Providing Some 20/20 Vision for Ag Retailers in 2020

When historians look back on 2020, I’m sure many of them will note how ironic it was that a year that describes “perfect vision” in optometrists offices across the country ended up being anything but clear in so many ways. And although much of the world spent most of 2020 trying to see how all of the multiple visions present would create some clear picture of the future, the nation’s top ag retailers luckily did manage to find some clarity in it all. Overall, CropLife 100 dealerships and cooperatives recorded just shy of $32 billion in revenues during the year, down only slightly from the 2019 total.

This was the primary finding of the annual CropLife 100 survey of the nation’s leading ag retailers. Now in its 37th year, the CropLife 100 helps provide some insights into how those retailers with annual sales ranging from “several million dollars to multiple billion dollars” have done over the past growing season/calendar year. And during 2020, the agricultural industry, while dealing with the normal levels of uncertainty that appear each and every year, also had to deal with a rather big “elephant in the room” blocking virtually every businesses clear view of the world, COVID-19.

By now, most everyone is aware just disruptive an influence on 2020 the coronavirus pandemic ended up being. Starting in mid-March, numerous states spent months with their economies and schools closed to keep this potentially deadly virus from spreading too far. This ended up putting millions of employees out of work, caused many businesses to close up permanently, and strained many states in their ability to cope with millions of sickened people. And even though many portions of the stricken economy did recover during the summer months, a resurgence in COVID-19 cases in the fall continues to threaten the nation’s ability to “get back to normal.”

Fortunately, for the nation’s ag retailers, COVID-19 shutdowns in other parts of the economy did not directly impact them. Early on, the government designated agriculture and its support structure (which included ag retailers) as “essential workers,” allowing them to continue operations during the early days of the pandemic. However, according to 2020 CropLife 100 survey, there were two areas where COVID-19 did come into play for the nation’s top ag retailers: Customer interactions and digital/software considerations.

First, let’s eyeball the customer interaction question. One of the ways local, state, and federal government officials recommended to slow the spread of coronavirus among the population was to practice social distancing. For many ag retailers, this meant transitioning from in-person visits to relying on telephone calls and digital communications to engage grower-customers.

But will this change in customer interaction continue once the COVID-19 pandemic ends? In a word, no. For most ag retailers, that is. According to 60% of 2020 CropLife 100 respondents, ag retailers that did adopt a remote communications model during COVID-19 anticipate that their grower-customers will return to more in-person interaction once the danger has passed. Another 5% said their companies hadn’t change their customer interaction practices despite COVID-19, so the question didn’t really apply in this case. For the remaining 35%, however, CropLife 100 retailers believed that the trend towards digital/remote relationships started by the pandemic in 2020 “would continue to be the norm going forward.”

As a follow-up question, the 2020 CropLife 100 survey asked respondents if, given the demands of digital communications with grower-customers, were ag retailers planning any changes/upgrades to their software systems that managed this part of their businesses. According to 53%, the answer to this question was “no, we are satisfied with our current system and approach.” Another 19% said they were “looking into making some changes to our current software.” The remaining 28%, however, were definitely planning to “make some changes to our existing software package” for remote communications.

