The CropLife 100 Report: Lots of Winners in the 2021 Race for Ag Retail Profits

In the annual race for profits, ag retailers and the crop inputs/services they provide normally end up in a “good news, bad news” situation. For every category or segment that runs a winning race in the quest for dollars, there usually is one that stumbles to the finish line. But occasionally, all the categories end up winning a medal in terms of profits come year’s end.

For the nation’s top ag retailers, this kind of race was last run nine years ago, during the 2012 growing season. And now, they can add 2021 to this “all-winners” scenario in terms of profitable years.

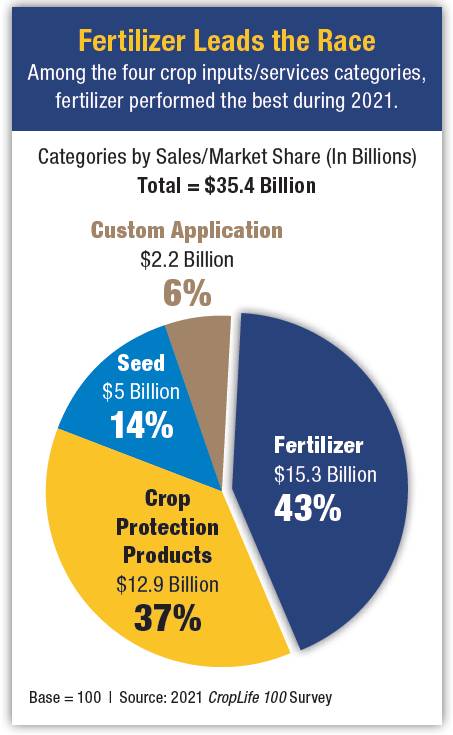

According to results from the 2021 CropLife 100 survey, 2021 was one of the best years, sales-wise, the ag retail industry has ever seen. Overall, revenue for the nation’s top ag retailers grew 11.7%, topping an all-time record of $35.4 billion. This represented a marked improvement over the 2020 results, when the aftereffects of COVID-19 and wet/dry weather combined to depress CropLife 100 ag retailer sales 1.9%.

As stated earlier, all four major crop inputs/services categories tracked in the annual CropLife 100 survey — fertilizer, crop protection products, seed, and custom application — ended up performing better than they did during the 2020 growing season. In fact, three out of the four (crop protection, seed, and custom application) also saw record revenue levels during 2021, according to the survey. And the fourth — fertilizer — ended up tying its previous annual revenue mark, last achieved during 2013.

Crop Nutrients in Demand

Speaking of fertilizer, this category really ran a strong race for dollars during all of 2021. According to the survey, crop nutrients boosted their yearly revenues from $12.8 billion in 2020 to $15.3 billion in 2021. This tied the all-time record for fertilizer income for one growing season among the nation’s top ag retailers, representing an impressive 19.5% sales increase.

Speaking of fertilizer, this category really ran a strong race for dollars during all of 2021. According to the survey, crop nutrients boosted their yearly revenues from $12.8 billion in 2020 to $15.3 billion in 2021. This tied the all-time record for fertilizer income for one growing season among the nation’s top ag retailers, representing an impressive 19.5% sales increase.

Furthermore, since this revenue increase easily outpaced that for the overall market, the fertilizer category was able to increase its total market share for all crop inputs/services categories 3%, from 40% in 2020 to 43%. In truth, this is still a long way from the days in the early 2010s, when the fertilizer category held a 55% market share among crop inputs/services. However, crop nutrients were the only category to record a market share gain this year.

Finishing in second place for the 2021 race for profits was the crop protection products category — a position the segment has held continually since almost the start of the 21st century. Overall, this category saw record revenues among CropLife 100 ag retailers, coming in with $12.9 billion. This marked a 5.7% improvement over the $12.2 billion in crop protection products revenue the nation’s top ag retailers recorded on their financial books during the 2020 growing season.

