What Precision Technologies Are Ag Retailers Investing in 2024?

Now in its second year, the 2023 CropLife Precision Agtech Buying Intentions Survey presents something of a mystery to interpret. On one hand, a slight majority of ag retailers in 2024 foresee spending more on precision agtech products this year compared with last year. However, when looking at the breakdown for the individual products that are included in the precison agtech category, the percentage of respondents planning to spend more than $1 million to make these purchases is down across the board vs. 2023.

But before we dive into this year’s numbers, let’s take a quick look back at what motivated CropLife magazine to gauge precision agtech buying plans. For 10 years now, CropLife has devoted a portion of its January issue to looking at what crop input categories the nation’s top ag retailers plan to spend their money on during the upcoming growing season.

However, since plenty of new developments and products have recently entered the agricultural workspace, our editors wanted to know more about how ag retailers were coping with all these potential new or improved product segments. Thus, in January 2023, we released the findings from our 1st annual Precision AgTech Buying Intentions Survey. Now, it’s time to dig into the 2nd annual survey results, to see what’s changed in a year’s time in the field of precision agtech.

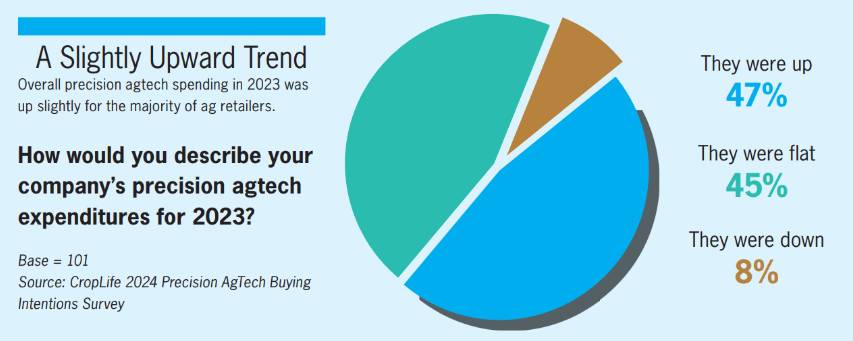

According to the survey, 2023 was a better year in terms of overall spending for precision agtech products than 2022 was. In last year’s survey, half of the marketplace (50%) indicated that their spending in precision agtech products for the 2022 growing season was flat, with 48% saying their spending levels had increased year-over-year. In the 2024 survey, however, 47% of respondents reported that their spending levels for precision agtech products had increased — down 1%. But the percentage of respondents reporting flat sales dropped even further — down 5% to 45%. The remaining 8% said that their spending levels on this category had dropped year-over-year between 2022 and 2023, an uptick of 6%.

Most importantly, these results matched up pretty well with another survey CropLife publishes — the CropLife 100. According to data from the 2023 survey, overall precision agtech revenues for 2023 were up slightly from the 2022 totals, from $796.2 million to $815 million — an increase of 2.4%.

Where is Spending Taking Place?

So, with an overall uptick in buying taking place in 2023 for precision agtech products, where do most ag retailers plan to spend their money on these systems during the upcoming 2024 growing season? Based upon the survey results, one segment — autonomous vehicles – will see the lion’s share of these dollars.

For the survey, CropLife asked respondents how much money they planned to spend on each of the 11 product segments we were tracking. This included three options: Spending more than $1 million in 2024, spending between $100,001 and $999,999, and spending less than $100,000. For the most part, the highest percentages among these three spending ranges were in the less than $100,000 sector, with figures ranging from a high of 72% for drones to 44% for soil sampling.

In terms of precision agtech segments that the nation’s top ag retailers plan to spend more than $1 million on in 2024, the newest led the pack. According to the survey, 20% of respondents plan to spend at least this much to purchase autonomous vehicles for their operations. Plenty of these kinds of products have been introduced over the past two years by tech suppliers such as Raven Industries and Case IH, so it appears that the intrigue these systems held for many ag retailers during 2023 will spill over into 2024 as well.

In second place among the spending more than $1 million group for 2024 is an “older” segment of the precision agtech business — autosteer. Older in the sense that this segment has been around since 2007 (which in the world of technology qualifies as an “old-timer!”). For these systems in 2024, 16% of respondents to the 2nd annual CropLife Precision AgTech Buying Intentions Survey plan to spend more than $1 million.

Rounding out the Top Five among precision agtech segments on the survey were a blend of older and newer technologies. In third place with spending of more than $1 million was the guidance systems segment at 11%. Also at 11% were imagery products. In fifth place was the boom/nozzle controls segment, with 9% of respondents planning to spend more than $1 million in 2024 on these systems.

Perhaps most surprisingly according to the survey data, a trio of newer precision agtech segments will see some of the lowest percentages of ag retailers spending more than $1 million on them during the 2024 growing season. This includes precision spraying systems, drones/UAVs, and artificial intelligence (AI). Each of these segments is expecting to have only 6% apiece of ag retailers buying them for the year at these dollar amounts. Considering how much product activity and industry interest has surrounded these three segments of precision agtech during the 2023 growing season, conventional wisdom would have predicted that at least one of them would have at least cracked double-digits among ag retailers in their 2024 buying intentions plans.