The Overall View

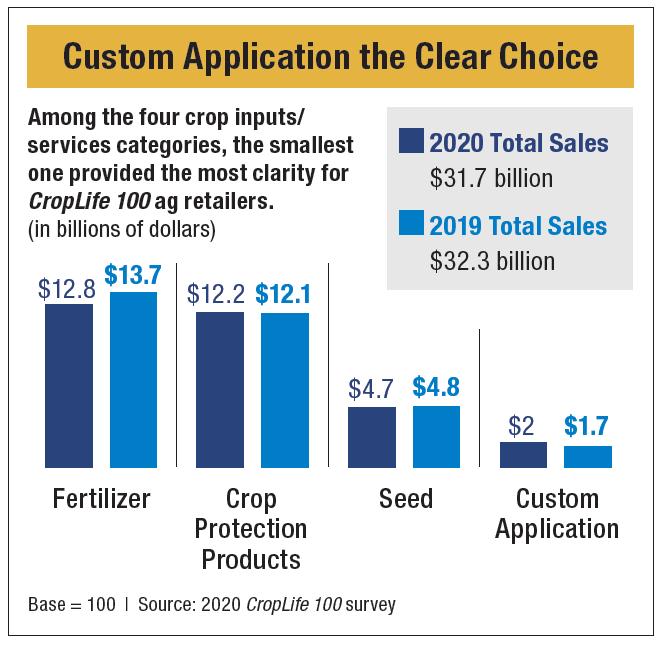

Now that we’ve managed to look around the COVID-19 elephant, let’s clearly review all of the overall numbers recorded by CropLife 100 ag retailers during 2020. According to the survey, the nation’s top dealerships and cooperatives had a hair over $31.7 billion in total sales this year. While this did represent a decline of 1.9% from the 2019 total of $32.3 billion, cracking the $30-billion mark for a third consecutive year for CropLife 100 retailers can be considered a “win,” given all the other factors working to obscure agriculture’s view to profitability during 2020.

To provide a clearer image of how the overall CropLife 100 retailers performed during 2020, it helps to take a peek at how the four major categories that make up the marketplace — fertilizer, crop protection products, seed, and custom application (which includes precision agriculture products and services). In a nutshell, the view was less than focused — one of the categories gained big, one lost big, one was up slightly, and the other was down slightly.

To provide a clearer image of how the overall CropLife 100 retailers performed during 2020, it helps to take a peek at how the four major categories that make up the marketplace — fertilizer, crop protection products, seed, and custom application (which includes precision agriculture products and services). In a nutshell, the view was less than focused — one of the categories gained big, one lost big, one was up slightly, and the other was down slightly.

As has been the case for many years with the CropLife 100, the clearest picture of the industry’s annual performance comes from viewing the sales of the two largest categories, fertilizer and crop protection products. During 2019, the fertilizer category had a great year, growing overall sales from $12.2 billion in 2018 to $13.7 billion. However, this revenue momentum faded completely from view during 2020. According to this year’s CropLife 100 survey, the nation’s top ag retailers saw their fertilizer revenues decline 6.6% to $12.8 billion. Consequently, this dropped the fertilizer category’s overall market share of CropLife 100 sales from 43% in 2019 to 40% — the same percentage it held in 2018.

Meanwhile, for the crop protection product category, the 2020 profitability picture was much clearer. For 2020, this category continued to build upon its sales performance of the past few years, with overall revenues growing from $12.1 billion in 2019 to $12.2 billion. Despite being only a modest 0.8% increase in sales, this was enough of a gain for the crop protection products category to grow its overall CropLife 100 revenue market share from 37% in 2019 to 39%.

For the seed category, 2020 could be described as “partially clear, partially blurred” in vision terms. According to 2020 CropLife 100 survey, this category’s overall sales dropped 2.1%, from $4.8 billion in 2019 to $4.7 billion. However, this decline wasn’t enough to affect the seed category’s overall revenue market share, which remained flat at 15%.

Regarding the final category making up CropLife 100 revenues — custom application — 2020 was clear as a bell, so to speak. For many, many years, this category has maintained sales in the $1.5 billion range each and every year, go enough to equal a 5% market share of overall revenues. However, during 2020, the custom application category clearly charged forward off these historic norms. According to the CropLife 100 survey, the category sales moved forward 17.6%, up from $1.7 billion in 2019 to just a hair under $2 billion. Significantly, market share for the custom application category improved from 5% in 2019 to 6%.

Regarding the final category making up CropLife 100 revenues — custom application — 2020 was clear as a bell, so to speak. For many, many years, this category has maintained sales in the $1.5 billion range each and every year, go enough to equal a 5% market share of overall revenues. However, during 2020, the custom application category clearly charged forward off these historic norms. According to the CropLife 100 survey, the category sales moved forward 17.6%, up from $1.7 billion in 2019 to just a hair under $2 billion. Significantly, market share for the custom application category improved from 5% in 2019 to 6%.

