Q2 2022 AgTech Venture Capital Investment and Exit Round Up

Last quarter, our analysis of Crunchbase data shows 193 AgTech startups raised a total of $2.78B. This represents a 27% drop in funding and a 21% decrease in deals from Q1 2022. There were six AgTech exits last quarter, all through M&A transactions. This represents a 54% reduction in the number of exits from Q1 2022.

AgTech Venture Investments

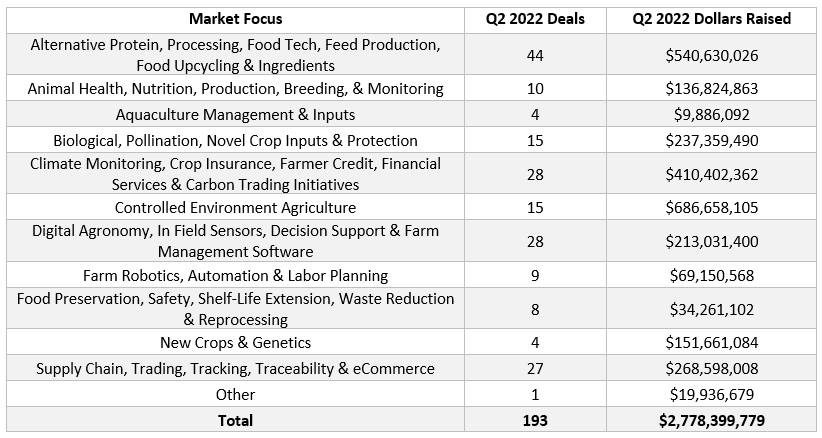

Below is a breakout of the deals and dollars that flowed to different sectors of AgTech last quarter:

The largest category drop in total investment dollars was in the alternative protein space, where companies raised $589M less than in Q1 2022. The biggest increase in total investment dollars quarter-over-quarter was in the new crops and genetics sector, where companies raised $129M more than they did in Q1 2022. The average round size continued to decrease last quarter compared to rounds completed in 2021. The average AgTech investment round was $19.3M in 2021, where last quarter the average round size shrunk to $14.4M.

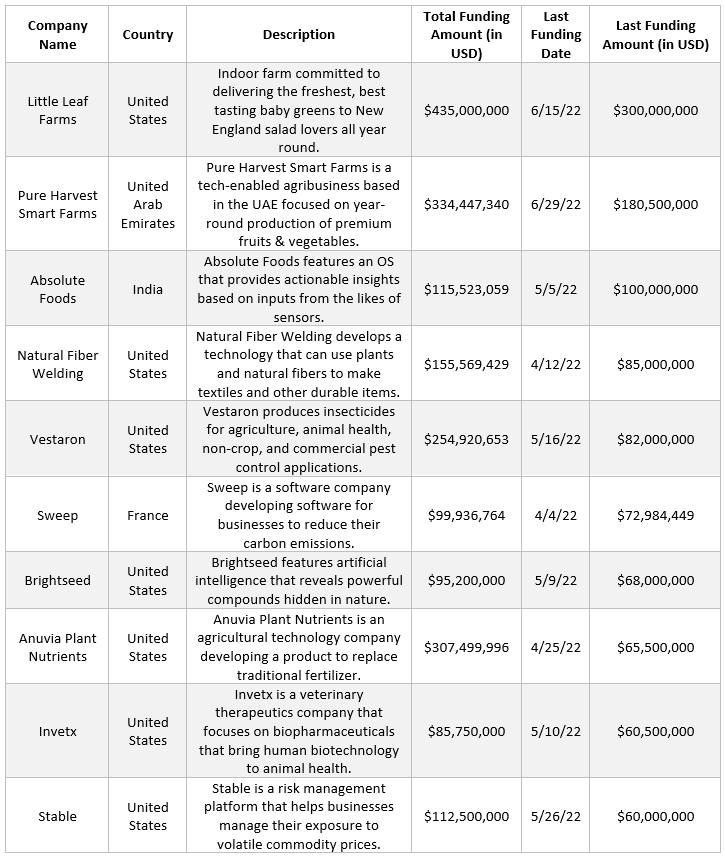

The 10 largest AgTech investments last quarter were as follows:

AgTech Startup Exits

The IPO market for AgTech startups has essentially been non-existent in 2022, as it has been for other industries outside of agriculture as well. Last year during the SPAC craze, there were eight IPOs / SPAC mergers closed in the first half of the year. This year there has only been one, and none in the last quarter.

Below is a list of the 6 AgTech exits last quarter:

Key Takeaways from Q2 2022

While last year rapid growth was enough to attract investors or explore an exit, the focus this year has been on showing a clear path to profitability. For some startups, this will not change their go-to-market strategy. However, some companies will have to rapidly focus on proving that they have a profitable business model rather than just showing growth.

In addition, founders and investors tend to make their largest returns from public listings rather than M&A transactions. The lack of new public offerings this year will increase the importance of having the option to being acquired. Based on an analysis of 18 AgTech M&A transactions since 2017 where the acquisition prices have been made public, the average AgTech M&A exit was for $131M, while the median price was $61.5M. This is considerably smaller than the average market cap at the time of listing for a newly public AgTech startup, which was $2.5B since 2017.

Many successful M&A transactions come out of preexisting partnerships between startups and larger companies, like the one that BioPhero had with FMC prior to their acquisition last quarter. If the IPO market continues to be closed, there will likely be many startups working to secure partnerships larger companies to ensure they have the option of an M&A exit in the future.