The CropLife 100 Mid-Year Report: A Work in Progress

Let’s be honest — going into the 2022 growing season, many ag retailers and their grower-customers were probably apprehensive. Although commodity prices had been on the rise (due in part to the Russia/Ukraine situation), persistent supply chain issues were also pushing up crop input prices, especially in the fertilizer and crop protection products markets. Indeed, many of the nation’s top ag retailers were likely wondering if any type of “normal operations” would work for them as the spring season got underway.

Luckily, it seems as if plenty of things in the marketplace are working for them thus far. According to annual CropLife 100 Mid-Year Survey conducted by CropLife® magazine, the nation’s top ag retailers have an incredibly positive outlook for the chances for profitability in 2022. In fact, based upon the survey results, 52% of respondents believe that the 2022 growing season will end up rating between an eight and a 10 on a 10-point scale (with one representing factors being worse than expected and 10 representing factors being better than expected). Better still, another 35% believe 2022 will rank between a five and a seven in their books. This means that overall, 87% of the nation’s top ag retailers are looking forward to many factors working in their favor throughout the rest of the year. Only 13% of respondents think that the 2022 growing season will rate between a one and a four on the 10-point scale.

Labor/Supply Shortages Still a Concern

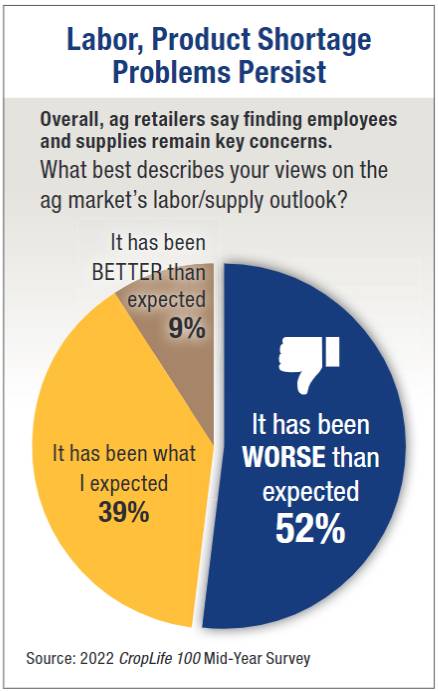

Somewhat ironically, however, although the general outlook for 2022 is positive for the majority of the nation’s top ag retailers, some things aren’t working out so well for companies right now. This includes ongoing shortages in both the labor and supply chain pools. For many months now, ag retailers have struggled to find enough workers to help out in their operations and keep a steady supply of crop inputs available to their grower-customer bases. And both of these challenges are reflected in the CropLife 100 Mid-Year Survey results.

Somewhat ironically, however, although the general outlook for 2022 is positive for the majority of the nation’s top ag retailers, some things aren’t working out so well for companies right now. This includes ongoing shortages in both the labor and supply chain pools. For many months now, ag retailers have struggled to find enough workers to help out in their operations and keep a steady supply of crop inputs available to their grower-customer bases. And both of these challenges are reflected in the CropLife 100 Mid-Year Survey results.

When asked to describe the current ag market’s labor and supply shortages, a majority of respondents – 52% – said the situation is “much worse than expected” for the 2022 growing season. Interestingly, this was 13% lower than the percentage of ag retailers that said labor was a major problem for their operations during the 2021 CropLife 100 Mid-Year Survey.

As for the rest of the pack, 39% of respondents said their labor/supply shortages are “about what we expected” thus far for the 2022 growing season. The remaining 9% said that given how this issue has persisted since the beginning of at least 2020, things for their operations are “better than we expected.”

Perhaps most troubling regarding the labor/supply shortages for most ag retailers, survey respondents believe these issues will continue long after the 2022 growing season comes to a close. In fact, when asked how concerned they were that these kinds of “negative market pressures” would spill over into the start of the 2023 growing season, 74% of the 2022 CropLife 100 Mid-Year Survey respondents said that they were “very concerned” this would be the case. The remaining 26% said they thought that labor/supply issues would be “somewhat concerning” for them in 2023. Significantly, absolutely no survey respondents believe that finding workers and crop input supplies will be of “no concern” for them for the 2023 growing season.

