Precision Survey: Ag Dealers Respond to Marketplace Shifts

The CropLife/Purdue Precision Survey is the longest-running continuous study of precision farming adoption, conducted at least every other year since 1996. The 87 agricultural retailer input supplier respondents mostly from the Midwest included cooperatives, independent retailers, and those part of a regional or national chain. Those answering as a farm equipment dealer or consultant in the first question were not allowed to continue. The results reported are for dealers that identified as primarily working with field crops such as corn, soybeans, wheat, rice, cotton, milo, sugar beets, and forages. Dealers that work with specialty crops such as tree fruits and nuts, vegetables, berries, and grapes are analyzed separately. A full report detailing all of the 2023 results will be posted online later this summer. The full report from the 2022 survey, and also previous years, can be accessed here.

The 2023 Precision Agriculture Dealership Survey shows continued growth in technology to streamline and increase the efficiency of operations, such as in sprayer boom section/nozzle control, turn compensation, and in fleet management and telemetry. These are possible reactions to input costs and skilled worker shortages. The enthusiasm continues for applying crop inputs with drones. More dealers will offer drone imagery, but fewer dealers are offering satellite or aerial imagery, and dealers say imagery use is declining on farms. Dealers say they will increase future customer offerings of variable-rate pesticide applications, but are much less euphoric than in previous surveys, and they suggest little growth or even a downturn in VRT fertilization and seeding. On-farm data continues to be used the most for fertilizer-related decisions and for hybrid/variety selection, but in the last few years dealers have not increased their use of on-farm data for decision-making.

