Fertilizer Revenues Decline 7% for Top 100 Ag Retailers in 2020

Back during the 1970s, a singer in one classic song said he “could see clearly now the rain is gone.” But for the fertilizer category among CropLife 100 ag retailers, the vision of 2020 following the end of the 2019 rains still left an incredibly blurry image, marked by losses in multiple areas.

In many ways, market watchers probably shouldn’t be that surprised by this performance when eye-balling the fertilizer category. Indeed, following some very good growth years during the early years of the 2010s, the fertilizer category began to see some significant pullback from grower-customers towards the middle years of the decade. In fact, during the 2013 CropLife 100 survey report, the nation’s top ag retailers said that their fertilizer market share compared with other crop inputs/services categories fell 2%. This was followed up by another 4% market share loss during 2014 and a 1% market share drop in 2015.

Then came 2019. While all-season spring and early summer rains disrupted field work across huge portions of the U.S., many industry observers probably wondered during the year part of the year if fertilizer applications/sales would suffer. After all, prevent plant acres around the country totaled almost 19 million acres, with heavy fertilizer using states such as South Dakota, Ohio, and Illinois severely impacted in the process, each recording more than one million crop acres remaining unplanted. Given these facts, the year was setting up to be another cloudy one for the fertilizer category.

A Strong 2019

But in the end, the clouds parted, metaphorically speaking, for crop nutrients. In fact, according to the 2019 CropLife 100 survey, fertilizer category revenues improved 13% from 2018, with overall sales among the nation’s top ag retailers hitting $13.8 billion. This sales gain also improved the fertilizer category’s market share of all crop inputs/services among CropLife 100 ag retailers, growing from 40% in 2018 to 43% by the end of 2019.

“Our fall application season was good,” Tim McArdle, Vice President for BRANDT, Springfield, IL, told CropLife® in our fall 2019 fertilizer report. “This could [have been] driven by strong corn acres, a possible resolution of trade between the U.S. and other countries, and good fertilizer prices.”

And by many indications, market watchers were anticipating that “a more normal” 2020 growing season would again boost the fertilizer category financially for ag retailers. “We are on track to have a good crop in central Illinois,” said McArdle in our fall 2020 fertilizer report. “Our good farmers know the value of replacing fertilizer removal.”

Still, when the final numbers for the fertilizer category among CropLife 100 ag retailers for 2020 were tallied, the expected sales uptick never happened. Quite the reverse happened, in fact.

According to this year’s CropLife 100 survey, the nation’s top ag retailers saw their fertilizer revenues decline 6.6% to $12.8 billion. Consequently, this dropped the fertilizer category’s overall market share of CropLife 100 sales from 43% in 2019 to 40% — back to the same percentage it was in 2018. In essence, all the gains for the category from 2019 have once again vanished.

Why? In truth, the answer could lay in one note of caution Phil Altstaetter, head of Crop Nutrients at Sunrise Cooperative, Fremont, OH, mentioned during CropLife’s fall 2020 fertilizer report: Grower-customer income. “I think the initial response, or gut feeling from folks, is with the local cash price of corn trading below $3 at harvest, it cannot be considered good news for fertility applications,” said Altstaetter.

