Message at CPDA: Keep an Eye on These Trends and Drivers in Crop Protection

Editor’s Note: This article is adapted from a presentation the author made at the 2022 Council of Producers and Distributors of Agrotechnology (CPDA) Adjuvants, Inerts and Crop Protection Conference in Nashville, TN in May 2022.

Wayyy back in 2019, most of us likely thought we’d seen enough volatility and change in the business of agriculture to last us a lifetime.

Ah, for the good old days!

The pandemic. Supply chain disruptions. Geopolitical disruption. War in Europe. Shortages of raw materials. Consumer activism. The list goes on and on.

And of course, all of this is on top of trends in global agriculture that predate 2020: Consolidation on all levels. Pest resistance issues. Increasing regulation. The continuing march to precision agriculture, which in turn is driving an awareness of the importance of soil health and with it a demand for green solutions.

Of course, every generation feels as though it’s living in unique times. Agriculture – including the crop protection industry – has survived before and will do so again. The golden question is how.

Anyone looking to survive – and indeed thrive – during this time of volatility and change in crop protection would do well to keep an eye on these trends.

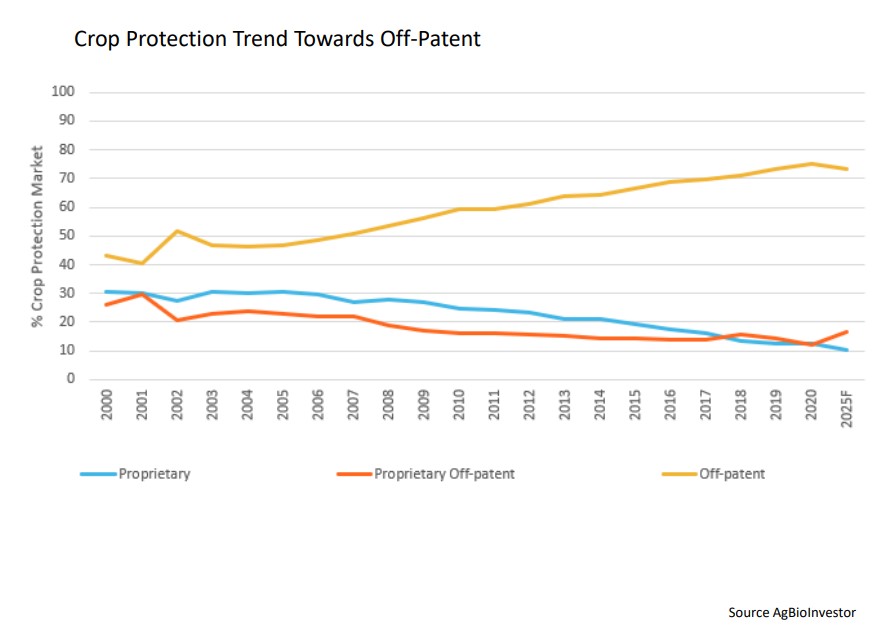

Generic Evolution. The trend to generic crop protection products has, of course, been afoot for decades. From roughly 40% of the crop protection market around the turn of the century, off-patent products now stand at a commanding 70%+, according to AgbioInvestor (see Figure 1).

Figure 1.

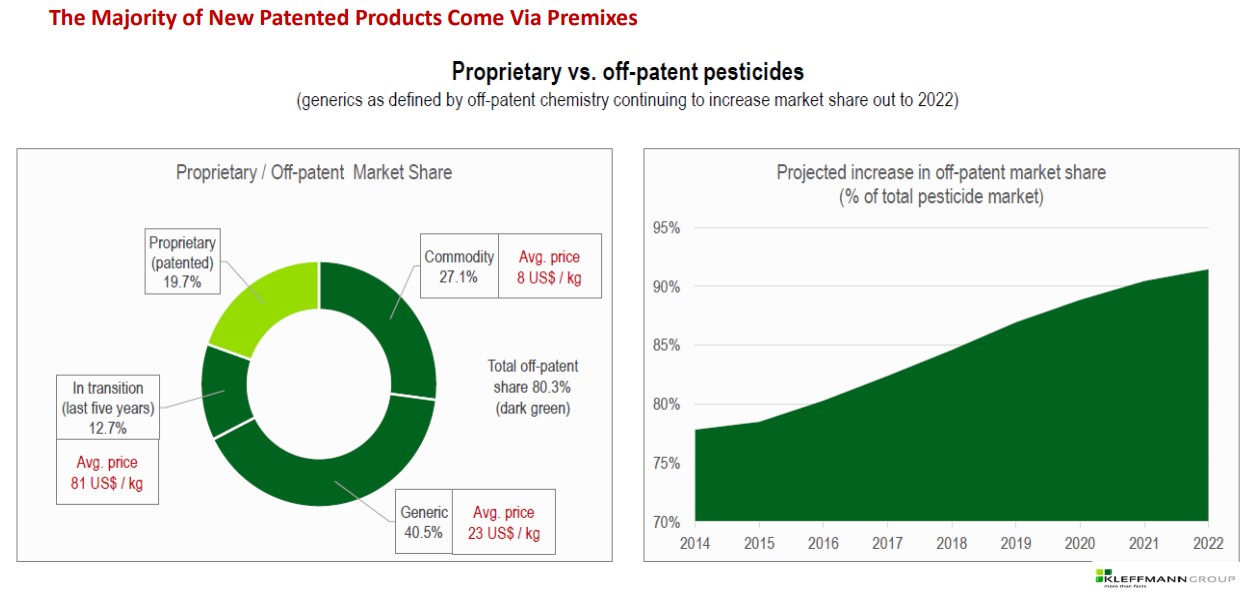

Toss in proprietary off-patent products, and generics’ share is over 90%. Proprietary, or patented, products now make up only 10% of the crop protection market – and the majority of is coming via premixes (see Figure 2).