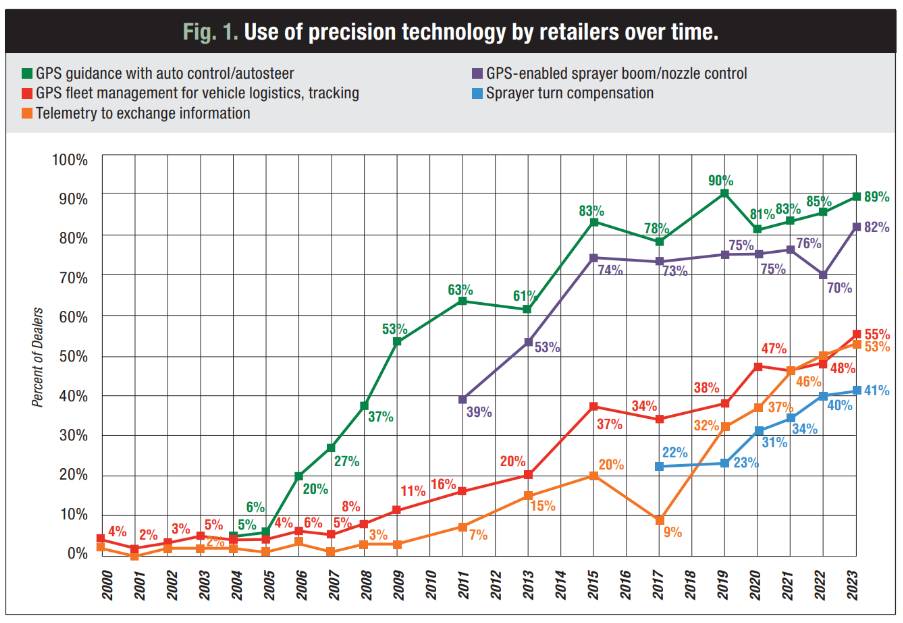

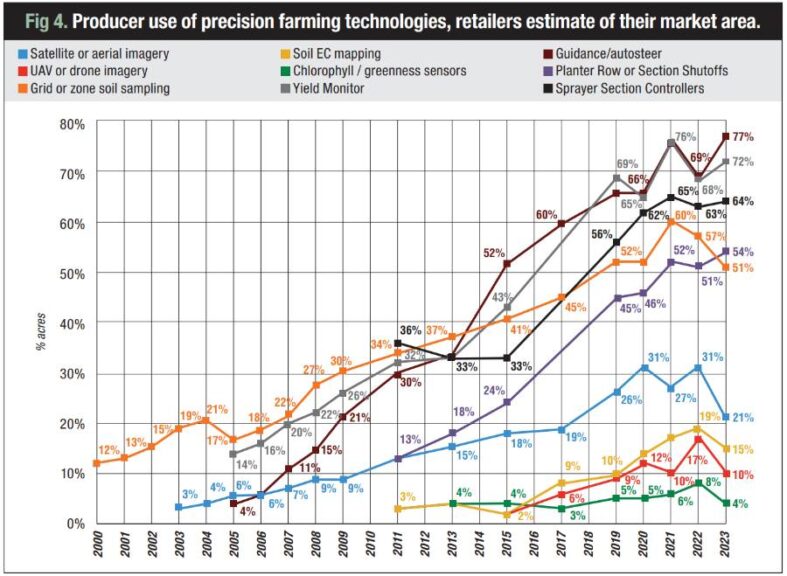

Eighty-nine percent of dealers use auto guidance on their application equipment (Figure 1), and 93% of those who offer precision services use guidance of any type (including manual guidance/light bars). This hasn’t changed much in recent years — and a few points year-to-year variation of survey results is normal, as respondents differ each year. GPS-guided boom section/nozzle controllers on sprayers, which reduce doubling-up and skips, are used at 82% of dealerships and sprayer turn compensation continues to grow, now at 41%. To help with their operational efficiency and also to ensure accurate work, for the first time more than half of dealers are using telemetry to exchange information among applicators or to/from office locations, sharply increasing over the last decade. Also, for the first time, more than half are using GPS fleet management to track the locations of vehicles and guide vehicles to work sites.

