Q1 2022 AgTech Venture Capital Investment and Exit Round Up

After 2021’s record breaking total of AgTech venture capital investments, the first quarter of 2022 saw the amount of money invested in the space slow down. Last quarter, our analysis of Crunchbase data shows 224 AgTech startups raised a total of $3.88B. This represents a 13% drop in funding and a 1% decrease in deals from Q4 2021. This decrease in total funding is consistent with a broader slowdown across all categories of venture capital investing.

There were 12 startup AgTech exits last quarter. Eleven of these occurred though M&A transactions, and there was one public listing via a merger with a Special Purpose Acquisition Vehicle or SPAC.

AgTech Venture Investments

Below is a breakout of the deals and dollars that flowed to different sectors of AgTech last quarter:

The biggest category decrease in funding last quarter was towards supply chain startups. The average supply chain related startup raised a round of $12.5M last quarter, down from $30M in Q4 2021. This represents a 59% decrease in round size. On average across all over AgTech startups, while the number of companies that raised capital remained about the same, the average round size last quarter decreased from $19.6M in Q4 2021 to $17.3M last quarter.

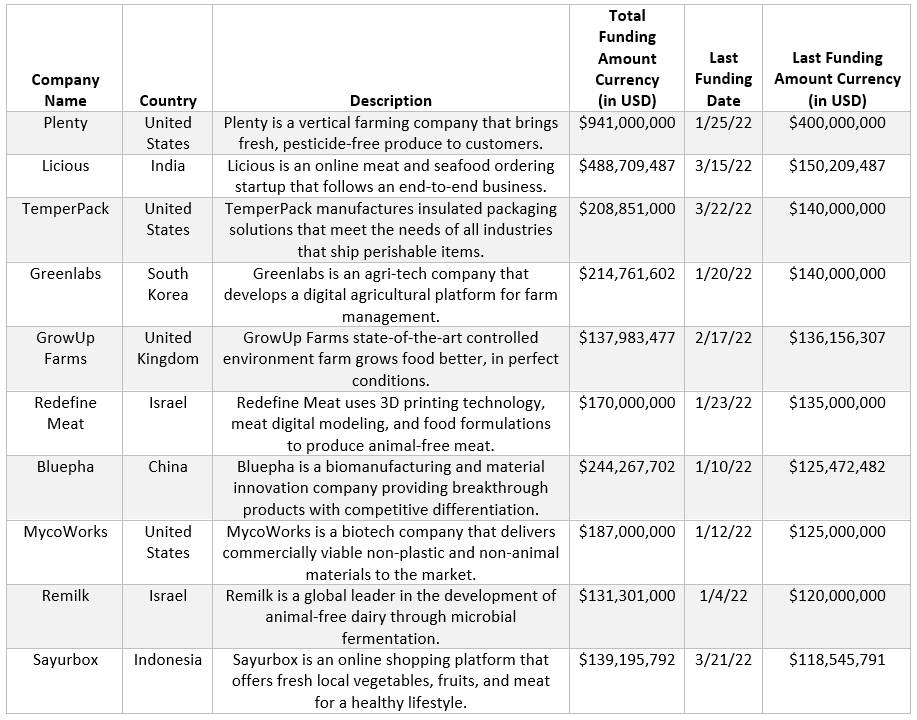

The 10 largest AgTech transactions last quarter were as follows:

