The CropLife 100 and Application Equipment: A Vastly Different Market Mix from 40 Years Ago

Over the past four decades, the self-propelled sprayers industry for ag retailers has evolved from one of multiple little players to being dominated by three large, well-financed and diversified companies vying for market share. And based upon the findings of the 2023 CropLife 100 survey of the nation’s top ag retailers, this trend has remained largely intact during the most recent calendar year. Still, if the data is correct, a few of the smaller players in the field will garner their share of new equipment purchases during the upcoming 2024 growing season.

For those students of history, this is a far cry from what the self-propelled sprayer marketplace looked like back in the 1980s. In fact, looking back through the December 1984 edition of Farm Chemicals magazine (the predecessor to CropLife), readers would not find sprayer ads sporting any of today’s Big Three company names. Instead, the manufacturers were smaller, with many players located in the state of Illinois. Examples from this time would include Paul’s Machine & Welding Co., Big Wheels, Lor-Al, and Rears Manufacturing Co. (which marketed a sprayer called the “Rubber-Duk”). Although market share numbers from that time are hard to come by, most market watchers speculate that each of these companies, and perhaps a half-dozen more, each controlled less than 15% of the total market share apiece.

(Editor’s Note: I saw an old Rears Rubber-Duk sprayer on one of my trips in the early 2000s through Oregon visiting ag retailers in the region. It was quite a durable workhorse, according to my guide through the area, and a very nice-looking machine!)

Back in those days, if there was one self-propelled sprayer manufacturer that controlled the biggest market share, it was Ag-Chem Equipment Co. Sprayers featuring the company’s distinctive yellow color — with both Ag-Chem and Big A names on them — were commonplace sights in crop fields of the time.

But in the early 2000s, things began to change for the sprayer market. AGCO Corp. purchased Ag-Chem. Within the span of a few more years, other formal “big name” self-propelled sprayer companies such as Miller-St. Nazianz in Wisconsin and Hagie Manufacturing in Iowa ended up as part of larger equipment families for Case IH and John Deere, respectively. In the meantime, the Big Three — Case IH, AGCO, and John Deere — began fighting each other for market dominance. It’s a battle that continues to this day.

And the Survey Says . . .

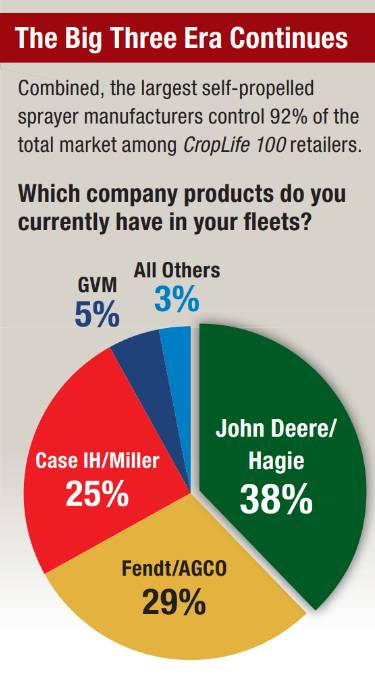

Base = 86 | Source: 2023 CropLife 100 Survey

According to the 2023 CropLife 100 survey, self-propelled sprayers representing one of the Big Three company names were present in 92% of the fleets among the nation’s top ag retailers. This was a slight decline of 1% from the market share these companies collectively held in 2022, however.

In terms of the fight for the top spot among manufacturers, John Deere continues to hold the lead. The company formally surpassed AGCO as the leading self-propelled sprayer maker approximately a decade ago and has steadily widened the market share gap since. In 2023, according to the CropLife 100 survey, John Deere sprayers were a part of 38% of ag retail fleets, an uptick of 1% from 37% on the 2022 survey. Meanwhile, No. 2 manufacturer Fendt/AGCO saw its market share among the top ag retailers hold steady between 2022 and 2023 at 29%. As for No. 3 Case IH, its overall market share among the nation’s top ag retailers fell 2%, down from 27% in 2022 to 25% this year.

Regarding the remaining 8% market share for self-propelled sprayers among CropLife 100 ag retailers, two manufacturers top the list. Coming in at 5% market share is GVM. Based in Biglerville, PA, GVM has maintained this 5% market share mark for about 10 years running now.

At 2% in 2023 was RBR Enterprise. The remaining 1% was held by various other manufacturers, including Horsch, Oxbo, and Precision Tank.

If you are looking for reasons why John Deere has managed to maintain its market share edge in self-propelled sprayers among ag retailers, consider the question of service. According to most survey respondents, service is a big reason why companies buy their agricultural products from certain manufacturers vs. the rest of the field.

And according to the 2023 CropLife 100 survey, John Deere easily led in this category. In fact, based upon the results, 63% of the nation’s top ag retailers indicated that John Deere reliability to provide timely service was why they had green-colored sprayers in their fleets. Finishing a distant second and third in the service area, according to 2023 CropLife 100 respondents, were Fendt/AGCO and Case IH/Miller/New Holland, at 20% and 17% respectively.

More John Deeres Ahead

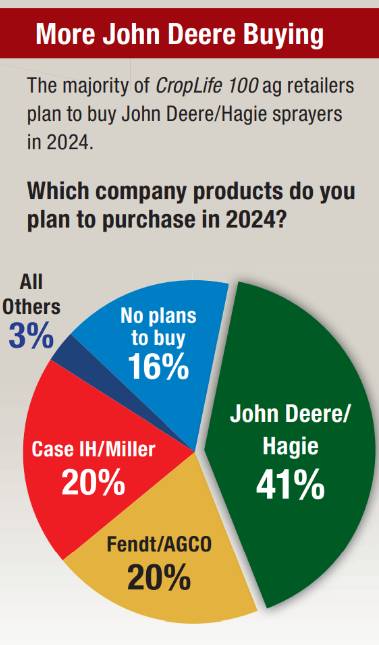

Base = 86 | Source: 2023 CropLife 100 Survey

Moving forward into the 2024 growing season, the majority of CropLife 100 ag retailers foresee the self-propelled sprayer marketplace looking much like it did during 2023. Indeed, when asked what sprayer manufacturers they planned to buy new equipment from during the 2024 growing season, John Deere/Hagie still came out on top. According to the survey, 41% of respondents are planning to purchase self-propelled sprayers in John Deere green or Hagie yellow/gray in 2024.

As for the rest of the field, Fendt/AGCO and Case IH/Miller/New Holland can expect near identical sales fortunes in 2024. According to the 2023 CropLife 100 survey, 20% of respondents plan to purchase sprayers sporting Fendt green or AGCO yellow during the 2024 growing season. Likewise, 20% are looking to buy Case IH/Miller red or New Holland blue units to add to their self-propelled sprayer fleets. The remaining 3% of CropLife 100 ag retailers are looking for self-propelled sprayers from smaller manufacturers in 2024, with both Horsch and RBR Enterprise being specially name dropped in the survey results.

Perhaps a bit troubling for self-propelled sprayer manufacturers however is the fact that a good portion of the nation’s top ag retailers “plan to sit 2024 out” when it comes to making new product purchases. According to the 2022 CropLife 100 survey, 15% of respondents didn’t plan to make new sprayer buys during the 2023 growing season. And in the 2023 survey, this percentage creeped up even higher — to 16%.