Biologicals Gaining Some More Traction

There’s little denying the biologicals category has been some impressive strides into the agricultural world over the past few years. Yet, most users still view the category as “supplemental” to their traditional crop nutrient/crop protection methods, with few users utilizing biologicals as “stand-alone” products. In addition, most ag retailers still source the majority of the biological products they stock from major crop protection product suppliers rather than smaller players.

This was the overall finding of the 2022 Biologicals Survey, conducted by CropLife® magazine this past January. This built upon an earlier such surveys, released back during the 2017-18 and 2020-21 growing seasons, looking at the performance of the biologicals category in the ag retail marketplace.

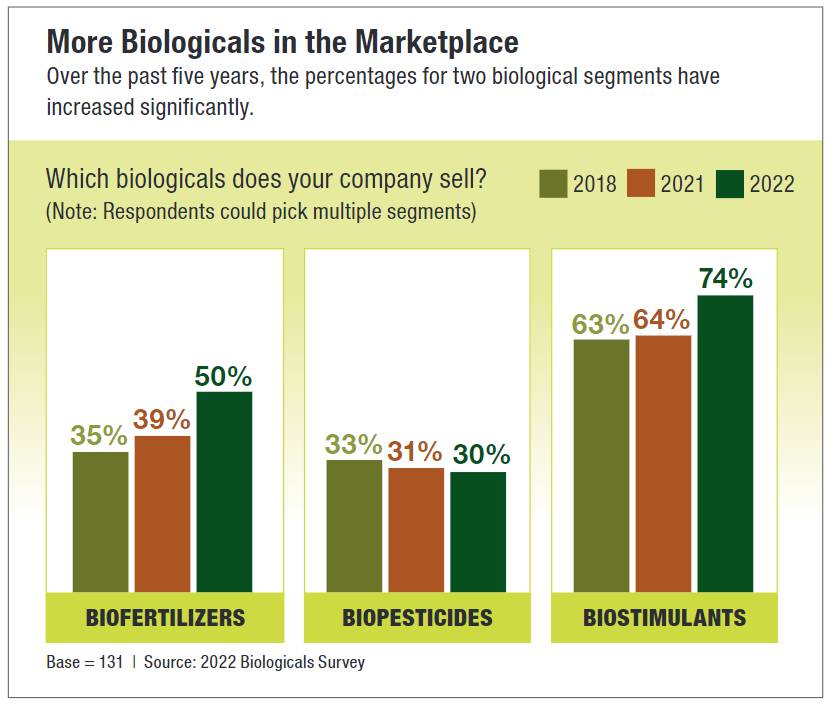

For starters, the 2022 survey asked about the mix of biological products companies currently sold to grower-customers — biofertilizers, biopesticides, and biostimulants. Respondents were allowed to choose all three biological product types for this question. And 18% indicated their companies sold no biological products at the present time — a 9% reduction from the 27% that said this was the case for their companies in the 2017-18 survey.

In terms of the three types of biological products, biostimulants remain the most common. According to the 2021 survey, 74% of respondents sell these products to their customers, up 10% from the 2020-21 survey. The percentage of respondents selling biofertilizers also increased from last year’s growing season, up from 39% in 2021 to 50% in 2022. Meanwhile, the biopesticide segment saw its percentage drop slightly from 2021, off 1% to 30% in this year’s survey results.

Regarding which suppliers respondents are getting their biologicals from (another question that allowed respondents to choose multiple options), major crop protection product companies lead the pack. According to the 2022 survey, Bayer CropScience is the leader in the field among respondents, being the source of biologicals for 42%. Syngenta was the second most popular biologicals supplier for respondents at 40%, with BASF and Corteva Agriscience tied for third at 39% apiece. Among smaller suppliers, Verdesian led the pack, supplying biologicals to 34% of 2022 survey respondents.

How are They Used?

As for how biological products are used by grower-customers, the vast majority in 2021 were utilized in conjunction or combination with conventional agricultural products.

And this hasn’t changed much during the past year. According to the 2022 Biologicals Survey, 80% of respondents indicated this was the case with their biological product users. Only 4% said that their grower-customers are using biological products in place of conventional products in their fields.

Regarding how these biological products are being applied by grower-customers, 14% of the 2022 survey respondents indicated these were used as topicals, down from 21% in the 2021 survey. Another 13% said that biological products are applied as seed treatments (a decline of 2% from last year’s survey results). The majority of respondents, 57%, said that biological users were applying products as both topicals and seed treatments.

(Editor’s Note: The remaining 16% of respondents for both of these questions said biological product usage was “not applicable” for their customers.)

Where’s the Trust?

