Crop Protection Sector Capitalizes on Technology, Biorational Innovations

Companies in the crop protection sector are working through distribution and inventory challenges exacerbated by higher interest rates, supply chain issues, and regulatory challenges, which are unlikely to ease in the next 12 to 18 months. However, technology advancements supported largely by AI, coupled with the growing adoption and proven efficacy of biologicals and biorationals, are paving a path forward in a dynamic marketplace.

Rob Schrick, N.A. Strategic Business Lead for Bayer U.S. – Crop Science, said the company started planning last year to assure strategic inventory stocks were optimized for 2024.

“You don’t want to be oversupplied, but you don’t want to be undersupplied either,” which is a constant balancing act for suppliers and the retailers and growers downstream contending with weed resistance and the acceleration of crop diseases and pests.

Rob Schrick, N.A. Strategic Business Lead for Bayer U.S. – Crop Science, said the company started planning last year to assure strategic inventory stocks were optimized for 2024.

For example, the foliar disease tar spot hit corn growers hard and has been “somewhat unpredictable,” said Schrick, who added that “the treatment numbers for fungicides in corn are trending much higher than what most people anticipated.”

Last year also saw significant white mold in soybeans, he said.

From a forecasting perspective, fungicide inventories are “a little dicey” to predict compared to herbicides.

A severe drought over three years or so could result in a build-up of fungicide inventory due to lack of moisture events that promote disease. Likewise, heavy rains, rampant diseases, or a relatively new disease can leave the distribution channel under-supplied.

Climate change and the increased frequency of extreme weather are among the variables that complicate the use of historical records to provide accurate forecasts for inventory management purposes as well as decisions regarding crop production and protection.

Bayer’s Delaro Showcase uses predictive analytics to help growers make better decisions about whether to apply a fungicide, explained Schrick.

“We’re looking to achieve a 70% accuracy and in the next two years, constantly improve recommendations by reflecting new data for growers when evaluating their return on investment as to whether they should apply a broad acre fungicide to “get the crop over the finish line late in the season,” he said, citing one of many examples of how Bayer is using advanced technologies in its business to facilitate better decision-making for growers.

When it comes to crop protection, “Mother Nature’s always going to win,” Schrick noted.

For example, “We’ve always had to deal with weeds that were either inherently tolerant to the chemistry that we use, or ones that we’ve selected for, or weeds that have the ability for metabolic resistance. They find a way around the herbicides.”

At the same time, Bayer remains focused on assuring the grower gets an optimal yield, he said.

Specifically, “How do we deliver for the grower the best yield for the least amount of input in the most efficient and sustainable way we can? That’s where we put our investment dollars.”

Currently, “The best way to solve for that is with new herbicides, and we have new mode of action (MOA) herbicides coming. We are also bringing a new (MOA) herbicide for corn and soy growers that will provide excellent activity on resistant waterhemp.”

In addition, “We’re bringing new soybean tolerances to herbicides that are on the market that haven’t been available to soybean growers. We’re giving them new tools, new methods, to overcome the challenges that they’re dealing with,” said Schrick.

“That’s the beauty of getting to work for Bayer. We’re continually innovating.”

The Biorational Boost

As the biologicals industry matures, using the proper language to accurately define various products and applications is also getting attention.

The responsibility Valent U.S.A. assumes for helping advance biologicals and biorationals aligns with its global leadership role around sustainability.

While biologicals broadly refer to products made from living organisms, Matt Plitt, President and CEO of Valent U.S.A., noted that biorationals encompass “biologicals plus any synthetic biology, which would include compounds and new innovations that we’re building using synthetic chemistry that mirrors biological compounds.”

The distinction is important, especially as discussions around the efficacy of biorationals attracts more interest across the agriculture industry.

Plitt views biorationals as complementary to a total production system, not a replacement for traditional production.

“We’re seeing a lot more biocontrol uses in specialty markets, which goes back to consumer demands, the organic market, including OMRI (Organic Materials Review Institute) certification driving some of that adoption. There are also growers who farm both organic and traditional production who are starting to utilize both biorationals and traditional chemistry together.”

He also acknowledged the role suppliers and manufacturers have in educating the agriculture industry, including retailers and growers, about biorationals.

“A lot of it has to do with science and training. As manufacturers, we have an obligation to make sure we equip ag retailers with the information and background behind biorationals. Ag retailers are independent, they’re neutral, and they’re making the best agronomic recommendations they can. That’s why it’s important that we provide the resources so they can make good, credible decisions on those recommendations to the farmer.”

Not surprisingly, the responsibility Valent U.S.A. assumes for helping advance biologicals and biorationals aligns with its global leadership role around sustainability.

Parent company Sumitomo Chemical Co. Ltd., of Tokyo, Japan, adheres to the philosophy of JIRI-RITA, which translates to “our business must benefit society at large, not just our own interests.”

For Plitt, sustainability is ex-pressed in the agriculture industry through Valent U.S.A.’s training, education, and investment in the next wave of talent.

“Another way is how we impact the farm and how we show up on the acre. This plays very heavily into our portfolio,” he explained.

The company differentiates itself in other ways, too.

“From Sumitomo Chemical’s synthetic chemistry discovery, to Valent Biosciences’ biorational discovery, and MGK’s botanical discovery in Minneapolis, we have access to all three of those product classes from discovery, to commercialization and farmer solutions, making us uniquely positioned in the market.”

