CropLife 100: The Half-Way Report

For more than 30 years now, CropLife® magazine has regularly tracked the state of the ag retail marketplace through its annual CropLife 100 survey. This report, which is published each December, provides a detailed look at how the ag retail market has performed over the past 12 months, what product/service categories have shown the most growth and why, and given hints to how the following year might play out for the industry. In many ways, the annual CropLife 100 is a benchmark for industry observers and decision-makers to learn important market intelligence and plan accordingly for the future.

But is this enough? That’s a question we here at CropLife asked as we were preparing the 2016 CropLife 100 report. Ultimately, we decided the answer was “no,” hence CropLife has been presenting a look at key CropLife 100 survey findings in each and every issue during 2017.

Of course, there was one important element missing from this data — new information. So we decided to poll our CropLife 100 universe one additional time to find out how the industry was doing at the mid-year mark. And with this goal, we proudly present the 1st annual CropLife 100 Mid-Year Report.

During the months of May and early June, we sent out a stripped down version of our CropLife 100 survey to the nation’s top ag retailers. In the end, approximately one-quarter of our market friends found the time between helping grower-customers prepare and plant their crop fields to send information our way. Luckily, the returned surveys included a nice cross-section of the industry’s big companies (such as GROWMARK, Simplot Grower Solutions, and CHS) to smaller players (such as Jay-Mar, Sims Fertilizer, and J.B. Pearl), and all spots in-between.

More Positive on 2017

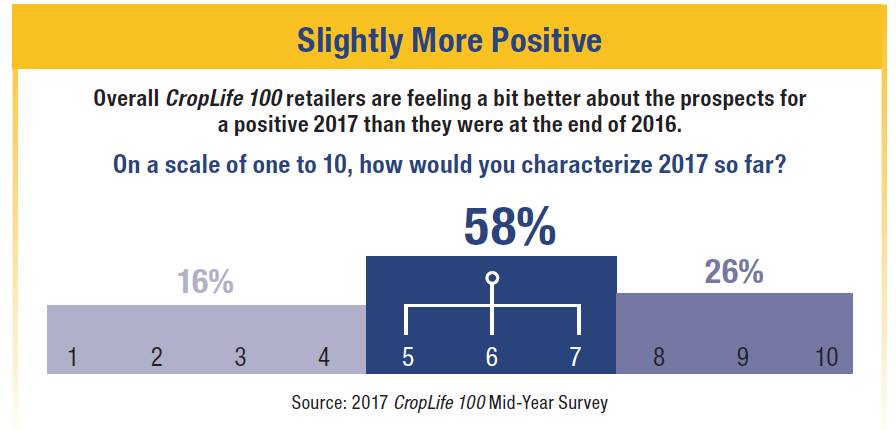

So what did we find out? For starters, the feelings towards how 2017 will end up as a market year have improved slightly. Back in the 2016 CropLife 100 survey, when we asked respondents to rate their outlook for 2017 on a scale of one to 10, 61% believed the upcoming year would rate between a five and seven financially — definitely the middle of the road.

