Q3 2022 AgTech Venture Capital Investment and Exit Round Up

Last quarter, our analysis of Crunchbase data shows 201 AgTech startups raised a total of $2.6B. This represents a 5% drop in funding and a 3% decrease in deals from Q2 2022. Overall, the AgTech sector fared much better than venture capital investments across all industries which endured a 33% quarter-over-quarter reduction in funding, according to Crunchbase News. There were 10 AgTech exits last quarter, all through M&A transactions. This represents a 67% increase in the number of exits from Q2 2022.

AgTech Venture Investments

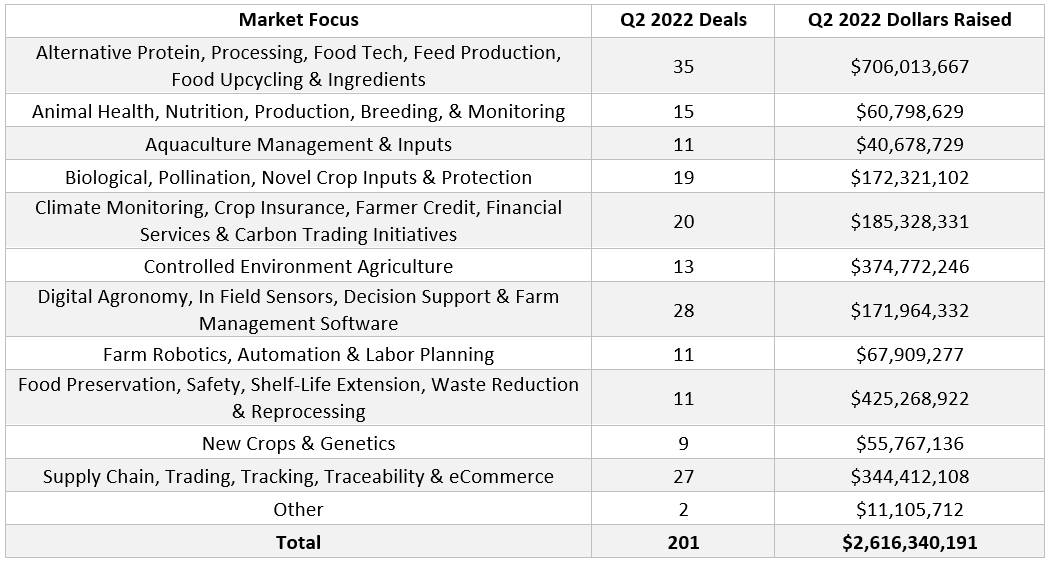

Below is a breakout of the deals and dollars that flowed to different sectors of AgTech last quarter:

The biggest increase in total investment dollars quarter-over-quarter was in the food waste sector, where companies raised $391M more than they did in Q2 2022. The largest category drop in total investment dollars was in the controlled environment agriculture sector, where companies raised $312M less than in Q2 2022. The average AgTech investment round last quarter shrunk to $13M, down from $19.3M in 2021.

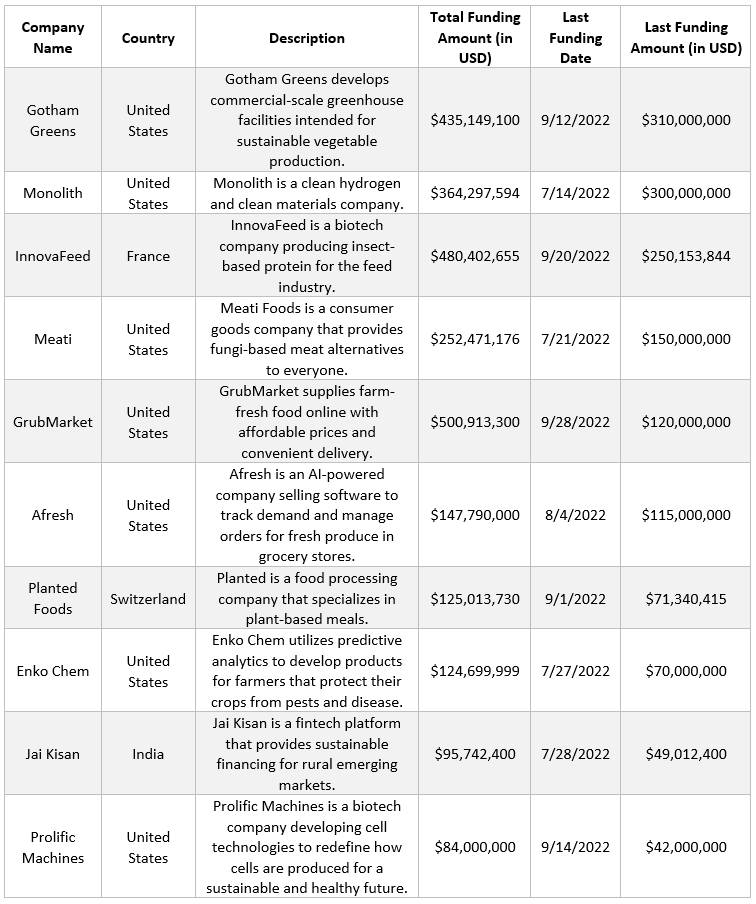

The 10 largest AgTech investments last quarter were as follows:

