CropLife’s Buying Intentions Survey: Here’s What Ag Retailers Plan to Purchase in 2024

Editor’s note: The 10th annual CropLife magazine Buying Intentions survey was sent to readers in November and early December 2023. In total, there were 221 surveys returned with valid answers. In terms of breakout, 64% of the respondents identified themselves as being ag retailers/cooperatives. Another 11% said that their companies were classified as fertilizer producers. Ten percent indicated they were pesticide manufacturers or formulators. Another 10% identified as manufacturers of equipment or components. The remaining 5% identified themselves as “other.” CropLife magazine would like to thank everyone that took part in this year’s survey. Your insights are appreciated.

Editor’s note: The 10th annual CropLife magazine Buying Intentions survey was sent to readers in November and early December 2023. In total, there were 221 surveys returned with valid answers. In terms of breakout, 64% of the respondents identified themselves as being ag retailers/cooperatives. Another 11% said that their companies were classified as fertilizer producers. Ten percent indicated they were pesticide manufacturers or formulators. Another 10% identified as manufacturers of equipment or components. The remaining 5% identified themselves as “other.” CropLife magazine would like to thank everyone that took part in this year’s survey. Your insights are appreciated.

Ten years ago now, members of the CropLife magazine staff had just returned from the annual Agricultural Retailers Association (ARA) meeting. All of us had been asked by ARA attendees what we thought would be the most active crop input categories during the upcoming growing season — over and over again! Instead of making educated guesses, however, we decided the best way to answer these questions was to poll our readers for their views.

With that, the annual CropLife Buying Intentions Survey was born! And this effort is still going strong!

So, now that we’ve taken a brief glance backward at the beginning of this survey, let’s look ahead to what the 2024 growing season is expected to look like for ag retailers in terms of purchase plans. Overall, most crop inputs/equipment/services categories should have similar years as they did in 2023. There are a few standouts, however, in each segment.

Perhaps this is a by-product of the kind of year ag retailers experienced during 2023. In fact, according to the 2023 CropLife 100 survey data, the nation’s top ag retailers recorded almost $48 billion in overall sales — another all-time high for the industry! And even though net farm income levels did decline from 2022, the $151.1 billion figure still marked the second highest total on record, according to USDA.

Now, with the introduction to this year’s survey out of the way, let’s review the major segments of the business for ag retailers to see how each might end up for the 2024 growing season.

The Fertilizer Outlook

During 2023, the fertilizer category crashed back down to earth following a string of years seeing positive growth numbers. In part due to higher-than-normal prices for virtually every form of macronutrient, overall fertilizer sales for the nation’s top ag retailers fell to $22.4 billion during the year. This marked a profound drop of $1 billion from the 2022 category sales total of $23.4 billion.

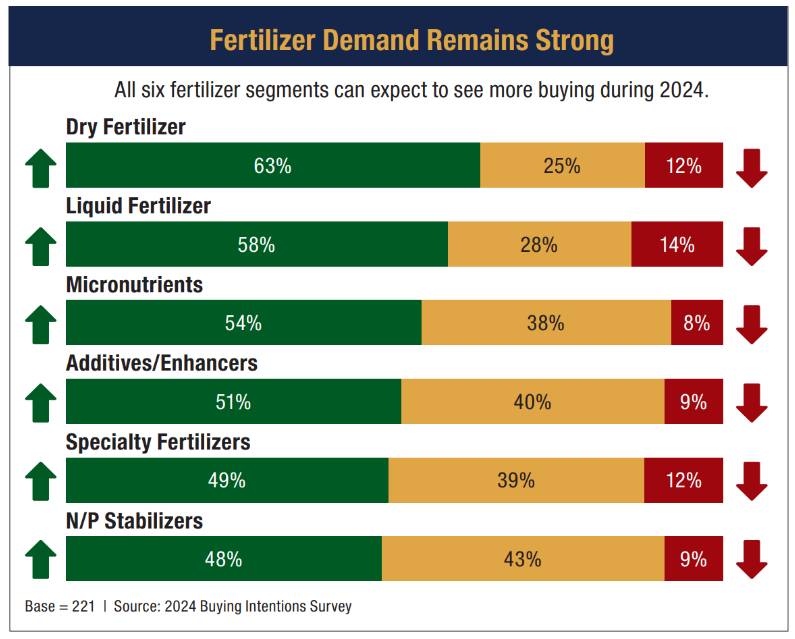

Luckily, according to the nation’s ag retailers, this “revenue hangover” from 2023 isn’t expected to severely dampen fertilizer category buying activity going into the 2024 growing season. According to the Buying Intentions Survey, all six of the segments that make up the fertilizer category will see stronger sales figures this year.