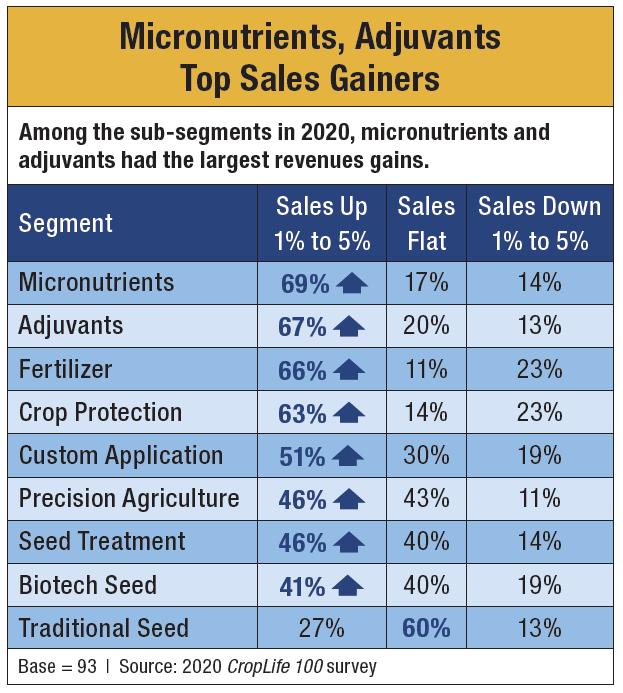

While category performance provides a good view of how the nation’s top ag retailers did, perhaps more clarity can be offered by looking at overall profitability. For many years now, the annual CropLife 100 form has asked respondents to describe how their profitability profiles ended up at the end of their calendar year. On average, this splits pretty evenly among those ag retailers that were more profitable vs. less profitable vs. flat in profits — around 33% each.

However, 2020 painted a different picture in this case. According to 2020 CropLife 100 survey, slightly over half — 51% — of the nation’s top ag retailers said their businesses were “more profitable” this year compared with 2019. Another 26% reported that their profitability levels in 2020 were “the same” as during the year before. Only 17% of CropLife 100 retailers reported lower profits between 2019 and 2020. The remaining 6% weren’t sure just yet how their company books would end up for the year.

Merger Mania Continues

For the past few years, one trend among CropLife 100 ag retailers that has been abundantly clear is a desire to merge. In fact, just as we were putting our 2019 CropLife 100 together, there were four companies in the rankings that ended up combining their businesses. This included Mid Kansas Coop (MKC) purchasing fellow Kansas-based ag retailer Mid-West Fertilizer and Simplot Grower Solutions buying Pinnacle Agriculture Distribution. Both these moves had a significant impact on the two companies’ standing within the 2020 CropLife 100. In MKC’s case, the ag retailer moved up the rankings from No. 60 in 2019 to No. 19 this year. Meanwhile, Simplot improved from No. 7 on the 2019 CropLife 100 to No. 3, surpassing GROWMARK in the overall sales for the year.

And in 2020, it was plain to see early on that mergers would again shake up the CropLife 100 rankings. In fact, just as we were gathering information for the 2020 survey, three hundred-million dollar cooperatives in the Mid-South region — Greenpoint AG, Tennessee Farmers Cooperative, and Agri-AFC — announced that they were combining their retail businesses on September 8. The newly merged retailers, during business under the Greenpoint AG name, saw its standing among CropLife 100 companies move up to No. 7 on this year’s list, making Greenpoint AG the latest member of the “More than $1 Billion” sales club.

And in 2020, it was plain to see early on that mergers would again shake up the CropLife 100 rankings. In fact, just as we were gathering information for the 2020 survey, three hundred-million dollar cooperatives in the Mid-South region — Greenpoint AG, Tennessee Farmers Cooperative, and Agri-AFC — announced that they were combining their retail businesses on September 8. The newly merged retailers, during business under the Greenpoint AG name, saw its standing among CropLife 100 companies move up to No. 7 on this year’s list, making Greenpoint AG the latest member of the “More than $1 Billion” sales club.