AgTech Startup Exits

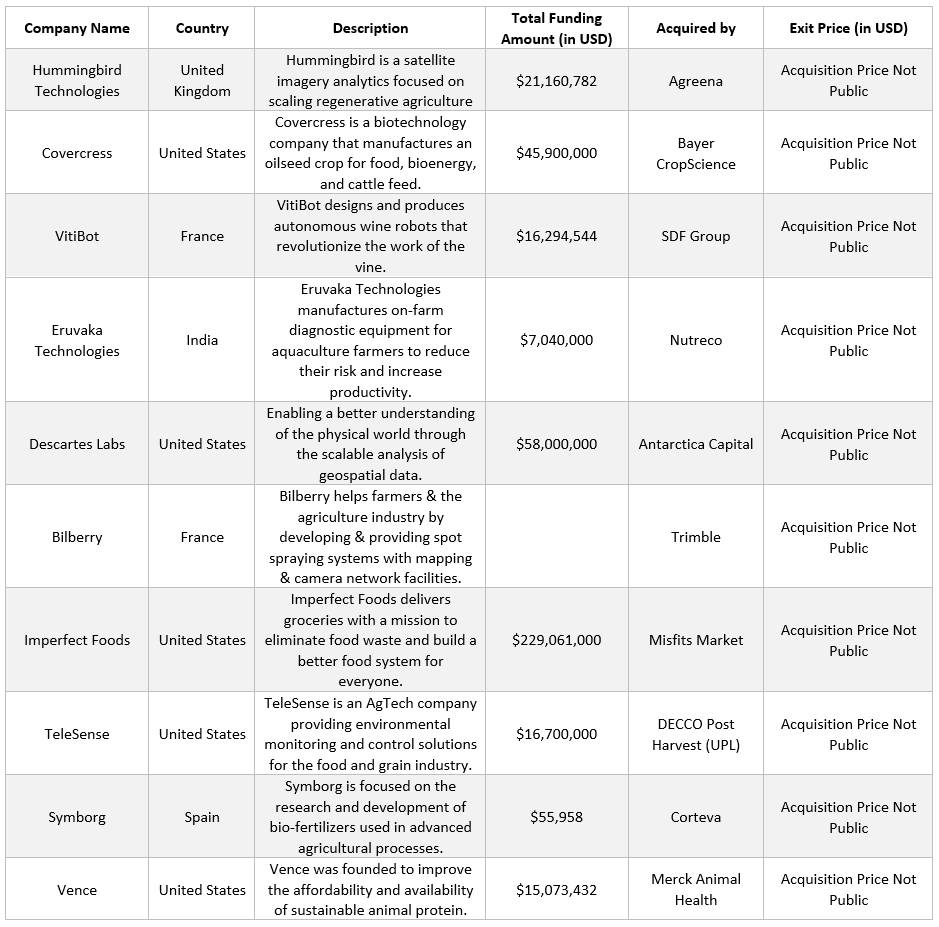

Below is a list of the 10 AgTech exits last quarter:

Key Takeaways from Q3 2022

While AgTech venture capital investments slowed down last quarter, agriculture stood up far better than most industries in terms of overall venture funding, and 2022 will be another very strong year for investments in the sector. In 2021, AgTech startups raised $12.2B, over double 2020’s number. In the first three quarters of 2022, AgTech startups have raised $8.9B. It looks like the year will end with between $10B-$11B worth of AgTech investments in 2022. There have been 639 AgTech startups funded this year, already beating the 632 deals completed in 2021.

While most venture capital-backed startups across all industries are struggling to find big exits, AgTech startups are showing strength here too. According Pitchbook, there were approximately 500 venture-backed exits in Q3 2021 worth $200B in announced value. Last quarter, there were only 302 venture backed exits worth $14B in announced value. However, there have been 29 AgTech exits so far in 2022, comparing well against last year’s 44, which was another record.

- Related: View past AgTech VC Roundups

Larger, publicly traded food and agriculture companies have been particularly acquisitive this year. So far in 2022, BASF, Bayer, Bioceres, Corteva, FMC, Mahindra, McCain Foods, Merck, Nutreco, SDF Group, Mosaic, Trimble, and UPL have all acquired an AgTech startup. For many of these companies, this was their first startup acquisition. As public ag companies have seen their share prices hold up well in a period of higher commodity prices and concerns about global food availability, it appears these companies are becoming more acquisitive, especially of technologies that help give them an edge in their sustainability stories.