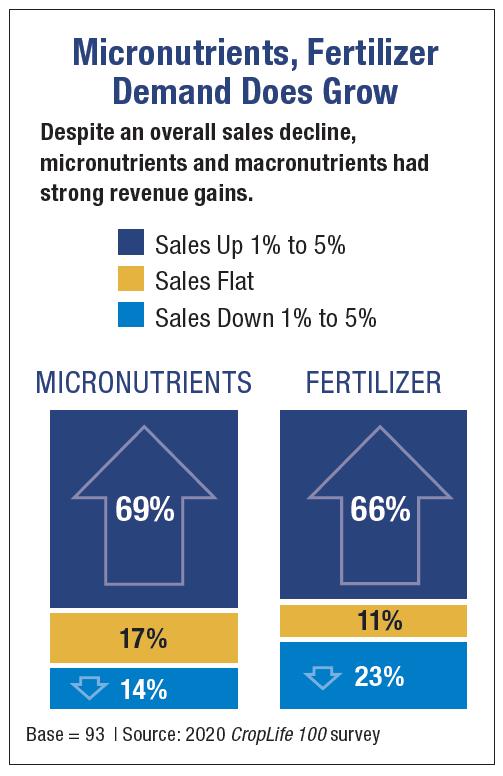

In addition, a particular oddity of this performance by the overall fertilizer category in 2020 is how the two major segments within this designation — micronutrients and fertilizer — ended up. According to the 2020 CropLife 100 survey, both segments saw their revenues increase between 1% and more than 5% between 2019 and 2020 for better than 60% of the nation’s top ag retailers. In micronutrients’ case, the number of ag retailers with positive sales growth for the year hit 69%; for fertilizer, it was 66%. Only 14% of respondents said their micronutrient sales were down between 1% and more than 5% for 2020, with 23% of CropLife 100 ag retailers seeing these same kind of revenue declines for fertilizers.

In addition, a particular oddity of this performance by the overall fertilizer category in 2020 is how the two major segments within this designation — micronutrients and fertilizer — ended up. According to the 2020 CropLife 100 survey, both segments saw their revenues increase between 1% and more than 5% between 2019 and 2020 for better than 60% of the nation’s top ag retailers. In micronutrients’ case, the number of ag retailers with positive sales growth for the year hit 69%; for fertilizer, it was 66%. Only 14% of respondents said their micronutrient sales were down between 1% and more than 5% for 2020, with 23% of CropLife 100 ag retailers seeing these same kind of revenue declines for fertilizers.

Macronutrients Performances

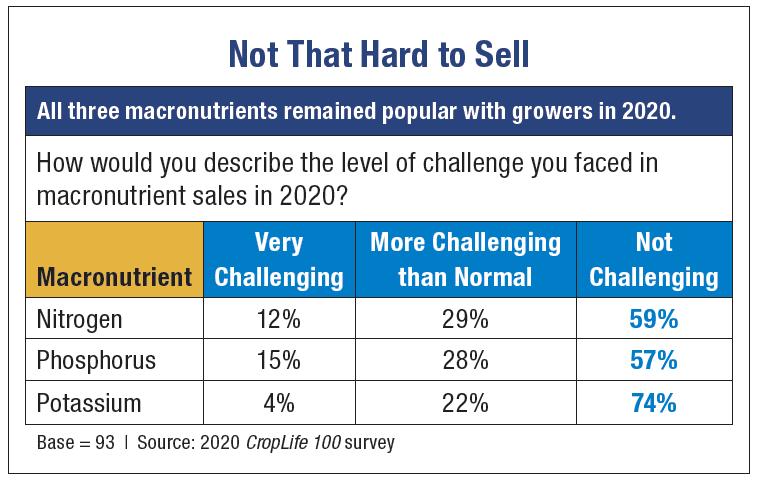

Another reason the fertilizer category’s 2020 performance seems odd ties back to how grower-customers apparently responded to using crop nutrients on their farms. For several years now, the annual CropLife 100 survey has asked ag retailers how easy/difficult it was to convince grower-customers to use the three forms of macronutrients — nitrogen, phosphorus, and potassium. During the prior growing season, according to the 2019 survey, more than half of respondents described their phosphorus and potassium sales as “not challenging,” at 59% and 65%, respectively. Meanwhile, convincing grower-customers to use nitrogen was a bit more challenging, with 25% of 2019 CropLife 100 ag retailers saying this was “very challenging” and 32% saying it was “more challenging than normal.”

According to 2020 CropLife 100 survey, potassium remained the easiest macronutrient to convince grower-customers to use during the current growing season. In all, 74% of respondents said potassium sales this year were “not challenging.” The remaining 26% described their potassium sales pitches in 2020 as “more challenging than normal” (22%) and “very challenging” (4%).

As for nitrogen and phosphorus, the numbers were remarkably similar. According to the 2020 CropLife 100 survey, 59% of the nation’s top ag retailers said nitrogen sales were “not very challenging” for the year while 57% said this was their experience with grower-customers when it came phosphorus. Still, 29% found selling nitrogen “more challenging than normal;” with 28% saying this was the case for phosphorus. Fifteen percent said phosphorus sales pitches were “very challenging” this year, while 12% said this was how nitrogen went for them in 2020.