Taking Measure of the Precision Agriculture Program: 6 Key Observations

Respondents to a CropLife® magazine survey on precision agriculture programs reveal confidence in value delivered and a strong internal commitment to the business … but challenges remain.

In the overall agriculture market, the rhetoric surrounding emerging technology over the past half-decade has been nothing short of breathless. Thanks to an infusion of investment and product development largely (but not exclusively) emanating from Silicon Valley, precision service providers have endured all measure of devices, applications, and techniques being heaped upon the market.

Some of the developments have proven useful, but many others have crashed and burned or been acquired and integrated. In 2018 the sorting out of the victors and the vanquished continues.

Retail professionals have seen all of this before — turn the clock back nearly two decades to the dot-com bust, when any internet-plus-agriculture model was going to revolutionize the industry. Going back even further, it took 20 years for tractors to fully supplant horses on U.S. farms.

The lesson learned (re-learned) is that change occurs slowly in agriculture (certainly too slow for 99% of venture capital companies to recoup an investment), and that for any technology to be adopted, it absolutely must integrate immediately into existing practices. It is also imperative that the precision service provider — the grower’s most trusted advisor — is at the center of any effort to integrate a product or practice.

Finally, there’s a welcome refocus on delivering value on foundational agronomic services, from soil sampling and prescription creation to variable-rate application and field scouting.

What this means in 2018 is that for retailers who provide precision services, establishing clear farm value to the services they offer is absolutely paramount — value that can be measured in a variety of ways. To get at retail strategies for establishing value, and what value points are most important, CropLife® magazine conducted an electronic survey of retail managers to get a sense for what factors are effective in driving precision programs. This article captures the six most interesting observations from the survey of retail managers.

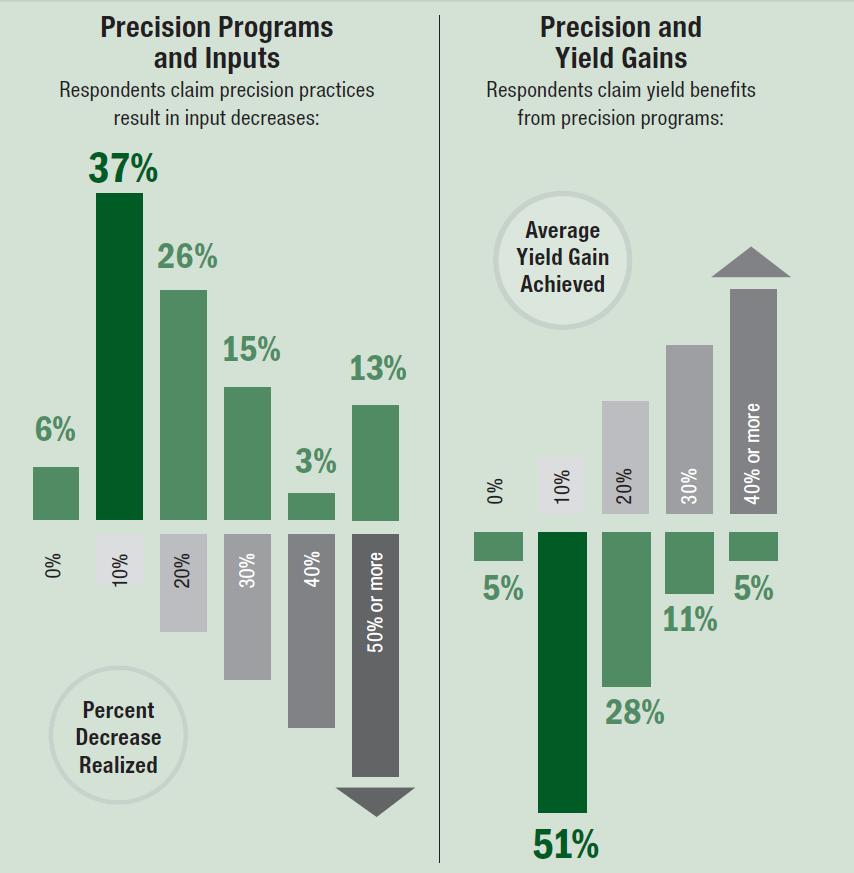

1. Respondents indicate they are registering value gains from precision in the form of decreasing input application.

One of the originally advertised benefits of precision use was the potential for decreased overall input use by growers, based on better prescription writing, higher accuracy, and improved efficiency. Technologies such as guidance, section control, assisted steering, and variable-rate technology should theoretically lead to improved input efficiency.

