For Application Equipment in 2020, Bigger Was Better

For ag retail equipment manufacturers, 2020 was not the best of years. However, the vision for 2021 could be clearer — providing the world-at-large finally moves past the coronavirus pandemic.

In an industry that conducts much of its business in person or at various trade shows, equipment makers had a particularly tough time this past year. In fact, once the early 2020 winter shows ended at the end of February, there were virtually no more in-person events held for the rest of the year. According to most companies, this severely limited their ability to engage with potential new customers while building up interpersonal relationships with older ones.

“Increased sales of high horsepower tractors, hay equipment, and Precision Planting products were partially offset by lower grain and protein product as well as sprayer sales,” said Martin Richenhagen, Chairman, President, and CEO for AGCO Corp., in the company’s third quarter earnings report. “We still face a demanding environment to manage our manufacturing, supply chain, and aftermarket operations.”

Of course, the nation’s top ag retailers primarily use self-propelled sprayers in their day-to-day operations. And despite having much of the country shut down during the spring due to efforts to limit the spread of COVID-19, ag retailers and their grower-customers were designated as “essential workers” by the federal government, exempting them many of the closure restrictions. In addition, it is estimated that growers received approximately $18 billion in COVID-19 from Washington, DC, during the year, so there was some money to apparently go around the agricultural marketplace.

Lower Numbers

However, among CropLife 100 ag retailers, resources seemed to have not gone into expanding their self-propelled sprayer fleet. In fact, according to the 2020 CropLife 100 survey, virtually every sprayer manufacturer saw their percentages fall regarding total sprayer units. To determine this, the CropLife 100 looks at what percentage of sprayers from each manufacturer are present in an ag retailer’s fleet vs. 100%. So for example, if a retailer has 10 units total, and seven of them are from one manufacturer, that manufacturer’s fleet percentage is 70%.

Using this formula, three manufacturers — John Deere/Hagie, AGCO, and Case IH/Miller – stood out from the rest during the 2019 CropLife 100 survey, with each representing more than 70% of the nation’s top ag retailer sprayer fleets. But in 2020, however, only two — John Deere/Hagie and AGCO — were able to maintain this 70% mark (and for AGCO, this was just barely the case, with the company coming in right at 70%).

Using this formula, three manufacturers — John Deere/Hagie, AGCO, and Case IH/Miller – stood out from the rest during the 2019 CropLife 100 survey, with each representing more than 70% of the nation’s top ag retailer sprayer fleets. But in 2020, however, only two — John Deere/Hagie and AGCO — were able to maintain this 70% mark (and for AGCO, this was just barely the case, with the company coming in right at 70%).

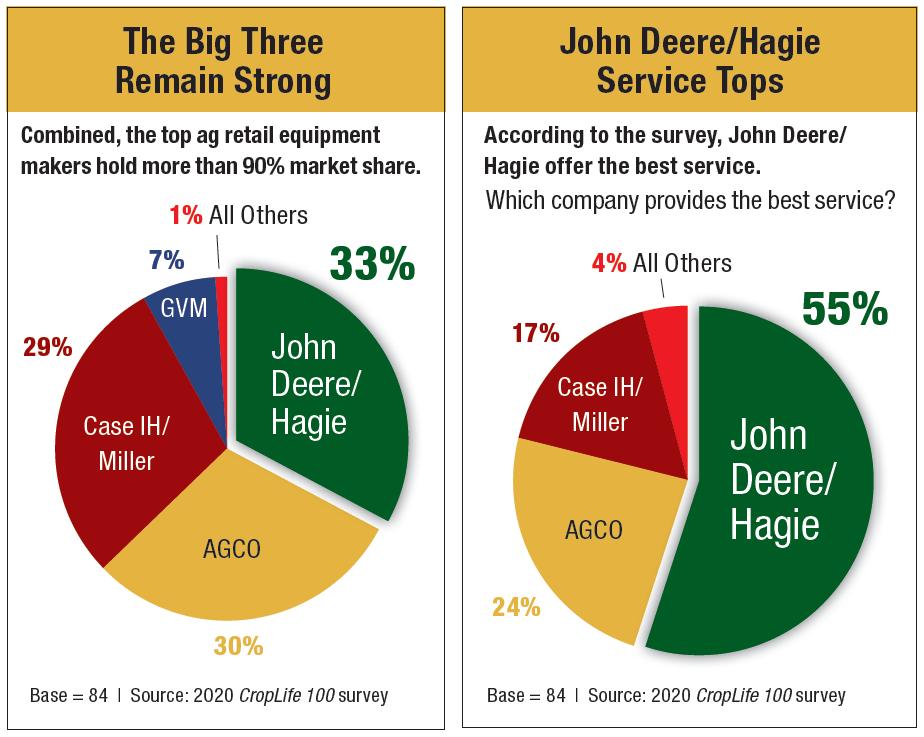

Speaking of percentages, another finding of the 2020 CropLife 100 is just how dominant the “Big Three” self-propelled sprayers manufacturers are within the ag retail world. When figuring out an industry market share for these three companies vs. everyone else, 92% of CropLife 100 fleets are made up of units from these equipment makers. In 2020, this broke out as 33% for John Deere/Hagie, 30% for AGCO, and 29% from Case IH/Miller. The only other self-propelled sprayer maker to top 1% market share was GVM at 7%.