Unfortunately, compared with their 2023 percentages, only two of the six will see higher buying activity in 2024 than they did the year before.

Leading the pack in terms of expected sales numbers are dry fertilizers, where 63% of survey respondents expect to spend between 1% and more than 11% more during 2024. The only other segment of the fertilizer category to see higher spending than in 2023 is additives/enhancers. In 2023, 48% of respondents planned to spend more on this segment. This year, the percentage grew to 51%.

The other four fertilizer category segments can all expect slightly lower buying percentage than they recorded during the 2023 growing season. For instance, liquid fertilizer buying activity will be up for 58% of 2024 survey respondents (compared with 59% in 2023). It’s a similar story to the other segments. Specialty fertilizer buying will be up for 49% of 2024 ag retailers vs. 51% in 2023. Nitrogen/phosphorus stabilizers spending increases should be up for 48% of respondents (compared with 55% the previous year). Perhaps the biggest hit will occur in micronutrients. In 2023, 60% of respondents said they planned to increase their spending in this segment. In 2024, however, this percentage has fallen to 54%.

The Crop Protection Products Outlook

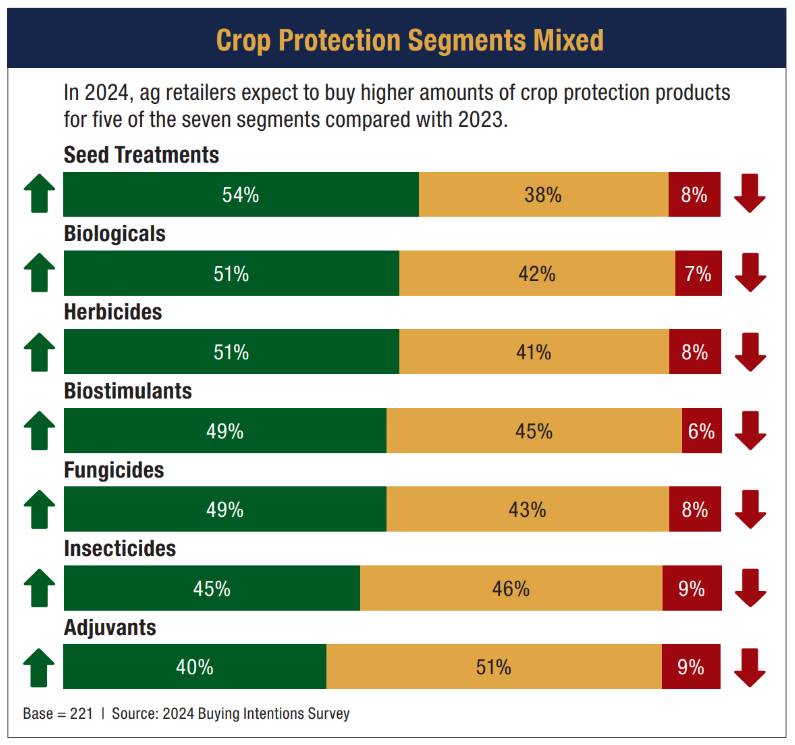

In 2024, the anticipation among ag retailers is that there will be more upward spending vs. flatness for five of the seven crop protection products categories. But three segments will see more than half of the nation’s ag retailers spending more than they did during 2023.

Perhaps the most impressive uptick in buying activity will be in the seed treatment segment. During the 2023 Buying Intentions Survey, seed treatment was only expected to see 51% of respondents increasing their spending between 1% and more than 11%. In 2024, however, this percentage has improved to 54% of respondents planning to spend more, with 38% spending the same as in 2023, and only 8% planning to spend less than the year before.

There are two other crop protection products categories expected to see more than 50% of ag retailers spending more on them in 2024 — one traditional, one new. On the traditional side are herbicides. In this segment, 51% of 2024 Buying Intentions respondents plan to increase their spending for these products between 1% and more than 11% this year. On the newer side are biologicals, which also scored a 51% percentage of respondents increasing their spending in this area. Likewise, another newer segment, biostimulants, can also expect an improvement in spending activity for 2024 among ag retailers, coming in 49%.

