Risk Management in Fertilizer Markets: How One Supplier Manages Price, Logistics, and Execution

The global commodity fertilizer markets are dynamic, political, and volatile — and it’s been especially wild this year. The entire fertilizer system has felt a significant supply strain due to the increased grain and oilseed production and inconsistent global imports, including lost imports during the pandemic, and government intervention into normal trade flows. These factors and more have contributed to hefty price increases and other business risks that come with procuring, selling, and delivering fertilizer.

One reason that our team at ADM Fertilizer has been successful, even during market fluctuations, is because of how we manage and respond to various risks. In our business, we work to manage risks, so that dealers and producers alike can achieve their crop production and yield goals each year.

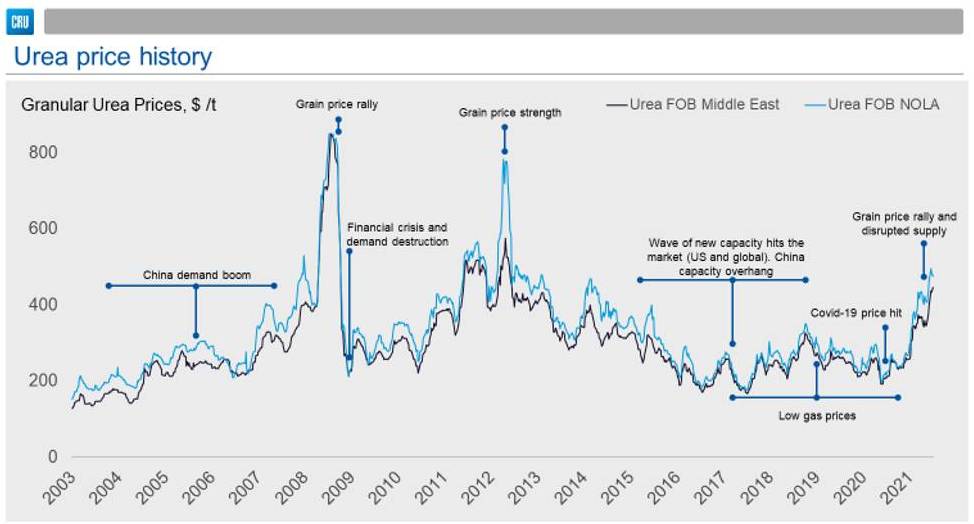

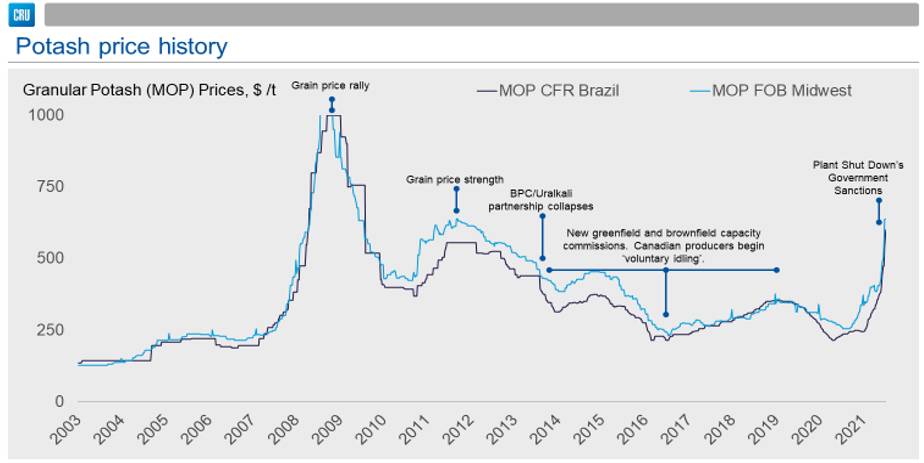

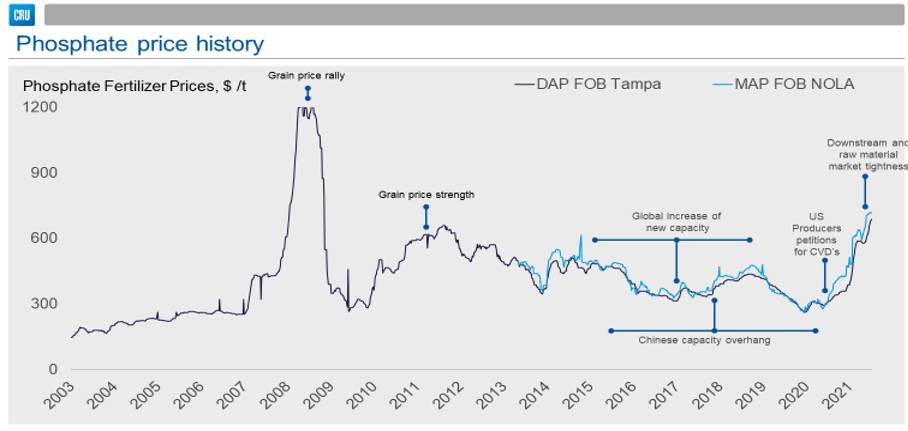

Price Risk

The perfect storm of low fertilizer inventories, combined with high domestic and global demand, drives up commodity prices, which is the predicament we’re in right now. Market jumps cause producers to look more closely at how they can tighten their operating budgets, with fertilizer accounting for roughly a third of those costs. Due to the uncertainty, producers often delay and end up buying fertilizer at the last minute, which can create volatility for dealers who have staged product for the local markets.

