The 2023 CropLife 100: Looking Back at a Dickens of a Year

Although Charles Dickens was describing the state of English society when he penned “A Tale of Two Cities” in 1859, the novel’s opening line could have just as easily been talking about today’s ag retail marketplace. Based upon the data collected in the 2023 CropLife 100 survey, this year had many “best times” moments. Unfortunately, there were also many “worst times” moments as well.

First, let’s look at some of the “best times” moments. And since this year represents the 40th time CropLife magazine has compiled a listing of the nation’s top ag retailers, some historical perspective is in order. Back in 1984 when the first CropLife 100 was put together, the sales range for the companies on the list was between $5 million and more than $80 million. In 2023, annual sales in the $80 million range would land an ag retailer in the mid-sixties out of the 100 largest companies, with 59 ag retailers on the 2023 listings recording yearly sales of more than $100 million. At the other end of the spectrum, an ag retailer would need to have double $5 million in annual sales just to make the list at all!

More “best times” in 2023 come from the overall growth of the ag retail marketplace itself. Back at the start of the 21st century in 2000, the nation’s top ag retailers had overall revenues of $10.9 billion. According to the 2023 CropLife 100 survey, this figure has skyrocketed over the past 23 years, now topping out at $46.7 billion – more than $35 billion higher! Better still, compared with 2022, CropLife 100 ag retailers increased their annual revenues by almost 2% year-over-year.

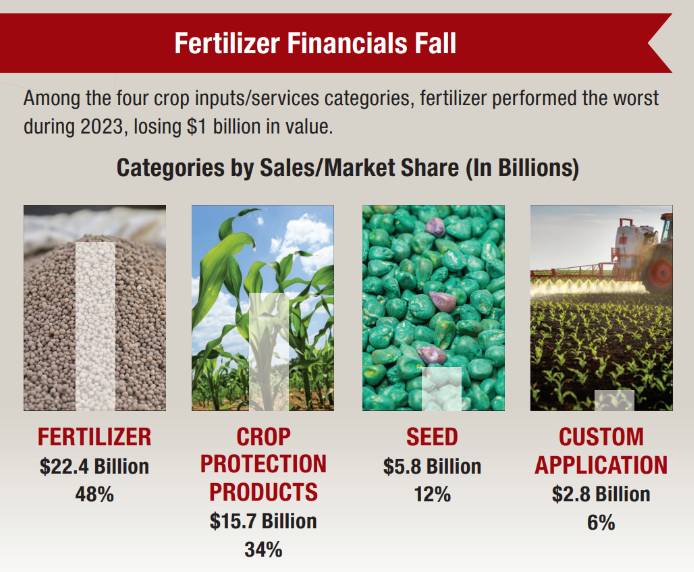

As for the four market categories tracked within the CropLife 100, three of the four (crop protection products, seed, and custom application) recorded sales gains during 2023. Overall, these three categories improved upon their 2022 sales performance to the tune of $1.7 billion. Surely, the best of times.

Now, unfortunately, we need to discuss “the worst of times.” Take the one category – fertilizer – not to record a sales gain in 2023. In fact, this one category took a severe revenue hit during the year. According to the 2023 survey, ag retailers had their sales in fertilizer dip $1 billion compared with 2022.