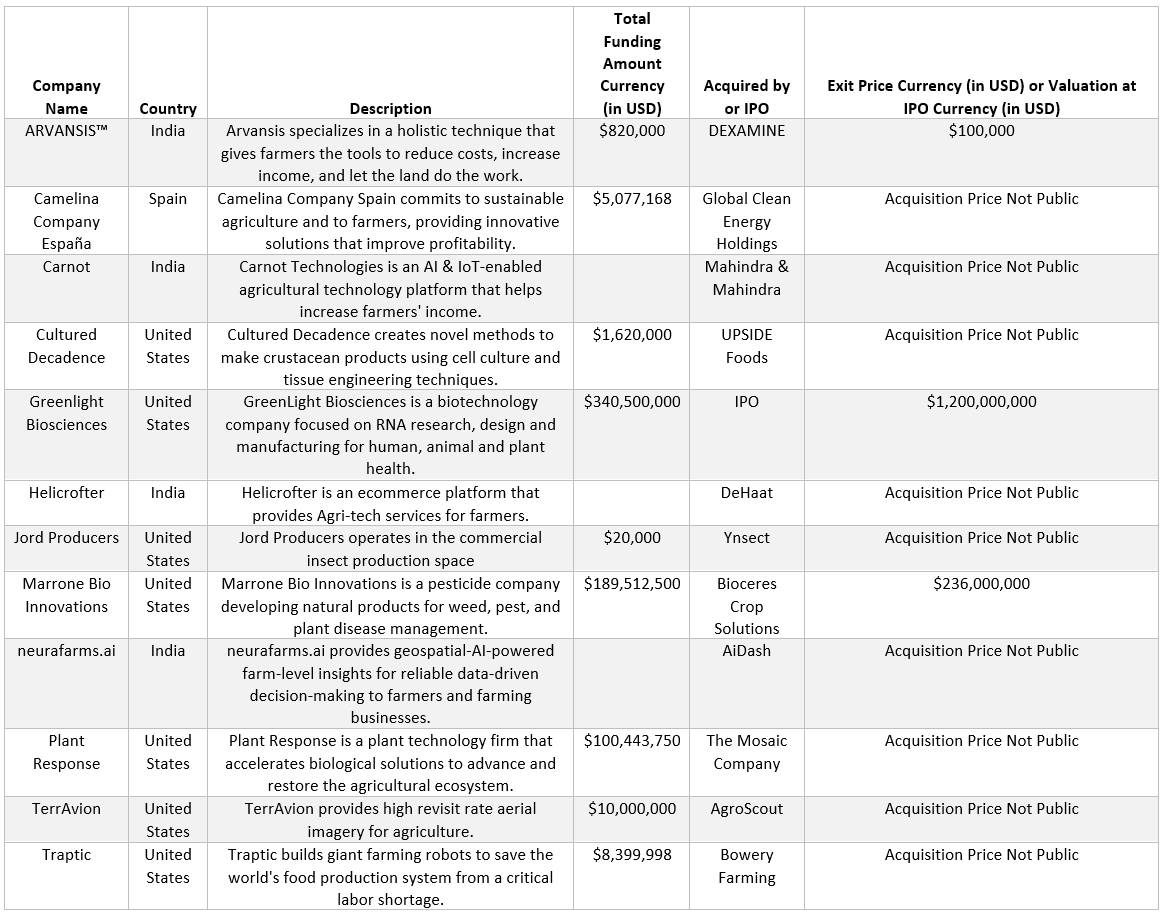

AgTech Startup Exits

Exit activity remained robust in Q1 2022. However, there has been a noticeable slowdown in going public through SPAC mergers, also mirroring trends being seen in other industries.

Below is a list of the 12 AgTech exits last quarter:

Key Takeaways from Q1 2022

While the total amount of dollars invested in AgTech last quarter decreased, the number of deals that were completed remained about the same. Around 1,000 AgTech startups could raise capital this year, which would set a record. The decrease in round sizes is probably related to the challenge of AgTech’s IPO performance last year. Most of the new AgTech public listings are down. Since public listings generally drive the greatest returns to investors, a slowdown will encourage investors to decrease round size.

On the exit side, 2022 is on pace for another strong year. However, it looks like M&A will be the dominant path startups will use to exit. The other exit trend that appears to be growing is startups buying other startups. While this technique is common in other industries backed by venture capital, it has been used less frequently in AgTech. It’s probably a sign of a maturing AgTech venture capital market to see this type of consolidation.