Seed Selection: Finding the Right Mix in 2024

When it comes to business, it’s often good to get in on the ground floor. Looking back at 2023 and ahead to 2024, if the ground floor involves soil, that’s definitely the case according to seed providers.

When it comes to business, it’s often good to get in on the ground floor. Looking back at 2023 and ahead to 2024, if the ground floor involves soil, that’s definitely the case according to seed providers.

2023 was a strong year for seeds according to the companies CropLife interviewed.

“We had a strong selling season that resulted in high corn and soybean seed volumes,” says Trevor Varilek, Product Director, Seed, CHS.

The leadership team at Clear Lake, SD-based AgriPartners, expressed similar sentiment. “We were happy with the 2023 seed year as we increased market share and units in both corn and soybeans,” AgriPartners indicated. “SD and ND finally planted a majority of their crop in 2023 compared to the previous four years when they had high rates of prevent plant acres.”

AgriPartners owes 42% of its revenue to seed, according to the CropLife 100, a ranking of the country’s leading retailers, by far the highest percentage of that group.

“Seed has always been a priority for our company and has been a significant percentage of our business since our beginning,” AgriPartners says. “There are many good products available but at AgriPartners, our emphasis is placing the right product on the right acre. This allows for higher yields and profitability for our growers. We consider this a normal year with less prevent plant acres in 2023 in ND and SD.”

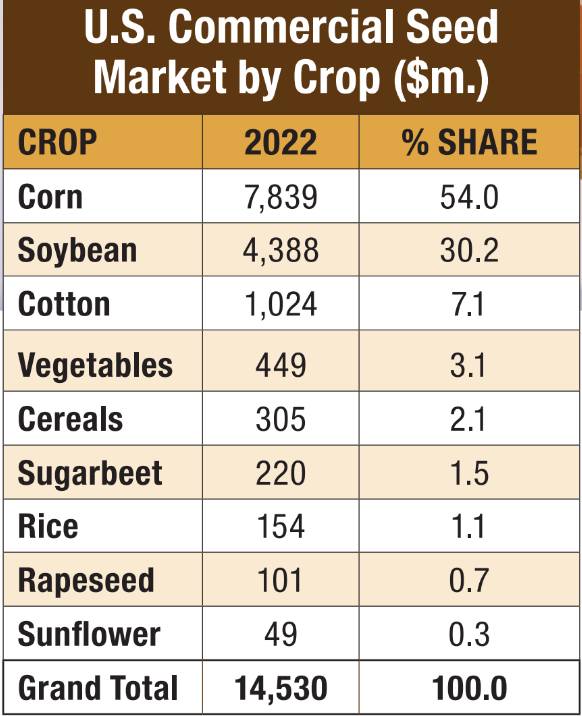

Source: AgbioInvestor

According to AgbioInvestor, the U.S. is the leading commercial seed market in the world with a value more than double that of China, the second leading seed market. The U.S. commercial seed market has grown at an average yearly rate of 1.3% since 2017. Seed providers and retailers of seeds have certainly been able to take advantage of that growth.

“Overall, 2023 was a pretty good year for seed at GROWMARK,” says Greg Fonger, Senior Manager, Sales, GROWMARK Inc. “For the sixth consecutive year we saw overall acre growth, fueled by strong seed corn sales. We continued to see downward pricing and margin pressure in the soybean market with further switching to the Enlist E3 trait platform and lost some acres to lower-valued seed suppliers in that trait.”

In 2023, even one of the uncontrollable variables cooperated. “There were a lot of positives with the seed market in 2023,” says Eric Boeck, Syngenta Seeds North America Regional Director. “Overall, we had favorable weather conditions during planting that allowed U.S. farmers to plant 94.9 million acres in a timely fashion, according to USDA. As a result of that favorable weather, replant seed and prevented plant acres in 2023 were half of what they were the previous year.”

Changing Approach

Like just about every aspect of agriculture, technology has changed how growers interact with their seed providers.

“In the digital era, the decision process for growers has drawn out to later in the fall and early winter timeframe,” CHS’ Varilek says. “Salespeople with strong relationships can many times still receive an early commitment, but the variety and seed type decisions are not made as quickly. Growers want the opportunity to review the performance on their farm as they have invested in tools to collect the information. We see fewer decisions made on the manufacturers’ data.”

It’s not just the tools in growers’ hands that is improving. The seeds available to them have evolved. They’re safer for the environment and more effective at combating pests and stress.

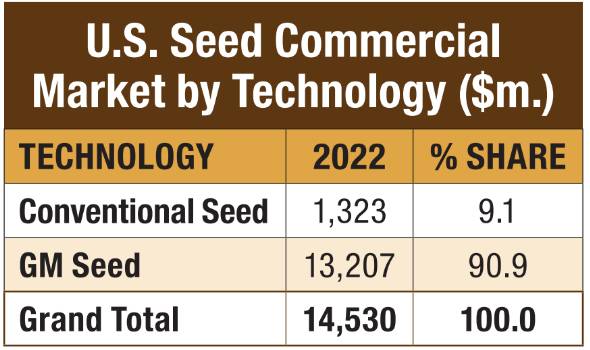

Source: AgbioInvestor

“The pace of innovation continues to accelerate as new technologies become available,” says Tim Glenn, Executive Vice President, Seed Business Unit, Corteva Agriscience. “Corteva is at the forefront of this trend, investing nearly $4 million — every single day — on research and development to advance new technologies and sustainable innovations for farmers.

