Farm Bill, Interest Rates Among Key Factors Impacting Agricultural Land Values in 2018

Data released by land grant universities and industry organizations point out that there has been less farm and ranch land for sale than usual the past few years. Despite today’s slow land market, Farmers National Company is experiencing a 50% increase in the land it has for sale over its previous high volume.

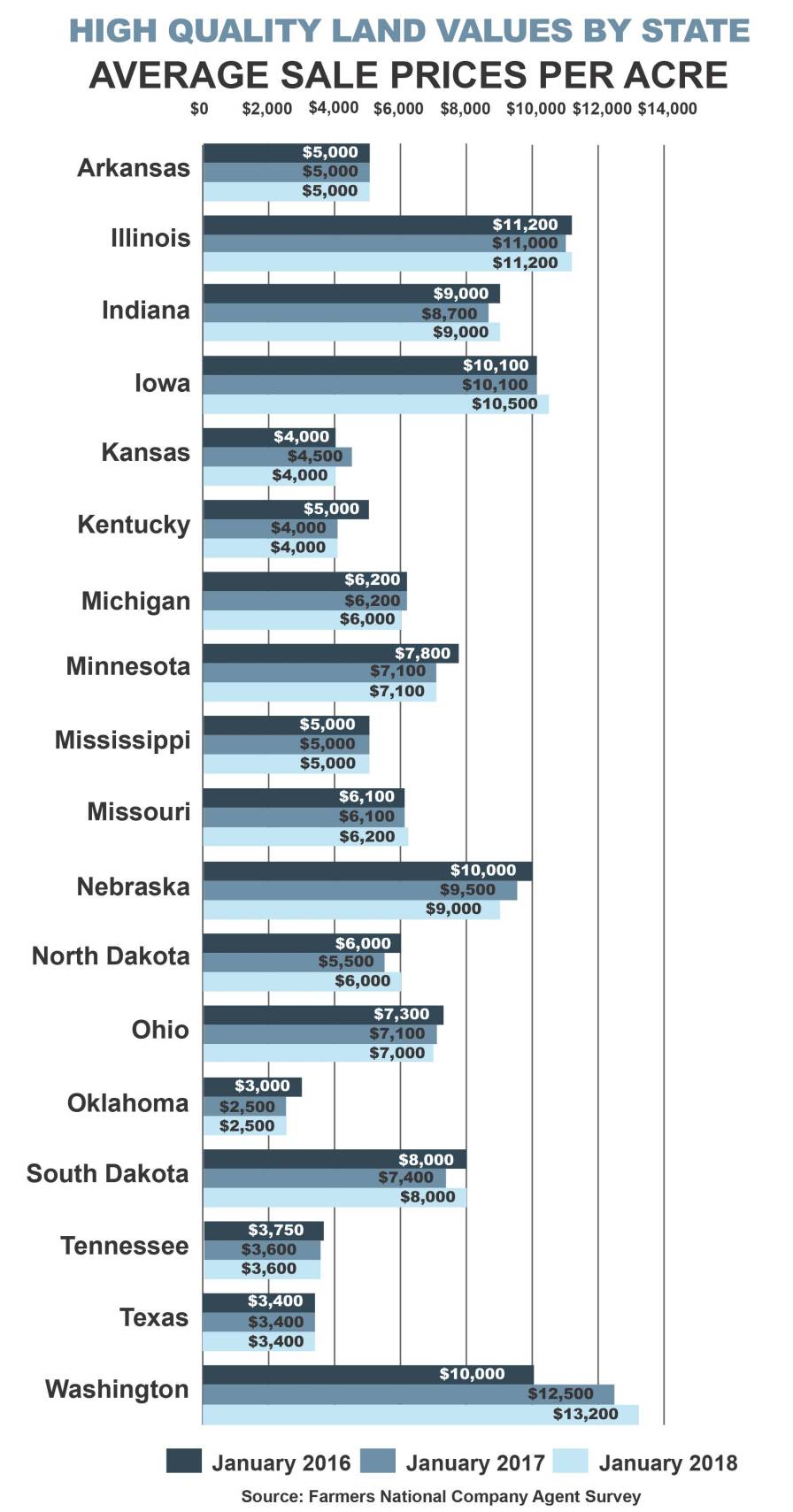

The historic run-up in land prices during the decade leading up to and including 2013 faded in to the background as the past four years instead witnessed a steady and measured decline in values for crop and grazing land throughout the Midwest and Great Plains. Some regions experienced the decline sooner with a larger drop-off in land prices, whereas other regions saw less of a decline. Good quality land generally declined less while lower quality tracts saw weak demand and a bigger price decline. At this time, the market for quality land is steady to slightly stronger. So, what’s next for land values, up or down?

Randy Dickhut, AFM, senior vice president of real estate operations for Farmers National Company, said there are a number of positive factors supporting current land values.

“The industry has experienced a post-harvest bump in land prices in most grain producing areas. With above average crop yields in most locations, farmer optimism has increased as has the bidding for quality crop land. The supply of land on the open market remains low while the number of buyers and demand is adequate for what is on the market at this time,” Dickhut said.

Other factors also are providing support for today’s land prices, Dickhut noted. Continued low interest rates are helping create a demand for ag land as a long-term investment for individuals and institutional funds.

“In general, there is still enough purchasing power in the hands of farmers to compete for good land or land that helps grow ones operation. We are also seeing a small increase in 1031 tax deferred exchange buyers as they move to trade into different land or to diversify out of other real estate holdings and into cropland,” Dickhut said.

However, there also are factors on the horizon that could negatively affect land values, Dickhut noted. Current farm economics are not conducive to strength in the land market. Low grain prices are keeping overall farm income levels depressed. That means that lower incomes are reducing the cash flow necessary to finance crop inputs, equipment needs and land payments, leaving less cash for land purchases.

