CropLife 100: The Big Three in Application Equipment Keep Growing

For ag retail equipment manufacturers, being part of a larger tribe has proven the way to be an industry survivor. This largely remained the case in 2019, according to data collected in this year’s CropLife 100 survey of the nation’s top ag retailers.

This certainly wasn’t always the situation. In fact, at the start of the 2010s, the ag retail equipment marketplace was evenly divided between large players (AGCO, John Deere, and Case IH) and smaller ones (Hagie, GVM, Miller-St. Nazianz, and Spra-Coupe). Since that time most of the smaller brands have been incorporated into the large company tribes (Hagie to John Deere, Miller now with Case IH, and Spra-Coupe discontinued by AGCO), with only GVM remaining as an independent.

This certainly wasn’t always the situation. In fact, at the start of the 2010s, the ag retail equipment marketplace was evenly divided between large players (AGCO, John Deere, and Case IH) and smaller ones (Hagie, GVM, Miller-St. Nazianz, and Spra-Coupe). Since that time most of the smaller brands have been incorporated into the large company tribes (Hagie to John Deere, Miller now with Case IH, and Spra-Coupe discontinued by AGCO), with only GVM remaining as an independent.

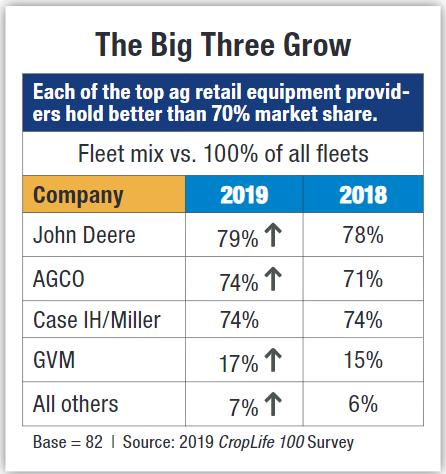

Given these facts, the nation’s top ag retailers have increasingly populated their self-propelled sprayer application fleets with units that sport the industry’s three primary colors — AGCO yellow, Case IH/Miller reds, or John Deere green/Hagie yellow and gray. Indeed, respondents to the 2018 CropLife 100 report indicated that better than 70% of their entire sprayer fleets were made up of machines from these three manufacturers.

(Editor’s Note: Since ag retailers can have multiple company sprayers on their lots, the percentages represented in this story are taken as each individual manufacturer vs. 100% of the fleets.)

For the most part this fleet mix didn’t change significantly during the 2019 growing season. According to the 2019 CropLife 100 survey, John Deere sprayers are still the most common color of sprayer in outlet yards, at 79%. This is a slight improvement from the 2018 total of 78%.

The battle for second place behind John Deere has changed somewhat. In 2018 74% of the nation’s top ag retailers had Case IH or Miller sprayers at their outlets. AGCO sprayers finished slightly behind this group at 71% — a 3% gap.

In 2019 this gap disappeared entirely. According to respondents, AGCO and Case IH/Miller sprayer numbers in their courtyards now both stand at the 74% mark. Perhaps more significantly, these percentages put both companies only 5% behind market leader John Deere in overall market share percentage — the smallest gap that has existed between the three sprayer manufacturers since 2014.

As for the rest of field, GVM led the way with their sprayers present in 17% of the nation’s top ag retail fleets, up 2% from the 2018 total. All other sprayer manufacturers were present in 7% of the mix, up 1% from 2018.

