Biologicals in 2024: Some Headway, But Headwinds Remain

For the biologicals category, the past few years have largely paralleled that old adage regarding “one step forward, one step back.” At times, it seems as if for every marketplace breakthrough the category has experienced, there has been some sort of setback as well.

And based upon the data gleaned from the 2024 CropLife® Biologicals Survey, this remains the case for the upcoming growing season. Looking at the totals, there are plenty of positives for biologicals fans to latch onto. For other sectors of the business, however, the up-and-down pattern of the past few years has remained stubbornly consistent.

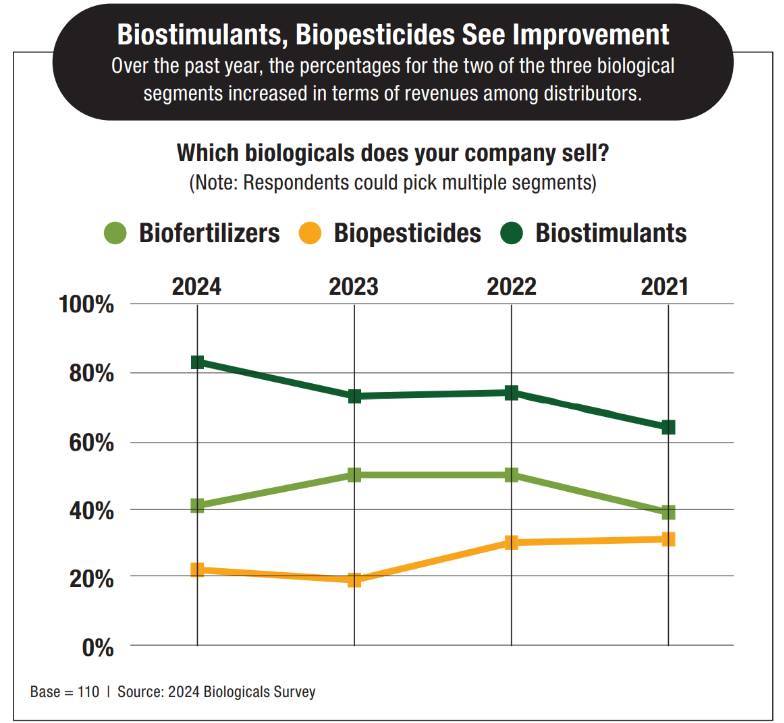

For an example of this trend in action, consider the individual sectors that make up the biologicals marketplace — biofertilizers, biopesticides, and biostimulants. In the survey, we asked respondents to tell us which types of biological products they sold to customers. This question allowed respondents to choose all three biological product types, which a majority of them indicated was the case for their businesses.

And the percentages were interesting. In terms of the three types of biological products sold among respondents, biostimulants remain the most common. According to the 2024 survey, 83% of respondents sell these products to their customers, an impressive increase of 10% from the 2023 survey. Biopesticides also showed an uptick in applications for year, growing from 19% in the 2023 survey to 22%.

On the flipside, the percentage of respondents selling biofertilizers dropped significantly from last year’s growing season. The prior two years, this sector held steady at 50%. In the 2024 survey, however, only 41% of respondents said they were marketing these biological products in their operations — a decline of 9% from the 2023 survey results.

Where’s the Trust?

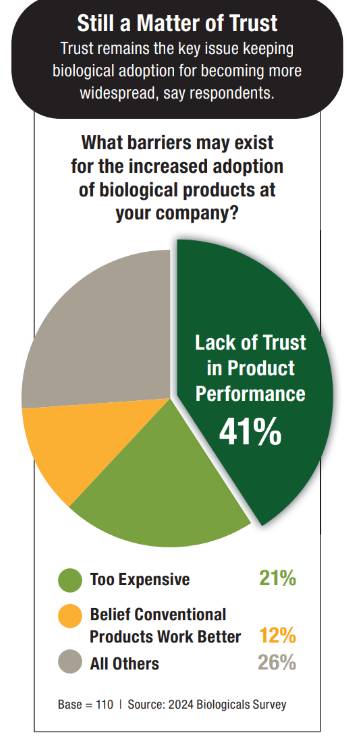

If there’s one constant from year-to-year for the biologicals category, it’s trust issues. Since CropLife began conducting its biologicals survey back in 2018, respondents have indicated a lack of trust in product performance has been the biggest reason adoption of these brands hasn’t caught on with more grower-customers.

