Biostimulants Raring for Regulation

The biostimulant industry remains in search of an official identity.

Eighteen manufacturers, upon being asked to name their most pressing concern, almost unanimously cite the absence of a legal definition of plant biostimulants.

“The biggest issue facing the bio-stimulant world today is an accurate description of what constitutes a bio-stimulant,” Dan Custis, President and CEO, Advanced Biological Marketing (Van Wert, OH), says. “The agriculture industry, to date, has not made that distinction. … There is a need to define what is a bio-stimulant, what it does to help in production agriculture, and what the benefit is to the farmer.”

Royce Schulte, BioSolutions and Innovative Nutrition Business Manager, Arysta LifeScience (King of Prussia, PA), says there currently is no state or federal path to market within the U.S. that allows the use of the term “biostimulant” or one that covers the appropriate product claims. “This leads to a lot of confusion in the marketplace and inconsistency in product efficacy,” he says.

“Uncertainty in the U.S. regulatory framework is a major issue,” concurs Jane Fife, Chief Science Officer, 3Bar Biologics (Columbus, OH). “Industry has been working hard for several years to get a legal definition of plant biostimulants.”

Biostimulant products range widely, from microbials to humic acids to plant extracts, phytohormones, and more, according to Rob Jarek, U.S. Market Development Agronomy Manager, Stoller USA (Houston). That variance, he says, is the root of the problem.

“There is confusion in the marketplace among retailers and growers as to what biostimulants are and what benefits they provide. Biostimulants need to be more clearly defined from a regulatory and agronomic standpoint so retailers and growers know what products to use and what results to expect,” Jarek says.

In Search of Clarity

Without such a definition, “far too many” products in the current market make “outrageous” claims with no efficacy data to substantiate them, Dion Pearce, Products Manager, Pathway Biologic (Plant City, FL), says. “That can muddy the waters and confuse growers with their purchasing decisions. Better education from biostimulant manufacturers and their partners can go a long ways in providing clarity to a product’s benefit and ROI. Poor products in the sector hurt the entire industry,” he says.

Jared Essman, an Agronomist in charge of Southeast Sales with Bio-Gro (Mabton, WA), agrees: “One of the greatest challenges … is the flood of the market with speculative information and unproven products. It is overwhelming, to the point that a majority of ag retailers and growers are avoiding the realm of options completely. The level of unique approaches definitely has a positive outlook, and further innovation should absolutely be supported. However, for the benefit of everyone involved with the food production chain, standardization of biostimulants, when it comes to testing, labeling, etc., needs to be supported on more than just the state level.”

Who should regulate this sector of agriculture? What constitutes legitimacy? What claims are allowed and not allowed? Which distribution mechanism is most efficient when introducing a new chemistry, approach or segment to agriculture? These are all questions that need to be answered, Johnny McRight, Founder and Manager, DeltAg Formulations (Greenville, MS), says.

“We cannot say that one of these issues is more important than any of the others. However, I do believe that if it can be determined that these materials are NOT pesticides, NOT PGRs (plant growth regulators), and NOT fertilizer, then a regulatory system or department would need to be established. Once that is done, then issues with legitimacy, claims, and distribution would all be resolved in a very short period of time,” McRight says.

Help on the Way

Several manufacturers see promise in the 2018 Farm Bill, which was signed into law on Dec. 20. The legislation includes a definition of plant biostimulants, which, according to Fife, is “an incredible accomplishment.”

The bill describes a plant biostimulant as being a “substance or microorganism that, when applied to seeds, plants, or the rhizosphere, stimulates natural processes to enhance or benefit nutrient uptake, nutrient efficiency, tolerance to abiotic stress, or crop quality and yield.” Along with this definition is a requirement for a report, within one year, that includes consultation with various industrial and governmental stakeholders.

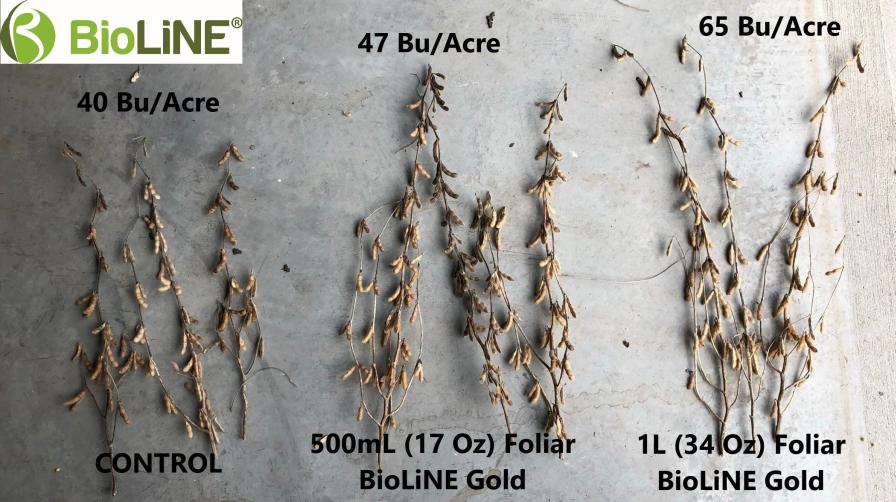

“These events bode well for the (North America) biostimulant market,” says Dr. Cameron Graham, a Research Chemist with BioLine Corp. (Alvinston, ON CAN).

