Crop Protection Market Proves Resilient in 2022, But Outlook Flat for ’23

For the crop protection products category, 2022 was a decent year. According to the 2022 CropLife 100 survey results, revenues for this category grew 16% for the year, up from $12.9 billion in 2021 to $15 billion. All three segments that make up this category — herbicides, insecticides, and fungicides — performed well, according to survey respondents, with average sales growing between 3% and 5% for 2022.

However, despite this fact, the one down note for the crop protection products category came in the market share department. Because the category failed to keep pace with the overall industry growth, the crop protection product category now holds a 33% market share vs. the other categories — a decline of 4% from the 2021 figure of 37%.

Despite abundant preparations for the 2022 season to stay ahead of supply shortages, soaring input costs, weeds, and uncooperative weather demonstrate again that nothing comes easy in farming.

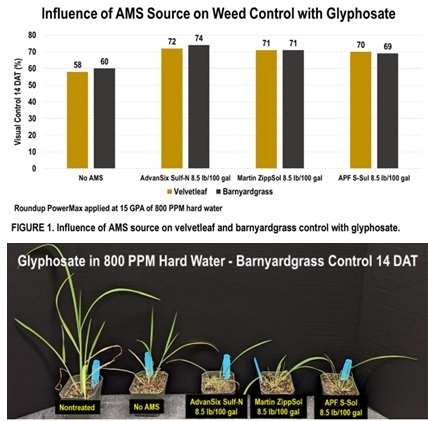

Where it was dry — the Western plains — it was very dry, and that lack of activating rainfall often impeded the performance of preemergent herbicides, resulting in large weeds and a scenario where the slightest variations in weather, herbicides, nozzles, spray volumes, and adjuvant selection mattered. At times, growers cut rates to save money or were dealing with herbicides with which they weren’t as familiar, because they couldn’t secure supply of their top choices.

“It could have been a few days’ separation between having a very successful postemergent season and one that they weren’t satisfied with,” Shawn Hock, Corn Herbicides Product Lead, Syngenta, told CropLife® magazine.

Ryan Wolf, Agronomy Service Manager with WinField United, says that every acre that needed to get sprayed got sprayed in ’22, although the product applied in many cases may not have been the grower’s first choice. There was plenty of product allocations, and plenty of bandwidth spent on deciding plan A, B, C, and D for the season, Wolf explains.

“For ’23, we’re still trying to figure out where we’re at — there are still a lot of allocations out there, and our basic manufacturers have given us lists of things that are tight on allocation. We might get it, we might not get it yet. It’s still a little bit iffy,” he says. “I think for 2023, for retailers and growers, they still need to start planning ahead. There are a lot of key AIs that have loosened up, but at what price point — there’s going to be sticker shock.”

On the flip side, basic chemistries like glyphosate and glufosinate are dropping in price and are not as tight as last year. Group 15s, preemergence herbicides, and some insecticides and fungicides will be hit-or-miss, he cautions.

At this time last year, retailers were at historic lows of inventory that was in warehouses to sell to the farmgate.

“That’s changed. We are now back to a channel that in certain segments, like fungicides, we have a lot of inventory in channel. That is something that is wildly different. That changes behaviors and planning for manufacturers, retailers, and ultimately the farmgate,” says Mike Henderson, Executive Vice President, Ag Markets with Atticus. “It doesn’t mean the supply chain is going to be any easier, it just means it’s different … We’re not going back to a pre-COVID era in our estimate. We are establishing a new normal, though.”

David Wheeler, Associate Director Technical Services at FMC Ag Solutions, tells CropLife the company has expanded and diversified its domestic capacity to improve on its ability to formulate in the U.S. through adding tollers and capital improvement projects. With respect to lead times, adjustments to the six-month window now needed — vs. 30 days several years back — have been made and things are largely on track.

As pest pressures can be unpredict-able, retailers are getting inventories on hand much earlier. “We’ve largely built back on a lot of confidence that’s needed. We are shipping a lot of that material right now, and they will have it on their hands now or early in the first quarter,” Wheeler says. The consequence is heavier pressure to produce supplies like insecticides over the winter, at least six to eight months before they’re applied.

“So far, we are able to keep up with that, but I think that could result in over-capacity at some point to the industry,” Wheeler says.

Henderson and others expect 2023 to be flat compared with this year, but on the positive side, commodity prices should remain robust.

“Even though we have a high commodity price environment, there is a lot of scrutiny on the farm to make sure [producers] understand the value of each of those inputs. Producers will continue to search for the best price to value.”