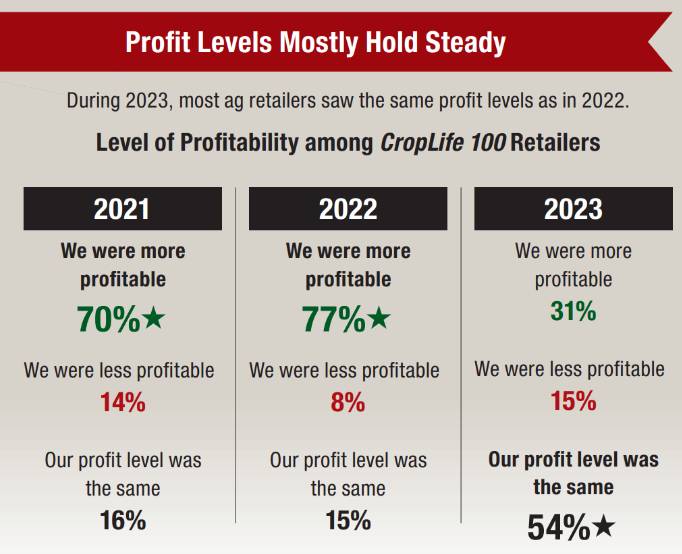

And perhaps this performance by the fertilizer category in 2023 helps explain one other bit of “worst times” fact on this year’s CropLife 100 – profitability. Throughout both 2021 and 2022, the nation’s top ag retailers enjoyed record profits according to the CropLife 100 survey data. In 2021, 70% of respondents said that they earned more profits than they did the year before. In 2022, this percentage had risen to 77%. As for the remaining 23%, 15% said that their profits 2021 vs. 2022 were the same, with 8% reporting a profit decline for the year.

Base = 100 | Source: 2023 CropLife 100 Survey

But in 2023, these percentages really flipped. According to the 2023 CropLife 100 survey, only 31% of the nation’s top ag retailers recorded a profit this year – a significant decline of 46% from the 2022 data. Even worse, the number of ag retailers within the CropLife 100 recording profit declines in 2023 almost doubled – to 15% from 8%. Slightly more than half of 2023 CropLife 100 survey respondents – 54% – reported that their profit margins 2023 vs. 2022 were virtually identical. Obviously, no profit growth equals a “worst of times” moment.

A Review of the Categories

Each year, besides tracking overall company performances, one of the key metrics in the CropLife 100 is to look at how the four major crop inputs/services categories have done. As stated earlier in this article, 2023 was an excellent sales year for three out of the four. Let’s review each, going from largest to smallest in terms of annual revenue.

For the biggest crop input category, fertilizer, 2023 marked a reversal of fortunes. Throughout the height of the COVID-19 pandemic years of 2021 and 2022, severe distribution pipeline disruptions caused the prices for the macronutrients used by grower-customers – nitrogen, phosphorus, and potassium – to double or even triple. These higher prices allowed many ag retailers to make more money year-over-year on these sales. Indeed, according to the 2022 CropLife 100 survey, the fertilizer category improved overall sales from $15.3 billion in 2021 to $23.4 billion – an incredible 53% revenue gain. As a result of this, market share for the fertilizer category easily topped 51% on the 2022 CropLife 100.

But what a difference a year makes. As distribution and supply issues for fertilizer normalized during 2023, prices dropped back to the levels that they had been before the pandemic hit. Naturally, this hurt overall sales for the category.

According to the 2023 CropLife 100 survey, the fertilizer category saw its sales plunge $1 billion, down to $22.4 billion. This 4% sales drop also meant the category had its overall market share of all crop inputs/services decline as well – from 51% in 2022 to 48%.

Now a $1 billion revenue loss could have spelled “the worst of times” for the CropLife 100 in many years. In 2023, fortunately, the other three categories were more than up to the task of picking up the slack.

For the crop protection products category in 2023, sales were just fine apparently. According to the 2023 CropLife 100 survey, this category’s overall revenues improved approximately 1% to $15.7 billion. Market share also improved, up 1% to 34% in 2023.

Base = 100 | Source: 2023 CropLife 100 Survey

According to the data, the crop protection products category benefitted from improved herbicide and insecticide sales in 2023 (as weed and insect resistance issues showed no signs of abating). Fungicide sales, however, were a bit more sluggish – perhaps because of drier/drought-like conditions being experienced across more than half of the continental U.S. during the 2023 growing season.

Like crop protection, the seed category had a fine 2023. According to the survey, sales in this category grew $800 million for the year, from $5 billion in 2022 to $5.8 billion. Also like the crop protection products category, seed’s improved sales performance in 2023 helped the category gain overall market share with the CropLife 100, from 11% in 2022 to 12% this year.

The smallest category – custom application – also saw a stronger sales performance in 2023. According to survey respondents, revenues in this area increased from $2.6 billion in 2022 to almost $2.8 billion this year. Like with the crop protection products and seed categories, customer application was able to capture 1% more overall market share among crop inputs/services within the CropLife 100, up from 5% in 2022 to 6%.