“Individual and institutional investors are well aware of the lower grain prices and incomes. The resulting reduction in the return on investment for land has kept some investors out of the land market during the past few years,” he said.

Another factor that may weigh on land prices is that lenders are being more cautious in the amount of money they will lend for agricultural land purchases. This could dampen demand as farmers and ranchers are the predominant buyers of crop and grazing land, Dickhut pointed out.

“Cash flow and equity concerns of farmers could generate additional land for sale in the market as some producers liquidate either land or equipment to shore up their finances. The magnitude of these additional land sales will probably be small and vary by region, but the potential for an increase in the supply of land on the market bears watching,” he said.

The final factor that could have a downward effect on land values are the outside influences. This could include negative outcomes for trade that U.S. agriculture depends upon, unexpected consequences from tax laws and potential changes in the next Farm Bill.

“The next six months will determine the direction of land values. Economic and financial factors will become more evident for producers and lenders. The factors and the outside influences will become better defined as we move through 2018. Now more than ever, professional advice and representation are critical to receiving a fair market price for agricultural land no matter if values move up or down. And more and more landowners are putting their trust in Farmers National Company to sell their land,” Dickhut said.

REGIONAL LAND VALUE REPORTS

Iowa

Demand for high quality cropland in Iowa remains strong despite the reduced farm income picture. “Values for good land have been fairly steady during the past year and have even seen a slight increase since harvest,” according to Sam Kain, ALC, GRI, ABRM, national sales manager for Farmers National Company based in West Des Moines, IA.

“Buyers of farmland are being more deliberate about their decisions, but farmers and investors are very interested in purchasing the right piece of ground that makes sense for them. Lenders are being more cautious in the amount of money they will lend on a land purchase, but there is still enough capital in the country to create demand for good land,” Kain said.

Auctions are still the predominate means to sell cropland in Iowa with more than 66 percent of Farmers National Company’s sales in the state being through the bidding process. Sam Kain noted that 99% of the Farmers National Company auctions result in a final sale. “We have very good success selling land through auctions in our Iowa marketplace as there is competition from farmers and investors,” Kain said.