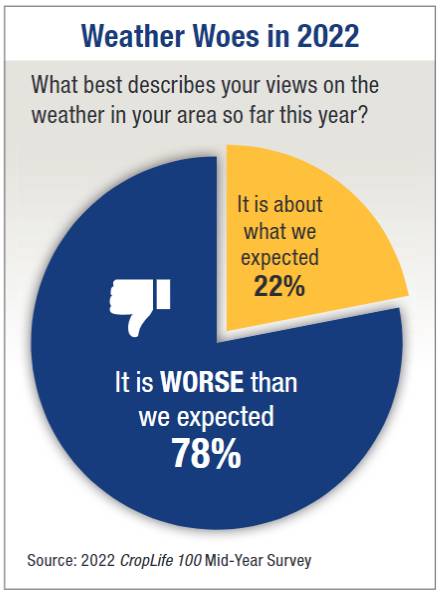

Still, if you are looking for an issue that seems to be of more concern for ag retailers for the 2022 growing season so far, you need to look not at the labor/supply pools, but to the skies. Across many parts of the country, the weather in 2022 has been an all-or-nothing proposition for many ag retailers and their grower-customers — too wet and rainy across much of the Midwest and too hot and dry across major portions of the Southwest and West. For example, persistent wet weather delayed planting and application work in many key Midwestern states such as Ohio, Indiana, and Iowa throughout the spring months. And out west, soil moisture was virtually non-existent in places such as West Texas (where sources indicated growers needed to drill down at least 18 inches to find “any” soil moisture).

Still, if you are looking for an issue that seems to be of more concern for ag retailers for the 2022 growing season so far, you need to look not at the labor/supply pools, but to the skies. Across many parts of the country, the weather in 2022 has been an all-or-nothing proposition for many ag retailers and their grower-customers — too wet and rainy across much of the Midwest and too hot and dry across major portions of the Southwest and West. For example, persistent wet weather delayed planting and application work in many key Midwestern states such as Ohio, Indiana, and Iowa throughout the spring months. And out west, soil moisture was virtually non-existent in places such as West Texas (where sources indicated growers needed to drill down at least 18 inches to find “any” soil moisture).

This “challenge from weather” was reported by all of the respondents to the 2022 CropLife 100 Mid-Year Survey. In fact, not one of them said that the weather for 2022 in their area was “better than expected.” Instead, 78% of respondents said that the weather woes they and their grower-customers had been dealing with during the 2022 growing season was “worse than expected.” The remaining 22% thought that the weather had been “about what we expected,” meaning that there were no unexpected issues to deal with thus far.

Fertilizer, Crop Protection Still Working for Living

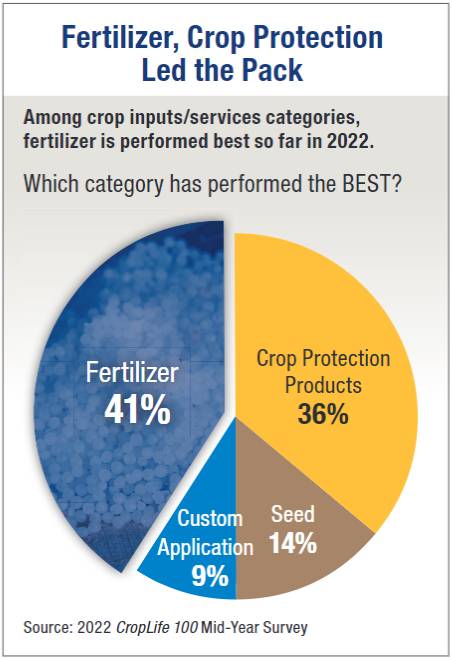

For many years now, the annual CropLife 100 Mid-Year Survey has tied to gauge which of the four key crop inputs/services categories — fertilizer, crop protection products, seed, and custom application — have performed in the early going of a particular growing season. Given how much news has surrounded the ongoing supply/price increase issues that have dogged the fertilizer and crop protection products markets so far during the first half of 2022, we thought both of these categories might be listed as performing “worse than expected” for the nation’s ag retailers this growing season.

For many years now, the annual CropLife 100 Mid-Year Survey has tied to gauge which of the four key crop inputs/services categories — fertilizer, crop protection products, seed, and custom application — have performed in the early going of a particular growing season. Given how much news has surrounded the ongoing supply/price increase issues that have dogged the fertilizer and crop protection products markets so far during the first half of 2022, we thought both of these categories might be listed as performing “worse than expected” for the nation’s ag retailers this growing season.