Despite this growth, however, the crop protection products category did end up losing out in one race during 2021 — for overall market share. Because the category’s growth rate was approximately half of the overall markets, the market share for crop protection products slipped slightly during 2021, down 2%, from 39% in 2020 to 37% today.

Next in the overall run for market share in 2021 was the seed category. Like the crop protection products category, seed ran a great race for dollars during this year, with overall revenue improving from $4.7 billion in 2020 to just over $5 billion in 2021 — an uptick of 6.4%. However, since this growth rate trailed that of the overall marketplace, the seed category did see its overall market share among crop inputs/services for CropLife 100 ag retailers dip 1%, from 15% in 2020 to 14%.

For the final category among the four major ones, custom application, 2021 also represented a record-setting run. Overall, the category saw its revenues improve 10%, from $2 billion in 2020 to $2.2 billion in 2021. Since this growth rate virtually matched that for the entire marketplace, the custom application category was able to maintain its overall market share among crop inputs/services at 6%.

Six Up, Three Flat

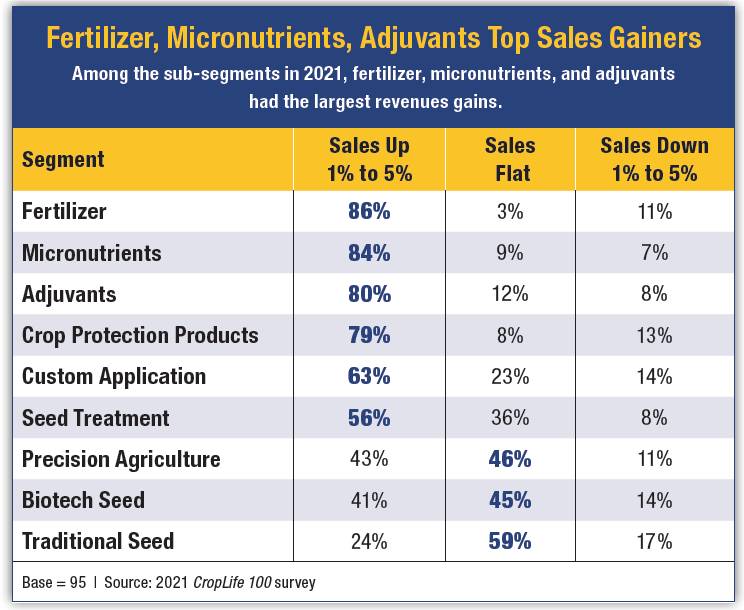

As the major crop inputs/services categories were enjoying record runs for profits during 2021, the nine smaller segments that make up the overall marketplace were also having some good runs of their own. In fact, six of the nine segments ended up with revenue growth vs. 2020. Three others had sales runs nearly identical to their 2020 races. Better still, no segment had more than 17% of the nation’s top ag retailers seeing any kind of sales declines for the year.

Leading the charge was the fertilizer segment, where 86% of CropLife 100survey respondents said their 2021 sales had increased between 1% and more than 5% compared with 2020. Close behind were the micronutrients at 84% and adjuvants at 80%. The crop protection products segment just missed this 80% mark, with 79% of CropLife 100 ag retailers saying their income here improved between 1% and more than 5%. Other positive gainers among segments in 2021 included the custom application segment (63%) and seed treatment (53%).

Leading the charge was the fertilizer segment, where 86% of CropLife 100survey respondents said their 2021 sales had increased between 1% and more than 5% compared with 2020. Close behind were the micronutrients at 84% and adjuvants at 80%. The crop protection products segment just missed this 80% mark, with 79% of CropLife 100 ag retailers saying their income here improved between 1% and more than 5%. Other positive gainers among segments in 2021 included the custom application segment (63%) and seed treatment (53%).

Among the three remaining segments, two — biotech seed and precision agriculture — were more flat sales-wise than up, but just barely. For biotech seed, 45% of survey respondents said sales were flat in 2021, vs. 41% that recorded sales increases between 1% and more than 5%. In precision agriculture, these percentages were similar, with 46% seeing flat sales during 2021 vs. 43% recording positive gains.