North Dakota, South Dakota and Minnesota

Areas within this three-state region have been experiencing steady to slightly increasing land values. “In eastern North Dakota and South Dakota, we are seeing for the first time in three years a slight increase in the selling price for good to high quality cropland,” said Brian Mohr, area sales manager for Farmers National Company in Garretson, SD. Minnesota land values are holding steady from year ago levels, too.

Even though farm incomes have been challenged during the past three years, farmers are competing to buy good quality cropland. “Farmers are interested in adding the right type of acres to their operations and seem willing to bid up to get the land purchased,” Mohr said. Conversely, range land in western South Dakota has not seen the buying interest or any strength in prices at this time.

“We are expecting a busy spring and summer marketing and selling land, as we believe there will be additional landowners wanted to sell at this time,” Mohr predicted.

Nebraska

Real estate sales activity in Nebraska has seen sales volume jump ahead of the previous levels in October and November. Paul Schadegg, area sales manager for the company said that “good quality land sells well, whereas lower quality crop or grassland struggles to find buyers.”

“Farmers National Company holds many auctions in Nebraska with most all ending with a successful sale. That is a great outcome for our clients, especially during this slower land market,” Schadegg said. Demand for high quality land extends throughout the state west to east.

Schadegg reported that sellers in the market at this time are mainly families and estates. “We are experiencing a land market with less property for sale and a more cautious demand. Some additional sales are expected before planting time from financially motivated sellers as the farm economy struggles with low grain prices,” he said.

Kansas and Oklahoma

The land market in Kansas and Oklahoma is slower than normal, reports Paul Schadegg, area sales manager for Farmers National Company. “There is less land for sale than normal and buyers continue to be more cautious in making purchase decisions,” he said.

“Good quality land sells well in most areas whereas lower quality crop or grassland struggles to find buyers,” Schadegg reported. Overall, prices for good quality cropland have remained fairly steady during the past year in these two states while lower quality land may have a harder time selling.

Texas

The land market in Texas remains mostly stable. “The diversity of land in Texas, the wider range of buyers and the varied uses for land in the state all help contribute to the land market being more stable the past few years here than in the major grain producing states,” said Paul Schadegg, area sales manager for Farmers National Company in Texas.

“We have a good supply of timber properties for sale in east Texas where there is good demand for these types of properties. Farmers National Company agents also have ranches, grazing land and cropland for sale over the rest of the state,” he said.

Washington, Oregon and Idaho

Land prices have flattened out in eastern Washington reports Flo Sayre, ALC, Farmers National Company broker in Pasco, WA. Location and quality make an important difference in land values in the region along with the wide range of crops, fruits and vegetables that can be grown, all which influence the price of a tract of land.

“Investors are still searching for prime locations and high quality for crop production,” Sayre said. She expects to see increased interest in selling land from aging farmers and potentially financially motivated sales. “Selling sooner than later might be a good strategy for anyone thinking of selling their land in the near future,” she noted.

Cropland in Idaho remains steady at this time. “Good quality irrigated land in central Idaho is seldom on the open market and has good demand. This helps hold the prices steady, especially during a slow land market,” reported Brian Mohr, area sales manager for Farmers National Company in that area.

Illinois, Indiana, Ohio, Michigan and Missouri

Quality is king throughout the eastern Corn Belt, reports agents in this region. “Good quality land is in demand in most regions. Prices for good land are steady to slightly stronger when compared to the same time a year ago,” reported Roger Hayworth, ALC, area sales manager for Farmers National Company based out of West Lafayette, IN.

There is generally less land for sale now than a year ago, Hayworth said. “The low supply of properties on the market helps support land values in the region,” he noted. “Auctions remain a good way to sell farmland in my area, but we are seeing some switch to more private treaty listings as the means to sell a farm.”

As in most regions, sellers of land are mainly families and trusts. “Local farmers continue to be the primary buyers of cropland. We are seeing a few investors step back into the market, especially those with 1031 exchange money to invest,” Hayworth said. “While the market is definitely slower, Farmers National Company’s listing volume is up in the region compared to 12 months ago.”