“Gene editing builds on conventional breeding to empower scientists to deliver innovative, sustainable products that increase yield, productivity, and resilience for growers around the world, and we see tremendous opportunities in agriculture for gene editing to unlock the natural power of plants by responsibly accelerating their natural variations,” Glenn continues.

Looking Ahead

As positive as 2023 was for the industry, seed providers and retailers are equally excited about the coming growing season.

“The seed market will continue to evolve throughout the 2024 growing season,” AgriPartners executive team says. “There will be changes in projected acres between corn, soybeans, sunflowers, and wheat. The margins will be tighter with the increasing input costs and current commodity markets.”

The seed market is expected to grow, but the planting mix is expected to shift.

“Looking to 2024, we expect there will be less corn acres planted in the U.S. and more soybean acres,” Syngenta’s Boeck says. “Right now, farmers are seeing that soybean market fundamentals are stronger than the corn fundamentals.” While there might some shifts to the distribution, it doesn’t appear they will be dramatic.

“I don’t expect any huge swings in the market for 2024 in either corn or soybeans, just slight shifts,” GROWMARK’s Fonger says. “I am expecting some growth in corn hybrids that include below ground protection from pests as we continue to see more rootworm pressure in certain geographies, but aside from that I am not expecting much change in the corn market. From a soybean perspective, I feel like we are getting to a more stable position in trait mix between XtendFlex and Enlist E3, and we are actually seeing in some geographies that the XtendFlex trait is gaining back some acres from Enlist.”

Again weather will play a major factor. And while it’s early, the feeling is generally positive. “Expectations are very high from the set of retailers I’ve visited with,” says CHS’ Varilek. “Many are coming off a robust 2023 selling season and hoping for an even stronger 2024. The fall season had great fertilizer and field work weather, so growers are on the right foot for starting the year strong.”

Despite the overall optimism there are some potential speedbumps that could influence the season’s seed market. “As farmers continue to be challenged by lower commodity prices, it’s vital that they get the most productivity out of every acre,” says Corteva’s Glenn. “In 2024, we intend to continue our focus on developing sustainable innovations to help farmers improve their crops’ yield potential.”

Much like the pesticide market, the seed segment has seen growth through biological treatments.

“We have seen major growth in the biological segment of our business as well as our seed treatment business,” says Eric West, Manager, Product Advancement & Research, GROWMARK, Inc. “We put tremendous value on both business segments as they are items that both protect and enhance the genetic potential of every seed that our customers place into their soils. “Many of the biological products tested have stimulated better early growth and vigor as well a boost in overall yield.”

Improved Technology

This is not your father’s seed market. “The technology for seeds has evolved to overcome agronomic issues such as herbicide, insect, and disease resistances,” AgriPartners says.

According to GROWMARK’s West, “For corn, we continue to see exciting new trait technologies being brought out by the major trait providers in the corn industry. A few of the newer trait platforms to the market have come out in high performing genetics to help make for early adoption.”

Opportunities, Challenges

“Three of the biggest trends we’re seeing affecting farmers and agriculture are climate change, food security, and the need for more sustainable farming practices,” says Syngenta’s Boeck. Yield is critical as growers’ margins are squeezed by lower commodity prices and other mitigating factors.

“Current challenges for 2024 will be profitability for growers and retailers,” AgriPartners says. “The increased cost of goods includes interest rates, production, land rent, land values among many other rising expenses. These will be a concern with the current commodity market prices.”

And as always, retailers and growers keep a watch on weather and search for ways to dimmish the negative effects when it turns bad. “Depending on geography, severe drought has challenged seed production and is a risk for supply,” CHS’ Varilek says. “Seed companies do their best to diversify and spread their risk far and wide, but some seed stocks are not large enough to do that.

“Finance rates and cost of capital have many companies evaluating their total seed production,” he continues. “Premium seed traits have a higher cost, which can challenge all companies if their return and carryover rates are very high. Due to this, decisions may be made that could limit the supply of key traits needed on the farm. Most companies will still create their high-volume products, but I’d expect the lower cushions of supply.”

Continuing to ensure grower-customers are aware of the benefits of various offerings brings them a step closer to success. “We feel that our biggest opportunity is in providing our customers with whole farm solutions that they can’t get from a seed only seller,” says GROWMARK’s Fonger. “Our sellers are providing crop nutrient and crop protection plans for all of their customers, and with that knowledge they can make better seed recommendations than any other seller, we just need to get better at bringing this whole farm solution to our customers.”