Making Sense of the Maturing Micronutrients Market

If manufacturers are accurate with their assessments, 2024 will be a great year to be in the micronutrient business. It’s not unusual for start of the season optimism, but that enthusiasm is often tempered with a bit of caution and a few “ifs.” Talking with a variety of providers they almost seemed to struggle or at least minimize the significance of potential challenges.

“The micronutrient market in the U.S. continues to have growth opportunities,” Jake Socherman, General Manager, Verdesian Life Sciences. “We’ve seen increased interest from dealers who want to include a micronutrient product that can be applied with their pre-plant fertilizers yet be available during the upcoming growing season.”

In a post-pandemic world, prices are returning to normal, and growers continue to explore ways to maximize their efficiency.

Micronutrients benefit the both the yield and health of a variety of crops including corn. Photo: Nachurs

“Micronutrient use will be strong in 2024 as growers try to extract as much revenue as possible out of their production acres,” says Tommy Roach, VP-Product Development & Technical Services, Nachurs Alpine Solutions. “Pricing for chelated micronutrients is back to pre-Covid price levels as production and supply channels return to a more normal operation.”

If there is a reduction in micronutrient use among some growers, it has more to do with the product’s rapid growth, than a distrust of their benefits. In other words, end users continue to “experiment” with micronutrients.

“Growers that like to ‘wait and see’ are now seeing others benefit from using micronutrients so there is growth opportunity in the wait-and-see segment,” says Galynn Beer, National Product Management Lead, AgroLiquid. “I think for those already using micros, there might be some reduction in demand because refinement always takes place. Someone who is successful with three pounds of zinc will wonder, then test, to see what the response of two pounds of zinc will yield. The veteran user will now seek the point of diminishing returns and a segment that knows there is value in micros will seek to gain maximum utility for his dollar. That could result in a slight reduction in volume with those users over time.”

Expectations

When it comes to market growth, Helena Agri Enterprises’ Jason Gregory, Brand Manager, Nutritionals and Coron Brands, uses two words: Yield potential.

“As we continue to see our yields grow, our crops will simply need more nutrients to perform at this level,” he says. “It isn’t any different than an elite athlete; as athletes train their bodies to reach their full potential competitively, they continue to fine-tune the calories/nutrients they take in daily. We will continue to evolve how we feed our elite yielding plants to gain the most potential as well.”

If there is much concern about the growth of the micronutrient segment, it comes from the things beyond any company’s ability to manipulate.

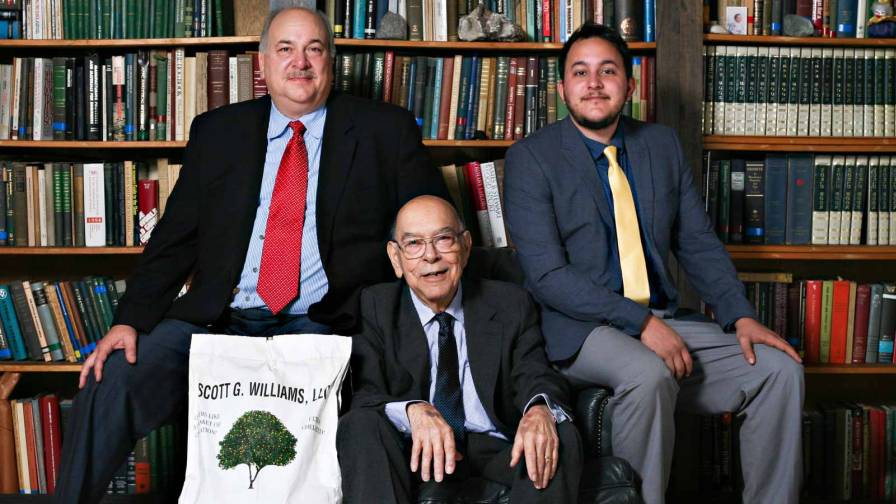

The leadership team at Scott G. Williams (l to r): Fernando Munoz, (General Manager), Maximo F. Muñoz (Founder, passed away last year), and Ed (Frank’s son and Plant Manager). Photo: Scott G. Williams

“We forecast another strong year but understand there are factors that are out of our control,” says Fernando Munoz, General Manager, Scott G. Williams, LLC. “It appears that the international sales aspect is getting stronger, but this area is so susceptible to large issues such as the price of fuel, transportation snafus, geopolitical conflicts, etc. As long as commodity prices remain strong and NPK prices don’t jerk up, micronutrients should do well.”