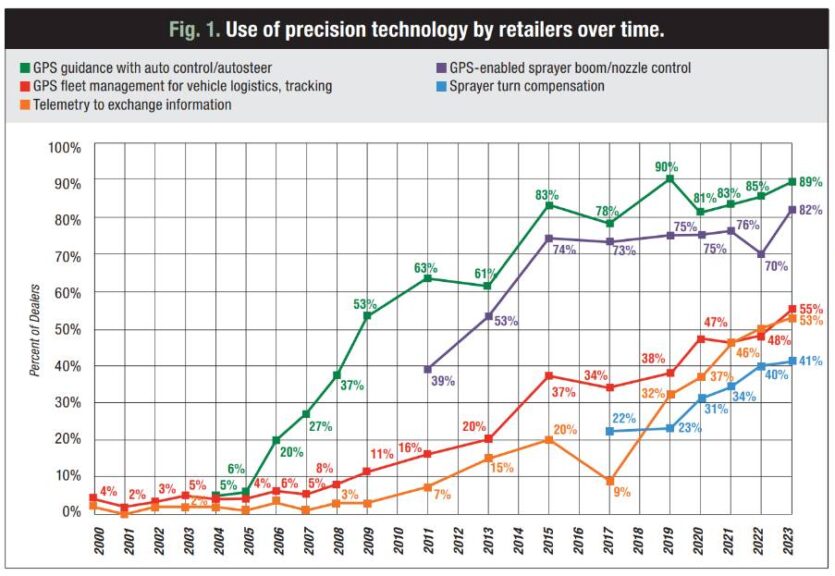

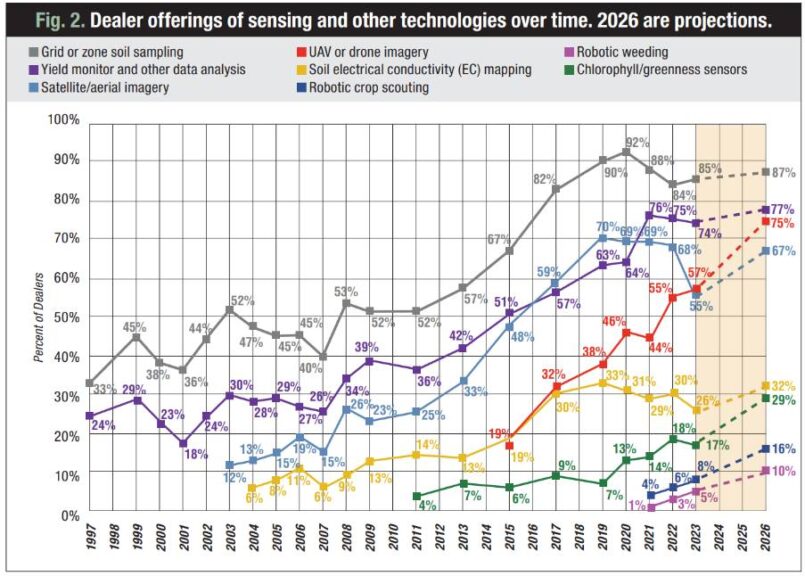

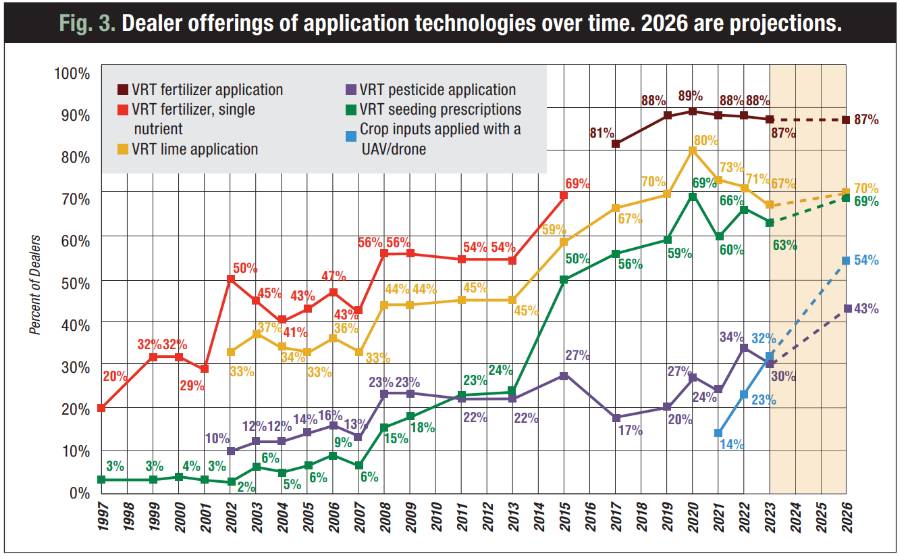

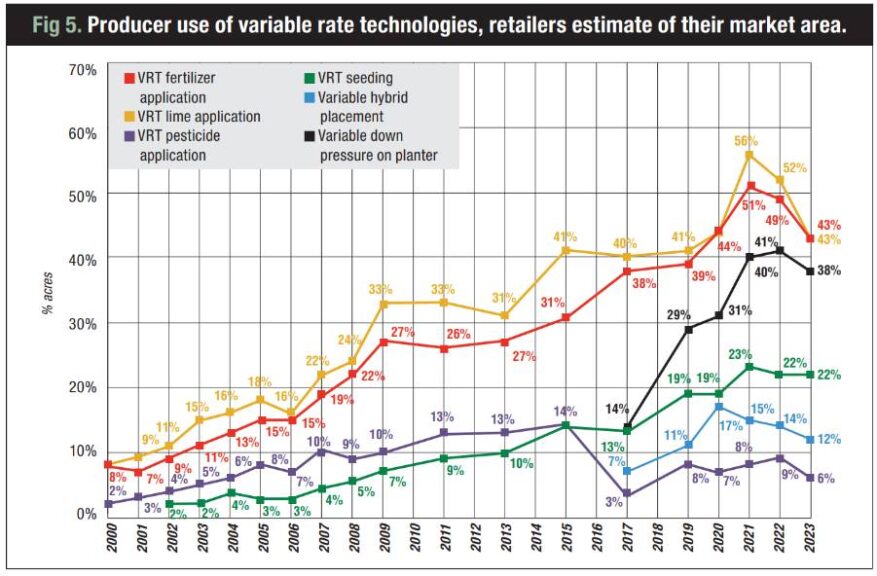

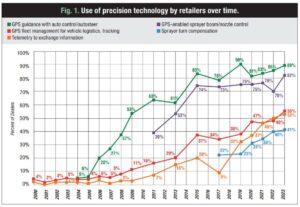

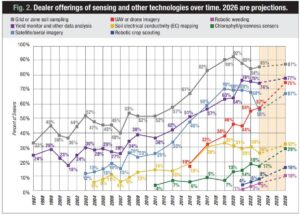

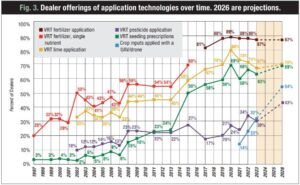

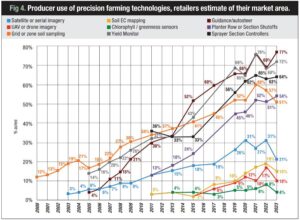

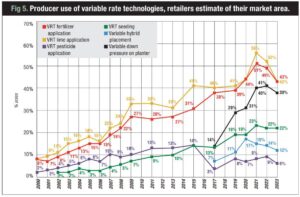

Along with dealer technology use, the survey tracks dealer offerings to their customers, what they expect to offer in three years, and also asks them to estimate their farmer customers’ overall use. An upswing in many precision offerings occurred in the decade from around 2011 to 2020 (Figures 2 and 3). Some 85% offer precision soil sampling and nearly 90% offer VRT fertilizer and lime applications, but these have plateaued in recent years. Dealers report the farms in their areas are using less grid or zone soil sampling, and less VRT fertilizer and liming applications in the last couple of years (Figures 4 and 5). The cost of the technology relative to the value gained in input savings or increased productivity mostly determines the return to precision investment, and both input costs and crop prices have moderated from their historic highs in the last year.

VRT Leveling

The percentage of dealers offering VRT seeding prescriptions has levelled off in the last three years, compared to a substantial upward burst in the decade prior (Figure 3). Correspondingly, dealers report that there are fewer acres in their market areas using variable hybrid placement and report no increases in their local areas using VRT seeding in the last few years (Figure 5). One of the biggest areas of growth anticipated by retailers has been high-tech pest management, for instance variable herbicide rates based on soils or sprayers responding to the presence of weeds. In 2020, 27% of dealers indicated they were then offering VRT pesticide applications, and 20% more said they would in three years, to possibly total 47% offering by 2023. The 2021 and 2022 surveys showed similar anticipation. But now that 2023 is here, the actual adoption hasn’t greatly changed. It currently stands at 30%, and only 13% more say they will offer by 2026 (Figure 3). Application technology for variable-rate is certainly up to the task, but determining valid rate recommendations on a site-specific basis remains a challenge, not only for weeds but for fertilizers and seeding, too.

About a third of dealers indicate they now use a drone for some crop input applications, but more than half say they will be doing this in three years, the largest anticipated growth of any product or service (Figure 3). Robotic weeding and robotic scouting continue to be small but are growing, with 10% and 16% of dealers, respectively, saying they would be offering these in three years if they are not already (Figure 2).

