2021 AgTech Venture Capital Investment and Exit Roundup

It’s been another fascinating year for AgTech investing. Last year shattered records for investments in AgTech startups. Based on our analysis of Crunchbase data, 632 startups globally raised $12.23B. This represents 137% growth in investment dollars in the space from last year, and 410% percent growth from five years ago in 2017.

In terms of AgTech exits, 2021 was also a big year with 39 venture backed startups exiting through M&A or a public listing. That represents a 179% increase in exits from 2020, and a 388% increase from the number of exits five years ago.

AgTech Venture Investments

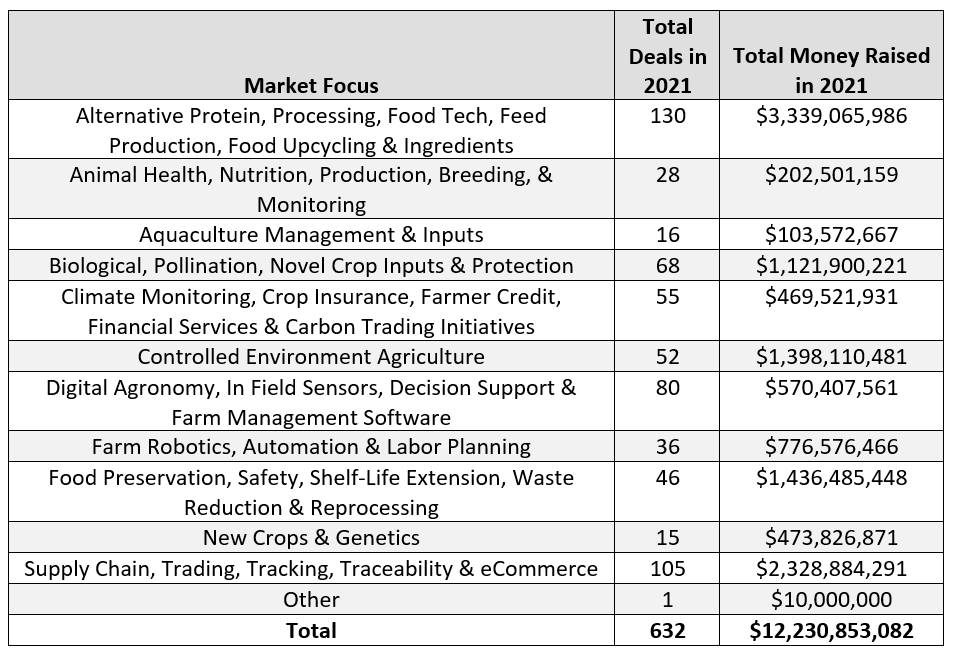

There were 632 AgTech startups that raised capital in 2021. Below is a breakout of the deals and dollars that flowed to different sectors of AgTech:

Alternative protein continues to be the area commanding the highest amount of investment dollars, representing 27% of all venture investments in this space last year. Supply chain related startups raised 19% of last year’s total. The area that saw the greatest increase in funding in 2021 was the food preservation space. Counterintuitively based on all the talk about carbon in agriculture these days, the area that saw the greatest decrease in total funding as a percentage were startups in the climate monitoring, crop insurance, and farmer financial services space.

