Biofertilizers: Looking Forward to Renewed Growth

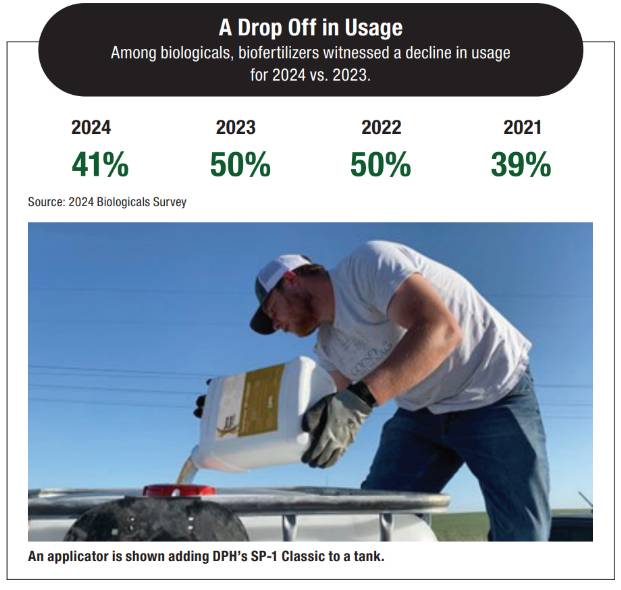

Things were a little different for biofertilizers in 2023. According to the data from the 2024 CropLife® Biologicals Survey, usage among ag retailers and their grower-customers declined from the 2022 growing season — down from 50% to 41%. This marked the first such drop for the sector since the magazine started polling readers on biofertilizer use back in 2018.

The question, of course, is why did this segment see such a pull-back from market users? According to Mick Messman, President/CEO of DPH Biologicals, part of the explanation for this might tie back to a natural evolution of the biofertilizers sector in the minds of users.

“Growers are interested in biofertilizers, but are demanding more from them, as they should,” says Messman. “Short shelf life, special handling requirements, and the inability to mix with other inputs — or inconsistent data around product benefits — are simply not going to make the cut in this competitive market.”

Matt Sowder, Director of Global Agronomy at Mosaic Biosciences, agrees with this assessment — and highlights a few other reasons why biofertilizers might be experiencing some marketplace sluggishness. “As long as fertilizer represents such a significant portion of costs per acre, the pressure will always exist to maximize return-on-investment — specifically, return on fertilizer investments,” says Sowder. “Interest and awareness has improved slightly, [but] overall it is difficult to discern if there is increased market penetration rather than consolidation of usage from competitive products with similar value propositions.”

Matt Sowder, Director of Global Agronomy at Mosaic Biosciences, agrees with this assessment — and highlights a few other reasons why biofertilizers might be experiencing some marketplace sluggishness. “As long as fertilizer represents such a significant portion of costs per acre, the pressure will always exist to maximize return-on-investment — specifically, return on fertilizer investments,” says Sowder. “Interest and awareness has improved slightly, [but] overall it is difficult to discern if there is increased market penetration rather than consolidation of usage from competitive products with similar value propositions.”

Despite this fact, however, DPH’s Messman says many companies that do business in the biofertilizers sector did see their markets for such products expand during 2023. “Farmer interest in biofertilizers continues to grow and biofertilizers are becoming a critical component for profitable Corn Belt production,” he says. “In the last year, DPH Biologicals has secured sales and distribution agreements with leading channel partners and added more than 30 new retail partners in the U.S. ag market alone.”

Andrew Duff, General Manager — North America at Groundwork BioAg, agrees. “Since joining Groundwork BioAg in 2023, I’ve talked with many growers across the Midwest and Midsouth who are trying biologicals on a significant portion of their farms,” says Duff. “Based upon demand, we [have] expanded our North American sales team to support farmers and help them tap into the benefits of our biofertilizer, Rootella.”

Furthermore, he points out that according to various biological category research reports, the global market for biologicals is expected to achieve a compound annual growth rate of 13% over the next four years. As a result, the company is rapidly expanding its production capacity around the globe.

