What Product Categories Are Ag Retailers Betting on for 2021?

For agriculture — and the world at large — there has never never been a year quite like 2020. As ag retailers and their grower-customers started gearing up for the 2020 growing season, the first hints of the impact a new virus called COVID-19 would have on the globe were just beginning to be felt. By the time the spring season began, however, virtually everyone across the world was dealing with this novel virus and the global pandemic it ended up spawning.

Because ag retailers and their grower-customers were deemed “essential workers” by the federal and state governments, they were able to continue planting crops and supplying crop inputs/services as normal. Still, in-person trade shows and conference disappeared from the calendar for much of the year (or moved to a virtual, online-only format out of caution) and digital meetings with customers instead of in-person visits became the norm.

So, with 2020 behind us, what looms ahead for the 2021 growing season for agriculture? As always, CropLife® magazine is devoting much of this issue to an evaluation of the State of the Industry for ag retailers and their grower-customers. And to kick this off, we present the findings from our Buying Intentions Survey, now in its seventh year. In essence, this attempted to find out in which categories ag retailers expected to spend their money during the 2021 growing season, noting if increases were in order, if expenditures were to stay flat compared with 2020, or if ag retailers thought they would spend less this year vs. last.

At first blush, it appears that 2021 will not be as strong a buying year for ag retailers compared with 2020. Perhaps still struggling with a hangover of sorts from the uncertainty of 2020, survey respondents indicated that their buying intentions for crop inputs/equipment/outlet supplies will be less strong than it was going into the 2020 growing season. Overall, there were 10 segments in the 2020 Buying Intentions Survey where ag retailers planned to increase their spending between 1% and more than 11%. In this year’s survey, there were only seven categories expected to see spending increases.

However, if an observer were to take a deeper dive into the 2021 Buying Intentions Survey numbers, a slightly stronger outlook would emerge. For example, take the percentage numbers of categories where ag retailers plan to spend less money vs. last year. In the 2020 survey, there were 11 categories with spending decreases ranging between 15% (micronutrients) and 26% (wheat seed). But in the 2021 Buying Intentions Survey, not a single category topped the 15% mark for decreased spending. In fact, the highest spending decrease recorded this year was 13% (in four different equipment-oriented categories).

The Equipment Outlook

To appreciate just how this “more spending” trend looks, consider the Equipment Segment. During the 2020 Buying Intentions Survey, every one of the eight categories that make up this segment were expected to see flat spending compared with the 2019 levels. And in terms of spending increases between 1% and more than 11%, the largest percentage recorded was 24% for the mixing/blending equipment category; the lowest was 10% for precision ag equipment.

Now according to the 2021 Buying Intentions Survey, flat spending will again be the norm for the equipment segment going into the upcoming growing season. As in 2020, respondents in 2021 say that their spending habits in all eight categories of the equipment segment will be flat.

But overall, there will be more spending taking place in the equipment segment in 2021 compared with 2020, in every single category. For instance, spending in 2020 for the precision ag equipment category was anticipated to be up between 1% and more than 11% for 10% of respondents. In the 2021 survey, the percentage of ag retailers planning to up their spending in this category has more than doubled to 24%.

Another category more than doubling its anticipated spending level in 2021 is chemical/fertilizer storage. In the 2020 survey, only 15% of respondents said they expected to up their spending in this category between 1% and more than 11%. In the 2021 survey, this percentage has improved to 31%.

Several other categories are also showing similar percentage gains. This includes agronomy software (up from 12% of respondents increasing their spending in 2020 to 22% this year), sprayers (up from 22% in 2020 to 31%), enterprise software (up from 13% in 2020 to 23%), and buildings/structures (up from 19% in 2020 to 30%).

As for the other two categories within the equipment segment — mixing/blending equipment and fertilizer spreaders — these can anticipate more modest spending gains vs. 2020 for the 2021 growing season. According to the 2021 survey, the percentage of ag retailers increasing their spending between 1% and more than 11% for mixing/blending equipment will improve 2% to 26%. For fertilizer spreaders, the percentage gain will be 6%, from 21% in 2020 to 27% this year.