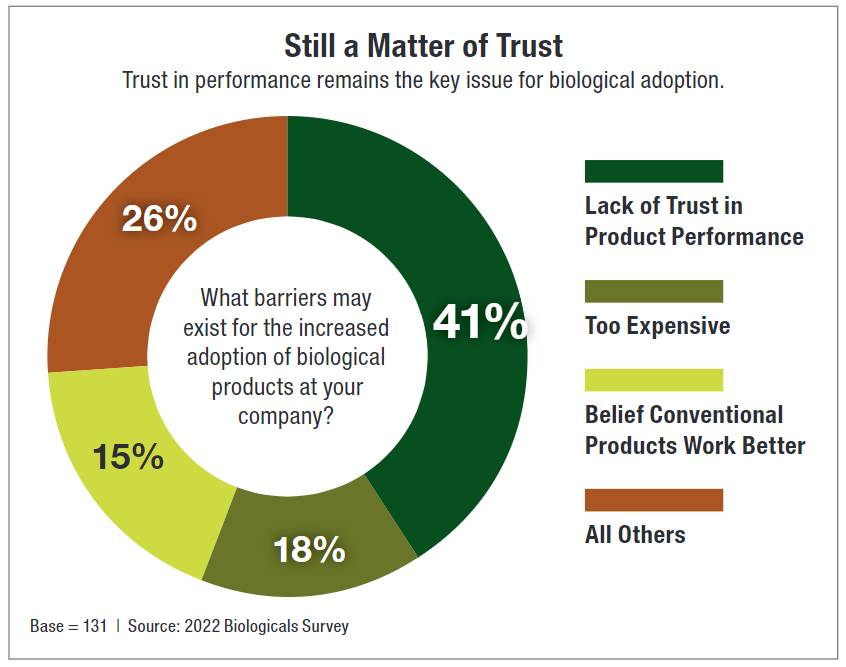

When survey respondents were asked about what barriers still exist within the agricultural marketplace to seeing the adoption of biological products become more widespread, they presented a range of reasons. By far the one mentioned most often by respondents was “a lack of trust in the product’s performance.” This was cited by 41% of survey respondents as the major reason biological products have had a hard time finding market acceptance. This was an increase from 37% in the 2021 survey.

In second place among barriers was cost. According to 18% of survey respondents, biological products are just “too expensive” compared with conventional agricultural products for grower-customers to use regularly (although this represented a drop of 2% from the 2021 survey). Close behind this was the belief that “conventional products are better than biologicals in the field,” which was mentioned by 15% of respondents. The remaining 26% cited myriad reasons for low biological product adoption, including storage concerns, a loss of seller profits, and regulatory issues.

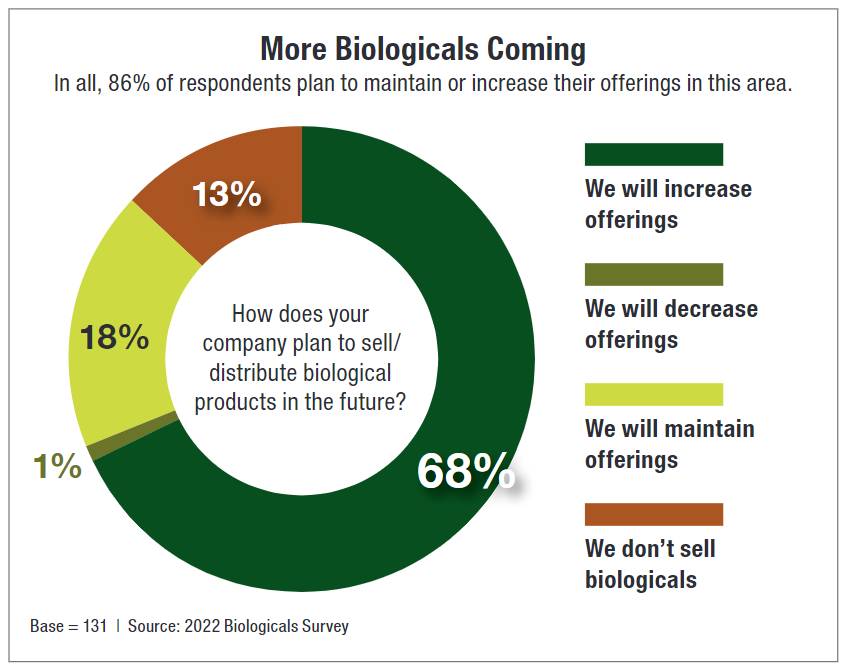

Despite all these obstacles, the future for the biological products category looks positive. According to the 2022 survey, 68% of respondents are planning to increase the number of biological products their companies sell to grower-customers during the coming year. Another 18% plan to maintain their current level of spending for biologicals. Only 1% indicated their companies plan to decrease the numbers/amounts there are currently spending on biological products for the 2022 growing season.