Passage of the Farm Bill is a “huge development,” according to the Biological Products Industry Alliance (BPIA), and represents the “first description of a plant biostimulant in any U.S. legislation (while being) largely consistent with the definition currently under development within the European Union.”

Manufacturers are enthused but cautious:

- Dr. John Breen, Director of Portfolio Strategy and Regulatory Affairs, Actagro (Fresno, CA) — “The most pressing issue for the industry is that, depending on the product, some state regulators don’t recognize some of the proven agronomic claims that can be made for this broad category of substances. This limits both understanding and adoption of these products because label claims are often too vague.”

- John Wolf, Senior Director of Innovation, Agricen (Plano, TX) — “The 2018 Farm Bill was an important milestone in creating a process to reach standards for biostimulant technology, but much more effort remains ahead to reach a consensus on national requirements.”

-

Jim Loar, CEO, Cool Planet (Greenwood Village, CO) — “The inclusion of biostimulants in the recently enacted Farm Bill will ensure a regulatory pathway for biostimulants and accelerate the adoption of biostimulants. Their promising benefits will be realized.”

In the view of Arysta’s Schulte, the ideal regulatory framework for biostimulants would:

- Protect growers from products with baseless claims.

- Protect the market from fraudulent products.

- Level the playing field for competitive products.

“All this can be accomplished,” he says, “through reasonable biostimulant-focused data requirements related to safety and effectiveness. … Fortunately, industry groups have come together with government agencies in Europe and the U.S. to explore regulatory scenarios for these unique products. Europe has made significant progress.”

Going to Bat for Biostimulants

Biostimulants, Cool Planet’s Loar says, provide growers with the tools to help achieve a new level of sustainable production and can “kickstart” biology’s natural systems to produce crops. “It is irrefutable that global population is growing, and agriculture will be enlisted, once again, to produce more with less to meet the needs of the growing global population. So, we urge policy writers to continue to pursue clear definitions and processes to enable growers to confidently adopt these new tools that align with society’s interests,” he says.

Mike Eade, Commercial and Marketing Director, North America, Plant Impact (Morrisville, NC), calls 2019 a “really exciting and challenging time” for the entire biostimulant category. “I’ve worked in ag for over 30 years, and I can truly say that the three-plus years I’ve spent with Plant Impact, focused on this relatively new category of input, has been as rewarding as it has been challenging,” Eade says.

The challenge comes from what Eade calls a “double-whammy issue” during the past year or so. “At Plant Impact our science and approach to research is robust, but we still need to work hard to establish trust in chemical biostimulants, as with anything new. This is the same for our peers. However, these efforts sit against a backdrop of very tough market conditions. Commodity prices are low, (and) there is ongoing and well-documented market uncertainty due to global trade issues,” he says.

“We and many other players in this growing sector are relatively small companies delivering a standard of development and trial rigor that is usually only seen from major agchem. Our data is strong and transparent, our product benefits are clear, and we’re partnering with respected distributors and retailers.”

Proving itself is a daily mission at Acadian Plant Health. The Nova Scotia-based company and other forerunners in the seaweed biostimulant space have invested heavily in research to illustrate that their technologies work, Vice President of Global Marketing Ron Taylor says.

“Increasingly in the seaweed extract sector, we are seeing new products that (a) contain small amounts of seaweed or (b) have been commercialized with little research or few crop trials yet claim similar science and benefits to our extract products,” Taylor says. “We’re addressing this by working hand-in-hand with our industry associations and regulatory partners to create more specific guidelines and classifications that will prevent untested products from being sold commercially. The sale of unproven products has the potential to undermine the credibility that companies like Acadian Plant Health have worked to build around seaweed extract products for the last 20 years.”

There is no shortage of data at Concentric’s new headquarters in Centennial, CO. “Our third-party research results now number over 200, with a wide variety of crops and geographies tested, and we have increased our understanding of the benefits of our selected microbes and their value to the grower,” Concentric President and CEO Donald R. Marvin says. “Products will be formulated based on plant type, geography, and soil conditions.

Adds Kevin Hammill, Chief Commercial Officer, Marrone Bio Innovations (Davis, CA): “Customers are inundated with multiple products that do not consistently deliver on their promise because they have not been broadly tested across represented geographies and environmental conditions. This significant variance in product performance means strong products get blended with inconsistent products. This dynamic can strain relationships among crop protection companies, retailers, and growers. Increasing communication between groups about expectations and determining a common way to measure can help plant health companies better support those they serve.”

Other officials offered advice to retailers and growers:

- Mike McFatrich, Vice President of Business Development, NewLeaf Symbiotics (St. Louis) — “The technology of many biostimulants readily fits with traditional crop protection tools, and that corresponding fit extends to their ‘plug-in’ applicability, which means the delivery of the product to the crop can be done similarly as a conventional crop input tool.”

-

Marty Campfield, Vice President of Domestic Sales and Marketing, Azomite Soil Products (Nephi, UT) — “These products can be viable options to include in soil fertility programs, so long as they are backed up with professional greenhouse, laboratory, and field research to prove product viability and validity.”

- Tommy Roach, Director of Specialty Products and Product Development, NaChurs (Marion, OH) — “Biostimulants can bring great value to production agriculture. However, there are products out there that have good efficacy and those that do not. Research a product carefully before you take it to your customer base. Do your homework and use common sense before making commitments, remembering that if it sounds too good to be true, it most likely is.”