Biostimulants Gaining Ground

Consumers have stepped up their demand for food produced more sustainably, with fewer “hard” chemicals and more compounds from nature. Biostimulants are helping increasing numbers of growers answer that call.

“Growers are embracing these products rapidly as they search for ‘greener’ options to produce their crops,” says Rad Page, Chief Commercial Officer for PlantResponse. “They’re also demanding that these products have solid science behind them and produce a consistent return on their investment. We think these expectations are driving the increased investment and innovation in this market segment.”

The global biostimulant market is currently valued at approximately $2 billion, reports Dr. John Bailey, National Row Crops Product Manager with Timac Agro USA. “Europe has the largest share at around 45%, North America and Asia have approximately 20% each, and Latin America comes in at around 15%.”

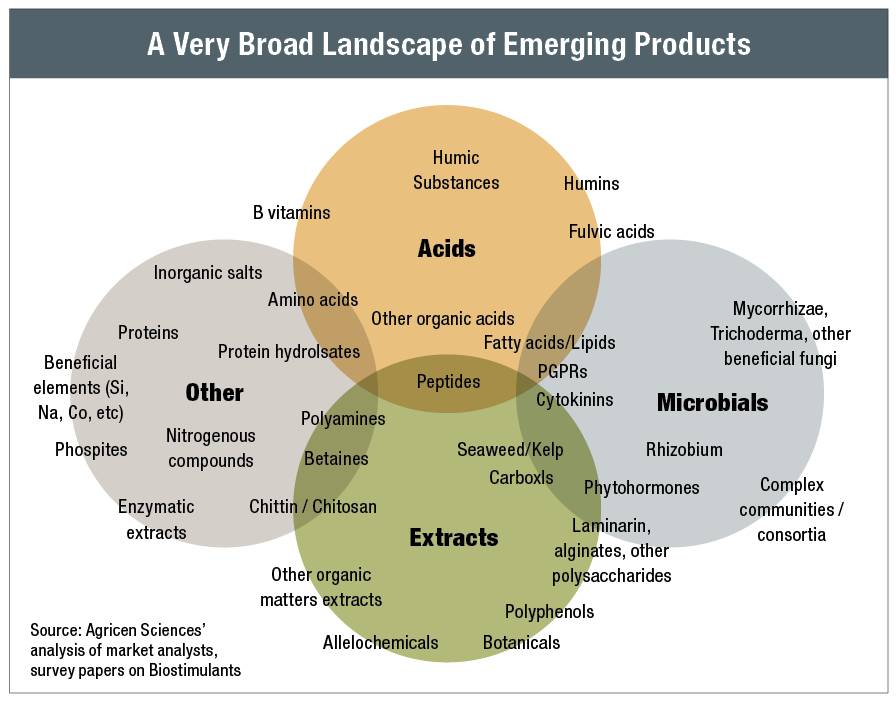

These natural options include things like amino acids, humic acids, seaweed extracts, microbials, beneficial fungi, protein hydrolysates, biopolymers, and inorganic compounds. They create healthier plants that are better suited to fight disease and endure abiotic stress. They increase early season growth and vigor, increase root and shoot biomass, and improve nutrient uptake and utilization.

Convincing Users

Many in the industry believe there is a lack of understanding of what these products do. The key is educating growers and others about how biostimulants can benefit agricultural production and how they can best be integrated with conventional ag practices, says Keith Jones, Executive Director of the Biological Products Industry Alliance (BPIA), an international group of more than 125 companies committed to this market.

Indeed, “growers need to understand that biostimulants are not silver bullets, and that different types provide different functions or modes of activity that may or may not provide benefit given the specific conditions at the grower’s site,” says Jane Fife, Chief Science Officer at 3Bar Biologics. For example, if soil inorganic phosphate is limited, then use of a phosphorous solubilizing Plant Growth Promoting Rhizobacteria (PGPR) may be something to consider rather than increasing the amount of fertilizer applied.

The science behind how and why these products work, the environments they are most successful in, and optimal methods of application is advancing, says BPIA’s Jones. Member companies developing biostimulants have in-house research to validate benefits and ensure product consistency.