But this just hasn’t been the case. In fact, among the majority of 2022 CropLife 100 Mid-Year Survey respondents, both categories are working “just fine,” despite some significant price increases and supply chain headaches. According to the survey, 41% of respondents say fertilizer has been the category that has “performed the best” for them during the 2022 growing season. This was followed by the crop protection products category, which was cited by 36% of survey respondents as their “best performer” for the year. The remaining two categories — seed and custom application — finished far behind their brethren, at 14% and 9%, respectively.

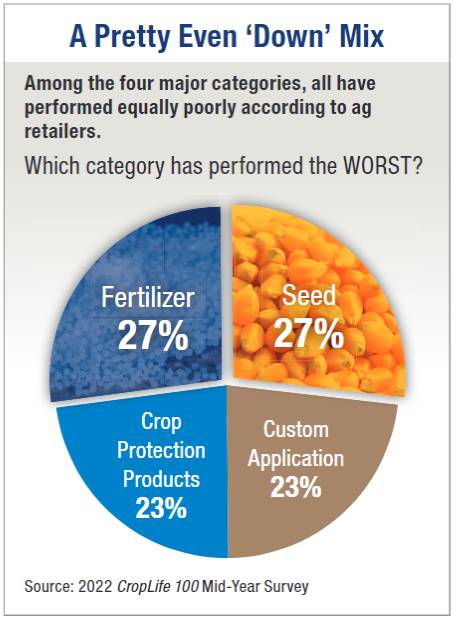

As far as which of the four major categories have performed “worse than expected” so far during 2022, the survey showed a pretty even four-way split. According to 27% of respondents, the fertilizer category was their “worst performer” in 2022. Coincidentally, this was the same amount received by the seed category. In a similar fashion, 23% of respondents said the crop protection products category was their “worst performer” this year — the same amount that the custom application category garnered.

As far as which of the four major categories have performed “worse than expected” so far during 2022, the survey showed a pretty even four-way split. According to 27% of respondents, the fertilizer category was their “worst performer” in 2022. Coincidentally, this was the same amount received by the seed category. In a similar fashion, 23% of respondents said the crop protection products category was their “worst performer” this year — the same amount that the custom application category garnered.

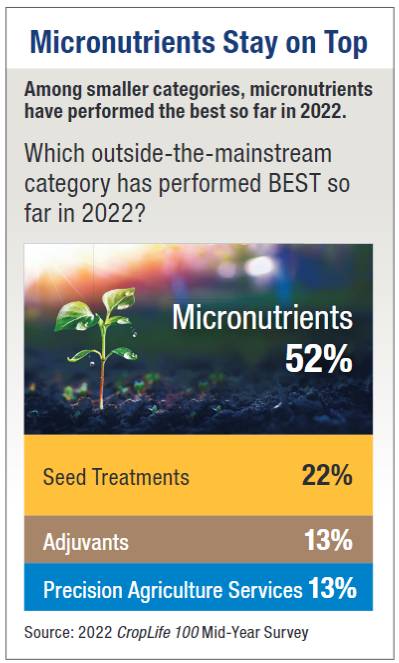

In addition to tracking the performances of the four major categories, the annual CropLife 100 Mid-Year Survey also looks at how some of the smaller segments have performed during the early going of the year. In most years, the micronutrients category tends to be described as the “hardest worker” by respondents.

And this remains the case in 2022. According to the survey, 52% of respondents said that the micronutrients category performed best for them this growing season. This is down only slightly from the 2021 survey, when 55% of respondents said micronutrients were their best smaller category performer.

And this remains the case in 2022. According to the survey, 52% of respondents said that the micronutrients category performed best for them this growing season. This is down only slightly from the 2021 survey, when 55% of respondents said micronutrients were their best smaller category performer.

In second place among the smaller categories in performance in 2022 was the seed treatments category, mentioned by 22% of survey respondents as their “top performer.” This perhaps reflected the desire by grower-customers to protect their investment in seed/crop yields as the growing season moves forward. Running out the “top smaller category performers” for the nation’s top ag retailers in 2022 were adjuvants and precision agriculture services, cited by 13% apiece.