For observers, keeping a watch on the 2021 CropLife 100 will bring more such ag retail mergers into view. For instance, in Indiana, 2020 CropLife 100 No. 16 company Co-Alliance has announced plans to merge its operations with No. 46 Harvest Land Coop come March 1, 2021.

“The opportunity to merge with Harvest Land brings both companies a chance to enhance their customer experience and meet the growing demands of the ever-changing agriculture industry,” said Co-Alliance CEO Kevin Still of the planned deal. “We are excited to bring this powerful combination to our grower members.” In terms of overall sales, the new cooperative should rank close to the Top 10 among CropLife 100 retailers on the 2021 rankings as a result.

Another 2020 CropLife 100 retailer to keep an eye on for 2021 is No. 39 Landmark Agronomy Services. The Wisconsin-based cooperative plans to merge with another coop within the Badger State, Countryside Cooperative. As with the case of the Co-Alliance/Harvest Land merger, the new cooperative plans to begin operating as a combined entity come March 2021.

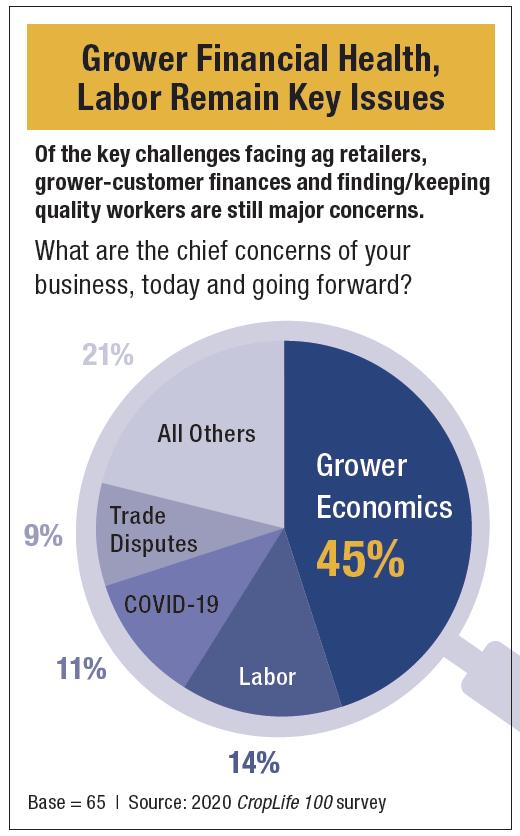

Looking a little more broadly at 2021, the vision for next year among CropLife 100 ag retailers seems fairly in focus — for now. According to the 2020 CropLife 100, slightly more than half of respondents (55%) say that their grower-customers are “cautiously optimistic” that the 2021 growing season will be a good one for their farming operations. One percent went so far as to call their grower-customers “very optimistic” for the prospects of profitability during the next year.

For the other 44% of respondents, the vision for 2021 is a little less in focus. According to the survey, 39% of CropLife 100 ag retailers that their grower-customers are “somewhat pessimistic” for 2021 to be a strong profit year for their businesses. The remaining 5% say that their grower-customers are “very pessimistic” for the chance to make money going into the new year.

As always, of course, what kind of year 2021 ends up being for the agricultural marketplace will depend upon myriad factors that could change everyone’s vision in the end, as Jim Howe, President/CEO for Star of the West Milling Co., Frankenmuth, MI, pointed out on his 2020 CropLife 100 survey form.

When asked about the upcoming year, Howe wrote: “The most stressful thing is the uncertainty of the commodity markets, driven by COVID-19 and the polarized political environment.”

In this sense, a comprehensive vision of how 2021 will look for the nation’s ag retailers will have to wait for some clearer lenses to become available . . .

Editor’s Note: As always, CropLife® magazine would like to thank all the CropLife 100 retailers that decided to take part in the annual CropLife 100 survey, for helping to make this report possible. We appreciate their time spent filling out our annual survey form. On the following pages, you will find the 2020 CropLife 100 company rankings, charts on some of the survey’s key findings, and a detailed analysis of a few major crop input/service areas.