The Fertilizer Outlook

While some of the overall numbers have changed between 2020 and 2021 when it comes to ag retailer buying intentions, the segment expected to see the most increases in spending remains the same — fertilizer. The only reason this is something of a surprise is because of the performance of the segment itself recently.

Going into the 2020 Buying Intentions Survey results, the fertilizer segment was coming off of a particularly strong sales year in 2019. And all six categories within the segment were expected to see spending increases by more than 50% of ag retailers.

But this wasn’t the case going into 2021. According to the 2020 CropLife 100 survey, the nation’s top ag retailers saw their fertilizer revenues decline 6.6%, from $13.7 billion in 2019 to $12.8 billion. Based upon this data, an overall flat spending curve might have been expected for the fertilizer segment in 2021.

Yet this is only part ways true. According to the 2021 Buying Intentions Survey, three fertilizer categories — dry fertilizer, liquid fertilizer, and micronutrients — are expected to see increased spending this year from the ag retail sector. In dry fertilizers, 63% of respondents anticipate spending between 1% and more than 11% more this year. For micronutrients, the figure is 60%. Liquid fertilizers, on the other hand, will have 59% of ag retailers from the survey spending more in for the 2021 growing season.

For the remaining three categories, however, the news is a little less rosy. In fact, for two categories — nitrogen/phosphorus stabilizers and additives/enhancers — the vast majority of ag retailers intend to keep their spending levels in 2021 at the same place they were in 2020 (at 55% and 52%, respectively). In both categories, 42% of respondents intend to increase their spending between 1% and more than 11%.

As for the remaining fertilizer category, specialty fertilizers, the news in 2021 will be equally split between good and so-so. According to the 2021 Buying Intentions Survey, 46% of ag retailers plan to increase their spending in this category this year. An identical number, 46%, expect to keep their specialty fertilizer buying habits at the same level they were during 2020. The remaining 8% expect to decrease spending in this area between 1% and more than 11%.

The Crop Protection Products Outlook

If there was a segment that could expect a big jump in spending increases for 2021, it would have appeared to be the crop protection products segment. For many years now, this segment of the crop inputs business for ag retailers has been on a steady growth curve overall. In fact, according to the 2020 CropLife 100 survey of the nation’s top ag retailers, this segment saw its overall revenues grow from $12.1 billion in 2019 to $12.2 billion — another all-time record. According to market watchers, much of this activity in recent years can be tied back to the large amount of prevent plant acres being reclaimed by grower-customers, using all sorts of crop protection products and custom application services to do so.

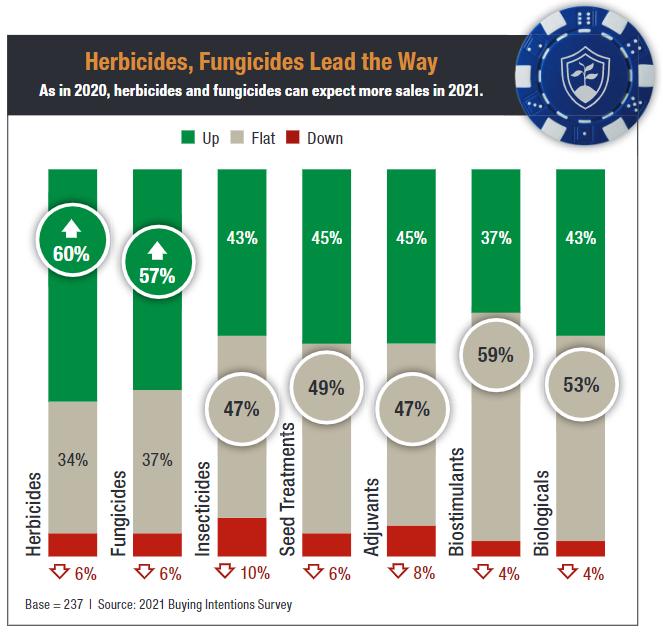

And part of this was reflected in the 2020 Buying Intentions Survey results last year. In fact, according to those findings, two categories likely to be used to reclaim prevent plant acreage — herbicides and fungicides — were predicted to see large spending increases among ag retailers (66% and 58%, respectively). Given these market trends, observers might have expected the crop protection products segment to maintain these kinds of spending increases in 2021, and maybe even expand them into the other seven categories (insecticides, seed treatments, adjuvants, biostimulants, and biologicals).