Respondents to the survey indicated relatively robust input efficiency gains, with about one-third saying precision practices have led to a 10% decrease in input use. Just over 40% put input reduction at 20% to 30% from precision use.

2. Yield gains also have been clearly demonstrated through precision programs.

Respondents also believe that yield gains can be attributed to their precision efforts. A bit more than half of respondents assert that their precision programs account for a 10% yield increase on average for grower-customers, while another one-third put the level at 20% to 30%.

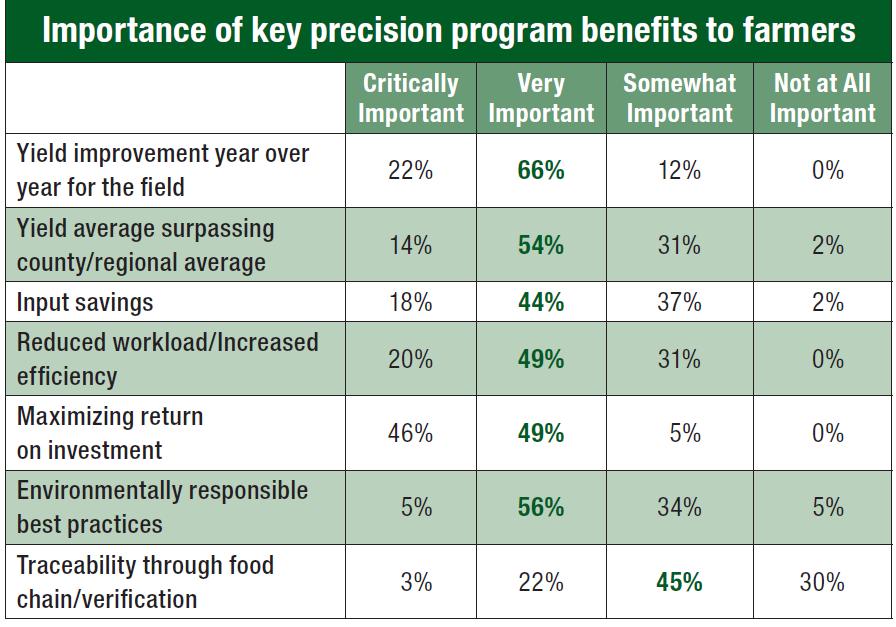

3. Yield and maximizing ROI lead the pack on value deliverables, but the difference in level of importance among variables is not large.

No one will be surprised that demonstrating return on investment leads the factors as far as value deliverables, with more than 95% indicating it as critically or very important. And yield improvement, whether year over year in the same field or compared with other fields in the same area over the same time frame, was a solid second place. (It is interesting to note that growers are more in tune with year-over-year improvement — 88% very or critically important — vs. surpassing the county/regional average, at 68%.

But other factors fared well among respondents. About 60% said environmentally responsible best practices are very or critically important. Nearly an equal number put reduced workload and increased efficiency (69%) and input savings (62%) at the same level. Even traceability through food chain verification had a quarter of respondents indicating it as a very or critically important value.

4. Precision practices add value to the business.

4. Precision practices add value to the business.

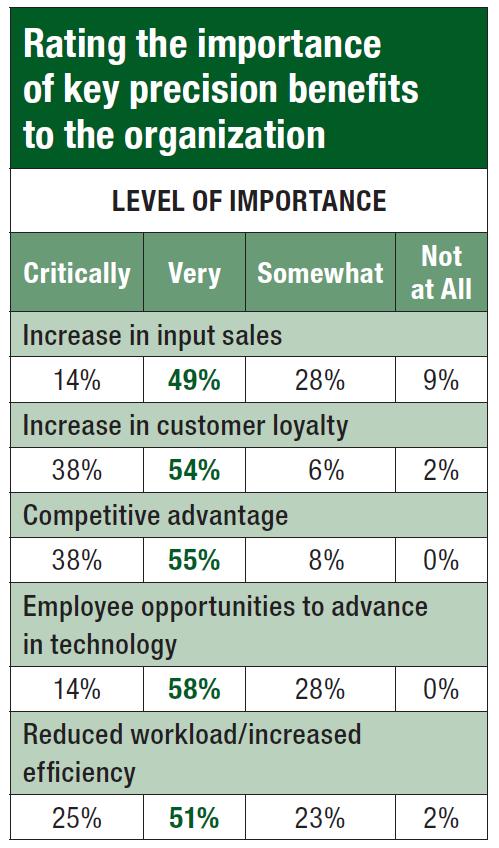

Retail respondents were asked to rate some of the potential benefits of precision agriculture practices on the retail operation itself, and some clear consensus emerged. From the business side, increase in customer loyalty was mentioned by more than 90% of respondents as either critically (38%) or very (54%) important. “Competitive advantage” gained 93% of very and critically important responses, and reduced workload and increased efficiency was indicated by 76% in the same categories.