If there’s one constant from year-to-year for the biologicals category, it’s trust issues. Since CropLife began conducting its biologicals survey back in 2018, respondents have indicated a lack of trust in product performance has been the biggest reason adoption of these brands hasn’t caught on with more grower-customers.

And this remains the case in 2024. According to this year’s survey results, 41% listed trust issues as the major reason biological products have had a hard time finding market acceptance. Luckily, this did represent a decline from the 2023 survey results, where 54% of respondents said “lack of trust” was the key issue impacting biologicals acceptance.

In second place among barriers was cost. According to 21% of survey respondents, biological products are just “too expensive” compared with conventional agricultural products for grower-customers to use regularly (this represented a 2% increase from the 2023 survey). Close behind this was the belief that “conventional products are better than biologicals in the field,” which was mentioned by 12% of respondents — a 3% decline from the 2023 survey. The remaining 26% cited other reasons for the low biological product adoption rate with their customers. This included storage concerns, a loss of seller profits, and regulatory issues.

The Majors Lead the Pack

As a newer category, the biologicals category has seen many new companies enter the marketplace in recent years. However, for those observers looking at the names of the leading biological companies, “well-established agricultural suppliers” doing business in this market still dominate when it comes to customer preference.

Regarding which suppliers respondents are getting their biologicals from (another question that allowed respondents to choose multiple options), major crop protection product companies easily stood out from the field. According to the 2024 survey, BASF is the leader in the field among respondents, being the source of biologicals for 44%. Corteva Agriscience and Bayer Crop Sciences were tied in second place, both being the source of biologicals for 43% of respondents. Winfield United was fourth at 36%, with Syngenta rounding out the Top 5 suppliers list at 33%.

Finishing out the Top 10 biologicals companies according to survey respondents were FMC Corp. ranked at No. 6, supplying products to 26% of respondents. No. 7 was Albaugh at 24%. Verdesian finished in eighth place, with 23% of respondents sourcing biologicals from the company. Novozymes was in the ninth spot, sourced by 22%. Finally, in tenth place at 21% was AMVAC.

Future Growth Seems Assured

For a category like biologicals, the outlook is almost as important as the current state of things. In this respect, the overall future for the biological products category still looks bright. According to the 2024 survey, 72% of respondents are planning to increase the number of biological products their companies sell to grower-customers during the coming year, only a slight drop from 74% on the 2023 survey. Another 17% plan to maintain their current level of spending on biologicals. Only 1% indicated their companies plan to decrease the numbers/amounts they are currently spending on biological products for the 2024 growing season. (Editor’s Note: The remaining 10% said their companies didn’t sell biological products at the time the survey was taken.)

About the Survey

The 2024 CropLife magazine Biologicals online survey was sent to readers in January. In total, there were 110 surveys returned with valid answers. In terms of breakout, 85% of the respondents identified themselves as being ag retailers/cooperatives. Another 10% said they were fertilizer producers/suppliers. The remaining 5% identified themselves as manufacturers/university representatives/researchers.

Region-wise, 50% of the respondents said their companies were located in the Midwest, 19% in the Plains, 14% were in the West, 9% in the Northeast, and 8% in the South. In terms of crops serviced (where multiple answers could be chosen), 90% of respondents dealt with corn, 86% with soybeans, and 70% with wheat.

CropLife would like to thank everyone that took part in this year’s survey. Your insights are appreciated!