The CropLife 100 Mid-Year Report: Taking the Temperature of the 2023 Season

Editor’s Note: The role of the ag retailer and trusted advisor to farmers across the U.S. is constantly changing — never more so than in the last three years. As the dust is seemingly settling — new market dynamics are here to stay, and many tried and true practices are gone for good. As the linchpin between grower-customer and the suppliers of sophisticated tools they use, ag retailers in the U.S. are essential to pushing crop production to the next level. In recognizing 40 years of the CropLife 100 ag retail ranking program, our editors will engage with numerous CropLife 100 ag retailers at the National, Co-op, and Independent levels and unearth opportunities and concerns in today’s modern agricultural market. We will also feature numerous stories throughout the year focusing on ag retailers that are celebrating milestones, exploring how they have managed to survive and thrive where others have not. This month, we gauge how the 2023 growing season is shaping up with input from the CropLife 100 ag retailers themselves.

Editor’s Note: The role of the ag retailer and trusted advisor to farmers across the U.S. is constantly changing — never more so than in the last three years. As the dust is seemingly settling — new market dynamics are here to stay, and many tried and true practices are gone for good. As the linchpin between grower-customer and the suppliers of sophisticated tools they use, ag retailers in the U.S. are essential to pushing crop production to the next level. In recognizing 40 years of the CropLife 100 ag retail ranking program, our editors will engage with numerous CropLife 100 ag retailers at the National, Co-op, and Independent levels and unearth opportunities and concerns in today’s modern agricultural market. We will also feature numerous stories throughout the year focusing on ag retailers that are celebrating milestones, exploring how they have managed to survive and thrive where others have not. This month, we gauge how the 2023 growing season is shaping up with input from the CropLife 100 ag retailers themselves.

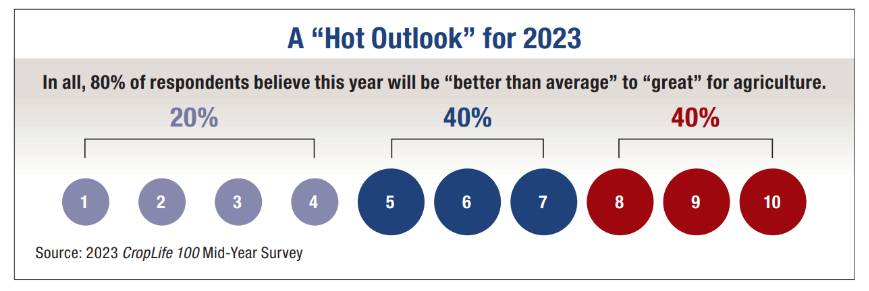

It’s a time-honored tradition in the world of medicine: Determining a patient’s health by taking their temperature. This month, CropLife® magazine is borrowing this idea as we present the results from our 7th annual CropLife 100 Mid-Year Survey. For the most part, eight in 10 ag retailers surveyed foresee a healthy outlook for agriculture in 2023, with just a few hints of worry for certain issues and product segments.

According to the annual CropLife 100 Mid-Year Survey, the nation’s top ag retailers have a fairly positive outlook for the chances for profitability in 2023. In fact, based upon the survey results, 40% of respondents believe that the 2023 growing season will end up rating between an eight and a 10 on a 10-point scale (with one representing things being worse than expected and 10 representing things being better than expected). Coincidentally, another 40% believe 2023 will rank between a five and a seven in their books. This means that overall, 80% of the nation’s top ag retailers are looking forward to many variables working in their favor throughout the balance of the year. Only 20% of respondents think that the 2023 growing season will rate between a one and a four on the 10-point scale.

According to the annual CropLife 100 Mid-Year Survey, the nation’s top ag retailers have a fairly positive outlook for the chances for profitability in 2023. In fact, based upon the survey results, 40% of respondents believe that the 2023 growing season will end up rating between an eight and a 10 on a 10-point scale (with one representing things being worse than expected and 10 representing things being better than expected). Coincidentally, another 40% believe 2023 will rank between a five and a seven in their books. This means that overall, 80% of the nation’s top ag retailers are looking forward to many variables working in their favor throughout the balance of the year. Only 20% of respondents think that the 2023 growing season will rate between a one and a four on the 10-point scale.

Finding Workers Remains an Issue

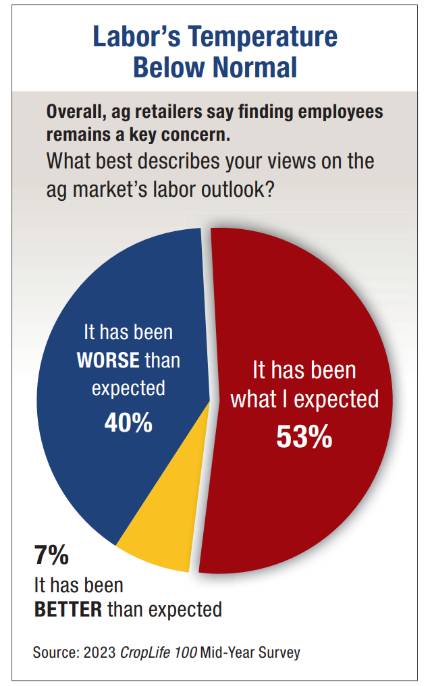

For almost as many years as the CropLife 100 rankings have existed, finding/keeping labor has been the No. 1 issue most ag retailers have faced year in and year out. In fact, according to the 2022 CropLife 100 survey, 46% of respondents rated finding/keeping a workforce as their No. 1 issue of concern during the 2022 calendar year. And this situation largely remains unchanged for the 2023 growing season, according to the data.