And as stated earlier, persistent issues with weeds and insects apparently kept demand for custom application work in crop fields high during the 2023 growing season. However, since precision ag/ag tech products and services make up a portion of this category’s overall sales profile, this group undoubtedly helped revenues grow. In fact, according to the 2023 CropLife 100 survey, revenues among ag retailers for this segment improved 2%, from $796.2 million in 2022 to $815.1 million in 2023.

Diving Into the Sub-Segments

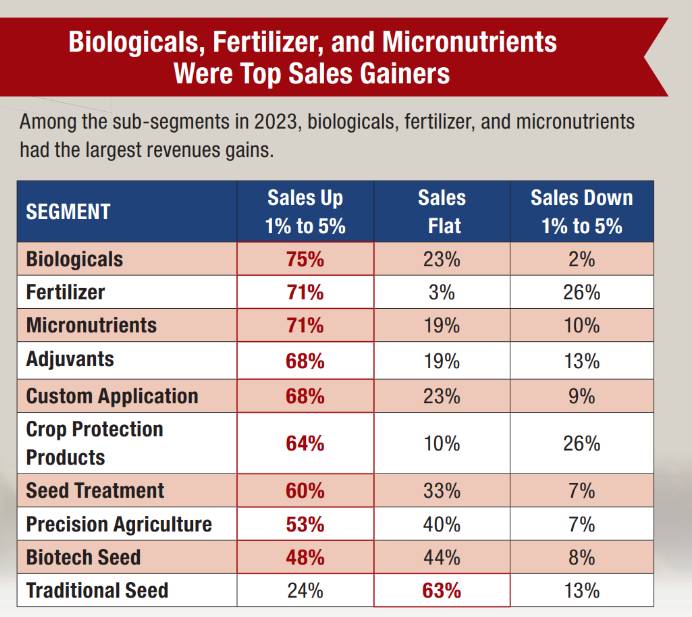

Besides looking at the four major categories of crop inputs/services, the CropLife 100 also dives into what’s happening with various smaller segments as well. These “sub-segments” include sales ranges for 10 different areas. And in another “best of times” example, eight of these 10 had sales increases from 2022 by more than half of the CropLife 100 ag retailers.

Base = 100 | Source: 2023 CropLife 100 Survey

Perhaps not surprisingly, leading the way among these 10 was the newest entry on the list – biologicals. According to the 2023 CropLife 100 survey, 75% of the nation’s top ag retailers had sales improvements of between 1% and more than 5% in this segment. Twenty-three percent had flat sales in biologicals, with only 2% reporting sales declines between 2022 and 2023.

Next up in performance were the crop nutrient entries – fertilizer and micronutrients. Among CropLife 100 ag retailers, both sub-segments had sales increases between 1% and more than 5% for 71% of respondents apiece. Among the remaining 29% for each, micronutrients performed a bit better, with 19% of respondents saying their sales in this segment were flat compared with 10% that reported sales declines. Fertilizer sales, meanwhile, were reported flat by 3% of CropLife 100 ag retailers in 2023 vs. 26% that saw revenue declines of between 1% and more than 5%.

The next five sub-segments on the list also performed well in 2023. According to the survey data, 68% revenue increases between 1% and more than 5% were seen in the adjuvants and custom application segments. The crop protection products segment sales were up for 64% of respondents. Meanwhile, seed treatment and precision ag were up between 1% and more than 5% for 60% and 53% of respondents, respectively.

As for the other two sub-segments – non-GMO seed and biotech seed – less than half of the CropLife 100 respondents reported sales increases in these areas. For biotech seed, 48% of the nation’s top ag retailers recorded revenue improvements of between 1% and more than 5%, with 44% saying their sales were flat in this segment. Non-GMO seed sales were reported up 1% to more than 5% for only 24% of CropLife 100 ag retailers in 2023. The majority – 63% – said their sales in this sub-segment were flat year-over-year.

