Seed Care Challenges — in the Courtroom and State Capitals

For the past decade or so, the area of seed treatment has grown in popularity, among ag retailers and their grower-customers. In fact, according to numerous agricultural market analysts, seed treatments have become increasingly important tools for grower-customers to protect their seeds and seedlings from many early-season insects, diseases, and other yield-robbing pests. Overall, it is estimated that treated seeds are used on approximately 150 million acres of cropland each year.

“Today’s seed treatments enable America’s farmers to realize greater yields, healthier crops, and higher revenues than ever,” writes Pat Miller, Director, State Affairs for the American Seed Trade Association (ASTA) on the organization’s website. “At the same time, seed treatment technology reduces potential risks to the environment, thanks to its highly targeted approach. To help protect pollinators, groundwater, and growers, pesticide seed treatment formulations and application processes are designed to keep the pesticide coating tightly adhered to the seeds until they are planted and ready to germinate.”

Furthermore, based upon the evidence, seed treatments remain an important part of ag retail business, too. According to preliminary data from 2023 CropLife 100 survey, seed treatment sales were up between 1% and more than 5% for 62% of respondents, an increase of 10% from the 2022 percentage. Those CropLife 100 ag retailers experiencing sales declines between 1% and more than 5% dropped, from 8% in 2022 to 6% this year. The remaining 32% of survey respondents said that their seed treatment revenues between 2022 and 2023 were “flat.”

In part, the reason for the rise in seed treatments popularity ties to more acceptance at the grower-customer level. “In our area, farmers are turning the corner and beginning to intensively manage soybeans,” said Jacob “Jake” Larson, Lead for the Seed Treatment Department at Asmus Farm Supply in Rake, IA, in the 2022 Seed Care Special Report. “Because of early planting, seed treatment is the first step in the process to reach their high yield goals.”

ASTA’s Miller agrees. “[Seed treatments] control key pests, especially those that are below ground, that could destroy the seed or damage the developing seedling,” he writes. “They are critical components of integrated pest management for reducing non-target exposure to pesticides and environmental impact, and potentially decreasing the need for supplemental foliar applications. Without the protection that seed treatments offer from such pests, the plants may die or lose yield.”

Legal Challenges

Despite these documented benefits from seed treatments, not everyone is convinced that the products used in this sector are regulated properly. For instance, in early June, a lawsuit was filed by the Center for Food Safety and the Pesticide Action Network North America in the federal U.S. District Court of Northern California in San Francisco challenging seed treatments. As written, this lawsuit would force EPA to “assess and register” seed treatments as pesticides. Currently, the agency exempts seeds coated with insecticides as treated articles exempt (TAE). Previously, EPA had denied a 2022 petition by the Center for Food Safety to begin the rulemaking process for regulating treated seeds as pesticides.

The groups in the lawsuit allege that since the neonicotinoid insecticides are commonly used on some treated seed, they can “cause widespread harm to birds, pollinators such as bees, beneficial insects, and endangered species.”

“Neonicotinoids have . . . contributed to the widespread decline of bee populations and other widespread ecological effects, including harming aquatic life,” said the lawsuit. “EPA must apply that [pesticide] registration process to coated seeds and stop exempting them from it.”

Unfortunately, this national lawsuit was only the first such legislative challenge to seed treatments. At the end of June, the New York State Legislature passed a bill prohibiting the sale or useof corn, soybeans, or wheat seed coated with five different neonicotinoids unless the state environmental and conservation commissioner determined there were not adequate alternatives.

The Empire State Senate approved the bill shortly thereafter, and the New York Governor Kathy Hochul was expected to sign it. Luckily, this legislation would not go into effect until 2027. However, this still makes New York the first state to take such broad action against treated seed.

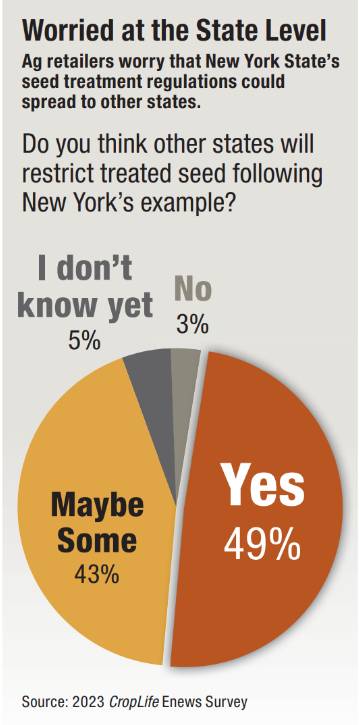

As a result of these legal/legislative challenges to seed treatments, ag retailers are already worried for their future business in this area. In fact, according to a poll of CropLife® magazine readers, 73% believe the Center for Food Safety and the Pesticide Action Network North America lawsuit has the potential to have a “major negative impact” on the treated seed segment of the ag business going forward. More significantly, 92% of respondents fear other states will follow New York’s example and begin regulating seed treatment more than they have in the past. Given these facts, this fear is justified. According to Kevin “K.J.” Johnson, President of the Illinois Fertilizer & Chemical Association, his state association has been fighting against neonic legislation in the Illinois state General Assembly for more than 10 years now. Fortunately, this fight hasn’t gone very beyond the discussion phase.

“So far, no neonic legislation has ever moved or received a hearing in Springfield, IL,” says Johnson.

Already Regulated

Of course, according to ASTA’s Miller, the really sad part about all these legal/legislative questions regarding seed treatment regulations is that the sector is already regulated on the federal level. Indeed, on the ASTA website, the organization lists seven examples of this fact.

- Seed treatment products are highly regulated, as are sprayed and soil-applied pesticides. They undergo thorough evaluation by the U.S. EPA, and applicable state agencies, prior to commercialization and periodically thereafter. Only after a seed treatment product is approved by the relevant federal and state agencies can the product be used in accordance with its EPA-approved label.

- Application of seed treatment products to seed must be performed strictly according to instructions on the pesticide label, approved by EPA.

- Labels for commercial seed treatment products carry language that must be placed on the tags of treated seed packages regarding permitted and prohibited practices.

- EPA assesses any potential risks for use of seed treatment products from applying the product and planting the seed (i.e., environmental fate, ecotoxicology, and operator exposures) to the consumption of the harvested commodity by the consumer. EPA’s associated science-based evaluation also considers the application rates, analysis of the quantity “planted per day,” typical seeding/planting rates per acre, etc.

- All pesticides are subject to periodic review to ensure that, as the science advances and/or policies and pesticide use practices change over time, all registered products continue to meet the statutory standard

of “no unreasonable adverse effects” on health, safety, or the environment. - Under EPA regulations, 40 CFR §152.25(a), the seeds treated with pesticides are considered “treated articles” if, and only if: a. The article contains or is treated with a pesticide; and b. The pesticide is intended to protect the article itself; and c. The pesticide itself is registered for this use by EPA without this “TAE” designation by EPA for seed, there would be costly duplication of regulatory effort without any additional

benefit to health, safety, or the environment, given EPA’s thorough review of the product’s use as a seed treatment. - The Federal Seed Act regulates the labeling, sale, and movement of seed in the U.S., and seed companies must abide by its provisions. The tag on a package of treated seed must include identification of what the seed has been treated with, guidance for safe handling, and other applicable labeling requirements.

For now, the industry will have to keep a close eye on what happens next for seed treatments in the nation’s courtrooms and state capitals. However, according to AFS’ Larson, seed treatments will remain an important part of the agricultural mix no matter what.

“Yes, I anticipate seed treatment staying a major growth area over the coming years,” he said. “It has become common practice for growers, and they are looking for innovation in this department.”