These same companies are also collaborating with universities, professional crop consultants, private research organizations and growers to evaluate the products. Besides BPIA, several other international biologicals coalitions have formed over the past 10 years, and the number of industry conferences to present vital information and technologies has grown.

In the Trenches

In fact, the 3rd World Congress on the Use of Biostimulants in Agriculture last year featured two speakers from J.R. Simplot Co., based in Boise, ID. The company has been selling biostimulants to growers for almost 20 years.

Crop on the right has been treated with Nexia, a new multi-action biostimulant product offered by J.R. Simplot.

Its line started simply, with enzymes and humic acids, says Ian Crawford, Plant Health Technologies Product Manager, PNW, and has advanced to recent successful product launches such as NutriBAND, a “chemo-attractant” with amino acids and organic acid that feed and stimulate microbes and roots to convert bound nutrients into plant-available forms and Nexia, which contains proprietary strains of PGPR that encourage a number of key growing processes.

There’s not a one-size-fits-all approach with these products, says Crawford. Simplot builds programs for growers by identifying limiting factors in fields, then finding solutions that deliver results.

In fact, precision ag specialists contribute to recommendations, helping quantify results of components added to a program. “We incorporate all kinds of metrics to evaluate the performance of a product, which includes measuring yield and quality. But we also use technology like satellite imagery to identify stress in treated plants and moisture monitoring. All kinds of things to measure if a product is delivering results or not,” he says.

A key factor in biostimulant recommendations is paying close attention to the health of the soil — and Simplot staff can move the needle with products that impact root health and vigor. Some of them have been in the firm’s trademarked Plant Health Technologies portfolio for 15 years, but teams are continually evaluating new products to stay on the cutting edge.

In fact, a specially-tasked Product Development Committee includes representatives from across the company’s vast sales territory.

Crawford says vendors come to Simplot promoting all kinds biologicals. Evaluating them is a full-time job. “First and foremost they have to deliver results to the grower, and equally, be profitable for all three parties — grower, supplier, and Simplot. If an offering fits those criteria, that’s a pretty good starting place,” he describes.

Simplot may test a product for two or three years before commercializing it.

“Suppliers can show us a valid technology, and they’re ready to go with it, but we feel like we owe it to our growers to screen a product before we present it to them. To have confidence in what we’re asking them to do,” Crawford says. “That way they’re not guinea pigs.”

Describing Adopters

Simplot’s huge footprint includes eight distinct sales areas. CropLife® asked Crawford if the West — and California, in particular — is ahead of the game in adopting biostimulants. He says he also works in the Midwest and sees very progressive growers there looking at products, including biostimulants, “to take things to the next level.”

Because Simplot’s territories are so large, the number of crops that it works on is in the hundreds. “We develop programs for each of these crops in each of these geographies,” Crawford says.

He does acknowledge that some biostimulant manufacturers target higher value crops. “But there’s real opportunity on those millions of acres of corn and soybeans,” he believes.

BPIA’s Jones reports findings that biostimulant use is now nearly evenly split between row crops and fruits and vegetables, and these two categories combined represent 80% of the total market. “Row crops are growing faster with seed treatments helping to drive growth. Foliar use is stronger in Europe,” says Jones.

Time for Rules

The biostimulant market is gaining ground so rapidly that it has caught the attention of regulatory agencies such as EPA. Many industry stakeholders, including Crawford, believe regulatory intervention is a good thing and will help drive out “fly-by-night vendors” that have a single product to sell and make outrageous claims about what it can do. For instance, some firms claim that if a grower uses their product, he can vastly reduce the amount of nutrients applied.

“This is reckless, and we see it frequently,” says Crawford. “Good products can be a part of a sound 4R crop nutrition program — not a replacement for it. Simplot has been a huge advocate of the 4R program initiative of the IPNI since its inception.”

“BPIA hopes to see a definition of the term ‘biostimulant’ in the next Farm Bill, plus EPA is working with USDA and others to study how to effectively regulate biostimulants in the U.S. with a single label that can be used in all 50 states,” says Jones. “Such a move would provide greater certainty for commercialization.

“If these steps can be accomplished in the next year or two, they would greatly pave the way for widespread use and acceptance of these products in the U.S.”