But this is apparently not going to be the case. According to the 2021 Buying Intentions Survey, herbicides and fungicides remain the only two categories within the crop protection products segment that will see spending increases between 1% and more than 11% this growing season. However, both will have fewer ag retailers spending more vs. 2020, at 60% for herbicides and 57% for fungicides.

For three other categories — insecticides, seed treatments, and adjuvants — the percentages of respondents spending more vs. spending the same in 2021 is pretty evenly split. In insecticides, 43% of 2021 Buying Intentions Survey respondents expect to increase their spending between 1% and more than 11% in this category, with 47% saying their buying habits will be the same as in 2020. For seed treatments, this split is 45% for spending more vs. 49% for spending the same. In adjuvants, the percentages between spending more and spending the same are 45% vs. 47%.

In terms of the other two categories within the crop protection products segment — biostimulants and biologicals — the outlook for 2021 remains relatively constant. In the 2019 Buying Intentions Survey, 36% of respondents expected to spend more money on biostimulants in 2020. In this year’s survey, that percentage increased slightly to 37%.

For biologicals, the outlook is similar. In 2019, 43% of ag retailers planned to spend more money in this category compared with 2019. Going into 2021, the percentage of survey respondents planning to spend between 1% and more than 11% in biologicals remains at 43%.

The Seed Outlook

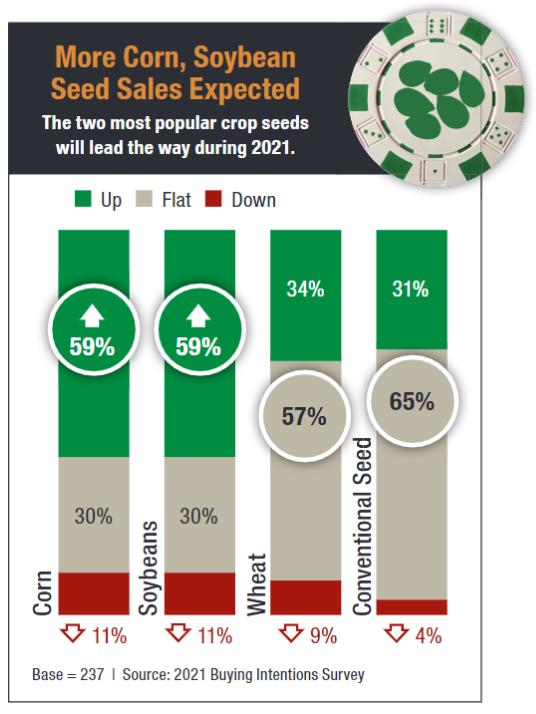

For the final segment looked at in the buying intentions survey, seed, the news is also somewhat muted going to 2021. According to 2020 CropLife 100 survey, the seed segment’s overall sales last year dropped 2.1%, from $4.8 billion in 2019 to $4.7 billion. And based upon the annual USDA estimates, growers are expected to plant more than 90 million acres each of the two most popular row crops, corn and soybeans, during the 2021 growing season.

These estimates are reflected in the 2021 Buying Intentions Survey as well. According to the numbers, 59% of ag retailers expect to increase their corn and soybeans seed purchases between 1% and more than 11% by 59% apiece. As for other seeds, 34% expect to spend more on wheat seed in 2021 (compared with 20% in 2020) and 31% will spend more on conventional seeds (vs. 25% the year before).