There are two segments of the crop protection products category that are expected to see more flatness than they did during 2023, however. For the insecticides segment, 45% of CropLife Buying Intentions Survey respondents plan to increase their spending, compared with 46% that expect to spend the same amounts for these products as they did during 2023.

For adjuvants, the percentages are more pronounced. According to the survey, 40% of ag retailers expect to increase their spending activity for these products. However, 51% predict spending identical amounts as during the 2023 growing season.

The Seed Outlook

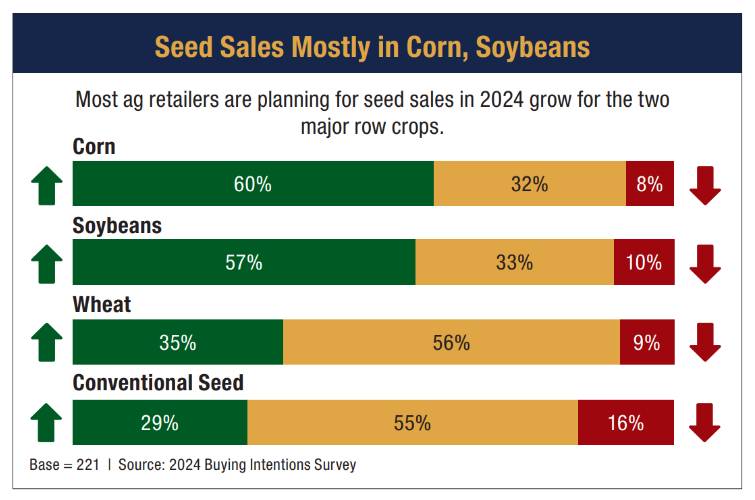

Each crop year for decades now, the two most popular row crops have been corn and soybeans. Consequently, most of the seed sales in the ag retail marketplace take place in these two segments.

And this status quo isn’t expected to change in 2024.

As was the case in 2023, 2024 CropLife Buying Intentions survey respondents anticipate increasing their sales activity in corn and soybean seeds significantly during the upcoming growing season. For corn seed, 60% of respondents will up their buying between 1% and more than 11% for the year. This represents a healthy bump from 2023, when 54% of respondents planned to increase their spending for corn seeds.

Likewise, soybean seed spending should also improve by 6% between 2023 and 2024. According to this year’s survey, 57% of ag retailers foresee more spending on soybean seeds in 2024 vs. 2023. The previous year, this percentage was 51%.

The Equipment Outlook

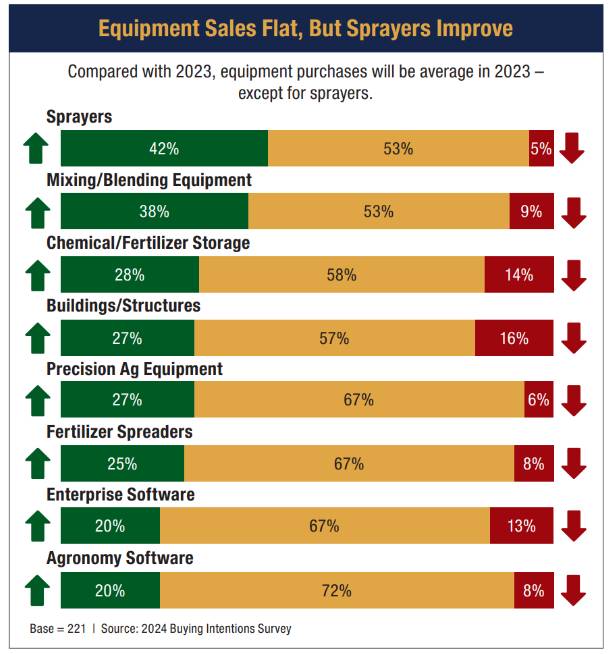

As has been the case throughout the history of the annual Buying Intentions survey, ag retailers predict overall sameness in their spending for products/services that fall into the equipment category. In fact, none of the seven segments in this category are expected to see 50% of respondents upping their spending activity during the 2024 growing season.

However, one segment does bear note. The past few years, activity in the self-propelled sprayers segment has been relatively slow among ag retailers. In fact, during the 2023 CropLife Buying Intentions Survey, only 38% of respondents planned to increase their spending in this area, with 52% spending the same amount as in 2022 and 10% spending less.

But in 2024, 42% of respondents plan to increase their buying activity for sprayers between 1% and more than 11%. Better still, the percentage of ag retailers planning to spend less on the segment in 2024 has been halved, to 5%.