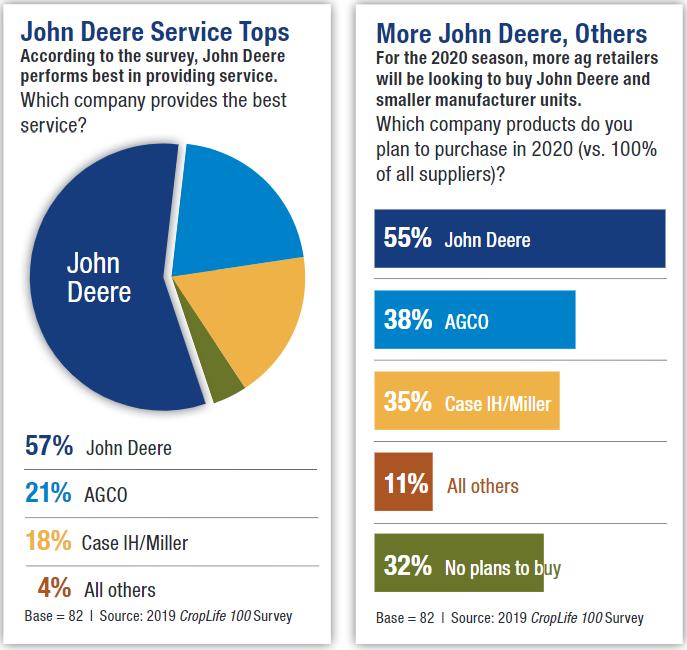

Plans to Buy

So, with the percentage mix set from the 2019 growing season, what could be the situation once the 2020 season rolls around? In a few words, this could be very interesting.

In terms of which company sprayers CropLife 100 retailers plan to buy for the upcoming season, John Deere can still expect to do the most business. Overall, 55% of respondents say that their retail operations will look to purchase green equipment in the new year — an improvement of 2% from the 2019 percentage. The story is similar for some of the smaller equipment manufacturers such as GVM, RBR Enterprise, and Oxbo. Whereas only 6% of the nation’s top ag retailers planned to buy these brand names during the 2019 growing season, this percentage has improved to 11% for the 2020 season.

In terms of which company sprayers CropLife 100 retailers plan to buy for the upcoming season, John Deere can still expect to do the most business. Overall, 55% of respondents say that their retail operations will look to purchase green equipment in the new year — an improvement of 2% from the 2019 percentage. The story is similar for some of the smaller equipment manufacturers such as GVM, RBR Enterprise, and Oxbo. Whereas only 6% of the nation’s top ag retailers planned to buy these brand names during the 2019 growing season, this percentage has improved to 11% for the 2020 season.

For AGCO, the news is a little less rosy. During the 2019 growing season, 43% of CropLife 100 respondents said they planned to buy new sprayers from the Duluth, GA-based manufacturer. However, for the upcoming 2020 season this percentage has fallen 5% to 38%.

The news is similar for the other big sprayer manufacturer, Case IH/Miller. While 41% of CropLife 100 ag retailers planned to buy units from these companies in 2019, this percentage has dropped to only 35% for the 2020 growing season.

What could be the reason for these sharp drops in buying intentions for AGCO and Case IH/Miller? Actually, it could tie back to the percentage of CropLife 100 ag retailers that plan to “sit out” the 2020 growing season when it comes to making new equipment buys.

For the past 10 years or so, the annual CropLife 100 survey has listed a “no plans to buy” option on the form to capture data from the nation’s top ag retailers that don’t purchase new equipment each year. Normally, the percentage of ag retailers that doesn’t buy new equipment tends to range from 10% to around 24%. For example, for the 2018 CropLife 100 report, 24% of respondents said their companies had “no plans to buy” new equipment during 2019.

But this percentage took a big jump in the 2019 survey. According to this year’s data, 32% of the nation’s top ag retailers do not plan to purchase new sprayers during the 2020 growing season — an all-time high. This could explain why the buying intentions percentages for AGCO and Case IH/Miller are lower in this year’s survey results.

Service, Please!

Besides looking at the current make-up of the nation’s ag retail fleets and what manufacturers could see sales boosts during 2020, the annual CropLife 100 form also looks to find out which ag retail equipment supplier performs best when it comes to servicing the vehicles that they sell. For several years now, John Deere has consistently ranked at the top of this list, according to respondents, with slightly less than half (in the mid-40% range) each year.

But this situation changed drastically during 2019. According to this year’s survey, a whopping 57% of the nation’s top ag retailers ranked John Deere dealers as providing the best service for their equipment. This was an impressive 10% improvement from the company’s 2018 total.

Finishing a distant second to John Deere for service performance in 2019 was AGCO, considered the best service provider by 21% of respondents. Case IH/Miller was in third place with 18% of the nation’s top ag retailers saying the companies had the best service.