Many industry executives seem to share a collective sigh of relief after leaving last year behind.

“I’m bullish on micronutrients as we begin 2024,” says Ben Hilgers, Marketing Manager, WinField United. “The micronutrients industry is more stable, as we’ve rode out the cycles of inflation and deflation that came in 2023.

“Just like in 2023, the micronutrients industry will almost certainly be influenced by factors such as fluctuating commodity prices and weather conditions,” Hilgers continues. “However, this fall brought more stable market economics as well as favorable field conditions to get fertilizers or dry, soluble micronutrients applied.”

Growth will also come from a deeper understanding among growers and consultants on how micronutrients work and where they’re most beneficial.

“Farmers and consultants have been expressing more concern that deficiencies in zinc, manganese, and copper are limiting crop yields,” David Annis, CPAg, CCA, Tiger-Sul Market Development Manager. “Farmers and consultants are also commenting that they are seeing micronutrient deficiencies where they’ve never experienced them before.”

Market Drivers

“For years, growers have worked to fine-tune and optimize their NPK inputs,” says TJ Bingham, Technical Agronomist, Koch Agronomic Services. “They adopted good management practices such as employing the 4R Nutrient Stewardship framework when thinking through these applications.

“Now, focus has shifted past macronutrients,” Bingham continues. “When looking through the lens of Leibig’s Law of the Minimum (or Liebig’s Barrel), we know that crops can still be at a disadvantage if some nutrients are less available or not being used effectively, even if other nutrients are abundant. In the past, growers had a more reactive approach to micronutrient management. A common practice was to provide nutrients after visual deficiency symptoms were observed or when soil tests indicated insufficient levels of a determined micronutrient. However, growers are now managing micronutrient nutrition in a proactive way, basing recommendations on crop demand with the goal of preventing deficiency and maximizing yield potential.”

Part of that proactive activity involves learning how micronutrients work with other crop inputs.

“The pairing of biological products with nutrition is not a new concept but is gaining more traction each year” says Devin Wirth, Agronomy Senior Technical Product Specialist, CHS. “The idea that micronutrients are added as a food source for the crop while a biological product drives growth creates a yin and yang effect. This helps the chances of each application become more effective. In addition, there is more innovation in micronutrient formulations for better nutrient uptake and translocation. This increases the likelihood that micronutrients are utilized where necessary in the plant. With better micronutrient formulations paired with new biologicals, these advances may help give new life to the micronutrient market.”

More and more manufacturers use the term “understanding.” It’s about science.

“In addition to finding biologicals to pair with micronutrients, CHS agronomists have been working to help micronutrients enter the plant more reliably and translocate more efficiently to get to where they’re most needed,” Wirth continues. “One way we’ve accomplished this is by pairing micronutrients with a high-quality chelate, like the patented Ortho-Ortho EDDHA chelate instead of industry-standard chelates like EDTA.”

And though it might be straying into a cliché, as the next generation takes control of the growing process, the belief is that the use of micronutrients will become even more widespread.

“As younger decision makers take over the reins of the industry, their education and experiences will benefit the micronutrients side of the industry,” Scott Williams’ Munoz says. “Further, in this modern age of trying to account for things like carbon credits and sustainable inputs, micronutrients will play a larger role so that NPK usage can be reduced without sacrificing yield or quality.”

Yield and quality are just two of the reasons providers expect micronutrient use to — at worst — maintain current levels.

“The last few years the demand for micronutrients has remained steady,” says AgroLiquid’s Beer. “That’s actually encouraging. It indicates that the value of micronutrients is recognized by growers through a variety of economic and supply chain issues. A steady market through the recent challenges demonstrates they are becoming staples of a solid fertilizer program.”