Is Corn Still King?

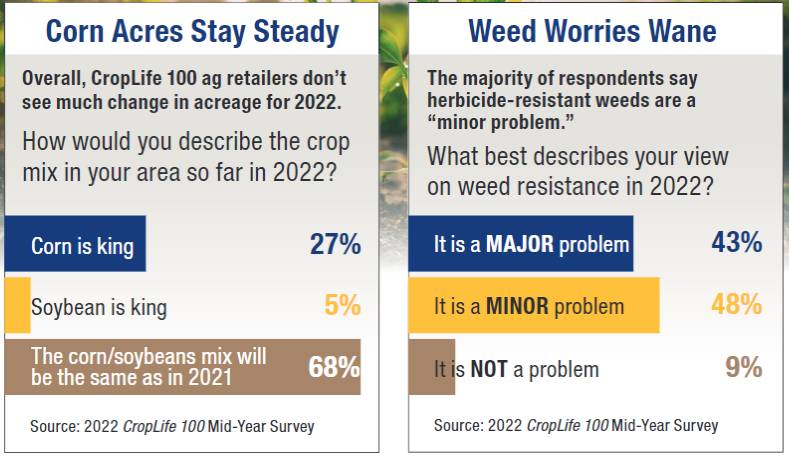

As far as the expected crop mix for the 2022 growing season, the nation’s top ag retailers seem to see significant disagreement with the overall outlook for the entire country. At the end of March, the USDA published its annual planting intentions survey results — and the numbers are a bit surprising. For 2022, the agency predicted that corn planted areas for the year would drop 4%, down 3.87 million acres to 89.5 million acres. On the flipside, USDA expected soybean planted acres for 2022 to increase 4%, up to 91 million acres. If this comes to pass, this will mark only the third time since the early 1980s that the nation’s soybean acreage would outpace that for corn.

However, according to the 2022 CropLife 100 Mid-Year Survey, the nation’s top ag retailers aren’t seeing this kind of acreage shift taking place in their areas. In fact, according to 68% of respondents, their grower-customers are expected to maintain their corn-to-soybean acreage ratios at the same level they had “during the 2021 growing season.” Another 27% of respondents said that their grower-customers were planning to increase their corn acres this year, not decrease them. Overall, only 5% of the nation’s top ag retailers answering the 2022 CropLife 100 Mid-Year Survey believe soybeans acres in their markets will “top corn for the year.”

With much of the “negative news” talked about in the 2022 CropLife 100 Mid-Year Survey focusing on labor and supply issues, there was one bit of somewhat surprising “positive news” to report. For many years now, the challenge presented by herbicide-resistant weeds has been an ongoing problem for many ag retailers and their grower-customers. In fact, during the 2021 CropLife 100 Mid-Year Survey, 75% of respondents said that herbicide-resistant weeds were a “major problem” in their parts of the country.

In response to this issue, crop protection product manufacturers have spent many, many years introducing new cropping systems (tied to such long-standing herbicides as 2,4-D and dicamba) and new herbicide offerings featuring multiple modes of action to combat these hard-to-kill weeds.

And these seem to be working. Based upon the results from the 2022 CropLife 100 Mid-Year Survey, only 43% of respondents now say that herbicide-resistant weeds are a “major problem” for their grower-customers — a significant 32% drop from the 2021 survey results. Instead, the majority of the nation’s top ag retailers, 48%, now describe herbicide-resistant weeds as “a minor problem” in their parts of the nation, up 28% from the 2021 survey totals. Better still, 9% of respondents to the 2022 CropLife 100 Mid-Year Survey say herbicide-resistant weeds are “not a problem” for their grower-customers. This is a 4% improvement from the 5% of the respondents that said this was the case during the 2021 CropLife 100 Mid-Year Survey.

With myriad factors working well in 2022, the nation’s top ag retailers are already feeling pretty positive when it comes to “the good work continuing” on into the 2023 growing season. When asked to describe the outlook for 2023 right now, 52% of survey respondents said that they were “very positive” or “somewhat positive.” Another 22% described themselves as “neutral” when considering next year. Only 26% believe the 2023 growing season could be a serious challenge to their profitability, saying they were “somewhat negative” in their outlook.