As for the last segment — traditional seed — the news in 2021 was the same as it has tended to be during the past 20 years or so. Overall, 24% of respondents to the survey said their sales in this segment improved between 1% and more than 5%. However, the majority, 59%, saw no revenue bump from traditional seed during the 2021 growing season.

Supply Side Economics

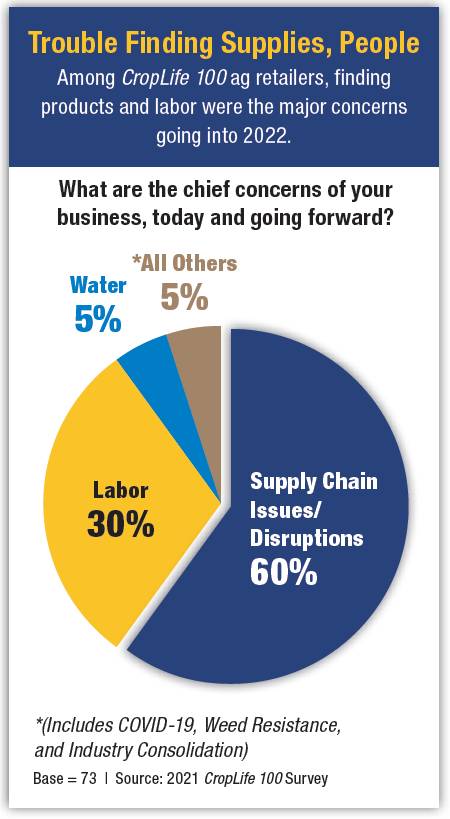

Despite all the winning going on with CropLife 100 crop inputs and services, there were still a few negatives that kept 2021 from being a complete winner of a year according to survey respondents. In fact, every year, the annual CropLife 100 survey asks the nation’s top ag retailers to rank the issues “keeping them up at nights” for each growing season. Normally, such concerns as industry consolidation, weed resistance, and water availability/regulations rate highest annually. During 2020, COVID-19 became a chief concern.

However, according to the 2021 CropLife 100 survey, only two issues currently are dominating the nightmares for 90% of the nation’s ag retailers. The first is labor. This has consistently ranked as a major concern each and every CropLife 100 survey for at least the past 20 years, and this remains the case for 2021. According to this year’s survey, 30% of respondents rank finding/keeping employees as their No. 1 issue going into the 2022 growing season.

But in 2021, finding/keeping labor at the retail level was easily trumped by one major issue that cropped up during the end of 2020 and remained a problem throughout the 2021 growing season — finding products. According to 60% of respondents to the 2021 CropLife 100 survey, supply chain disruptions (and the subsequent cost increases associated with many of these hard-to-find items) was — and will remain — a major obstacle to the nation’s top ag retailers achieving profits during the 2022 growing season.

But in 2021, finding/keeping labor at the retail level was easily trumped by one major issue that cropped up during the end of 2020 and remained a problem throughout the 2021 growing season — finding products. According to 60% of respondents to the 2021 CropLife 100 survey, supply chain disruptions (and the subsequent cost increases associated with many of these hard-to-find items) was — and will remain — a major obstacle to the nation’s top ag retailers achieving profits during the 2022 growing season.

“One word sums up our biggest concern for the 2022 growing season, and that is ‘supply,’” wrote Kathleen Sims, President of Sims Fertilizer & Chemical, Osborne, KS, on her 2021 CropLife 100 survey. “Not only what we sell, but the inputs that are required to get the products to the growers.”

Adam Lovelace, Vice President of Farm Centers at The Andersons, Maumee, OH, agreed. “Potential supply chain disruptions continue to be a concern,” wrote Lovelace. “The aberrations in the supply chain in 2021 were management, just took a little more effort than in previous years. The current outlook for potential disruptions in 2022 appears to present a much more challenging environment.”