So what are the implications? The growth of generics will continue to pressure margins among crop protection suppliers. While access to most actives generally will be available, pathways to the farmer will change. The channel will continue to vertically integrate, making market access critical for both large and small suppliers. The result: strategic sourcing will be key to survival. Look for differentiated business models to appear.

Technology Shifts and Dynamics. Grabbing the most attention of course are the inroads biologicals continue to make relative to synthetic chemicals. But look down the road a bit. Robotics and automation, currently found mostly in smaller-scale operations, have just begun what is likely to be a mid- to long-term disruption across most or all of agriculture. Closely related is AI and its ability to make speedy associations among complex and lengthy sets of data, which at bottom is the heart of precision agriculture.

At the distribution level, blockchain is posed to streamline (among other things) data share, compliance with sustainability programs, and participation in carbon credit programs. And given ongoing snags in supply chains around the world, will distributed manufacturing get more of a public hearing? I wouldn’t bet against it.

Then of course there are pending technology disruptions at the research level: digital biology, genomics, and new insights into the soil ecosystem, which could place at least as much attention to what is happening below the surface of farm fields as above it.

Global Macro Economic Trend Disruptors: 2023-2025. Agriculture is a global market, and in a global market, as they say, no one is immune. I’m keeping an eye on these 10 worldwide disruptors:

- Global economic trade transition – are we moving from globalization to deglobalization? Again, given supply-chain problems, which are now compounded by increasing nationalization in many key areas of the world, one could see this happening.

- ESG, or Environmental, Social, Governance – this is now a given, an expectation rather than a slogan.

- Oil and energy complex – the transition from fossil fuels to green energy is going to be a challenge for U.S. agriculture, which with its broad acres and vast distribution system is especially reliant on transportation (not to mention synthetic chemistries, plastic packaging, and fertilizers derived from fossil fuels).

- The current labor shortage will be substituted by automation – and this will have significant impacts not just technologically but also financially and socially.

- Technology – innovation in bio-solutions, engineering, and information management is catalyzing change in nearly every major agricultural production area of the world.

- Government stimulus due to the pandemic – 14% of the $85-trillion economy is debt and inflation. This will continue to act as a drag on the global economy.

- Weather in extremes, climate change, and the world’s carbon footprint – as a weather-dependent industry, agriculture is especially vulnerable, though also is in a position to be a net-positive factor by participating in carbon sequestration.

- China’s real estate challenge is a financial bubble – with costs that will be a drag on agribusiness along with the rest of the Chinese economy.

- Russia and China’s political and military strategies – with their vast economic and production might, these countries have the capacity to cast a continuing pall over global agriculture.

- Supply chain challenges, both in ports and in trucking – these are likely to last due to nationalism and changes in the world order.

Given all this, in the immediate months ahead I’ll be looking at these data points and whether they’re likely to have a positive or negative impact on agriculture:

- Commodity prices

- Interest rates and inflation

- Supply chain cost of goods sold (COGS), raw materials, and availability

- Taxes and debt

- Money supply, defense policy, and interest rate policy

- Farm policy

And Finally: The Opportunities

Having talked about current disruptors, let’s close with a look at a number of multi-billion-dollar areas that are ripe for their own type of disruption – positive disruption.

Water Use. Take just one look at the acute drought situation in the southwestern U.S. and you know this problem isn’t going away, either for agriculture or for society at large.

Crop Protection. Are we ultimately moving from a synthetics-centered industry to a biologicals-centered industry. Or something somewhere between?

Fertilizer/Climate Change. I’ve spoken and written at some length about the opportunities before agriculture to not only participate in carbon markets but also to reduce the use of nitrogen fertilizer by as much as 20% through increased use of biostimulants and other naturally derived compounds capable of fixing nitrogen.

Food/Nutrition. With obesity approaching majority levels in the U.S. and Generations Y and Z demanding more healthy and wholesome food options, can we rise to the challenge of evolving our crop mixes and production and economic models while continuing to ensure the sustainability of American farmers’ operations?

Precision Ag. We’re now about a quarter-century into the precision revolution, yet we’re still catching up to fully capture the promise that managing variability within and across farm fields offers.

There’s a saying that the difference between stumbling blocks and stepping stones is how you use them. All of the above are likely to be either stumbling blocks or stepping stones or, more than likely, both. In the end history will write whether we’ve treated them as intractable challenges or as transformative opportunities.