Opportunities

Micronutrients appear to be following in the footsteps of their crop input cousins. Pesticides have become specialized; they’re able to treat specific problems in designated spots in a field.

“Single micronutrients and/or blends are being combined with specialty ingredients and technologies that are targeted for in-season application for stress mitigation” says Nachurs’ Roach. “These specialty ingredients include (but not limited to) fulvic acids, seaplant extracts, fermentation metabolites, and amino acids just to name a few. Nachurs will be releasing one such product this year at Commodity Classic.”

It’s not just the products that are becoming more sophisticated. The tools used to identify where micronutrients can be most useful also continue to improve.

“Farmers are becoming more aware of the symptoms of micronutrient deficiencies, the importance of soil testing, and the effects of micronutrient deficiencies,” Tiger-Sul’s Annis says. “However, the apparent recession, the cost of micronutrients, and their application cost and difficulties have all been factors in farmers being able to adequately address this problem.”

It’s not just the products that receive a refresh. Manufacturers are exploring new ways to apply products.

“Tiger-Sul has been innovating new application methods including the application of sulphur bentonite products in blends by air,” Annis says. “Tiger-Sul is also experimenting with ways to best apply sulphur bentonite pastilles with traditional ground methods, such as broadcast spreading and applying micronutrient enhanced sulphur bentonite with cover crops.”

As the micronutrient segment continues to mature growers, consultants, and providers continue to explore new ways to get the most from these products.

When used properly, micronutrients can improve primary nutrient utilization and overall yield. But products that allow convenient application and ease-of-use are also critical to providing value to the grower. Photo: AgroLiquid

“First, growers (and the industry) are recognizing that micronutrients actually improve the efficiency of primary nutrients,” AgroLiquid’s Beer says. “This reduces the need to over-apply primary nutrients to compensate for poor efficiency, which is a win all the way around. A little cost savings on primary nutrients is shifted to the worker-bee micronutrients and the social pressure of reducing fertilizer applications becomes reality. Second, technology through timely tissue testing and versatile application methods is expanding the window of time a grower can make his decision on which micros to use and when.”

In other words, the mindset is shifting. Micronutrients are moving from beneficial afterthoughts to essential tools.

“Micronutrients have never been more important to our industry,” says Helena’s Gregory. “As our producers and breeders have continued to push the yield limits of what goes into the ground, the need for micronutrients continues to grow. Though it dates to 1840, the Law of the Minimum has never been more important. With insights from our AGRIntelligence program, Helena is able to help producers pinpoint nutritional needs and improve return on investment across their cropping systems.”

Challenges

Like many “newer” practices or products, micronutrients have to overcome decades of skepticism and/or a lack of understanding their value.

With EvenCoat Technology, WOLF TRAX DDP micronutrients thoroughly coat every granule in a fertilizer blend. This uniform coating ensures micronutrients are evenly distributed throughout the blend. Photo: Koch Agronomic Services

“Growers need to understand the critical role played by efficient nutrient distribution across the field to ensure that a micronutrient investment will be fully utilized,” says Koch’s Bingham. “The biggest challenge with micronutrient nutrition is field distribution and soil availability of those micronutrients, thereby limiting plant uptake. We need to continually educate growers and the industry on how technologies can bridge the gap between placement and nutrient interception. By doing this, we approach micronutrient nutrition with a precision management mentality, optimizing every application and maximizing nutrient uptake potential.”

With the growing popularity of micronutrients, many well-known and a few not-so-well-known companies have joined the cause, which creates a lot of racket in the channel. And even if the products are proven effective it can be a challenge to know which solution is best for any given grower.

