The Grower Acreage Consolidation Question

For the past few years, one of the consistent concerns among ag retailers taking part in the annual CropLife 100 survey has been the rapid pace of industry consolidation. From manufacturers buying other manufacturers to ag retailers merging with nearby ag retailers, consolidation has regularly ranked high on the list of things “keeping me up at night,” according to survey respondents.

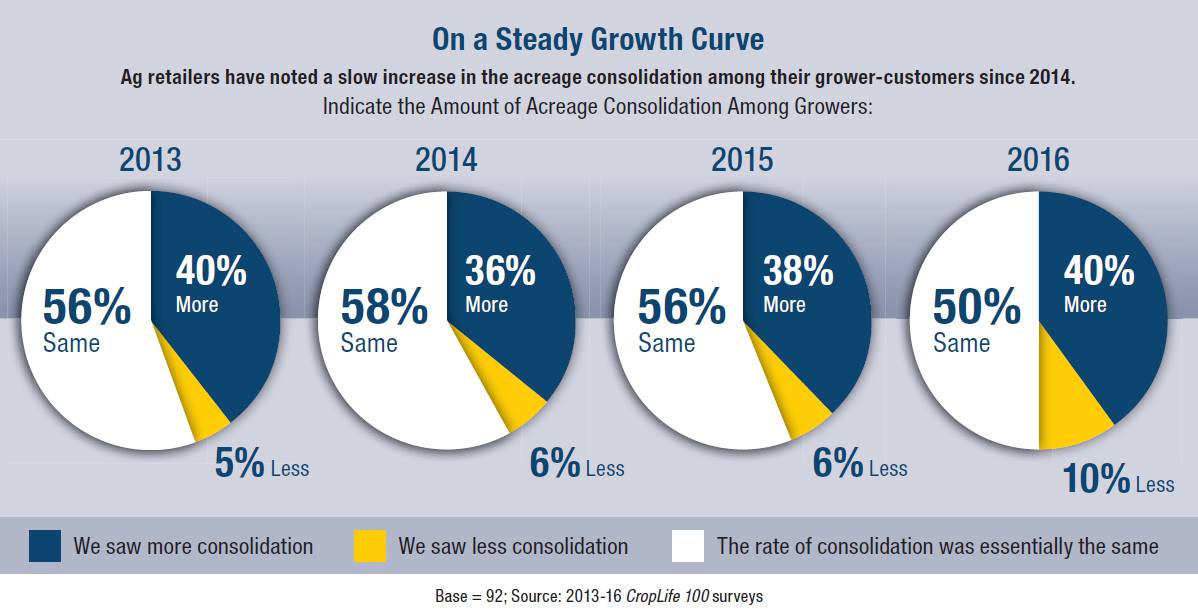

However, one important area of the agricultural marketplace that hasn’t received as much attention ties back to the grower-customers, specifi cally how quickly (or not) farm acreage is consolidating in the 21st century. To gauge this trend, CropLife® magazine began asking CropLife 100 ag retailers to tell us how fast or slow the grower acreage in their parts of the country were consolidating back during our 2013 survey. That first year, 40% of respondents said they had noticed a definite increase in acreage consolidation among their grower-customers. However, the majority, 56%, indicated the rate of acreage consolidation had remained steady compared with the prior year.

Year-By-Year Comparisons

Between 2014 and 2016, these percentages haven’t altered significantly. During the 2014 CropLife 100 survey, 36% of respondents said the grower acreage in their areas were consolidating more rapidly than they had the year before. Still, almost two-thirds (58%) indicated that this rate of consolidation had not changed from 2013.

In 2015, the situation was very similar. According to the CropLife 100 survey, 38% of respondents said the grower acreage consolidation trend was increasing, a 2% increase. Correspondingly, the percentage of ag retailers saying this trend remained constant from the year before fell by 2% to 56%.

This past year brought more of the same when it came to the grower acreage consolidation movement. According to the 2016 CropLife 100 survey, 40% of ag retailers noticed an uptick in this trend compared with 2015, up another 2%. However, the percentage of those respondents saying this movement was the same as during the prior year fell 6%, down to 50%. Significantly, 10% of respondents in the 2016 survey said the grower acreage consolidation trend in their areas had actually fallen during the year. This marked the first time since CropLife began asking this question of ag retailers that “less consolidation” answer had received a double-digit percentage reply.