“Groundwork BioAg has expanded commercialization in the U.S., Brazil, India, Canada, and other countries in Europe,” says Duff. “With the addition of China, Argentina, and South Africa in 2023, the company and its local partners offer farmers access to the most highly concentrated mycorrhizal inoculant products available for mainstream agriculture.”

Market Drivers in 2024

Moving into the 2024 growing season, Mosaic’s Sowder predicts commodity prices could play a big part in how well or poorly biofertilizers perform. “Perhaps the driver that pushes cost awareness most for production is still depressed commodity prices going into 2024, as we see in corn futures today,” he says.

Still, DPH’s Messman says that interest in biofertilizers among ag retailers and their grower-customers should remain high this year for two simple reasons — yield and profitability. “Yield and profitability have been, and will continue to be, the most critical drivers of biofertilizer sales in 2024,” he says. “We’ve had a few good years of high crop prices that have helped offset inflation and costs.

“But with so many future unknowns — be it the supply chain, political and regulatory impacts, climate extremes, or harvest prices — growers are more cautious to add any new cost or change to their operation — be it biofertilizers or anything else,” continues Messman. “They [need to] come with clear, specific benefits and an acceptable return-on-investment.”

To this end, Messman says DPH has taken steps to improve the availability of its TerraTrove SP-1 Classic to customers. “Unlike so many of the crop input products that farmers depend upon, SP-1 Classic is domestically produced in DPH’s Illinois production facility, mitigating global supply chain issues,” he says. “That means growers can trust SP-1 Classic will be available — when they need it, even if other products are in short supply or skyrocket in price. We’ve already seen first-hand the immediate impact of that in 2022, with many growers using SP-1 Classic for the first time to offset a portion of their fertilizer inputs without taking the risk of sacrificing yield.”

In addition, DPH is planning to launch some new offerings for the marketplace during the upcoming growing season as well. “DPH Biologicals is advancing several new technologies in the biologicals category,” says Messman. “The 2024 launches will be primarily focused on biocontrols, while we intend to advance a next generation easy-to-use biofertilizer product to pre-launch status in 2024.”

Wild Cards, Weather

Given these positives, are there some so-called “wild cards” or “black swan events” that could negatively impact the biofertilizers sector in 2024? Of course, says Groundwork BioAg’s Duff.

“Climate, conflict, and cost have been among the many environmental and financial challenges growers face to produce the food, fuel, and fiber the world demands,” he says. “The predictions we are hearing indicate 2024 will be no different.”

But according to DPH’s Messman, the biggest wild card potentially affecting the biofertilizers sector in 2024 will be the same as it tends to be every year for agriculture — weather extremes. “The increasing occurrence of weather extremes will continue to be a reason growers use biofertilizers, especially in drought and extreme temperatures,” he says. “However, they also want products with specific benefits to defend against weather stress as well as offer other benefits.”

He adds that the company’s SP-1 Classic is specifically formulated to aid with weather extremes. “For instance, when soil-applied SP-1 Classic improves soil tilth, structure, and compaction optimizing conditions for early season moisture retention and uniform crop establishment,” says Messman. “[And when] applied as a foliar, SP-1 helps plants focus their energy on growth and improve their water-use efficiency, improving crop resiliency to heat, drought, and salinity stress.”

A few other market drivers could have a positive impact on the biofertilizers sector in 2024, says Groundwork BioAg’s Duff. “Following the high fertilizer prices in 2022, growers needed a replacement that offered the strongest return-on-investment,” he says. “In addition, many growers I talk with are looking to boost profitability with the help of passive income, such as carbon credits.”

To tap into his desire, adds Duff, Groundwork BioAg in 2023 invited farmers across the Midsouth and Midwest with a minimum of 250 acres to participate in a pilot program using Rootella Carbon. “Rootella Carbon is proven to sequester significant amounts of carbon in cropland and is open to all farmers,” he says.

According to Duff, participation in this program instantly qualified growers for carbon credits without requiring changes to existing land management practices.

“[It offered] clear benefits to crops and the land above and beyond carbon revenue,” he says. “As early adopters and stewards of their lands, these farmers understand there is more they do to improve soil health than the public may realize.”