CropLife 100: A Bump in Seed Sales in 2023 Bodes Well for the Future

In 2023, the seed category managed to increase both overall sales and market share among the nation’s top ag retailers. For a segment that has spent the past few years stuck, this was a welcome change.

The seed category among CropLife 100 ag retailers is new, relatively speaking. In fact, for the first dozen or so CropLife 100 listings, more than 90% of ag retailer revenues came primarily from two categories: Crop protection products and fertilizer. However, when the first biotech seed traits and improved genetics began to appear in the mid-1990s, more and more CropLife 100 ag retailers began to get heavily invested in this growing segment. By the time the 2000 CropLife 100 was compiled, the seed category had grown its sales to $855 million — good enough to represent a 7.9% market share among all crop inputs/services sold by ag retailers ranked within the listings.

Over the next decade, the seed category steadily improved upon its sales performance. By the 2010s rolled around, the seed category was reliably recording sales in the $5 billion range and holding onto a 15% market share among CropLife 100 ag retailers.

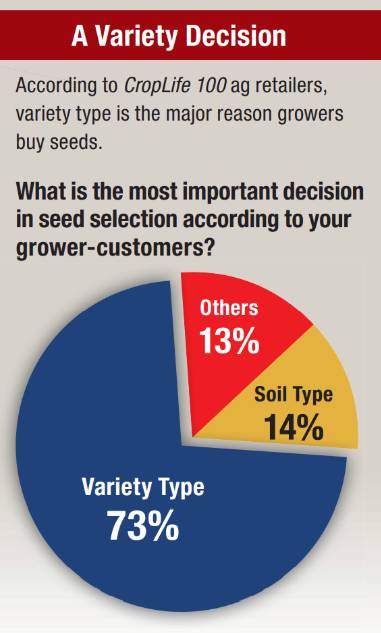

According to many market watchers, seed is the “most personal” decision grower-customers make each growing season “because all of the other crop input/service decisions are made afterward.” As a way to gauge what other factors go into the annual seed purchase decisions, the 2023 CropLife 100 survey included a question on this issue. We asked respondents “what is the most important decision when making seed purchases according to your grower-customers?”

Base = 77 | Source: 2023 CropLife 100 Survey

According to CropLife 100 ag retailers, the overwhelming reason grower-customers pick the seeds they plan to plant each year is variety type. This was mentioned by 73% of respondents as the most important decision in buying seeds. A distant second was soil type, cited by 14% of CropLife 100 ag retailers. The remaining 13% said that there were numerous other reasons their grower-customers decided on their seed purchases, including expected weather conditions in the year ahead and “just buying whatever seeds our customers usually buy.”

A Market Pause

Although the future looked bright for the seed category entering the 2010s, the market growth stalled. Throughout the CropLife 100 rankings between 2015 and 2021, seed category sales stayed at this $5 billion mark and market share moved up or down 1% each year, ranging between 12% and 14%. In fact, on the 2022 CropLife 100, the seed category experienced another $5 billion sales year. However, since the fertilizer category recorded gangbuster growth, the market share for the seed category dropped to only 11%.

In 2023, the seed category did relatively well. For the first time in almost a decade, sales revenue for the segment improved year-over-year, up 1.4% to just shy of $5.7 billion. The market share for the category also improved, up 1% to 12%.

Digging a little deeper into the numbers, it seems as if biotech seed drove market growth vs. traditional seed. According to the 2023 CropLife 100 survey, 49% of respondents saw increases between 1% and more than 5% for biotech seed, with another 43% recording flat sales from 2022. Only 8% reported sales declines in this segment.

The traditional seed segment, meanwhile, at least held its own. According to the survey results, 63% of CropLife 100 ag retailers recorded flat sales in this segment during 2023. Twenty-four percent said their traditional seed revenues for the year improved 1% to more than 5%. The remaining 13% had sales declines year-over-year.

Bucking Historic Trends

So, with a positive year in the books for the seed category in 2023, what does the outlook appear to be going into the 2024 growing season? For some answers to this important question, it seems prudent to look back over the historic trends the seed category has experienced in the CropLife 100 over the past few decades.

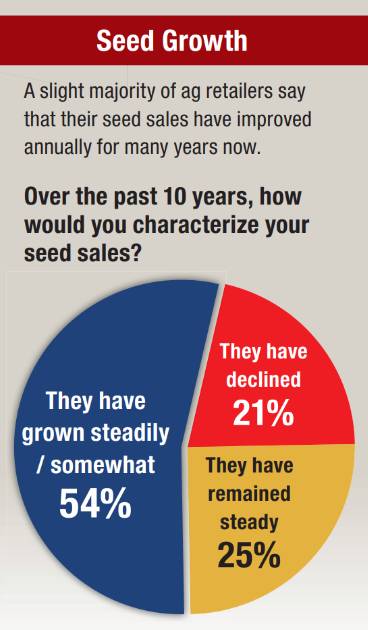

Base = 72 | Source: 2023 CropLife 100 Survey

As stated earlier in this analysis, the seed category has remained relatively stuck in market growth for the past decade or so. In fact, when asked about historic growth patterns for seed over the years, one-quarter — 25% — of 2023 CropLife 100 respondents said their seed sales have remained “constant” or “steady” throughout the years. Perhaps a bit more troubling, 21% of the nation’s top ag retailers said that their seed revenues have fallen throughout the past decade or so. In total, 46% of CropLife 100 ag retailers haven’t seen much movement in seed category sales historically.

However, a slight majority — 54% — have witnessed sales growth in this category. For 25%, the seed sales uptick is decided as “growing somewhat.” For the other 29%, their seed category sales increases are described as “growing steadily” throughout the course of the 21st century.