At ADM, we offer a customized approach to buying nutrients in bulk that can save time and money, especially during the busiest seasons. This approach allows dealers to manage how much risk they can take on, instead of having a fixed long position or exposure to securing product. Our price point can be managed through making financial swaps, leveraging our geography, and working creatively with key partners to position tons for the market at the right time.

Sometimes great risk management plans fail, and they don’t quite come together. Today’s market is no exception. While the average retail prices for Potash are in the high $400s, recently tipping $500, replacement Potash is trading closer to $600 for farmers in the Midwest. When the industry norm is to sell behind replacement, profit margins can start to close, making risk management even more critical.

At ADM, our global footprint has allowed us to learn and stay in front of key factors that will drive the grain and fertilizer markets. It is a necessity to be connected to the primary drivers in this market and have intel from these regions. We do this by leveraging our distribution partners who share information about global markets and political climates that can create wild volatility and uncertainty.

In addition, we are able to utilize many different commodity merchandising techniques to manage flat price risk. We utilize and engage in a variety of other non-fertilizer commodity markets as part of our hedging strategy. We tap into ADM’s global commodity trading platform and synergies in other commodity markets across regions. In combination, these opportunities help make ADM Fertilizer’s risk management strategies unique in the industry and help us offer dealers competitive pricing mechanisms to manage price risk.

Logistical Risk

In our last article, we talked about the importance of getting logistics right. It sounds easy, but as we all know, the logistics system is incredibly complex to navigate with multiple process steps and modes of transportation to maneuver.

One weather event can blow up a carefully planned timeline. Remember 2019? The wet spring of 2019 was challenging for many dealers. ADM used its network to bring tons of fertilizer from outside of certain regions to meet the needs of our customers and deliver on sales as committed. We had trucks travel from Ohio to North Dakota to help one retail partner. During years like that, the old adage of cheaper isn’t better was true when measuring partners who executed contracts versus partners who failed to deliver.

Looking ahead and adding to the pressure are high fuel prices and supply chain demands across almost every industry. Freight companies are on overdrive trying to catch up. Fortunately, we manage all of our transportation shipment types as basic commodities and have our own vast distribution network that includes vessels, barges, railcars, and trucks. This is why we recommend working with key distribution partners who can provide flexibility and help deliver and execute. ADM Fertilizer, ADM Artco, and ADM Trucking, can help utilize the logistics of fertilizer while providing flexibility and risk management support.

We have implemented favorable logistic positions, as well as risk management strategies, that allow us to succeed during time sensitive execution periods. We’ve built a diverse fertilizer storage system in North America that is supported by our logistics, which allows us to service the market during the primary application periods.

Execution Risk

There are certain times of the year when execution risk is critically important. Technology is allowing growers to increase the speed of planting and the window for just-in-time application. It’s extremely important that fertilizer inventories are in a position to supply retailers the necessary nutrients when they need them for their farmers. It’s important to pick a distribution partner who can execute for you – this is where ADM leverages its global knowledge and team. We are able to get the product to you when you need it, how you need it, where you need it, and give you the opportunity to manage price risk along the way.

Managing Risk for the Good of our Dealers

Risk is the word of the day – and we understand that it isn’t just logistics, execution, and price – we know it’s also credit/collections, quality, contract integrity, and more.

Solid risk management strategies that are diverse and creative are the foundation of the ADM Fertilizer business. We continue growing year after year in North America to meet the changing needs of today’s customer. While managing risk is a daily grind, we are here to help make it financially attainable. We also help our dealer partners with this through ADM Benison Quinn Commodities Inc, and ADM Financial services where we take hedging and financial services to the next level for our partners.

In conjunction with our grain team, from the country elevator system to global and domestic end users, producers and financiers, we work to help mitigate the day-to-day exposure in the ag sector. We understand market fundamentals, supply and demand, weather, geo-political inputs, consumer trends, railroad efficiencies, and investing trends to increase manageable risks.

Integrity drives what we do, our clients benefit from service that focuses on protecting their bottom line, which may not always be trading futures and options. Our experience allows us to approach grain handling and grain processing customers with the intent of maximizing profitability via securing carries and creating specialized hedging strategies. The greatest risk and biggest stress point for our customers is the unforeseen factor, so we provide valuable information to help our customers make decisions with more confidence.