For almost as many years as the CropLife 100 rankings have existed, finding/keeping labor has been the No. 1 issue most ag retailers have faced year in and year out. In fact, according to the 2022 CropLife 100 survey, 46% of respondents rated finding/keeping a workforce as their No. 1 issue of concern during the 2022 calendar year. And this situation largely remains unchanged for the 2023 growing season, according to the data.

When asked to describe the current ag market’s labor, a majority of respondents — 53% — said the situation is “about what we expected” for the 2023 growing season, meaning finding/keeping employees is on par with the market dynamics that existed during the 2022 growing season. Perhaps more troubling, 40% of respondents said their labor issues were “much worse than expected” thus far for the 2023 growing season. This represented a significant uptick compared with the 2022 CropLife 100 Mid-Year Survey results, when only 13% of respondents reported that this was their workers quest situation. Overall, only 7% of ag retailers said that finding workers to man their operations was “better than we expected” so far this year.

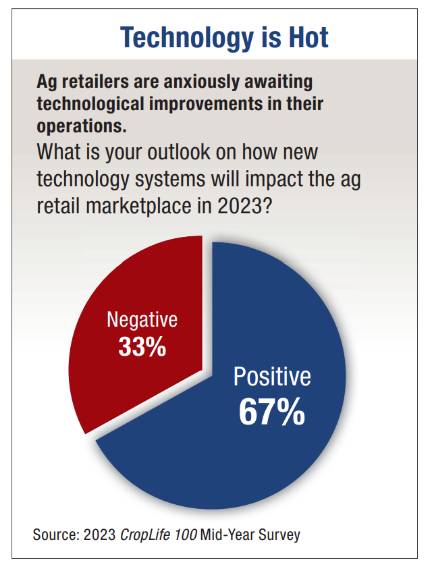

As the push to find workers continues, many ag retailers recently have begun looking to technology to help fill some of their needs. In the past year, rapid advances in such technologies as drones and artificial intelligence have promised to offer some non-human options for ag retailers to fill some of their positions in the field.

As the push to find workers continues, many ag retailers recently have begun looking to technology to help fill some of their needs. In the past year, rapid advances in such technologies as drones and artificial intelligence have promised to offer some non-human options for ag retailers to fill some of their positions in the field.

To gauge how the nation’s top ag retailers feel about the prospects these technology systems might offer in the way of innovation and worker assistance, the 2023 CropLife 100 Mid-Year Survey asked what kind of impact these new offerings will have on their company operations during the 2023 growing season. Overall, 67% of respondents believed such technology systems would have a “positive impact” on their operations this year. The remaining 33% weren’t that sure just yet, being “neutral” to the potential benefits technology advances in agriculture could bring to their companies. Significantly, however, no respondents believed the impact of new agricultural technology systems would have a “negative impact” on their businesses.

Fertilizer, Crop Protection Looking “Hot”

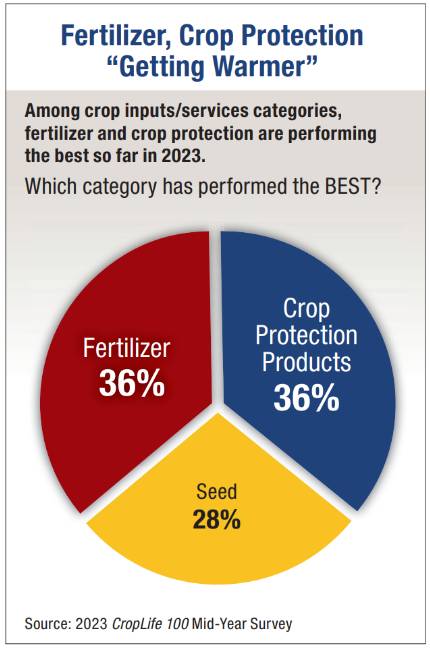

Each year since its inception, the annual CropLife 100 Mid-Year Survey has tied to gauge which of the four key crop inputs/services categories — fertilizer, crop protection products, seed, and custom application — have performed in the early going of a particular growing season. Although some market watchers have cautioned that demand for crop inputs/services in 2023 might be slower than normal, the overall consensus is that the temperatures for three of the four categories ranks as high to hot. Only one is abnormally cold.

Each year since its inception, the annual CropLife 100 Mid-Year Survey has tied to gauge which of the four key crop inputs/services categories — fertilizer, crop protection products, seed, and custom application — have performed in the early going of a particular growing season. Although some market watchers have cautioned that demand for crop inputs/services in 2023 might be slower than normal, the overall consensus is that the temperatures for three of the four categories ranks as high to hot. Only one is abnormally cold.

