An Interest Rate Outlook and Implications for Agribusinesses

At the end of March, the Federal Open Market Committee (FOMC) of the United States Federal Reserve met and voted to hold the federal funds rate steady for the second consecutive meeting in 2024. Many expected the FOMC to consider lowering the federal funds rate at this meeting, potentially signaling the start of a downward trend in interest rates. However, contrary to expectations, this adjustment did not happen. It suggests that, at least in the short term, interest rates will remain unchanged.

Before we predict what interest rates will do for the remainder of 2024, let’s take a step back and review what got us here. It’s likely that no one needs to be reminded of the inflation experienced by the U.S. and global economy in recent times. This inflationary pressure prompted the FOMC, the policymaking body of the U.S. Federal Reserve, to enact an unprecedented series of increases in the federal funds rate – the rate at which banks borrow money. Currently, the target range for the U.S. federal funds rate stands at 5.25 to 5.5 percent. While the current level of the federal funds rate is not at a historical high, the pace at which the FOMC raised it was fast. Consequently, this rapid increase can make it feel higher than its numerical value might suggest when compared to historical data.

Now, let’s fast forward to March 2024. One of the main data points that the FOMC examines to determine interest rate policy is inflation. While inflation remains elevated, it is lower than it was at this time last year. Many anticipated that the FOMC would take their foot off the gas a bit. However, that wasn’t what they chose to do. The FOMC seems steadfast not to repeat the mistakes of the 1970s and 1980s when rates were reduced too quickly, leading to increased inflation and further interest rate hikes.

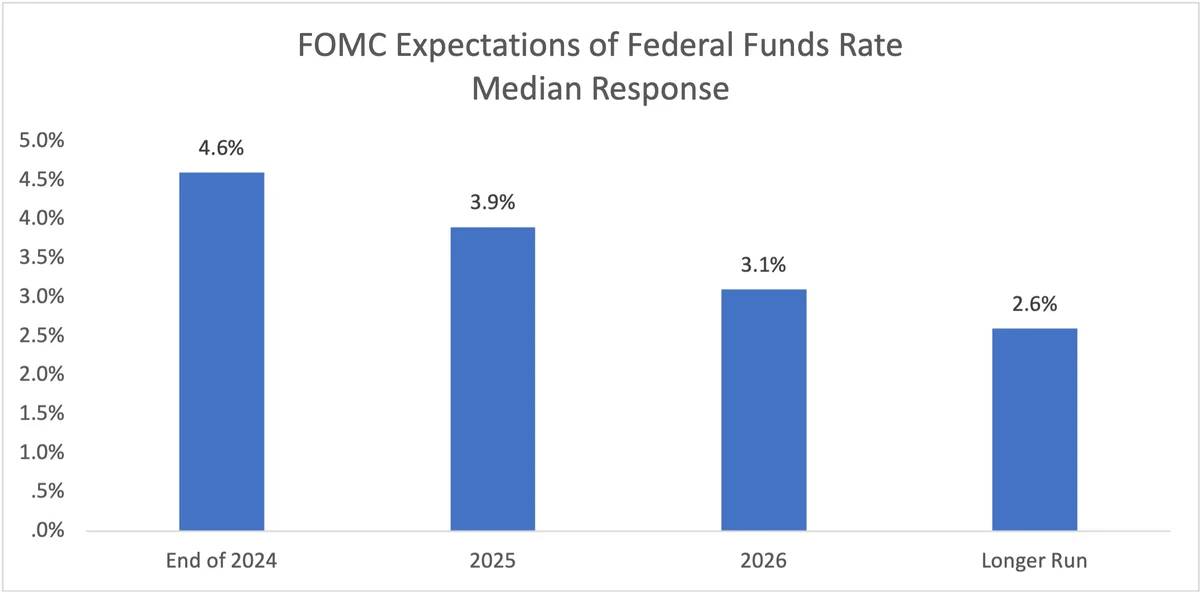

The chart below illustrates the median federal funds rate predictions from the voting members of the FOMC. At present, the federal funds rate is targeted to reach 4.6% by the end of 2024, 3.9% by the end of 2025, and 3.1% by the end of 2026. In the near term, this is likely to translate into three federal fund decreases in 2024, with each decrease lowering the target by 25 basis points. With only six FOMC meetings left in 2024, it suggests that half of these meetings should include announcements of a decrease in the federal funds rate.

What does this mean for agribusinesses?

Much of agriculture is debt financed, as opposed to equity financed. This implies a potential decrease in borrowing costs for many businesses within the agricultural supply chain. We may also see a resurgence in investment in physical assets such as land and equipment as borrowing costs decline. For businesses servicing farmers, this could lead to increased investment opportunities as the cost of borrowing for farmers also decreases. Another potential impact could be an increase in asset prices, namely land values.