2023 Fertilizer Sales Were a Mixed Bag for Leading Ag Retailers

If you are a bottom-line person, the fertilizer category among CropLife 100 ag retailers did not have a great year during 2023. According to data collected on the 2023 CropLife 100 survey, the nation’s top ag retailers saw their fertilizer revenues drop off significantly during this past growing season – from $23.4 billion in 2022 to $22.4 billion this year. Even worse, because of this sales decline, the fertilizer category saw its overall market share of all crop inputs/services among CropLife 100 ag retailers fall 3%, down from 51% in 2022 to 48%. This marked an end to a string of market share gains the fertilizer category has managed to chalk up over the past several years.

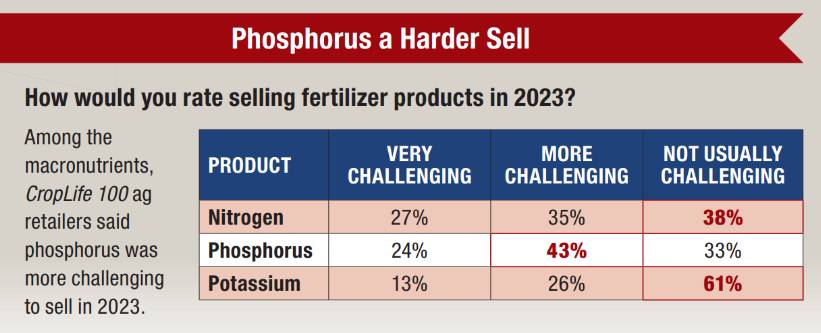

According to most ag retailers, the culprit for this sales declines in 2023 tied back to higher fertilizer prices coming “back down to earth.” Not too long ago, exceptionally high fertilizer prices were causing plenty of worry among ag retailers. The fear was that grower-customers would be severely cutting down on their macronutrient applications – particularly phosphorus and potash. Indeed, most crop nutrients were selling at nearly $1,000 per ton, with some forms of nitrogen easily cracking the $1,500 per ton barrier.

Base = 99 | Source: 2023 CropLife 100 Survey

But based upon the latest fertilizer price data at press time, these higher prices have settled back. In fact, according to one grower that CropLife spoke with at a recent trade conference, nitrogen-based fertilizers are now selling for $500 to $600 per ton – about the same amounts that were being paid by growers back at the start of 2021.

According to ag retailers, this price drop meant that grower-customers were expected to be in a “buying mood” going into the 2024 spring season. “We are positive with what the fertilizer prices have come down,” said Jay Boomsma, Vice President, Chemical/Fertilizer Division at AgriPartners, Clear Lake, SD, talking with CropLife this past fall. “The grain market price is still high enough to make it very profitable for the farmer. It’s one of best fertilizer-to-corn price ratios we have had! Phosphorus and potassium will perform the best. Prices have declined and farmers have not been applying enough for cost per acre.”

No Fall Off in Usage

As further evidence that the fertilizer category’s financial decline in 2023 tied back to prices dropping, consider how CropLife 100 ag retailers characterized their overall fertilizer segment sales. In the 2023 CropLife 100 survey, data tracked revenues year-over-year for both the fertilizer and micronutrients segments. Among CropLife 100 ag retailers, both sub-segments had sales increases between 1% and more than 5% for 71% of respondents apiece. Among the remaining 29% for each, micronutrients performed a bit better, with 19% of respondents saying their sales in this segment were flat compared with 10% that reported sales declines. Fertilizer sales, meanwhile, were reported flat by 3% of CropLife 100 ag retailers in 2023 vs. 26% that saw revenue declines of between 1% and more than 5%.

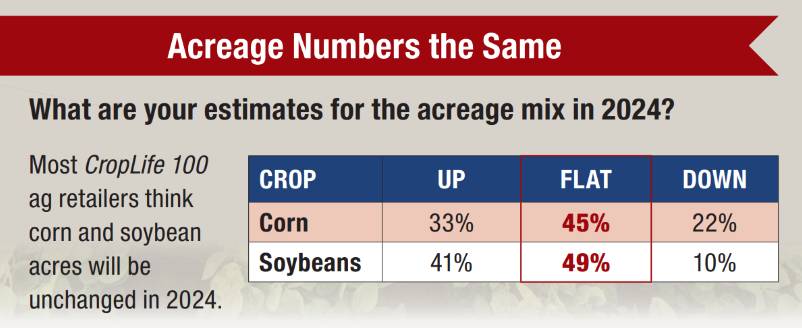

Furthermore, the outlook for the fertilizer category going into 2024 appears a bit brighter. As always, much of the financial fortunes for the macronutrients has historically been tied directly to how much corn the nation’s growers plan to plant. Although there has been plenty of speculation that the growing demand for renewable diesel will see an increase in soybean acres vs. those for corn, CropLife 100 ag retailers aren’t anticipating the acreage mix in 2024 to look all that different than it did during the 2023 growing season.

In fact, when asked what acreage changes were expected in 2024 based upon their grower-customer views, the majority of the nation’s top ag retailers said no changes were forthcoming. For corn acreage, 45% of 2023 CropLife 100 respondents expected this number to be the same as in 2023 – approximately 94 million acres. Furthermore, 33% of respondents thought corn acreage next year would increase slightly (between 1% and 5%). Since fertilizer usage tends to be higher in the growing of corn vs. soybean, this bodes well for the market in 2024.

Base = 97 | Source: 2023 CropLife 100 Survey

Meanwhile, soybean acreage is expected to also remain static from 2023 – approximately 83 million acres – according to CropLife 100 ag retailers. Here, 49% of respondents say the acreage totals for soybeans will be flat, with 41% forecasting an increase and 10% foreseeing a decline.