According to the majority of 2023 CropLife 100 Mid-Year Survey respondents, two categories are working are leading the way in positive performance thus far this year. Based upon the survey results, 36% of respondents say fertilizer has been the category that has “performed the best” for them during the 2023 growing season. Likewise, the crop protection products category was also cited by 36% of survey respondents as their “best performer” for the year. One other category — seed — also is performing well, with 28% of respondents saying their sales in this segment are “better than expected” thus far.

For the remaining category, custom application, the news is less positive. On the 2023 CropLife 100 Mid-Year Survey, no respondents said this segment was performing well for them.

As far as which of the four major categories have performed “worse than expected” so far during 2023, the survey showed a more even four-way split. According to 36% of respondents, the fertilizer category has been their “worst performer” in 2023 this spring. In a similar fashion, 29% of respondents said the crop protection products category was their “worst performer” this year. The seed category was rated the “worst performer” by 21% of respondents, with custom application cited by 14% as seeing the most negative sales numbers so far this year.

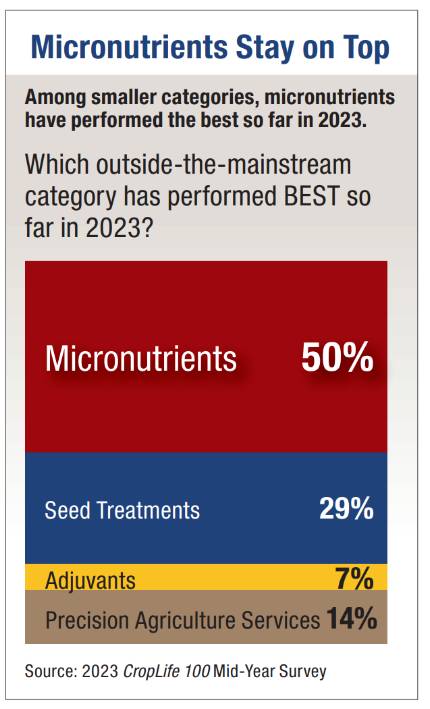

In addition to tracking the performances of the four major categories, the annual CropLife 100 Mid-Year Survey also looks at how some of the smaller segments have performed during the early going of the year. In most years, the micronutrients category tends to be described as the “hardest worker” by respondents.

In addition to tracking the performances of the four major categories, the annual CropLife 100 Mid-Year Survey also looks at how some of the smaller segments have performed during the early going of the year. In most years, the micronutrients category tends to be described as the “hardest worker” by respondents.

And this remains the case in 2023. According to the survey, 50% of respondents said that the micronutrients category has performed best for them this growing season. This is down only slightly from the 2022 survey, when 53% of respondents said micronutrients were their best smaller category performer.

In second place among the smaller categories in performance in 2023 is the seed treatment category, mentioned by 29% of survey respondents as their “top performer.” Rounding out the “top smaller category performers” for the nation’s top ag retailers in 2023 are precision agriculture services at 14% and adjuvants at 7%.

Splitting Between Corn, Soybeans

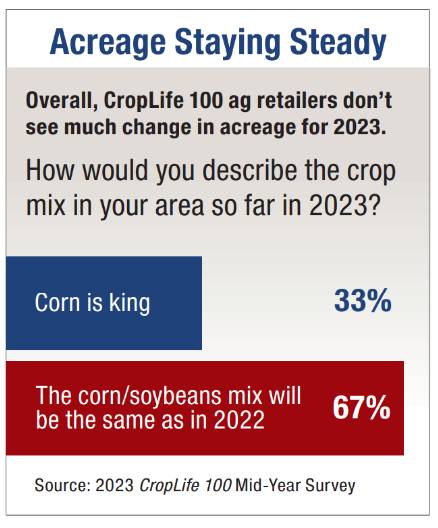

As far as the expected crop mix for the 2023 growing season, the nation’s top ag retailers seem to see significant disagreement with the overall outlook for the entire country. At the end of March, the USDA published its annual planting intentions survey results. For 2023, the agency predicted that corn planted areas for the year would increase 4%, up to 92 million acres. On the flipside, USDA expected soybean planted acres for 2023 to improve slightly, to 87.5 million acres.

As far as the expected crop mix for the 2023 growing season, the nation’s top ag retailers seem to see significant disagreement with the overall outlook for the entire country. At the end of March, the USDA published its annual planting intentions survey results. For 2023, the agency predicted that corn planted areas for the year would increase 4%, up to 92 million acres. On the flipside, USDA expected soybean planted acres for 2023 to improve slightly, to 87.5 million acres.

However, according to the 2023 CropLife 100 Mid-Year Survey, the nation’s top ag retailers aren’t seeing this kind of acreage shift taking place in their areas. In fact, according to 67% of respondents, their grower-customers are expected to maintain their corn-to-soybean acreage ratios are the same level they had “during the 2022 growing season,” when soybeans slightly outpaced corn. The remaining 33% of respondents said that their grower-customers were indeed planning to increase their corn acres this year.