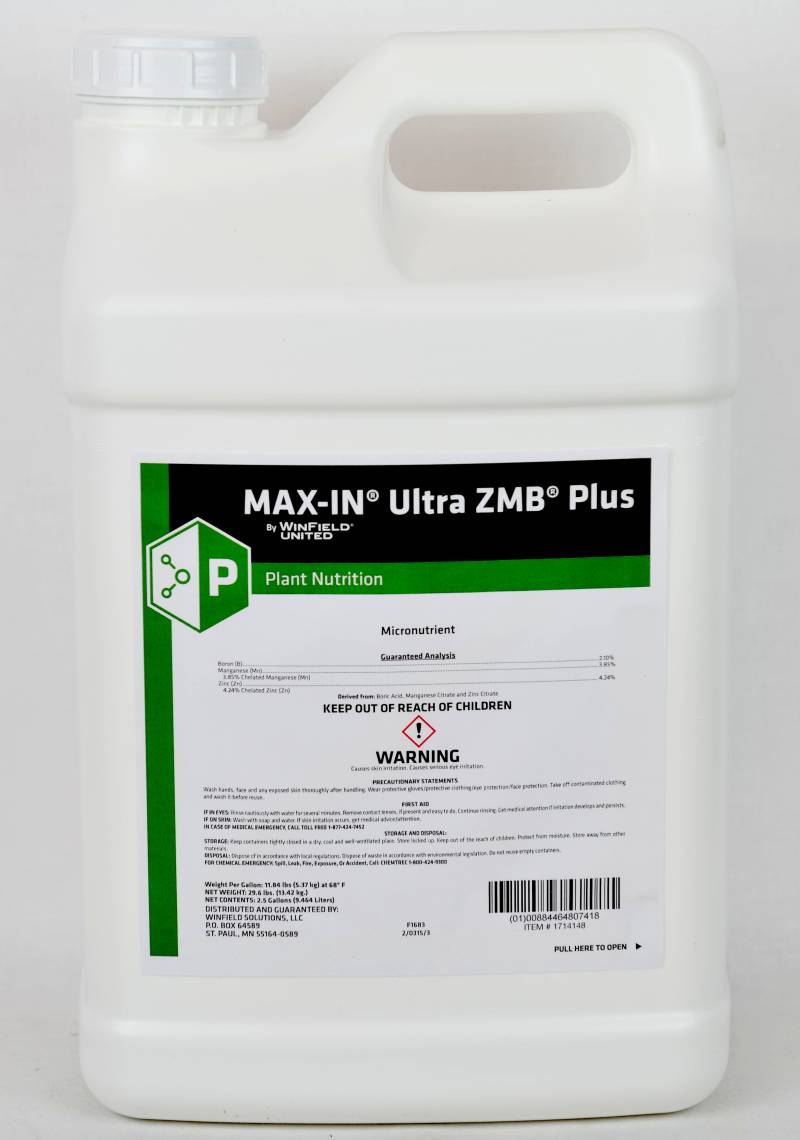

WinField United recently launched MAX-IN Ultra ZMB Plus, a premium liquid foliar micronutrient blend that delivers a high load of zinc, manganese, and boron to crops. Photo: WinField United

“One challenge is navigating industry noise to provide the most effective agronomic recommendations,” WinField United’s Hilgers says. “In the adjacent biostimulants industry, there are many new products and an equally high number of radical product claims to sift through. WinField United performs rigorous testing to validate products and claims, ensuring that our retailers can trust the products that we move forward. Our testing is not swayed by the latest and greatest, we look for products that provide consistent and measurable value for growers to ensure long-term success.

“Information, tools and testing may not be as shiny as some brand-new, unproven technologies, but they are more reliable and give retailers the resources they need to intelligently question and provide the best agronomic solution at the farmgate,” he continues.

“Micronutrients should not all be lumped into one category; we need to break them out into two segments; soil-applied micronutrients (liquid or dry) and foliar applied micronutrients,” says Verdesian’s Socherman. “The two categories work in conjunction together. Soil applied micronutrients (liquid or dry) work in the soil, which is where most nutrients are taken into the plant; while in-season, foliar micros function as supplemental nutrition delivered at a mid/late-stage vegetative state and will only provide a temporary fix. By the time a deficiency in the leaf tissue is noticed, you’ve already lost out on your crops potential yield. These two systems should work in tandem to provide a complete nutritional program and increased yield.”

“The more we learn about the physiology of each crop, the more prescriptive we can be with our applications,” CHS’ Wirth says. “This can set us up for more success with micronutrient applications in the future.”