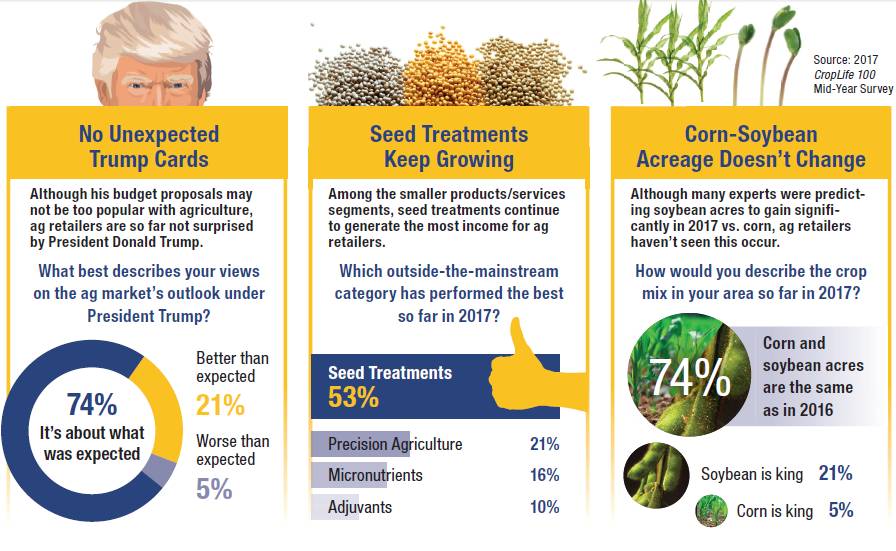

In the mid-year survey, this percentage is incredibly similar, with 58% of respondents rating 2017 between a five and seven on the 10-point scale. However, in the 2016 survey, the majority of CropLife 100 retailers, 40%, choose five as their rating for 2017. Now at the half-way point of the year, the majority of this group, 32%, rate 2017 as a seven. Better still, 26% of respondents rate 2017 between an eight and 10. In the 2016 survey, the percentage stood at only 14%.

Of course, one of the major components of any CropLife 100 survey is tracking the sales performances for the various products/services ag retailers offer their grower-customers. This includes fertilizer, crop protection products, seed, and custom application services in order of current market share.

On the survey, we asked respondents which of these four categories was showing the most positive growth thus far in 2017. Overwhelmingly, respondents indicated that fertilizer was doing the best, chosen by 48%. This could be significant seeing that falling fertilizer fortunes the past three years has tended to depress overall annual CropLife 100 sales figures.

On the flip side, we also wanted to know which of these four categories was showing the worst sales performance thus far in 2017. Here, the percentages weren’t quite as decisive. Thirty-three percent of respondents said seed was showing the most negative growth so far, with 28% saying this “honor” belonged to the crop protection products category. Again, this could represent a significant change in fortunes, as both seed and crop protection products have gained sales/market share over the past two years among CropLife 100 ag retailers.

While seed might be leading in the underperforming group, another part of the seed market is doing just fine. When we asked respondents which “smaller” category of their businesses was performing the best so far in 2017, the clear choice was seed treatment. According to 53% of respondents, this segment remains a growing part of their operations. Precision agricultural services finished a distant second for this question at 21%.

Weeds Continue to Vex

In terms of general market trends and challenges facing the nation’s top ag retailers half-way through 2017, herbicide-resistant weeds remain the biggest one. When we asked CropLife 100 retailers to describe the battle to control these weeds in their areas, 37% indicated this was a “major” problem for them. Another 37% wrote that herbicide-resistant has become a “major problem” in their marketplaces since the 2016 survey took place. The remaining 26% said herbicide-resistant weeds were a “minor” problem for their grower-customers. Perhaps significantly, however, not a single respondent choice the “herbicide-resistant weeds are not a problem in my area” option.

Of course, starting in 2017, ag retailers and their grower-customers have gained some new tools in the fight against herbicide-resistant weeds. Several manufacturers such as BASF, DuPont, and Monsanto have begun offering dicamba-resistant cropping systems. According to the mid-year survey, 26% of respondents have started using these products in their businesses and found the experience “better than expected.” A slightly lower percentage, 21%, have found using these systems “worse than expected.”

Still, the vast majority of respondents, 53%, have not yet begun using these systems. “There has been strong demand for the dicamba seed traits, but a very limited amount of chemistry sprayed so far,” wrote Dave Coppess, Executive Vice President, Sales & Marketing for Heartland Co-op. “The restrictive label and high wind speeds are limiting the window of application.”

In our final pair of questions, the CropLife 100 Mid-Year Survey asked respondents how they felt 2018 would play out now that the industry has made it through half of 2017. Surprisingly, the majority, 58%, had no view on this topic, choosing to answer “neutral.” Thirty-one percent thought that 2018 would be “somewhat positive” a financial year for agriculture, while the remaining 11% believed it would be “somewhat negative.”

The last question had to do with a topic that has dominated the agricultural marketplace for the past year or so — crop protection manufacturer consolidation. Throughout 2016, several of the world’s largest crop protection product suppliers proposed merging with one another. This included ChemChina and Syngenta, Dow and DuPont, and Bayer and Monsanto. At the time of the 2016 CropLife 100 survey, respondents were following all of these deals with a mix of indifference and dread according to a few of the open-ended responses we received.

For the Mid-Year Survey, we asked CropLife 100 ag retailers how they now viewed all of these high-level transactions on their potential impact on their individual business operations. The majority, 58% said they were “somewhat concerned” about these deals, with another 11% describing themselves as “very concerned.” The remaining 31% either said they were “not concerned” about these proposed mergers or were “not sure” what they would ultimately mean.