Crop Protection Product Sales Have Rebounded (Again) for CropLife 100 Retailers

Despite many sector challenges — including oversupply and falling prices — the crop protection products category performed well in 2023.

Since the first CropLife 100 listings appeared back in 1984, perhaps no category has experienced as many ups-and-downs as crop protection products. But all indications, 2023 represented another small step in the sector’s effort to rebuild market share compared with other crop inputs among CropLife 100 ag retailers.

For much of the life of the CropLife 100, the crop protection products category — known at times as the farm chemicals or agrichemicals sectors — WAS the big player vs. other crop inputs. In fact, throughout the 1980s and 1990s, this category was the largest among crop inputs and services offered by the nation’s top ag retailers, routinely topping 50% of the total market share.

But this market dominance by crop protection products started to change as the agricultural industry and world neared the start of the 21st century. In fact, by the time the CropLife 100 for 2000 was compiled, the crop protection products category was facing a serious challenge from the fertilizer category. In that year’s listings, crop protection products still accounted for the lion’s share of crop inputs/services sales among CropLife 100 retailers at 47.4%. However, the fertilizer category wasn’t far behind — achieving a 41.5% market share for the year.

Over the next few years, the gap between the crop protection products and fertilizer categories continued to shrink. Finally, in 2006, fertilizer managed to surpass crop protection in market share among CropLife 100 retailers. And by the time the CropLife 100 for 2012 rolled around, the fertilizer category was significantly ahead of crop protection products in market share — 55% vs. 28%.

For the past decade, the crop protection products category has slowly but steadily rebuilt much of this lost market share among the nation’s top ag retailers. Luckily, this trend continued in 2023.

According to the 2023 CropLife 100 survey, the crop protection products category witnessed a modest 5% growth in overall sales, from $15 billion in 2022 to $15.8 billion. Better still, the category was able to improve upon its market share of all crop inputs/services from 2022, up 1%

to 34%.

Supply/Price Issues

Given market conditions throughout 2023, this might come as something of a surprise to observers. For much of the year, crop protection product manufacturers were reporting significant oversupply of products in their pipelines. As a result, this depressed prices, with many companies reporting less than stellar sales figures throughout much of 2023.

However, these conditions didn’t seem to affect the nation’s top ag retailers as severely. In fact, according to the 2023 CropLife 100 survey, 64% of respondents said that their crop protection product sales for year grew from 2022. Another 10% reported that their sales in this category were flat from the year before. Only 26% reported sales declines in 2023 vs. 2022.

Base = 99 | Source: 2023 CropLife 100 Survey

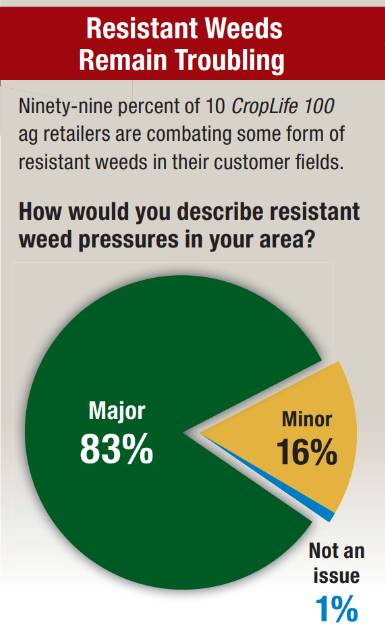

As has been the case for the past several years, herbicides seem to be keeping overall crop protection products revenues high among CropLife 100 retailers. This is a byproduct of the ever-expanding list of resistant weeds ag retailers and their grower-customers are having to deal with each growing season. According to the latest data from weed scientists and researchers, there are 523 unique cases of herbicide resistance in the world in 2023. In the U.S., this includes species such as waterhemp, Palmer amaranth, ragweed, and marestail — with many of these showing resistance to multiple active ingredients/modes of action for control.

CropLife 100 ag retailers report that resistant weeds remain a big problem for their grower-customers. In fact, according to data from the 2023 survey, 83% of respondents described resistant weeds as a major problem in many/some of the crop fields they help manage. Another 16% said resistant weeds were a “minor problem” in their areas of the country. Only 1% said they had “no issues” with resistant weeds.

The Segments Breakdown

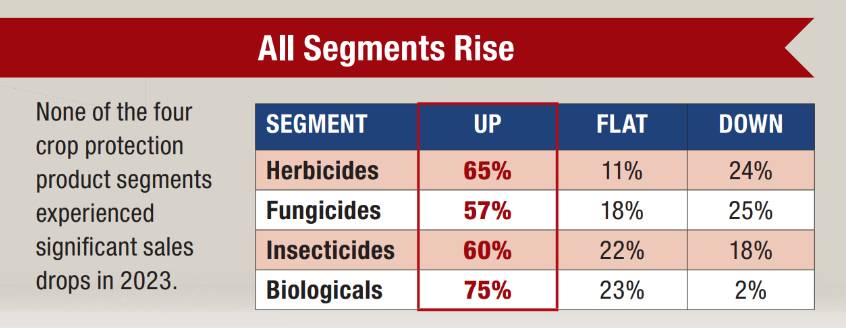

Perhaps this helps explain why herbicides lead among all crop protection product segments in terms of sales. In 2023, this segment of the business recorded revenue increases vs. 2022, with 65% respondents saying their sales increased. Another 11% had herbicide sales that were the same as during the 2022 growing season. The remaining 24% said their herbicide sales in 2023 fell from the year before.

Base = 100 | Source: 2023 CropLife 100 Survey

And even though herbicides performed the best among the crop protection product segments, the others weren’t that far behind. For insecticides, 60% of respondents recorded sales increases between 1% and more than 5% during 2023. Likewise, fungicide sales were up for 57% of CropLife 100 ag retailers during the year. (See the table for a complete breakdown of sales performance for these segments.)

New to this year’s survey was a question regarding biologicals. According to respondents, this segment had sales increases for 75% of CropLife 100 ag retailers compared with 2022. Another 23% had flat sales in this segment. Perhaps significantly, only 2% of CropLife 100 ag retailers saw biologicals sales declines for 2023.