Of interest as well was the response to the notion of employee opportunities to advance in technology, which nearly 60% viewed as very important.

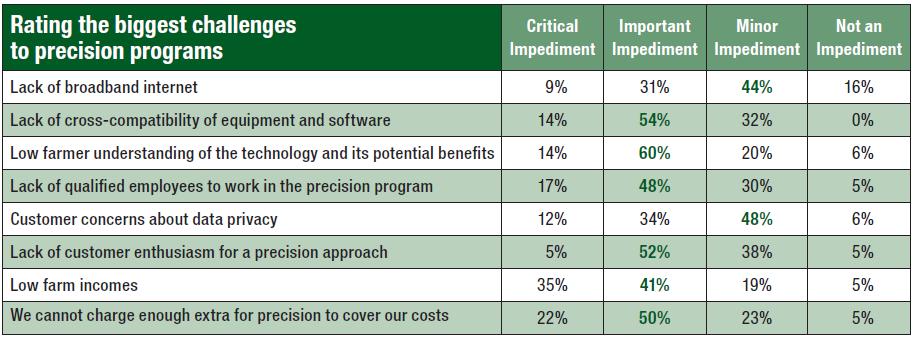

5. Income, charging for value, technology understanding top the challenges to precision programs.

To get a sense for what retailers see as challenging in keeping a precision agriculture program on track, three factors clearly lead the pack. Low farmer understanding of the technology and its potential benefits registered with nearly three-fourths of respondents, who say it is a critical or important impediment. Two critical financial/management issues also topped the impediments, including 76% pointing to low farm incomes and 72% expressing that they cannot charge enough for precision services to cover the costs.

Other mentioned impediments to precision provide some interesting perspective. Customer concerns about data privacy garnered a 34% response as an important impediment, with an additional 12% calling it critical.

Lack of cross-compatibility of equipment and software was indicated by two-thirds of respondents as critical or important, and more than half pointed to a lack of customer enthusiasm for taking a precision approach (57%) as a roadblock.

Interestingly, a lack of broadband was not seen nearly as widely as a key impediment, with just four in 10 saying it is important or critical.

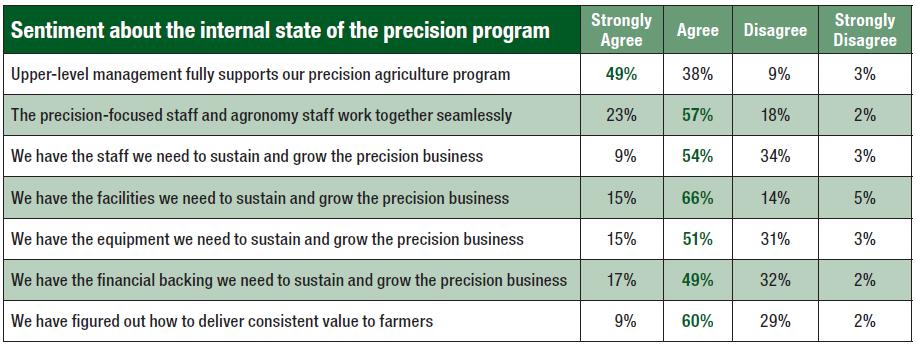

6. Respondents reveal generally positive sentiments about the internal state of their precision programs.

Challenges from the previous section aside, respondents were relatively positive about their organizations’ approaches to their precision programs and the overall support from within their organizations.

For example, nearly half strongly agreed with the statement, “Upper-level management fully supports our precision agriculture program,” and 80% agree or strongly agree that their agronomic and precision-focused staff work together seamlessly.

Enthusiasm was somewhat less on statements related to staffing, financing, and value creation. About one-third of respondents disagreed that the precision department is adequately staffed, that the financial backing for the department is enough to sustain the business, and that their organization has figured out how to deliver consistent farmer value.

Editor’s note: The survey was conducted in March and April of 2018 via SurveyMonkey. It was sent to retail and precision department managers pulled from the audience list of CropLife® magazine. The questionnaire was developed with assistance from Dr. Bruce Erickson of Purdue University.