Over the years, according to most CropLife 100 ag retailers, one of the key factors in determining what companies self-propelled sprayers to purchases ties back to how well that manufacturer and its equipment dealer network can service units when there are problems. For several years now, we have tracked this question among manufacturers on the annual CropLife 100 form, asking respondents to tell us which company offers the best service in their opinions. Over the past few years of CropLife 100 surveys, John Deere/Hagie has ended up at the top of this ranking, being pegged as offering the “best service” by more than 50% of respondents. AGCO and Case IH/Miller have typically finished second and third, respectively.

And not much as changed on this front. According to the 2020 CropLife 100 survey, the nation’s top ag retailers still rank John Deere/Hagie as having the best service among manufacturers. This year, however, the percentage dropped slightly, from 57% in 2019 to 55%. Also dropping slightly in this year’s survey was No. 3 Case IH/Miller, down from 18% in 2019 to 17%.

With these two equipment makers losing some votes for “best service” among CropLife 100 ag retailers, No. 2 AGCO picked up some new fans. In the 2019 CropLife 100 survey, 21% of respondents said AGCO offered the best service. This year, that percentage climbed to 24%.

The Outlook for 2021

In truth, ag retail equipment manufacturers probably shouldn’t be that surprised that the 2020 growing season didn’t produce strong sales numbers for their products. This was hinted at by the respondents to the 2019 CropLife 100 survey, when 32% of the nation’s top ag retailers said they had “no plans to buy” any new self-propelled sprayers during the upcoming calendar year.

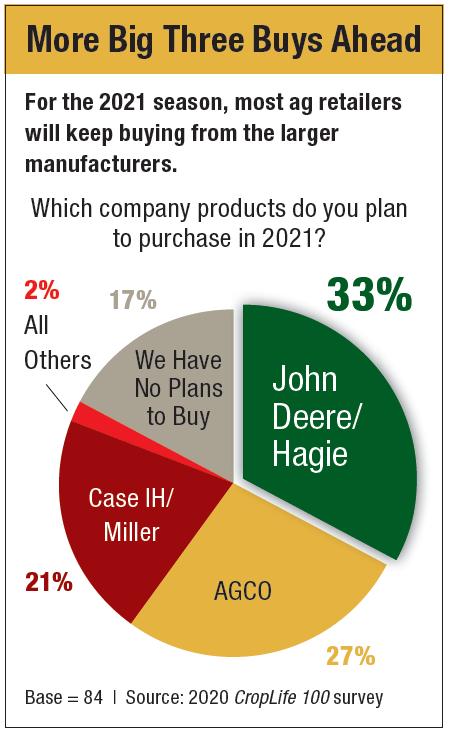

However, according the results of the 2020 CropLife 100 survey, things are definitely looking more positive for the 2021 growing season. Based upon the data from this year’s ag retailers, only 17% of them say that their companies have “no plans to buy” ag retail equipment next year, a 15% drop from the previous year’s survey results.

However, according the results of the 2020 CropLife 100 survey, things are definitely looking more positive for the 2021 growing season. Based upon the data from this year’s ag retailers, only 17% of them say that their companies have “no plans to buy” ag retail equipment next year, a 15% drop from the previous year’s survey results.

Naturally, this begs the following question — what manufacturers are the other 83% of CropLife 100 ag retailers looking to buy products from in 2021? For the most part, the answer remains the largest ones.

According to the 2020 CropLife 100 survey, 33% of the nation’s top ag retailers looking to buy self-propelled sprayers in 2021 will make these purchases from John Deere/Hagie. Another 27% plan to buy from AGCO, with 21% making equipment purchases from Case IH/Miller. This means visitors to most CropLife 100 ag retailers during the 2021 season (assuming COVID-19 is a thing of the past) will see sprayers sporting green, yellow, and red paint jobs.

What about the missing 2%? According to the 2020 CropLife 100 survey, this group of ag retailers are looking to find their self-propelled sprayers from the other manufacturers that serve the marketplace. This will include such companies as GVM, RBR Enterprise, Equipment Technologies, and New Holland.