All about AI

Numerous technologies, dominated by AI, are helping companies optimize their business internally and externally.

“From a global strategy, Sumitomo Chemical is very focused on DX (digital transformation),” said Plitt, including the area of improved operational efficiency.

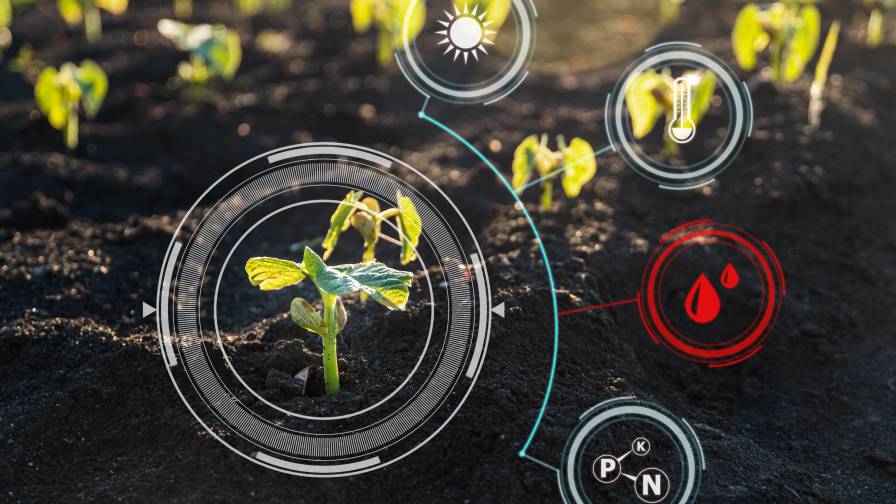

Numerous technologies, dominated by AI, are helping companies optimize their business. Photo: Leonid / stock.adobe.com

He expects that AI will play an increasingly prominent role in the company, especially around predictive modeling and forecast accuracy, along with optimizing supply chain management. Sumitomo Chemical is implementing AI as part of their discovery process looking at molecular compounds and streamlining that effort with a goal to speed up timelines and manage costs of discovery.

“AI takes a lot of time and cost out of the process,” said Plitt, “which is critically important because if you look at the regulatory pathway today, it’s 13 to 14 years to market and approximately $330 million. It’s expensive to bring a product to market. We’ve got to get some big wins in terms of how we can be more efficient on product development, and AI can play a role.”

The company’s DX strategy “is also advancing our CRM platforms to help with our internal customer segmentation to meet the needs of different customers, because not every retailer is the same. I’m optimistic that we’ll use AI to further help customize our offerings.”

Obstacles and Opportunities

From a global perspective, the CPP market is facing headwinds for the next 12 to 18 months, especially from a pesticide perspective, according to Bob Trogele, COO and EVP of AMVAC Chemical Corp.

While AMVAC reported positive results for the fourth quarter of 2023 many other companies ended the year with negative earnings, “and Chinese suppliers are struggling with profitability,” said Trogele.

In addition, for economies such as Brazil, China, and Europe, “the story is not over yet” with regards to the broader CPP sector and what it will encounter in the near- to mid-term, he said. “Those are major markets. And on top of that, you’ve got erratic weather patterns to contend with.”

Trogele noted that oversupply of CPP in China remains an issue, and “it’s anybody’s guess as to when that will correct itself.” China’s recession is likewise troubling because “they are so important to the ag industry as a buyer of commodities.”

At the same time, regulations are stifling innovation and investment for the CPP market.

“We’ve got to move away from the emotions and get back to what’s pragmatic,” he suggested.

Indeed, it’s not only agriculture that’s affected by the proliferation of regulations, “it’s the entire life sciences industry, including human health and the animal sector,” said Trogele. The assumption used to be that “big companies would survive anything [economic downturns, changes in the regulatory landscape, etc.], but that’s not the case anymore.”

The drag on innovation in CPP is also feeding commoditization, he noted, and it’s happening at a faster pace, particularly on the supply side.

“The margins have gotten thinner, and research is slowing down. Now, everybody is scanning the market for growth segments, which is making biorationals, precision ag, and ag technology very attractive. Adoption rate and monetization of technology is key for investors,” said Trogele. “Higher interest rates are also weighing on CPP companies. Venture capital is drying up and while private equity “has lots of money, they’re being choosier about where to park that money because they have to achieve higher returns [to offset the higher interest rates].”

However, despite the various challenges, there are numerous bright spots from Trogele’s perspective.

AMVAC is very focused on its core market of North America, which overall is less risky than most other global regions thanks to resources such as water, energy, and exceptionally talented people in the agriculture industry, he noted.

South America is also a very important market, while “China, India, and Ukraine are also attractive from both a biorational and technology standpoint.”

Trogele is also excited about biodiesel, including sustainable aviation fuel, which he said could provide a significant boost to the American farming industry while simultaneously mitigating the impact of disruptions occurring in other global regions.

He estimated getting into the global carbon and methane markets could add roughly $25 billion in incremental value to the U.S. agriculture system, from farmers to brokers as well as tax revenue for the federal government.

The caveat is that it must be “intelligently organized, because right now it’s not.”

However, the potential for participating in a clean energy global trading market is huge, said Trogele.

“It would be a win-win for everyone.”