Venture Backed AgTech Exits

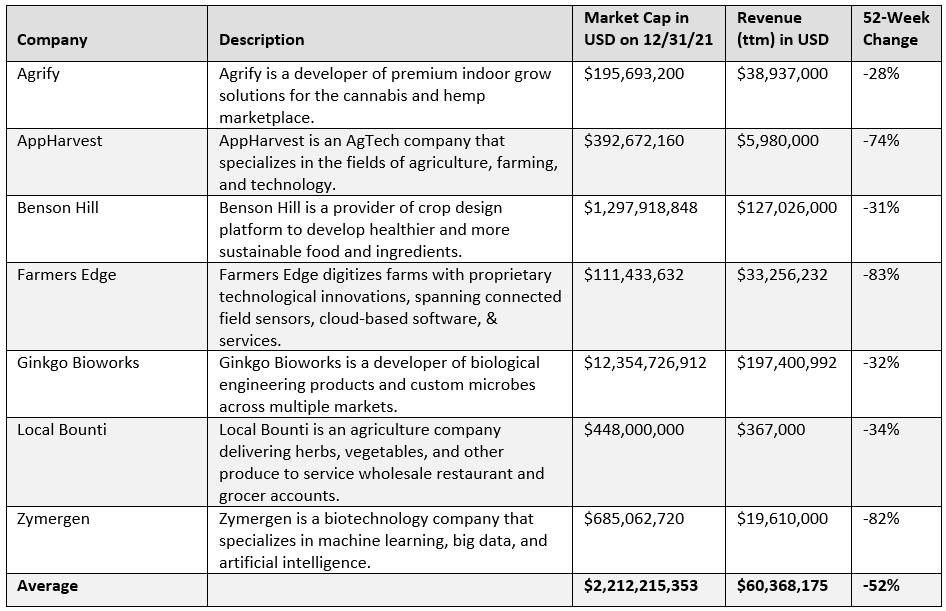

There were 39 exits back venture backed startups last year through either M&A or a public listing. Five of the seven public listings were through a merger with a Special Purpose Acquisition Vehicle or SPAC.

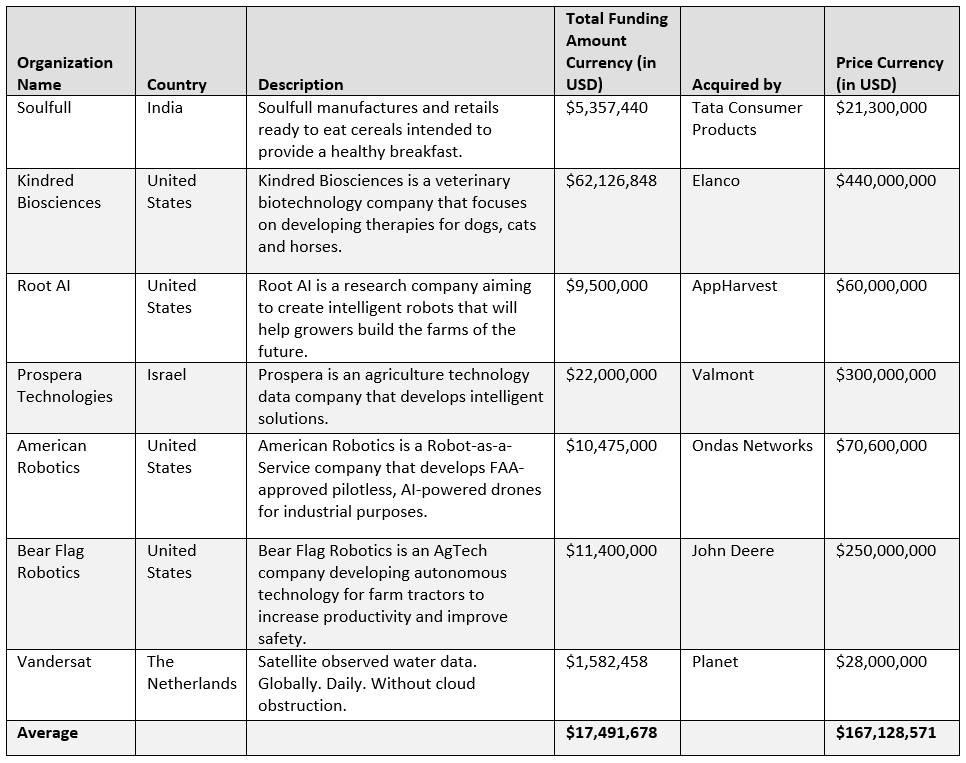

Of the 32 M&A transactions, exit prices were made public for seven which are listed below:

The average purchase price for was $167M, which is down from an average of $224M across all AgTech M&A exits with public pricing data between 2011 – 2021. On the public listing side, seven companies exited in 2021. However, it was a challenging year for these newly public companies with their average share price down 52% in 2021.

Key Takeaways from 2021

The number of investments bounced back in 2021 after a steep drop in 2020 due to Covid. Only 420 deals were completed in 2020, and many of the deals that year were follow-on investments in companies as investors wanted to make sure their portfolios could make it through the pandemic.

However, across the last five years, the number of deals is roughly flat. There were 642 AgTech startups that raised capital in 2017, as opposed to 632 in 2021. So, the dramatic increase in total dollars invested is a result in individual companies raising more capital rather than an increase in the number of deals. In fact, of the 632 deals last year, 15% of startups that raised money have now brought in over $50M in venture capital. These well-funded startups brought in 75% of the $12.23B raised last year.

Founders and investors are counting on some big exits in the coming years to recoup these investments. Looking forward to seeing what 2022 has in store for AgTech startups.