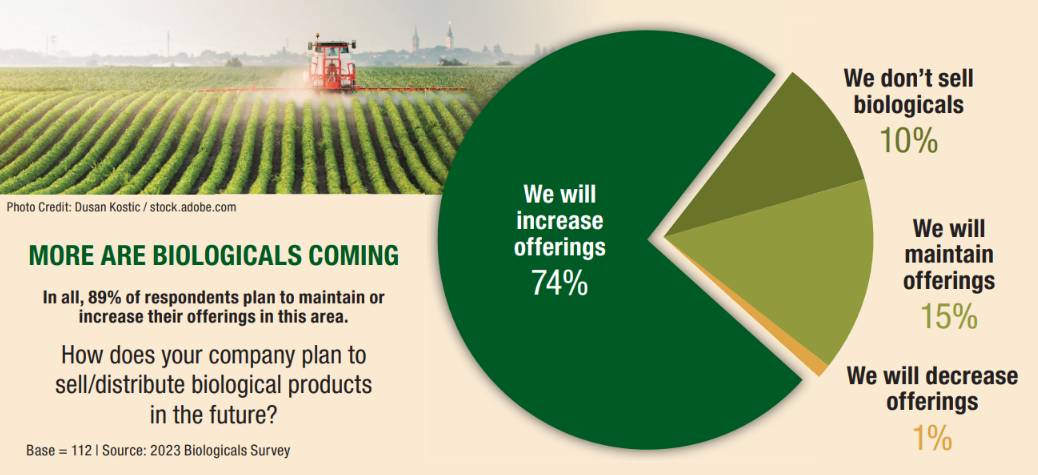

Despite all these obstacles (and some evidence of market flatness in some areas), the overall future for the biological products category still looks positive. According to the 2023 survey, 74% of respondents are planning to increase the number of biological products their companies sell to grower-customers during the coming year, up from 68% for the 2022 survey. Another 15% plan to maintain their current level of spending for biologicals. Only 1% indicated their companies plan to decrease the numbers/amounts there are currently spending on biological products for the 2023 growing season.

Survey Statistics

The 2023 CropLife magazine Biologicals survey was sent to readers in January. In total, there were 112 surveys returned with valid answers.

In terms of breakout, 89% of the respondents identified themselves as being ag retailers/cooperatives. Another 5% said that they fertilizer producers/suppliers. The remaining 6% identified themselves as manufacturers/university representatives/researchers.

Region-wise, 46% of the respondents said their companies were located in the Midwest, 22% in the Plains, 13% were in the West, 12% in the Northeast, and 7% in the South. In terms of crops serviced (where multiple answers could be chosen), 90% of respondents dealt with corn, 82% with soybeans, and 67% with wheat.

CropLife magazine would like to thank everyone that took part in this year’s survey. Your insights are appreciated!