Drones Stats

We started asking about drone imagery just eight years ago, and since then it has grown from 19% of dealers offering to 57% today (Figure 2), and the second highest growth anticipated behind drone input applications.

In contrast, fewer dealers are offering satellite or aerial imagery this year. There had been a steady increase in the last decade in this service area, peaking at over two thirds of dealers in recent years. However, that figure has now fallen to 55%. Dealers also report fewer acres in their trade areas utilizing satellite/aerial imagery or drone imagery (Figure 4).

There have been few notable changes in the use of data for crop management decisions in recent years following the sharp increase several years ago (data not shown). We define pooled data as that which is aggregated from multiple farms, either managed within the dealership or as part of an outside offering.

Forty-two percent of dealers said phosphorus and potassium decisions were majorly influenced by pooled data, and about a third said nitrogen and hybrid/variety selection decisions were heavily influenced by data. Far fewer dealers say on-farm data is important for decisions about overall planting rates, for variable planting rate prescriptions, for variable hybrid placement, or for pesticide selection. Sixty-eight percent of dealers say their organization has a customer data privacy statement and/or data terms and conditions agreement, steadily up since 45% in 2017.

Since the survey was started, we have asked dealers to report the barriers that have kept them and their customers from adopting precision agricultural practices. These are general questions, not specific to any technology. The 11 dealer barriers questions and the seven farmer barriers (as viewed by dealers) questions have remained nearly the same over the years, providing a continuum of dealer viewpoints.

A few barriers have stood out over time. With two exceptions, dealers indicated the biggest three barriers from 2013 to 2023 were “it is difficult to find employees who can deliver precision agricultural services;” “the equipment needed to provide precision services changes quickly, increasing my costs;” and “the fees we can charge for precision services are not high enough to make precision services profitable.” The exceptions were in 2019 when “my farmers are interested in precision services, but pressure on farm income limits their use” was the highest factor. In 2023, “incompatibilities across types of precision equipment/technology limit my ability to offer precision services” was the third highest barrier. The employee issue this year far exceeds all others — perhaps some of the drive for adopting the operational efficiencies of fleet management and telematics.