The Outlook for 2024

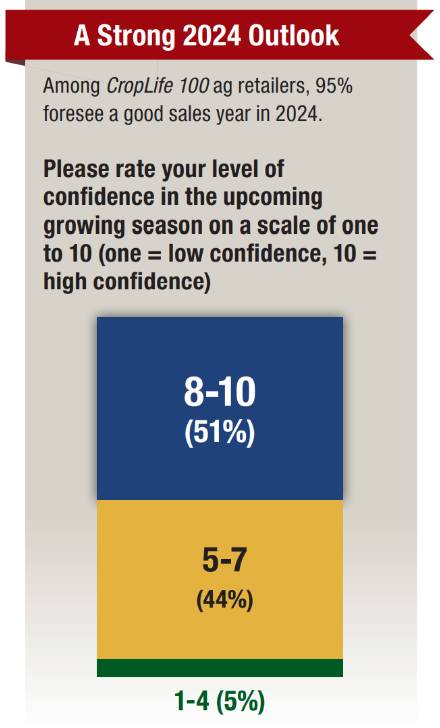

Although 2023 was decidedly mixed in terms of market performance for CropLife 100 ag retailers and their grower-customers, the feeling among survey respondents is that the 2024 growing season could represent a return to “the best of times.”

Base = 100 | Source: 2023 CropLife 100 Survey

When asked to rate the confidence level for next year according to what their customers are telling them – using a one to 10 scale, with one being low confidence and 10 being high confidence – 95% of the nation’s top ag retailers rate the outlook for 2024 as a five or better. Broken down a bit, 44% believe that the financial outlook for next year will rate between a five and a seven on a 10-point scale. Better still, 51% think the prospects for a strong sales season in 2024 rate between eight and a 10. Perhaps most significantly, only 5% of survey respondents believe that the next growing season will rate lower than a four – and not a single ag retailer rated the financial prospects for 2024 lower than a three.

While the overall outlook for 2024 remains high, the outlook for e-commerce still falls within “the worst of times” category. About a decade ago, e-commerce was all the rage in ag retail. As internet input sales became a trend in 2014 or so, many traditional ag retailers attempted to follow suit. And during the COVID years, the trend among CropLife 100 ag retailers picked up considerably as more grower-customers used remote means instead of in-person ones to order their growing season supplies. In fact, approximately 50% of CropLife 100 retailers were offering e-commerce during these times.

But that time is apparently over. In the 2022 CropLife 100 survey, 65% of respondents reported offering “no e-commerce option” to their customer base. And this percentage has creeped up again in 2023, to 66%. As for the 34% of respondents that do offer these services to customers, third-party manufactured systems are the most popular, used by 21%, an increase from 19% in 2022. Auction-based services also saw their percentage increase among dealers, up from 1% in 2022 to 3% this year. Home-grown systems were the least popular, used by only 10% of respondents – a decline of 5% from the 2022 survey results.

Base = 80 | Source: 2023 CropLife 100 Survey

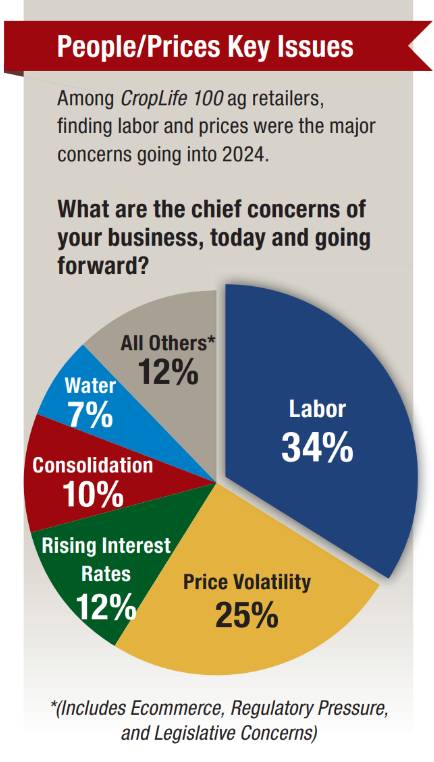

Among the key concerns the nation’s top ag retailers have going into the 2024 growing season, many are the same ones that have dogged the industry for numerous years now. For more than 34%, finding

and keeping employees is the No. 1 issue facing them this year. In 2022, the percentage of CropLife 100 most worried about this issue stood at 46%.

According to respondents, price volatility – in terms of rising input costs/prices and uneven commodity prices – is the second biggest concern going into 2024. The percentage of respondents citing this as their top concern stands at 25%.

For CropLife 100 ag retailers in 2023, a newer concern for next year is rising interest rates. This was mentioned by only 2% of ag retailers in the 2022 CropLife 100 survey, but 12% of the 2023 survey respondents cited this as a major concern going into the 2024 growing season.